10 VCs say interactivity, regulation and independent creators will reshape digital media in 2021

The digital media industry will give us plenty to talk about this year.

When we last surveyed venture capitalists about their media investments, the big topic was the impact that the pandemic would have on the industry, and on the prospects for new startups.

Obviously, the pandemic hasn’t gone away, but when asked to predict the biggest storylines for 2021, VCs pointed to themes as varied as new distribution models, new kinds of interactivity, new tools for creators, the return of advertising business models and even the role of media in a democratic society.

“We are headed toward a content universe where consumers’ power of choice grows to new heights — what premium content to consume and pay for, and how to consume it,” Javelin’s Alex Gurevich wrote. “The consumers will have the final choice! Not traditional media and content distribution companies.”

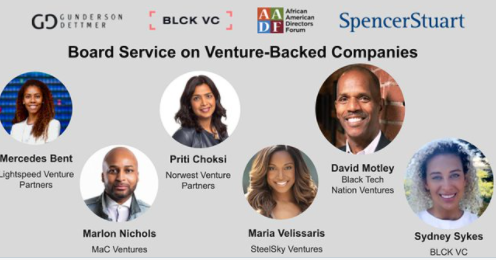

For this new survey, we heard from 10 VCs — nine who invest in media startups, plus a tenth who’s seeing plenty of media pitches and was happy to share her thoughts. We asked them about the likelihood of further industry consolidation, whether we’ll see more digital media companies take the SPAC route and of course, what they’re looking for in their next investment.

What do you think will be the biggest trend or story in digital media in 2021?

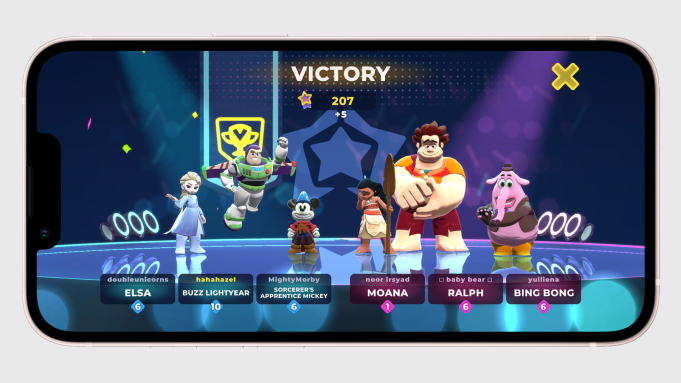

Michael Palank: If 2020 was the year every major media company either announced or grew their direct-to-consumer video/audio/gaming offering, 2021 will be the year where those offerings optimize and differentiate or die. We expect the hunger for original content to continue, but we feel the type of content will continue to diversify from both a story and IP perspective and a format perspective. It is not unthinkable that a major media company like Apple, Amazon or Disney looks to acquire Clubhouse in 2021.

As the lines between video games and filmed entertainment continue to blur we can also envision new companies popping up to take advantage of this trend. I also feel these content platforms will need to differentiate by way of better discovery and personalization.

I fully expect every major media company from Disney to Apple to Amazon to Microsoft will be looking for new and innovative ways to separate themselves from the rest of the pack in 2021.

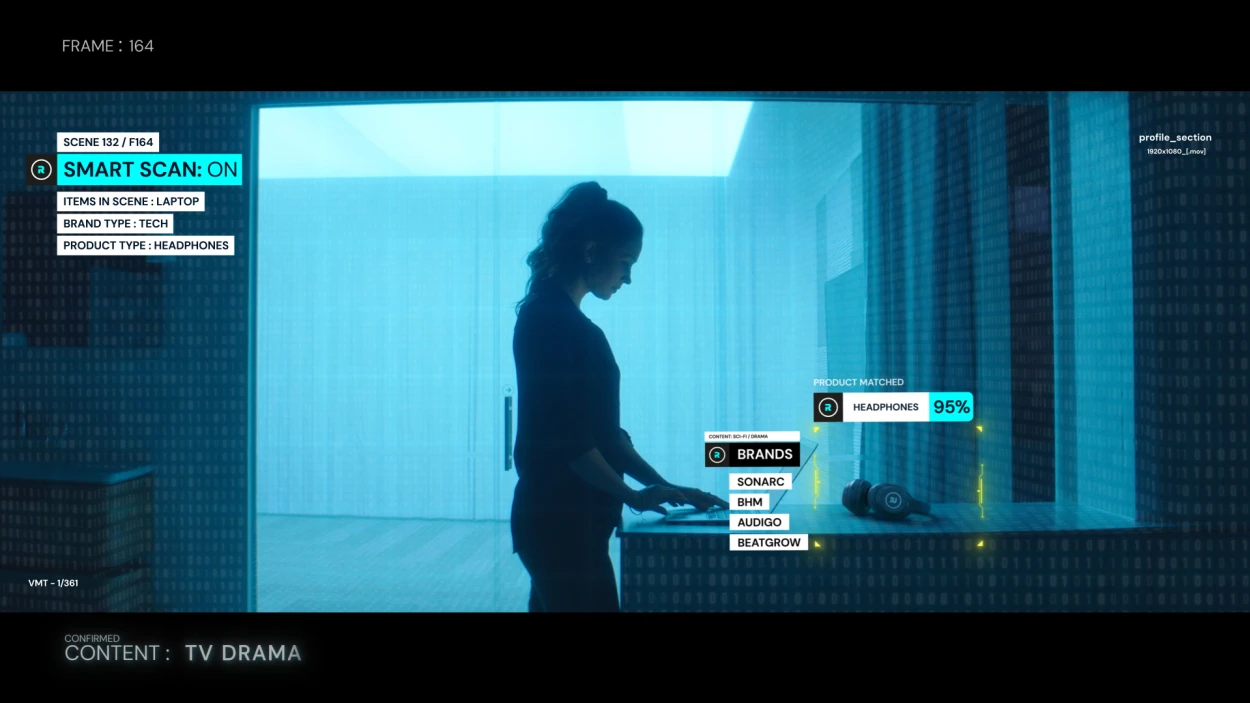

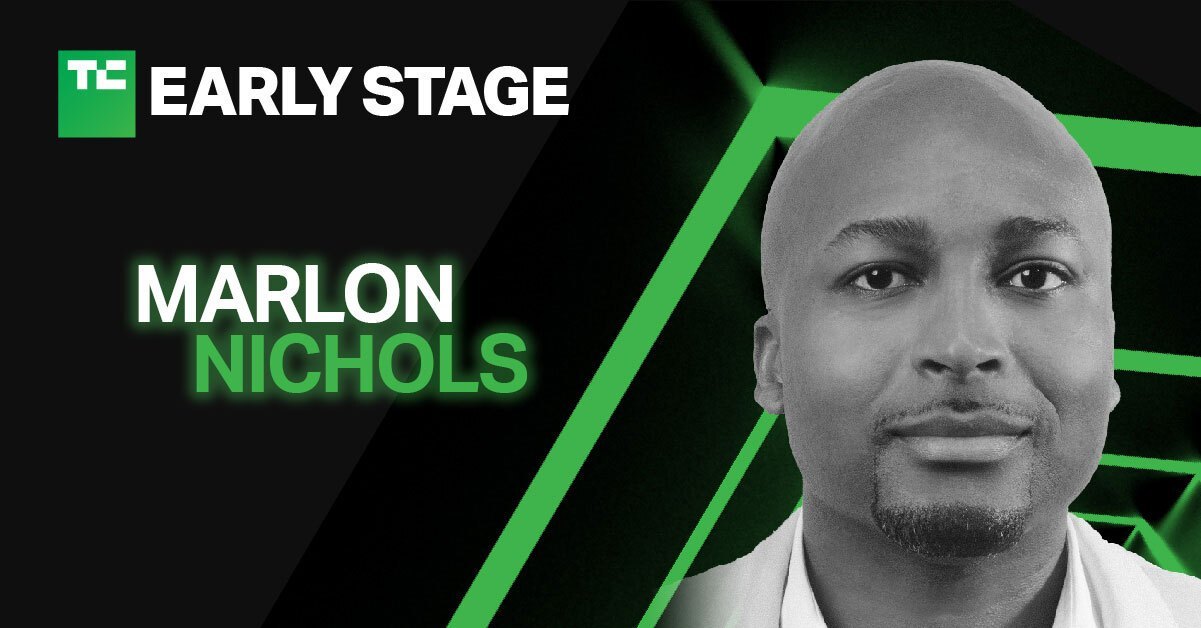

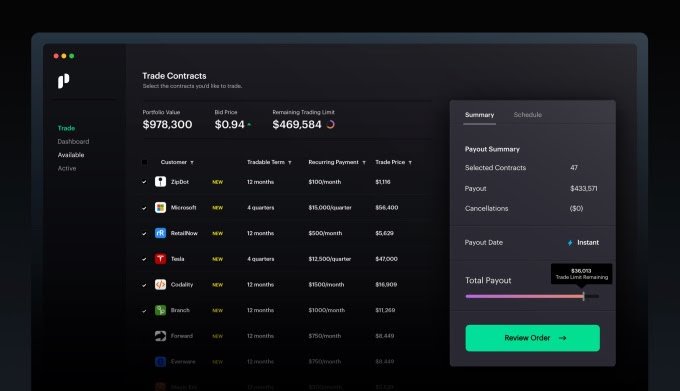

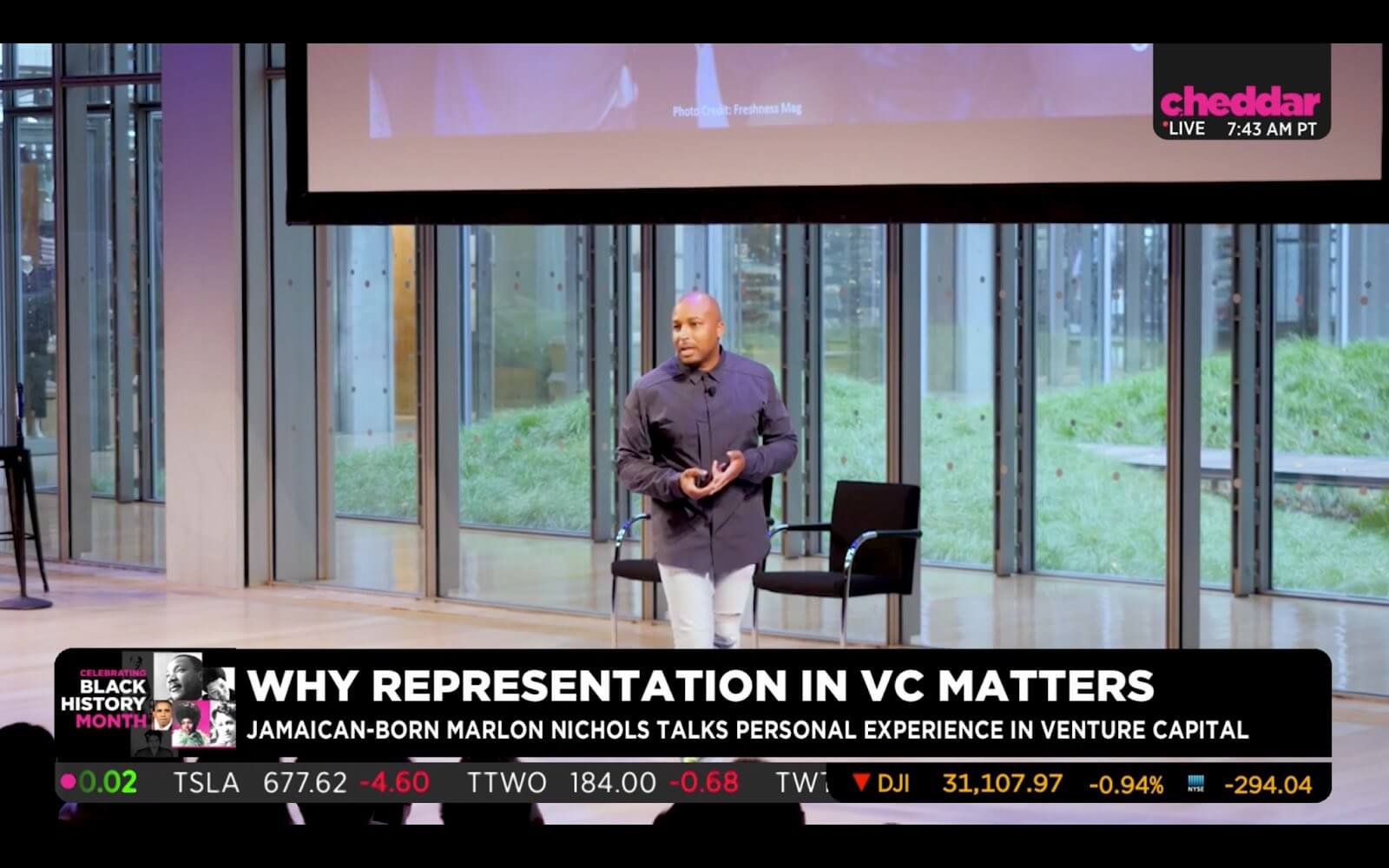

Marlon Nichols: I think that the continued creation of streaming platforms from content creators/owners (e.g., Disney+, HBO Max, etc.) will force downward subscription pricing adjustments across the board and streaming platforms will need to revisit advertising as a revenue stream. That said, we know that watching ads on a paid platform won’t fly with consumers so I believe we’ll see contextually relevant product placement become the accepted form of brand/content collaboration going forward. I led MaC’s investment into Ryff because of this thesis.

. . .

Read the full TechCrunch piece with this amazing lineup.

- Daniel Gulati, founding partner, Forecast Fund

- Alex Gurevich, managing director, Javelin Venture Partners

- Matthew Hartman, partner, Betaworks Ventures

- Jerry Lu, senior associate, Maveron

- Jana Messerschmidt, partner, Lightspeed Venture Partners

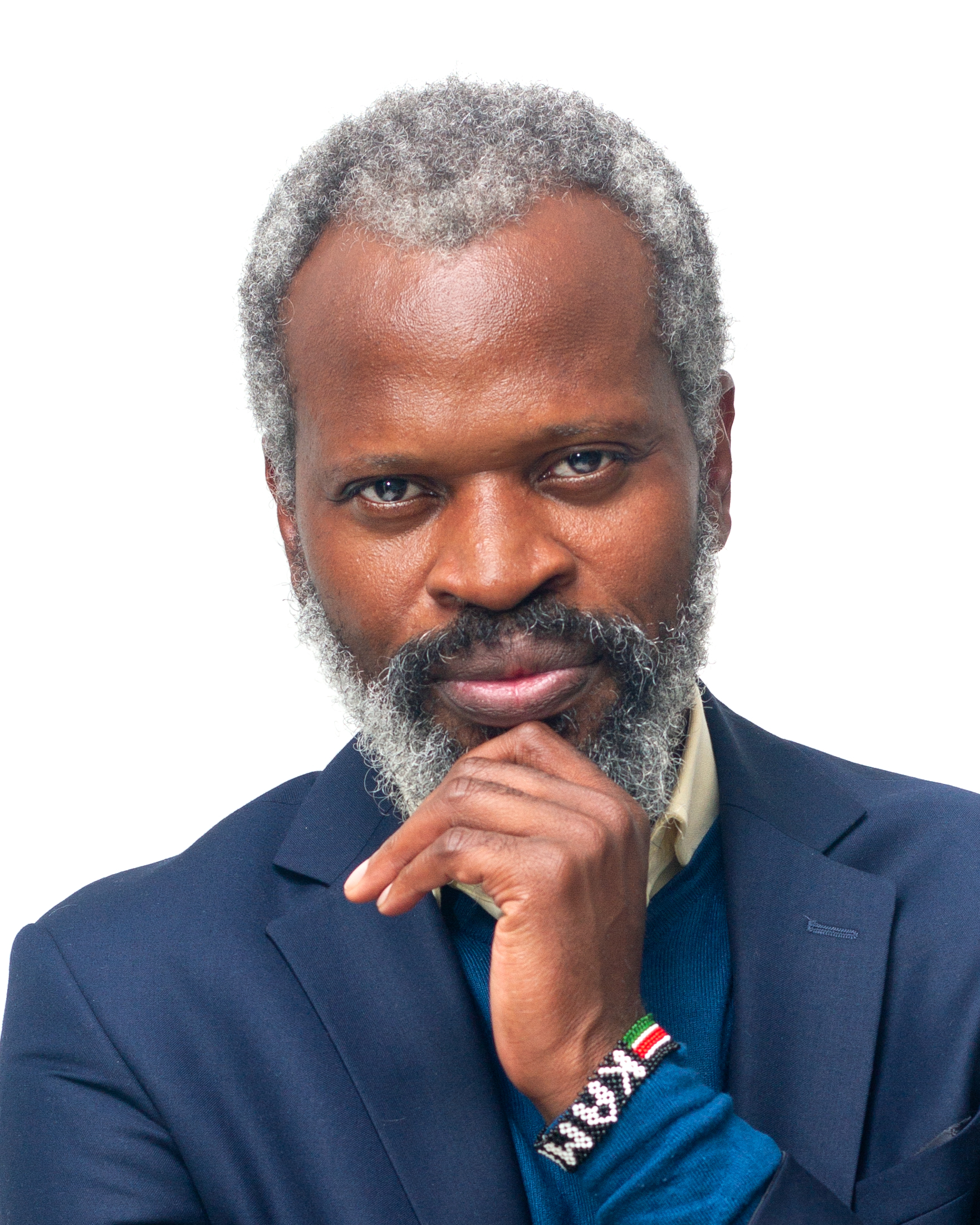

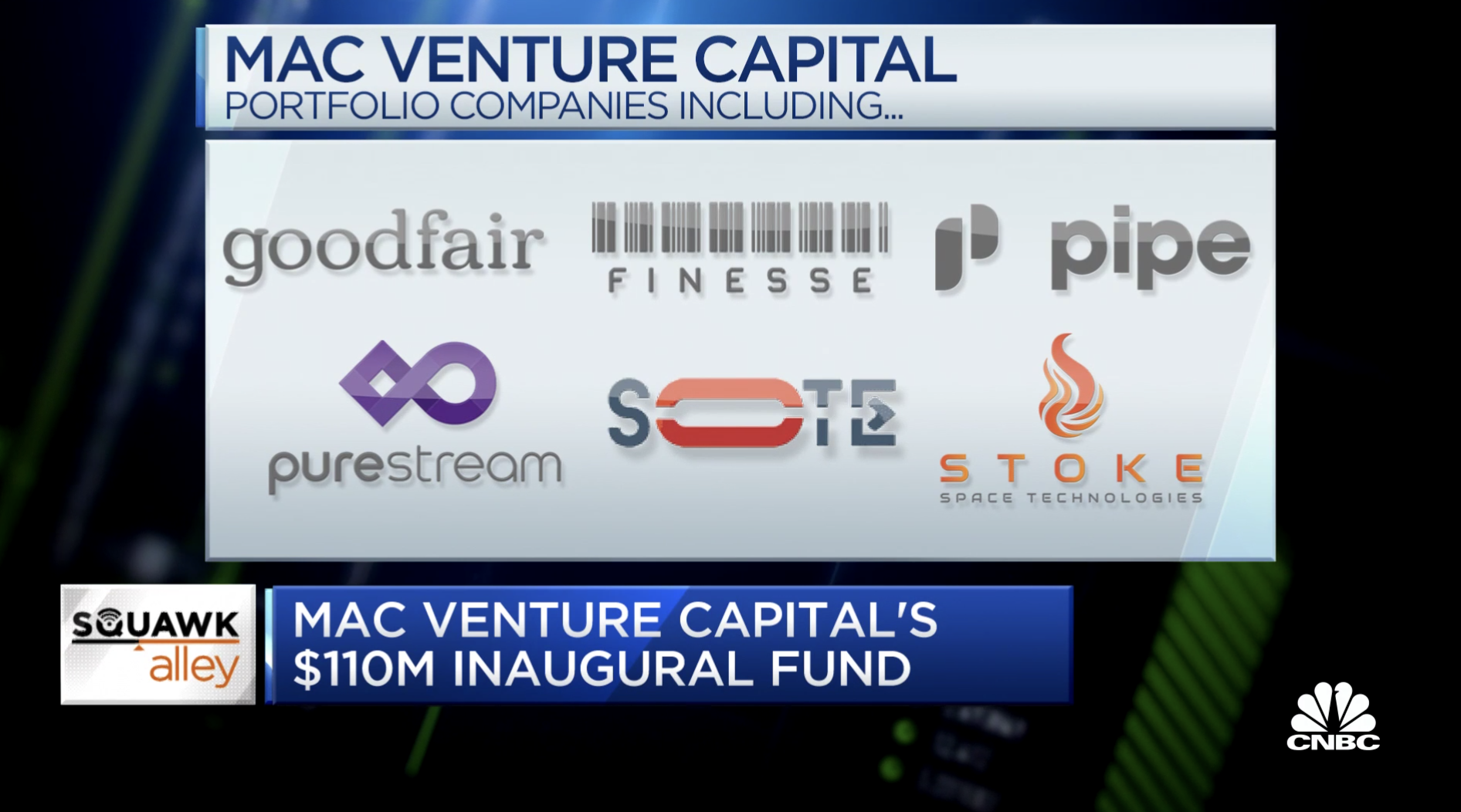

- Michael Palank, general partner, MaC Venture Capital (with additional commentary from MaC’s Marlon Nichols)

- Pär-Jörgen Pärson, general partner, Northzone

- M.G. Siegler, general partner, GV

- Laurel Touby, managing director, Supernode Ventures

- Hans Tung, managing partner, GGV Capital

.png)