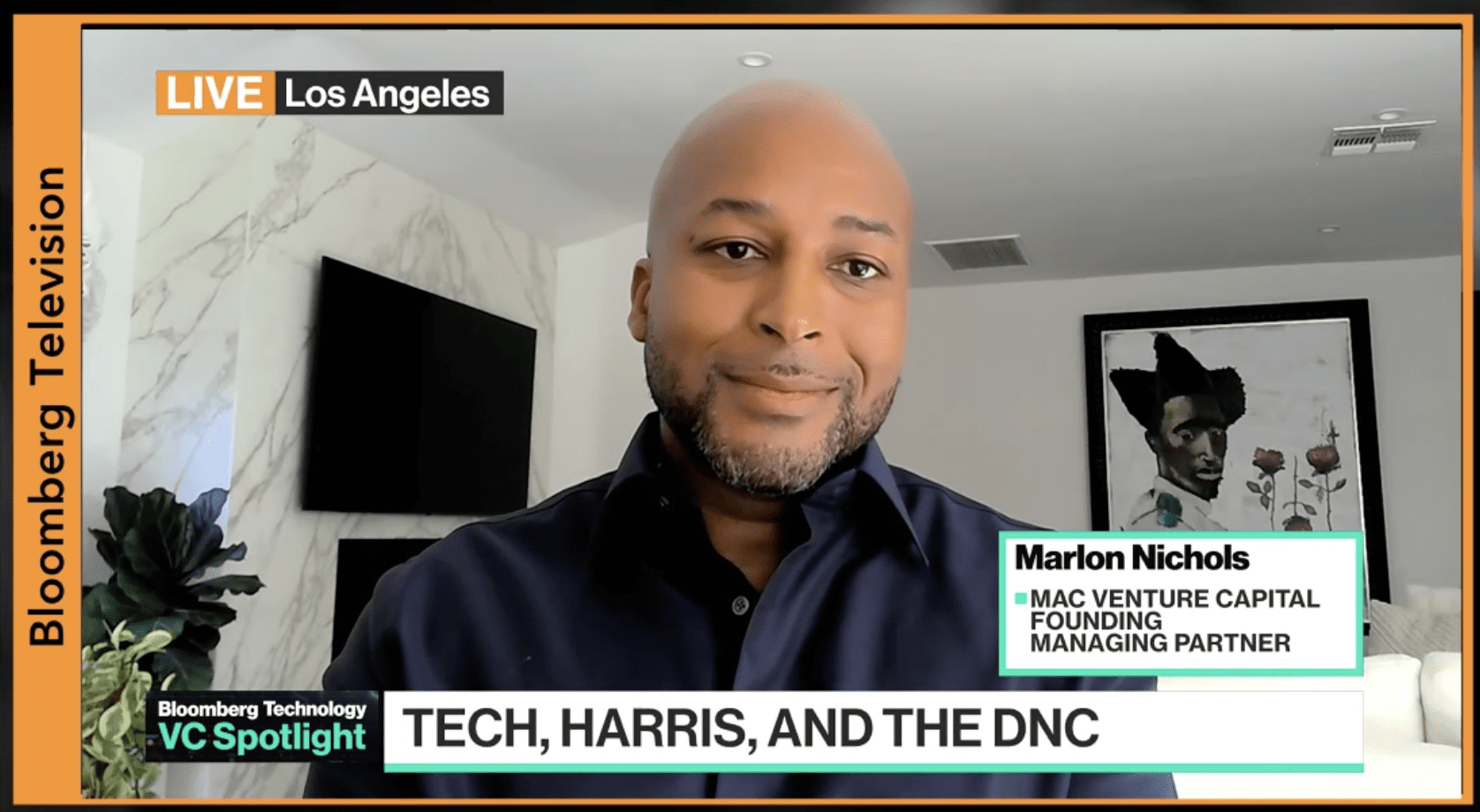

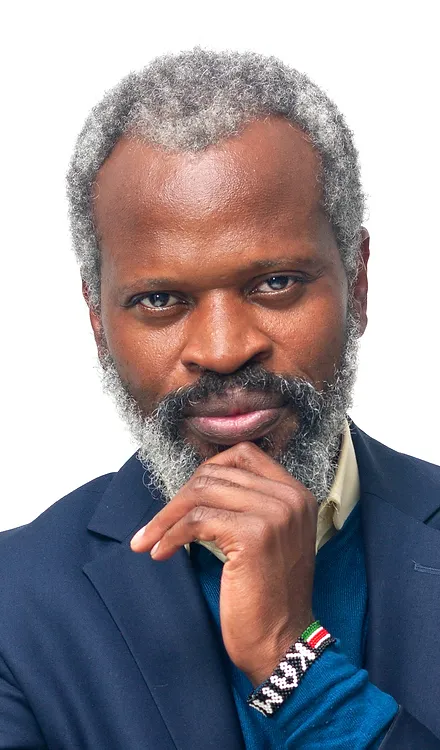

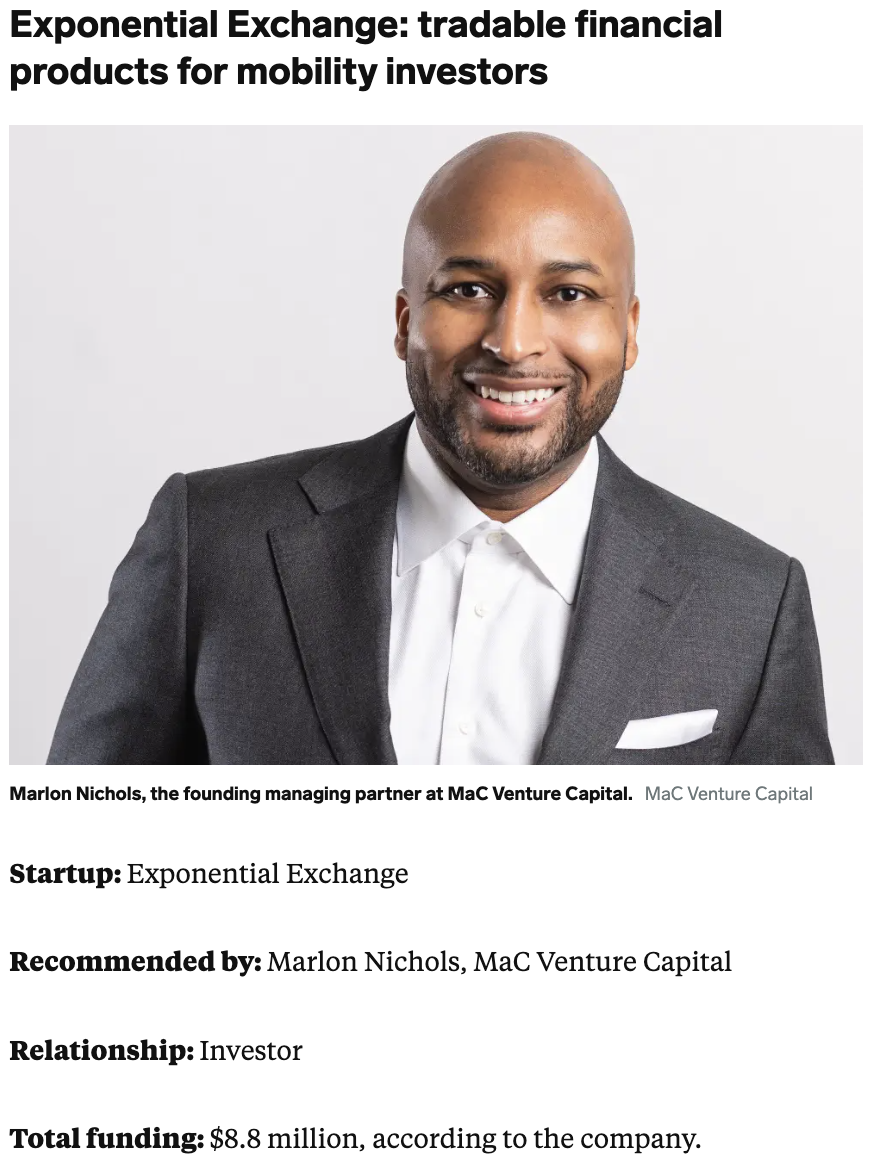

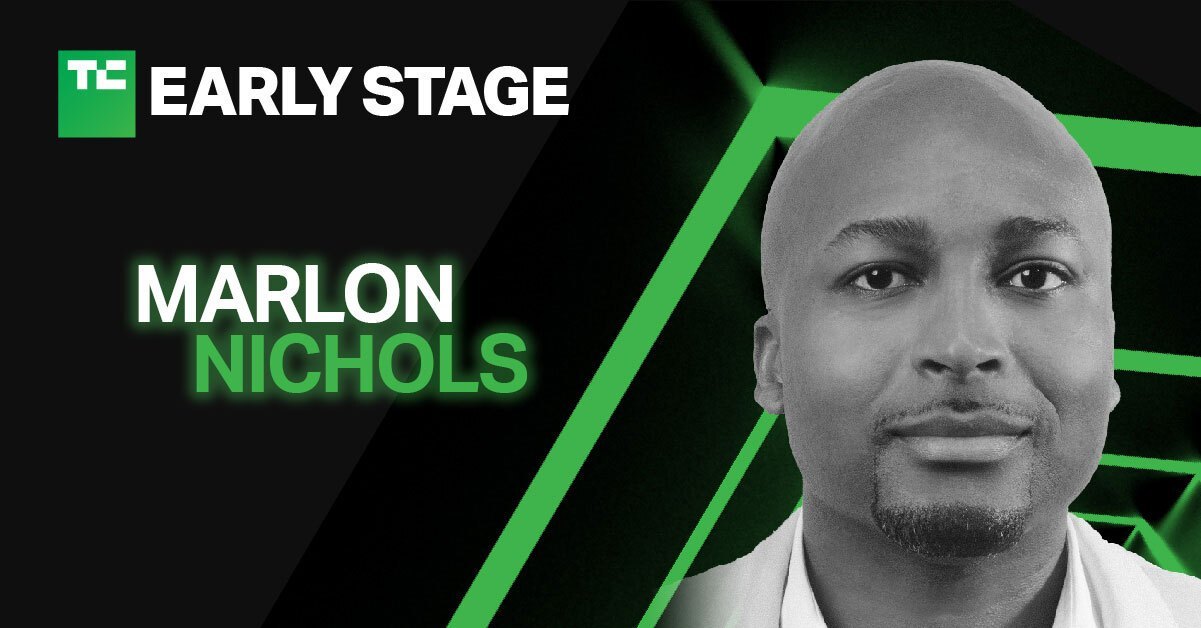

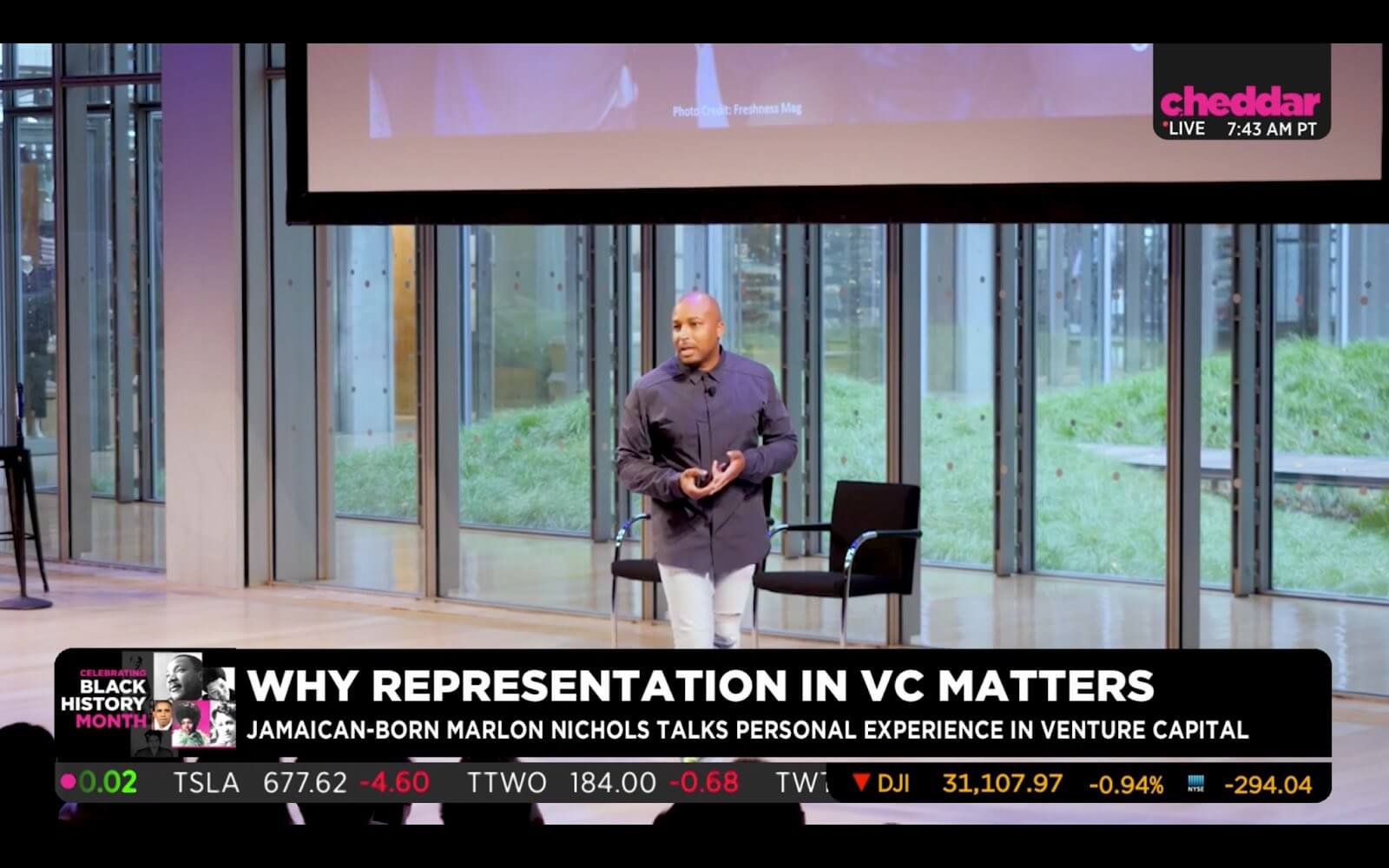

Marlon Nichols, Investing in The Future For The Rest Of America

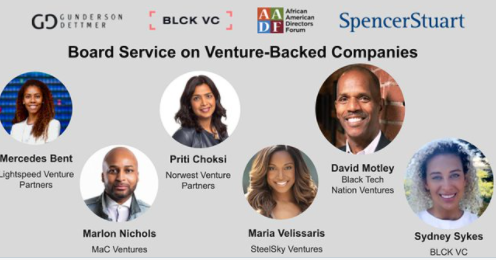

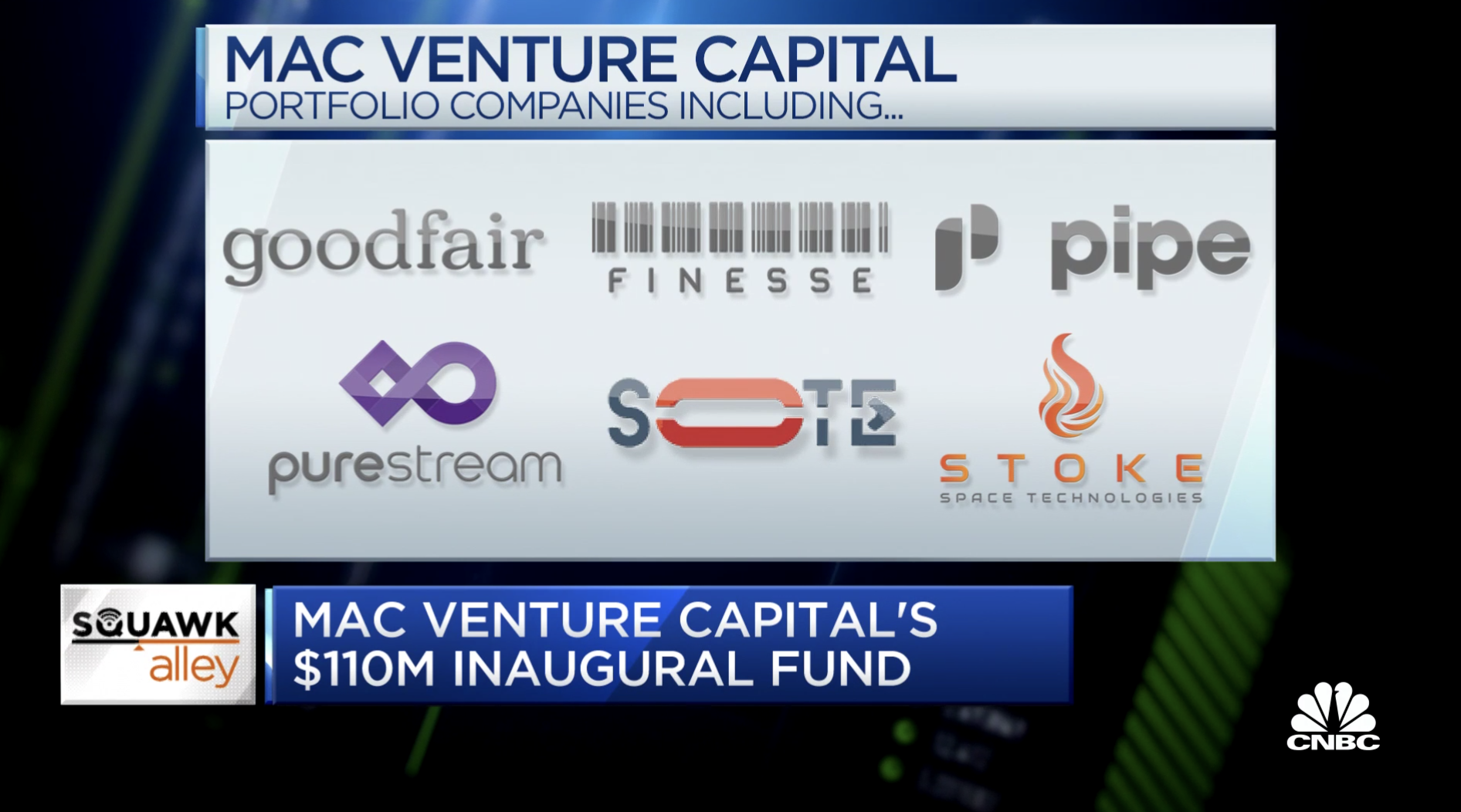

Marlon Nichols is a founding managing partner at MaC Venture Capital (formerly Cross Culture Ventures, a top decile performing fund), which finds the entrepreneurs who are building the future for the rest of America. He’s an industry veteran – a former Kauffman Fellow and Investment Director at Intel Capital, where he launched Intel’s $125M diversity fund. Marlon, with an extensive background in technology, private equity, media, and entertainment, has a unique eye for global trends and shifts in consumer behavior. This has helped him capture high-potential investments, which include Gimlet Media, MongoDB, Thrive Market, Fair, LISNR, Mayvenn, Blavity, Wonderschool, and other companies that reflect overlooked markets. He serves on the board of directors for Ajua, Blavity, LISNR, Ryff, and Wonderschool.

Thanks to his background as a professional athlete, Marlon utilizes sports leadership philosophy when working closely with CEO’s to build the ventures of tomorrow. His diverse network of media and entertainment industry leaders, tech entrepreneurs, Fortune 500 executives, and sports professionals helps him develop strategic partnerships and promote brand expansions for his portfolio companies.

Marlon is a 2018 nominee of the ADCOLOR in Tech award, a recipient of MVMT50’s SXSW 2018 Innovator of the Year award, Digital Diversity’s Innovation & Inclusion Change Agent award, was named Pitchbook’s 25 Black Founders and VCs to Watch in 2018 and 2019, was a TechWeek 100 winner and was named one of Silicon Republic’s 26 VC professionals spearheading change. He’s also been featured on TechCrunch, Fortune, Blavity, NBC and many more. He has been featured as a keynote speaker and regularly appears in the media as a thought leader in investing and cultural trends.

Marlon earned his Bachelor of Science in Management Information Systems from Northeastern University and an MBA from the SC Johnson College of Business at Cornell University, where he is also adjunct faculty in entrepreneurship and venture capital.

In an exclusive interview with AsiaTechDaily, Marlon Nichols says:

The top two things that turn me off to startups are 1- When the founder doesn’t know the numbers of the business well. I find it difficult to believe that you can successfully run a company if you don’t understand or you’re not consistently thinking about what it will take to achieve the company’s goals—2- When founders ignore or disregard the competitive landscape. Founders should be reasonably paranoid else; you’ll have your lunch eaten.

Read on to know more about this industry veteran and his journey.

What background and domain expertise do you have?

Marlon Nichols: I’ve worked in a successful enterprise software startup that experienced a successful exit. I led global implementations for the company before playing a vital role in the company’s European expansion. I also led a successful career in consulting, first, as a consultant to the Blackstone Group. I helped them to create and run shared services organizations as they were acquiring hotels and hotel chains. I then focused more on media and entertainment clients like Warner Music and McGraw Hill. The primary objective was to help them navigate the challenges that the internet presented, such as music piracy and the diminishing need for physical bookstores. What makes you turn into an investor? I learned that while I love aspects of operating technology companies, I am naturally curious and need variety. I also learned about myself that I need to have real skin the game if I am going to be effective truly. I like to interact with smart executives on matters of company strategy and operations. Also, I love finding and interacting with cutting edge technology. As such, venture capital seemed like the perfect career for me to pursue. So far, my assumption has proven correct.

What kind of startups/ sectors have you invested in?

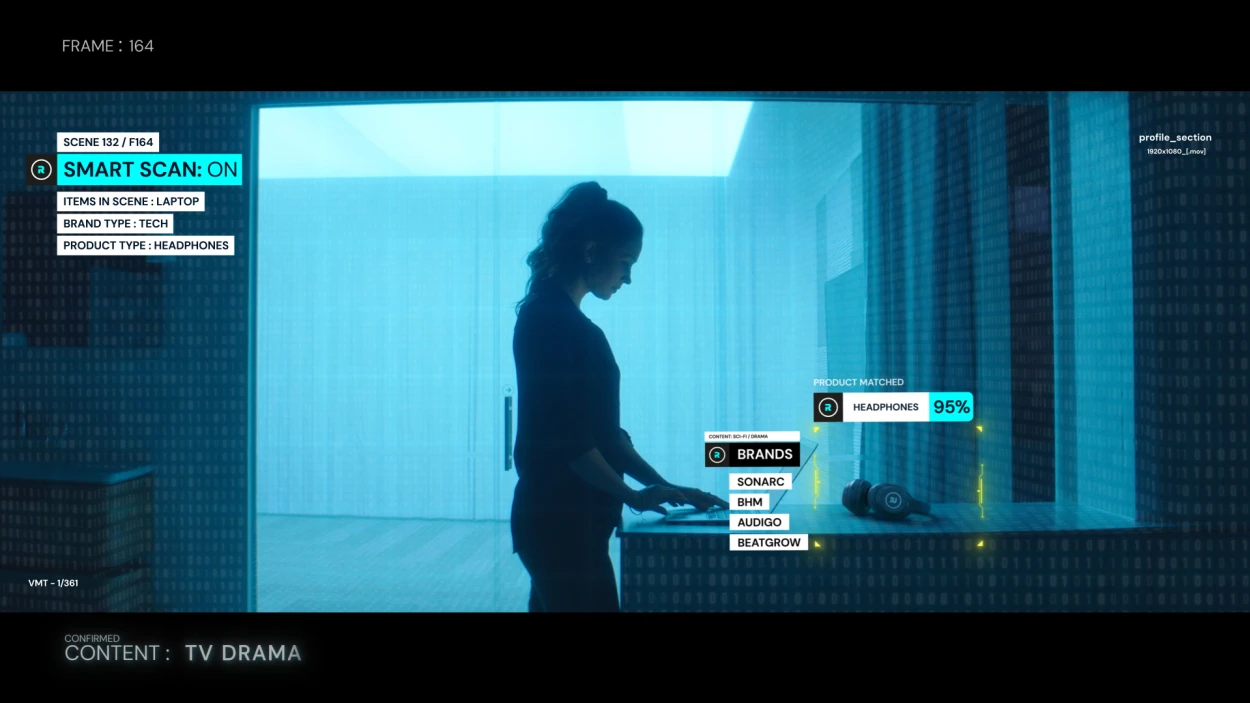

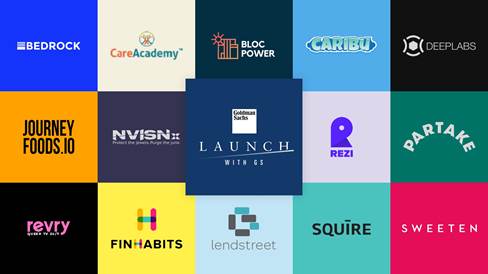

Marlon Nichols: We are sector and industry agnostic, but we tend to invest in six broad areas. 1- commerce, which includes market places, e-commerce, and select product/ services companies that leverage the internet/ mobile to sell and distribute. E.g., Airspace Technologies, fair, Mayvenn 2- Finance and Education, progressive companies that provide alternative solutions to consumers in the finance and education space e.g., Good Money, Truebill, Wonderschool, Catalyte 3- Health and Food, this category is focused on improved access, better cost structure, and better products e.g., Thrive Market, yumi, Ready Responders, Firefly Health 4- Immersive reality, This category consists of AR/VR companies that primarily focus on selling to enterprises and companies that create alternative realities for consumers. E.g., Phiar, Gridraster, Brud 5- Media & Sports, which focuses on technology companies that drive the distribution and adoption of content. E.g., Ryff, PlayVS, Fazeclan 6- Smart Cities, this category is focused on solutions that help to improve the planet’s health and increases efficiencies for citizens e.g., Blockpower, Citizen, Grin

What would be the core factors that you decide “Not” to invest in certain companies?

Marlon Nichols: At the seed stage, which is when we do the lion share of our investing, the team is the most important aspect. It would be difficult for us to back founders that don’t have a unique superpower related to the venture they are undertaking. We also like founders that have the ability to motivate others and recruit well. If you can’t build an exceptional team, it is unlikely that you can win a category.

What would be the KPI that you usually check about the startups’ growth?

Marlon Nichols: It may be diverse in each industry like LTV, CAC, MoM, etc. but it will be helpful to understand more about your additional investment factors. It does vary not only by industry but also by the company, so it’s a difficult question to answer on a general basis. That said, a couple of rules of thumb are as follows. At this stage, we are primarily looking for trend lines—for instance, user growth of at least 30% MOM for three or more months. We look for churn rates that are well below the industry avg./ median. In SaaS companies, we look for a three month or less payback period. For enterprise-facing companies, we tend to look for signed and paid pilots that have well-defined success criteria and are performing well towards those goals.

What is your typical investment range, and how many startups you invest in?

Marlon Nichols: Our ticket size generally ranges between $500k and $1.5M. We have gone below and above that range. There are more than 100 companies in our portfolio. Can overseas headquartered startups get funding from you? We have invested in companies that are headquartered outside of the US. Canada (voice flow), Kenya (Ajua), France (Afrostream), Latin America (Grin), etc. That said, we primarily focus on the United States/ North America.

Right after being an investor like in the early days, there must be some tough times in building up the first fund along with building up a second fund or giving back the good returns to those LPs. If there is any similar tough time like this, please tell us more about it and how you (or your team) overcome the difficult times.

Marlon Nichols: Fundraising is always difficult, especially the first time around because your team doesn’t have a unified investment track record. As you invest out of the first fund and those companies perform well, it makes the second time around a little easier—albeit still difficult. LPs have generally been willing to listen to our story so we can’t complain there. Finding the right GP: LP fit is another story. All in all, we’ve been pleased with how our process plays out.

What are the main factors that startups fail as per your experience AFTER getting investment, and how can they prevent mistakes in advance from your personal perspective?

Marlon Nichols: The top two things that turn me off to startups are 1- When the founder doesn’t know the numbers of the business well. I find it difficult to believe that you can successfully run a company if you don’t understand or you’re not consistently thinking about what it will take to achieve the company’s goals—2- When founders ignore or disregard the competitive landscape. Founders should be reasonably paranoid else; you’ll have your lunch eaten.

What’s your advice to entrepreneurs who have a chance to meet investors like you?

Marlon Nichols: Succinctly paint a picture of why your company needs to exist, how you plan to succeed, how you are approaching the challenge differently, and how you will sustain the differentiation/ widen and deepen the moat.

What’s your general thought about the term “Global,” and What are the important factors (criteria) for local startups to consider for international expansion?

Marlon Nichols: Startups first need to find real success in their local markets before they consider international expansion. When the time is right, you must ensure that the same differentiating factors and value proposition exist in new markets before tackling them. Understanding the competitive landscape and cultural differences should also be major considerations.

What kind of startup or tech industry will impact the world in the future like 2-3 years locally in your view?

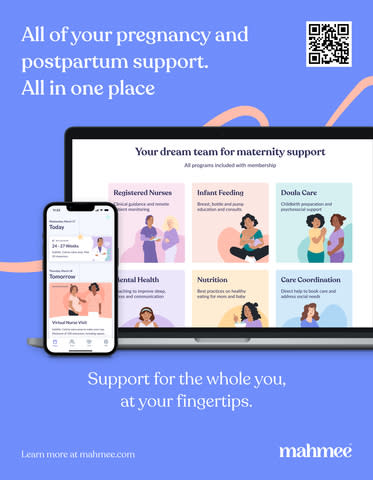

Marlon Nichols: I’m betting pretty heavily on HealthTech. The healthcare system in the US is clearly broken and the government has struggled to fix it. I believe technology has the opportunity to provide for better service and increasing efficiency while driving down costs. We’ve invested in Arine, Ready Responders, Firefly Health, and Mahmee for this reason.

What are the one or two things that you would do differently if you could go back to 10 years ago?

Marlon Nichols: I would have started my venture firm earlier. I love what our team has built and I’m excited for all that we have planned.

You can follow Marlon Nichols here.

Original Post: AsiaTechDaily, 3/4/20