Funding To Black Startup Founders Quadrupled In Past Year, But Remains Elusive

Editor’s note: This article is part of Something Ventured, an ongoing series by Crunchbase News examining diversity and access to capital in the venture-backed startup ecosystem. As part of this series on venture funding to Black entrepreneurs, we also look at Georgia’s role as a growing startup hub for Black startup founders. Later this week, we examine the state of VC funding to Black female startup founders. Access the full Something Ventured project here.

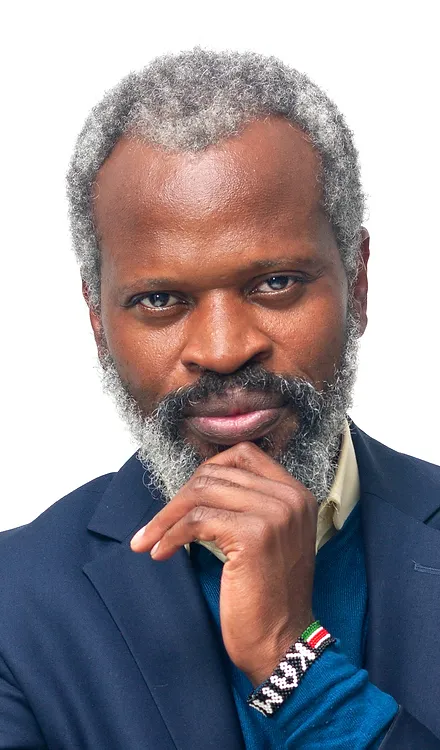

Charley Moore still remembers being the only Black startup attorney practicing on Silicon Valley’s Sand Hill Road.

That was 25 years ago. Earlier this year, Moore raised $223 million in growth capital for Rocket Lawyer, marking one of the largest funding rounds ever to a startup founded by a Black entrepreneur.

While venture funding to Black startup entrepreneurs in the U.S. remains woefully small, Crunchbase numbers show a significant uptick over the past year that coincides with the racial justice movement that reignited across the country.

Funding to Black entrepreneurs in the U.S. hit nearly $1.8 billion through the first half of 2021 — a more than fourfold increase compared to the same time frame last year. Led by funding to early-stage startups, this year’s half-year total has already surpassed the $1 billion invested in Black founders in all of 2020 and the $1.4 billion invested the year before that.

Entrepreneurs and investors who spoke with Crunchbase News say several factors are driving more positive change after years of painfully slow progress.

For one, more Black investors are being elevated to partner level at venture firms or are spinning up their own funds to provide capital to a more diverse set of entrepreneurs. A handful of high-profile exits along with large late-stage rounds to Black-led companies are also paving the way for more up-and-coming startups.

And in a hypercompetitive dealmaking environment, venture capitalists are looking outside their normal social and geographic spheres for promising startups to fund.

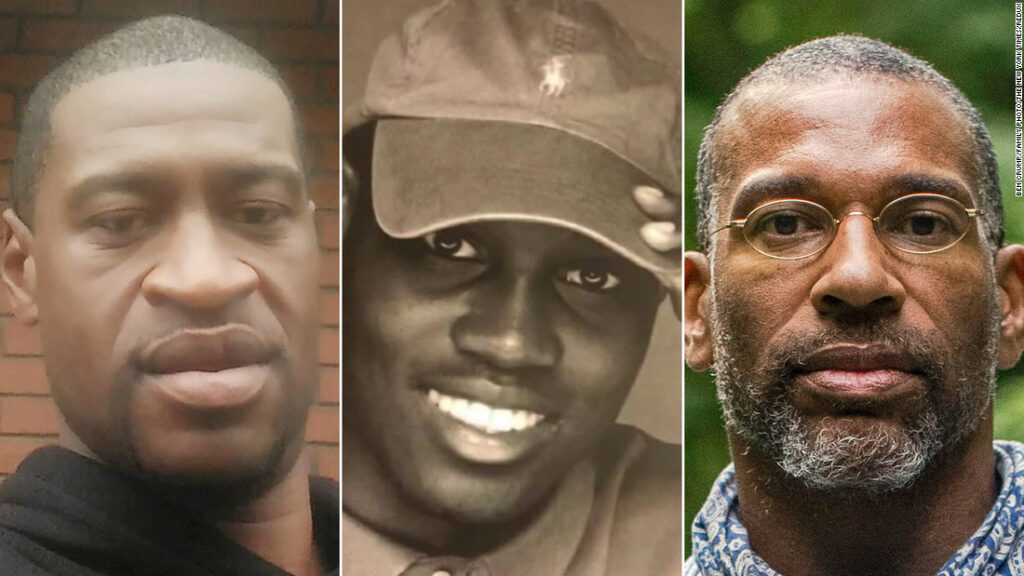

But perhaps more than anything, it was George Floyd’s murder last summer — and the ensuing racial justice movement — that lit a fire under Silicon Valley.

“I haven’t seen this amount of interest and conversation in the business community at large about race since the anti-apartheid movement of the ’90s,” said Moore, whose company offers low-cost online legal services to individuals and small businesses.

To be sure, much work remains to be done. Black startup entrepreneurs still received only a tiny fraction — 1.2 percent — of the record $147 billion in venture capital invested in U.S. startups through the first half of this year, Crunchbase numbers show. That compares with the more than 13 percent of the U.S. population that is Black or African American.

Early-stage leads

Still, investment in Black-founded startups as a percentage of overall U.S. venture funding has doubled since 2020, when it was a meager 0.6 percent.

Most promisingly, early-stage funding has led the way in 2021, with the largest proportion of venture capital investment to Black-founded companies at the Series A and Series B stages.

Several of those early-stage fundings were very large Series A and B investments, such as a $350 million round to Atlanta-based scheduling platform Calendly, a $115 million investment in Southern California-based fashion brand Savage X Fenty and $85 million to New York-based agtech company Gro Intelligence.

In total, Crunchbase numbers show 35 Black-founded companies raised Series A or B rounds in the first half of 2021, including 10 deals of $20 million or more.

While early-stage venture funding lays a foundation for the next cohort of successful startups, later-stage rounds and successful exits offer the kind of validation that traditional venture investors look for when placing their next bets.

“I hope that we’ve set an example as being good stewards of capital for traditional venture funds,” said Moore. In April, Rocket Lawyer raised a $223 million growth round led by Vista Credit Partners that he said represented a strong return on investment for early investors in the company including GV, Morgan Stanley, August Capital and others.

“We’ve shown that a company with a team that’s really dedicated to a mission can succeed with a Black founder and CEO, but it takes the whole ecosystem to do it,” he said.

This year also marked the first public-market debut for a venture-backed company in the U.S. with a Black founder and CEO: Real estate brokerage Compass, led by Robert Reffkin, went public in April and was valued at $8 billion after the stock’s first day of trading, although that figure has recently dropped to around $5 billion.

Floyd’s May 2020 murder at the hands of a white police officer sparked widespread cries for racial justice as well as a call for better access to capital and economic opportunity for Black Americans.

Racial inequity in the U.S. runs deep and across generations. The country’s median white household is an estimated 7.8x wealthier than the typical Black household — $188,200 vs. $24,100 — and Black Americans hold just 4 percent of the nation’s wealth.

The contrast is even starker when it comes to who receives venture funding. That matters because venture capital is the lifeblood of the startup ecosystem, which increasingly serves as a gateway to wealth and prosperity in the U.S.

Startup entrepreneurship “isn’t easy for anybody, regardless of race or gender,” Moore said. “Invention, let alone commercializing an invention at scale, isn’t easy for anybody. We have to always remember that, and then think about the fact that it’s not going to be easy for anybody, but how do we at least level the playing field so that everybody can have the same opportunity?”

Last summer’s racial reckoning prompted many venture investors to increase commitments to funding Black founders, and the numbers seem to indicate some results — at least in the near term.

While just $442 million was invested in Black-founded startup founders in the first half of 2020, Crunchbase data shows that increased to $589 million in the second half of the year. That momentum continued into 2021, with at least $1.8 billion invested in the first half of this year.

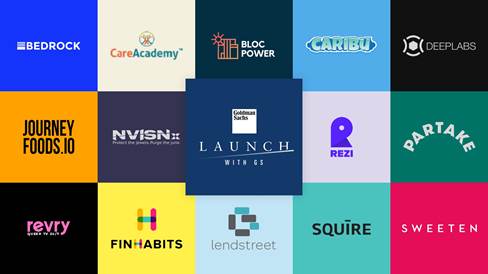

One of the venture funds that launched in the aftermath of Floyd’s death was SoftBank Group’s SB Opportunity Fund, a $100 million investment vehicle that backs Black, Latinx and Native American startup founders.

The fund came together within 48 hours once the firm decided to act, according to Tonya Williams, a principal at the fund, and was “really in response to the public protest at the time, and the outcries and examination that a lot of companies and individuals are going through thinking about systemic racism and the effects of it on personal lives.”

Roughly half of the fund has already been invested in 50 U.S. companies, including 27 founded by Black entrepreneurs. The majority of these have been seed-stage investments.

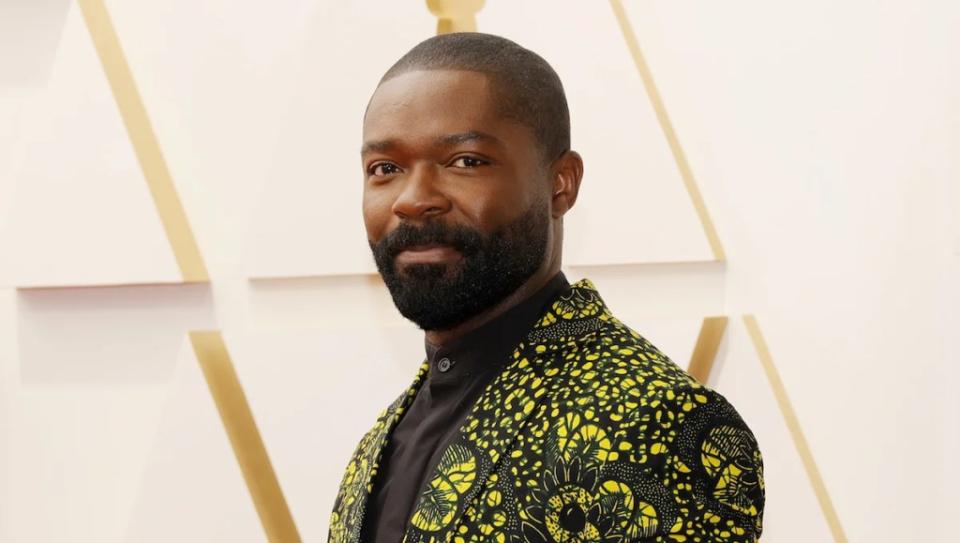

Tonya Williams, principal at SoftBank Opportunity FundWilliams said SoftBank believes its vast network in the startup world can help those companies further accelerate their growth. Some of the fund’s portfolio companies are already planning another funding, just eight to 10 months after raising.

Black-led Base10 Partners raised a $250 million Advancement Initiative fund, announced in March, to invest in high-growth-stage companies. The fund is set up to help historically Black colleges and universities — which typically don’t have large endowments — and organizations focused on supporting diverse talent. To date, five HBCUs are signed up as LPs, according to Luci Fonseca, who recently joined the fund. The firm does not take fees or carry from HBCUs investing in the fund, but does from other limited partners. It also donates a further 50 percent of its carry on these funds to HBCUs.

The goal is to provide for students going forward.

“They’re serving low- and middle-income students primarily, right, so there’s a lot of support that they need to provide to their students,” said Fonseca, speaking about HBCUs which are punching above their weight given how small endowments are for these colleges. “Our hope is that we’ll have the capital back to the schools, you know within three to four five years versus 10.”

‘Representation and autonomy’

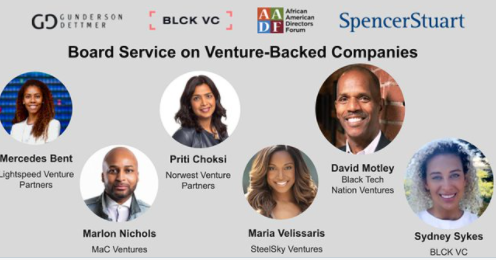

Many of the people we spoke with for this article said one key to greater racial parity in startup investing is more diversity among VCs: The more Black investors writing checks, the more investment in Black entrepreneurs.

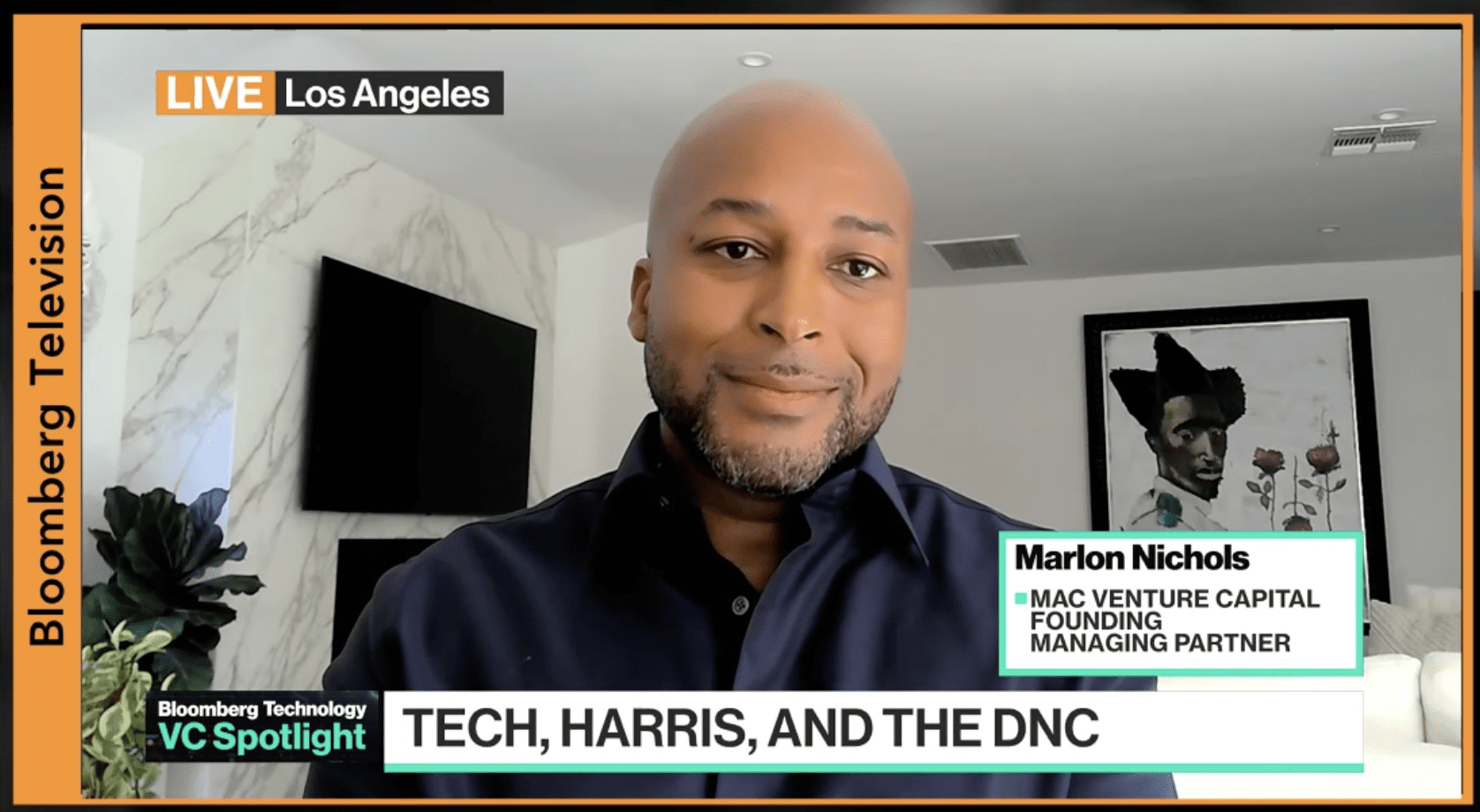

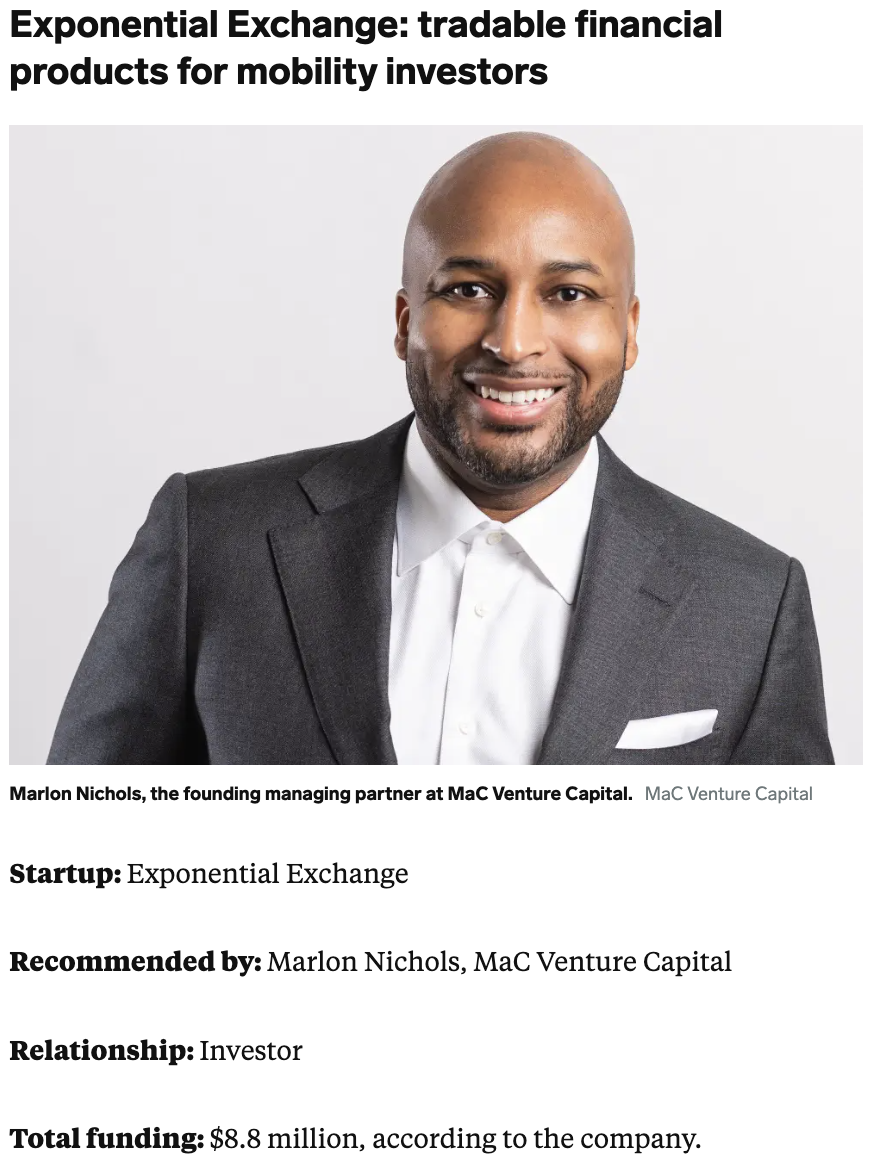

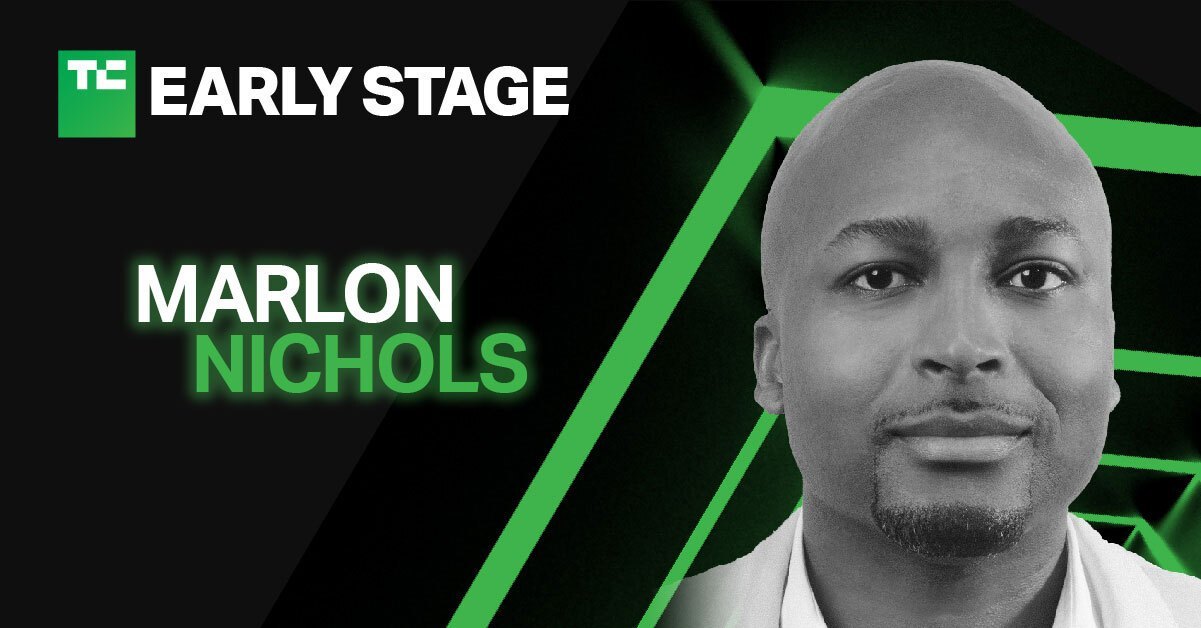

“It’s just a natural thing to invest and want to work with things and people that we have a lot of commonalities with,” said Marlon Nichols, a co-founder and managing partner at MaC Venture Capital and former director of investments at Intel Capital.

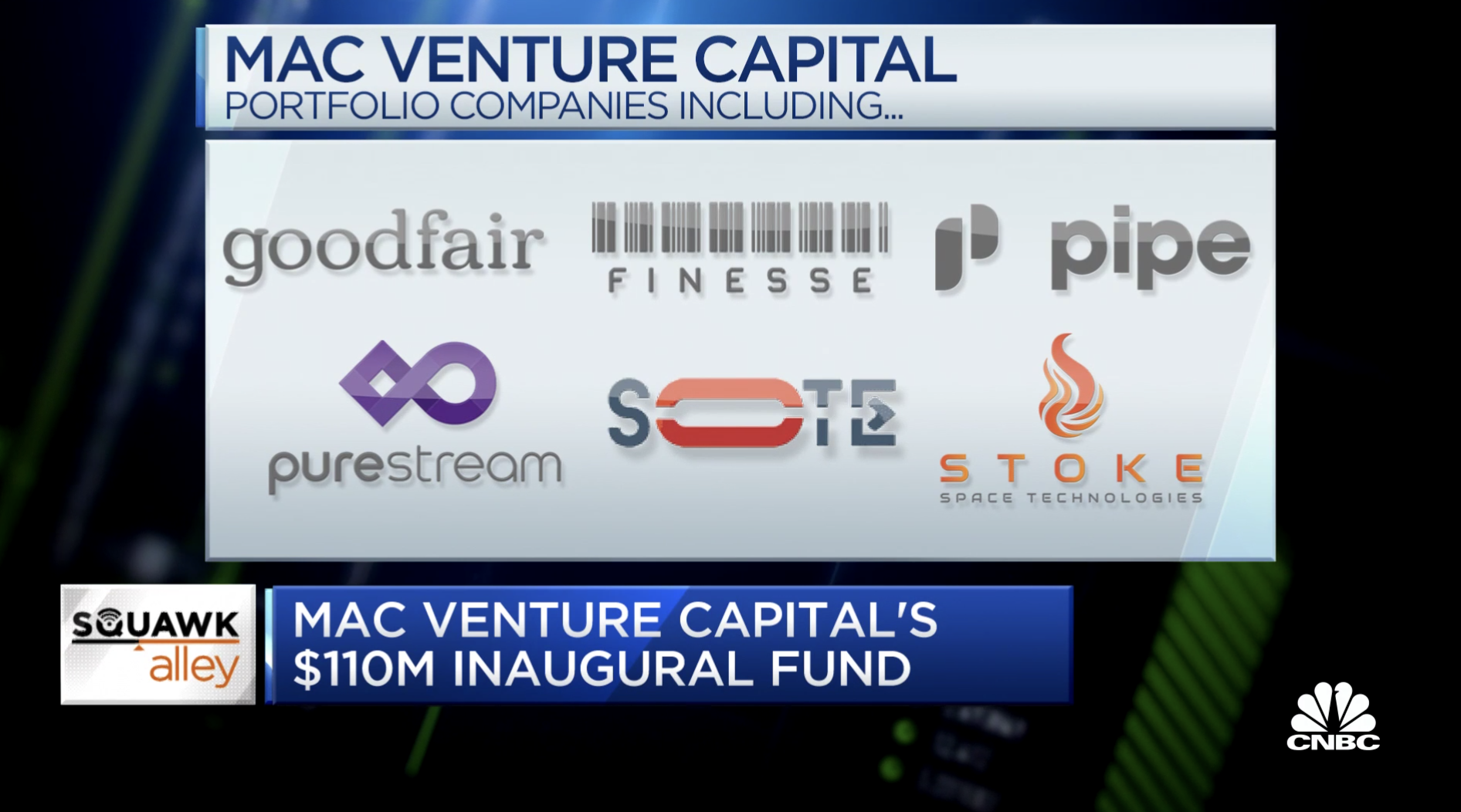

His Los Angeles- and Palo Alto-based firm, founded by a majority Black team, raised its inaugural seed fund of $110 million earlier this year.

MaC Venture isn’t focused solely on investing in people of color, Nichols said, but rather seeks to back startups working on overlooked problems that can lead to big “cultural shifts,” whether they be consumer-facing or enterprise technologies. The fund has invested in roughly 36 companies since it first started deploying capital in July 2019.

Many of the startup founders it has backed just so happen to be Black, Brown or women.

“Usually, the best people to create solutions, or see challenges, or to go after opportunities, are the folks that have lived through or have significant experience with those challenges and the underlying opportunities,” Nichols said. “If we’re taking a look at Black culture or Latinx culture and trying to solve some of their biggest pain points, we’d be idiots to ignore entrepreneurs that are coming from those communities.”

Diverse founders tend to seek the firm out, Nichols said: “They know that we’re going to take a good, hard look — a real look — at what they’re building and who they are and have an understanding of their experiences.”

Black representation in the VC ranks increased slightly in the past year, from an estimated 3 percent of investors to 4 percent this year, according to BLCK VC, an organization that aims to help double the number of Black venture investors by 2024.

“While 1 percent may not seem meaningful, I can tell you as an investor leading and working in this community — as a Black man operating in this community — that 1 percent is something that we all feel,” said BLCK VC co-founder Frederik Groce, speaking last month at a virtual panel discussion hosted by the group.

Although those single-digit percentages are still too small, the industry is showing “shifts happening in its core,” said Groce, who is also a partner at Palo Alto-based Storm Ventures.

The percentage of junior-level venture investors in the U.S. who are Black has increased from 5 percent to 7 percent in the past two years, he said, representing a rising class of future partners who will be more diverse than their predecessors.

Among BLCK VC’s programs are its Black Venture Institute, which helps Black executives become angel and venture investors, and Breaking Into Venture, a nine-week program to help early-career professionals move into the VC industry.

“I’m just adamant that it’s really about representation and autonomy,” Nichols said. “So not just hiring, but actually giving folks like me the power to actually make a difference.”

Black-led megafunds emerge

It was just three years ago, in 2018, when Base10 Partners and the Material Impact Fund were the first two Black-founded venture firms to raise funds above $100 million.

This year alone, Reach Capital, Harlem Capital Partners and MaC Venture Capital — all firms with Black partners — have each raised funds above $100 million for the first time.

“The biggest change has been that downstream capital is just moving at a pace we’ve never seen for people of color,” said Henri Pierre-Jacques, co-founder and managing partner at New York-based Harlem Capital.

Five years ago, he was amazed when a Black founder raised a $6 million round, he said. Now companies are raising multiple $100 million rounds.

The firm, founded in 2015, invests in Black, Latinx and female founders and has completed its 28th investment from its first fund. It’s now preparing to deploy its second fund across 40 to 45 companies with $1 million to $2 million checks for around 10 percent to 15 percent ownership.

Pierre-Jacques expects dealflow in 2021 to double versus last year, and expects to close another three deals this year, on top of the 15 investments made halfway through the year.

The firm raised $30 million from corporations including PayPal, Bank of America, Foot Locker and Apple for its March 2021 Fund II announcement of $134 million, he said. The fund came together in five months.

Role of corporations

Increasingly, corporate America is playing a role in funneling money to such diverse funds, and in turn, diverse founders, with Apple, Bank of America, PayPal and eBay all making commitments in the past year to invest millions of dollars in diverse fund managers.

“It is really helpful if you’re raising a $30 million fund, and corporations come in for $15 million in your first close,” Pierre-Jacques said.

Much of the newfound interest in investing in Black-led funds also stems from limited partners chasing returns, Nichols of MaC Venture said. His firm’s inaugural fund performs in the top 2 percent for its vintage, he said.

“Scarcity drives value in a lot of ways,” he said. “And if traditional LPs are starting to see competition from places where they traditionally hadn’t seen competition, that FOMO is going to start to soak in and they’re not going to want to miss out on the next Sequoia that happens to be a Black-led fund.”

‘Not yet meaningful enough’

While the figures for Black founders and funds are moving in the right direction, they’re still a long way from being representative. Many industry leaders worry that nothing has fundamentally changed — that a year from now, we’ll be having the same conversations all over again.

Crucially, they say, Silicon Valley’s incumbent class of largely white, mostly male investors need to expand their horizons and start writing more checks to startup founders who are not like them.

“We want to make sure that the next leaders of the tech ecosystem of the U.S. reflect the diversity of our nation,” BLCK VC co-founder Sydney Sykes said at the group’s event last month. “And that means that we need to have more Black entrepreneurs. Still only about 1 percent of venture-backed founders are Black. That change is not yet meaningful enough. We believe that institutional changes result from the changes in our networks. Do the people we interact with today, the entrepreneurs we fund, the friends we interact with — are those different from a year ago? I don’t know if that’s true yet.”

Crunchbase Pro queries referenced in this article

- Funding to Black-founded companies in H1 2021 ($1.8B)

- Black/African American founded unicorn companies (6)

- SB Opportunity Fund in Black-founded companies in the U.S. (19)

- Funds raised by Black-founded Venture Firms in 2021 (7)

Illustration: Dom Guzman