Four strategies for getting attention from investors

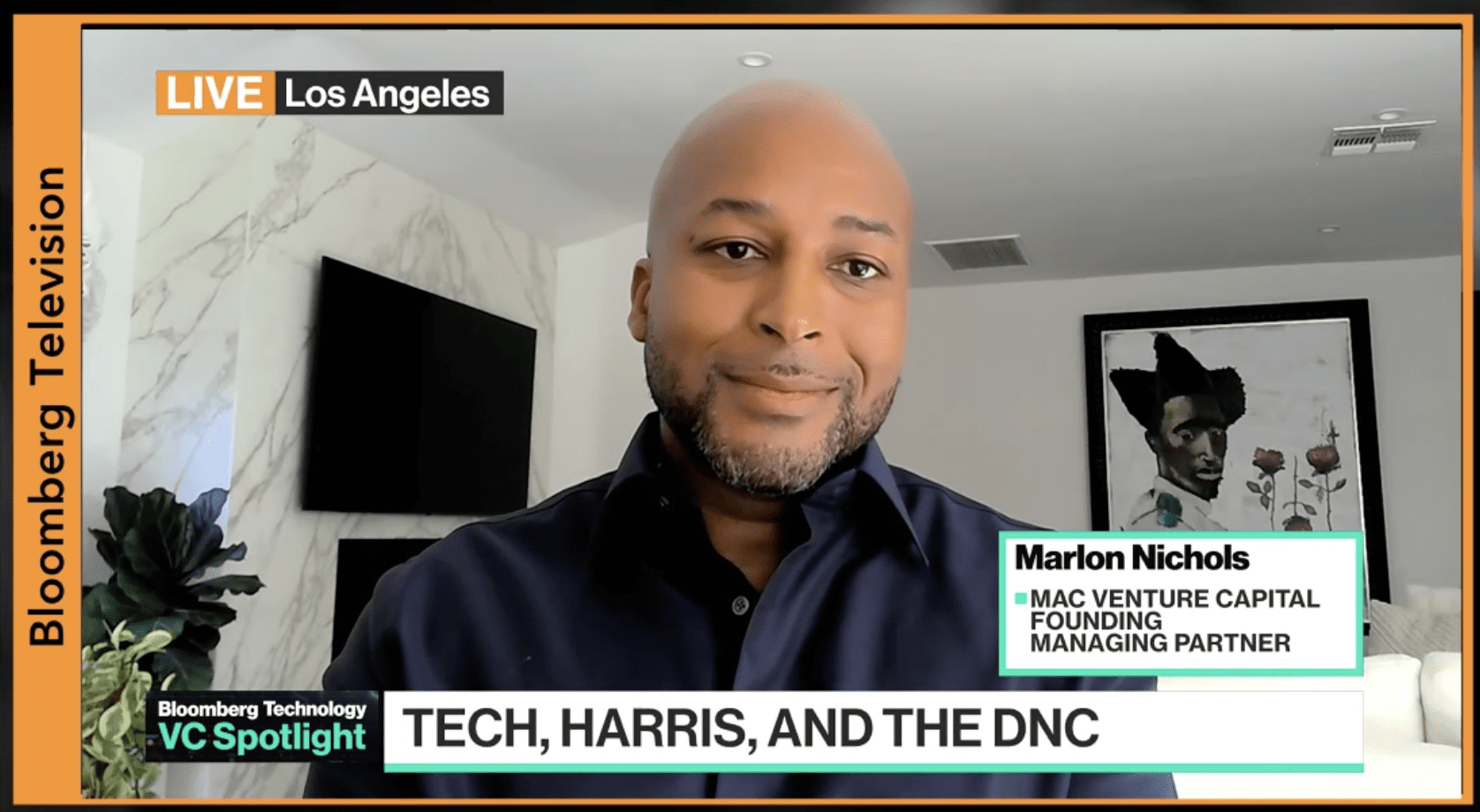

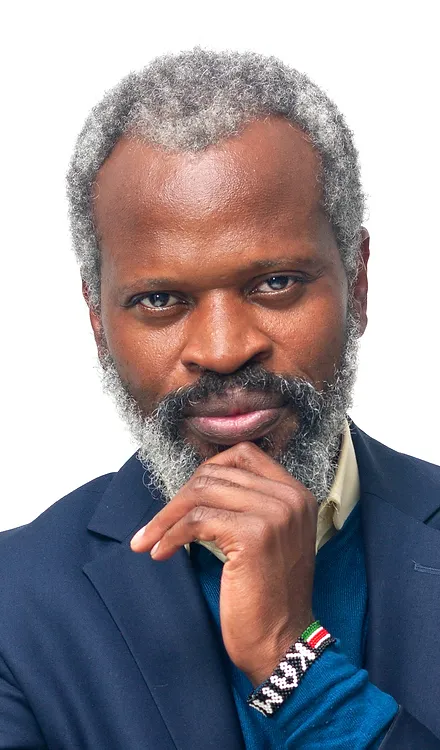

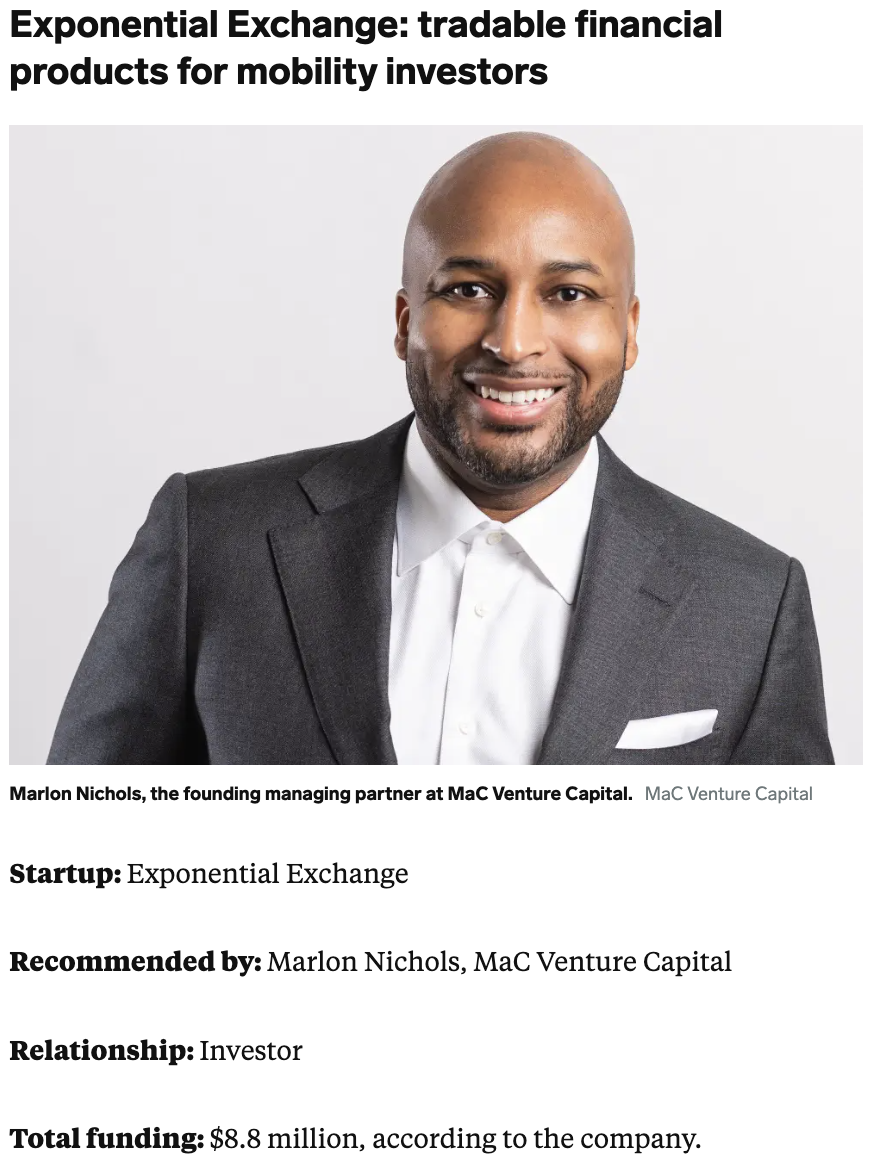

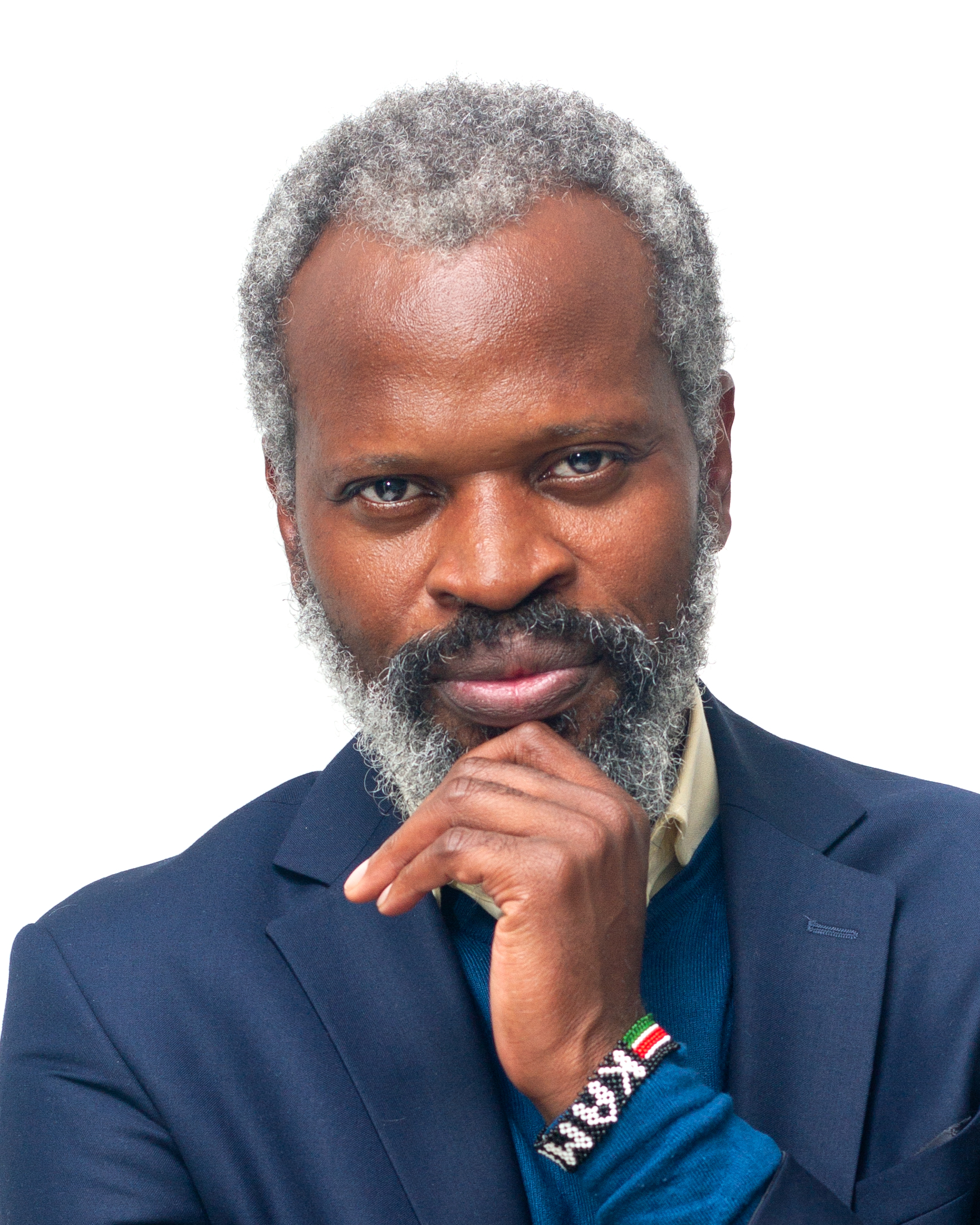

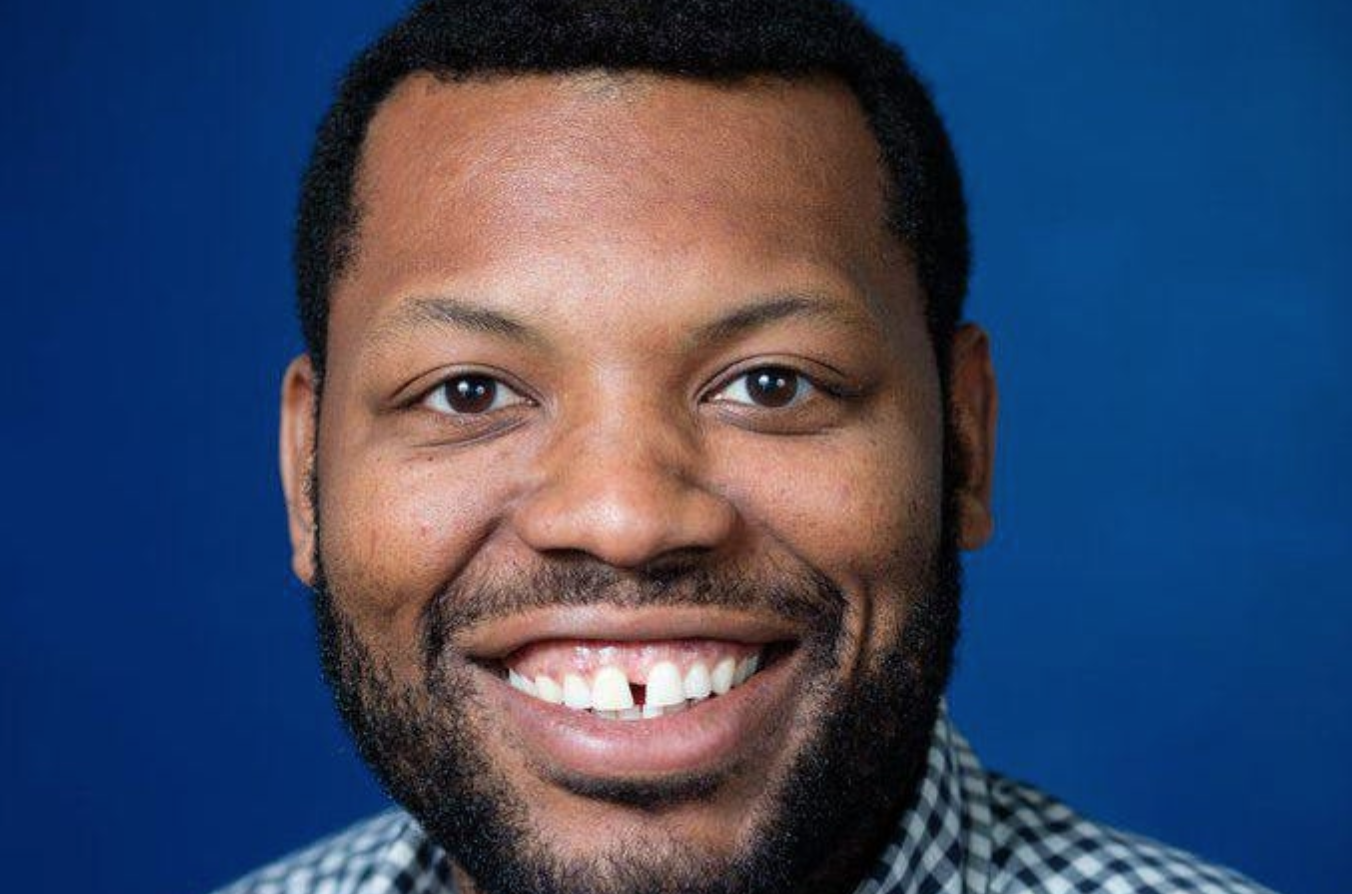

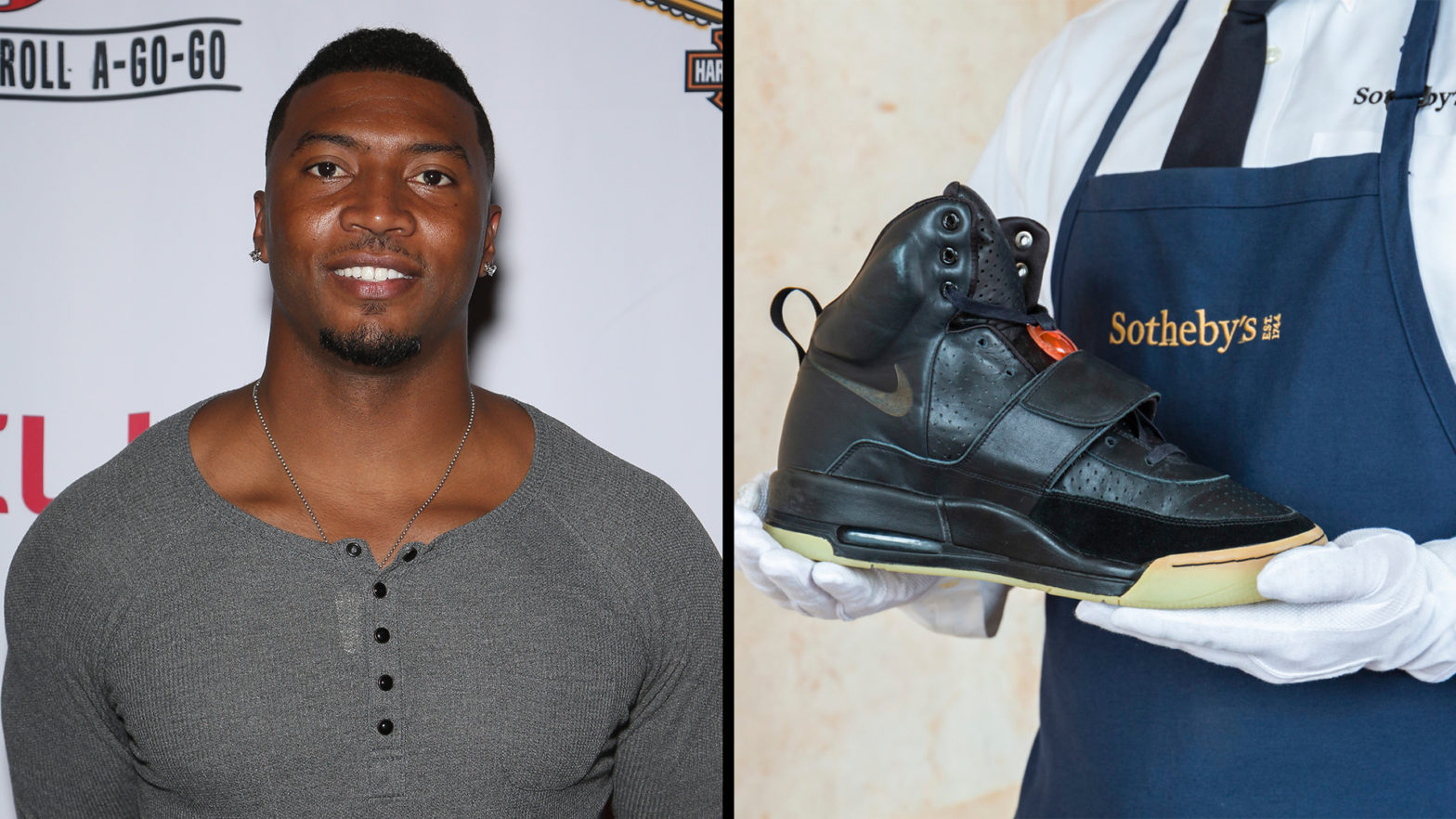

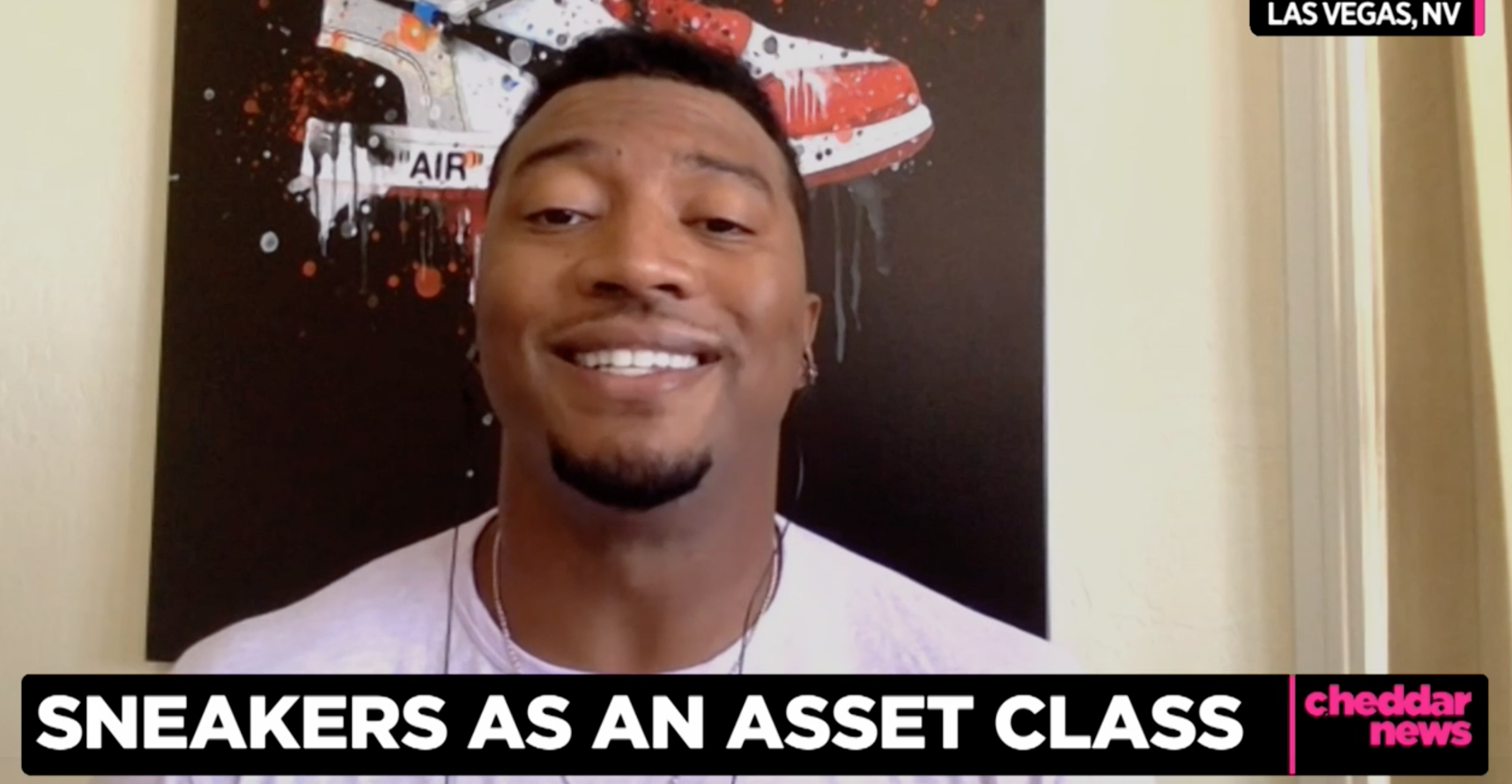

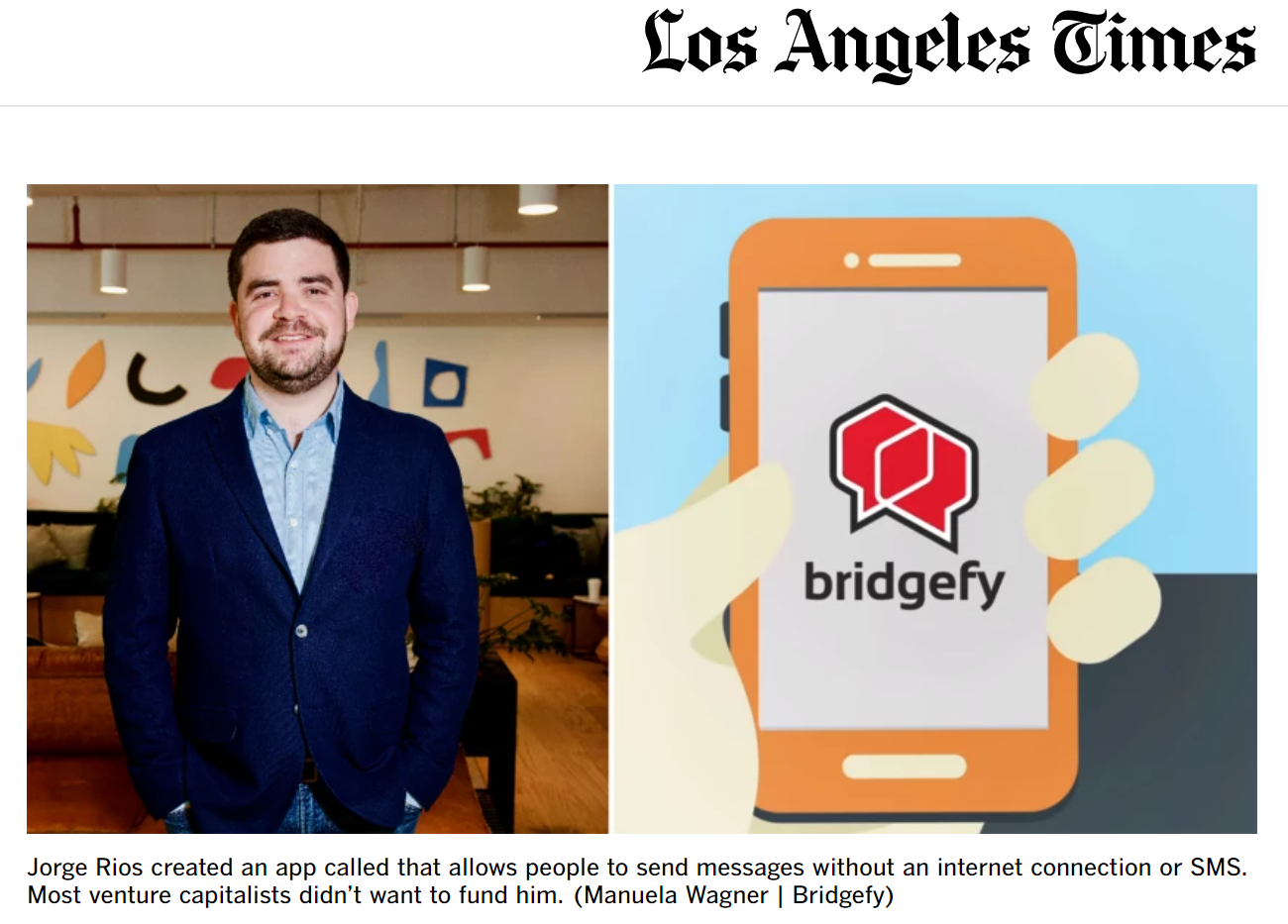

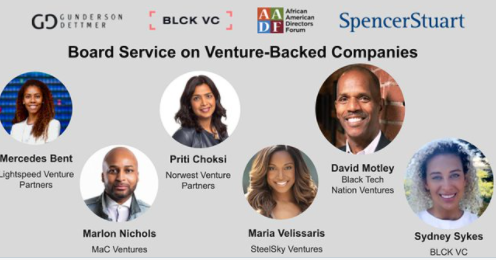

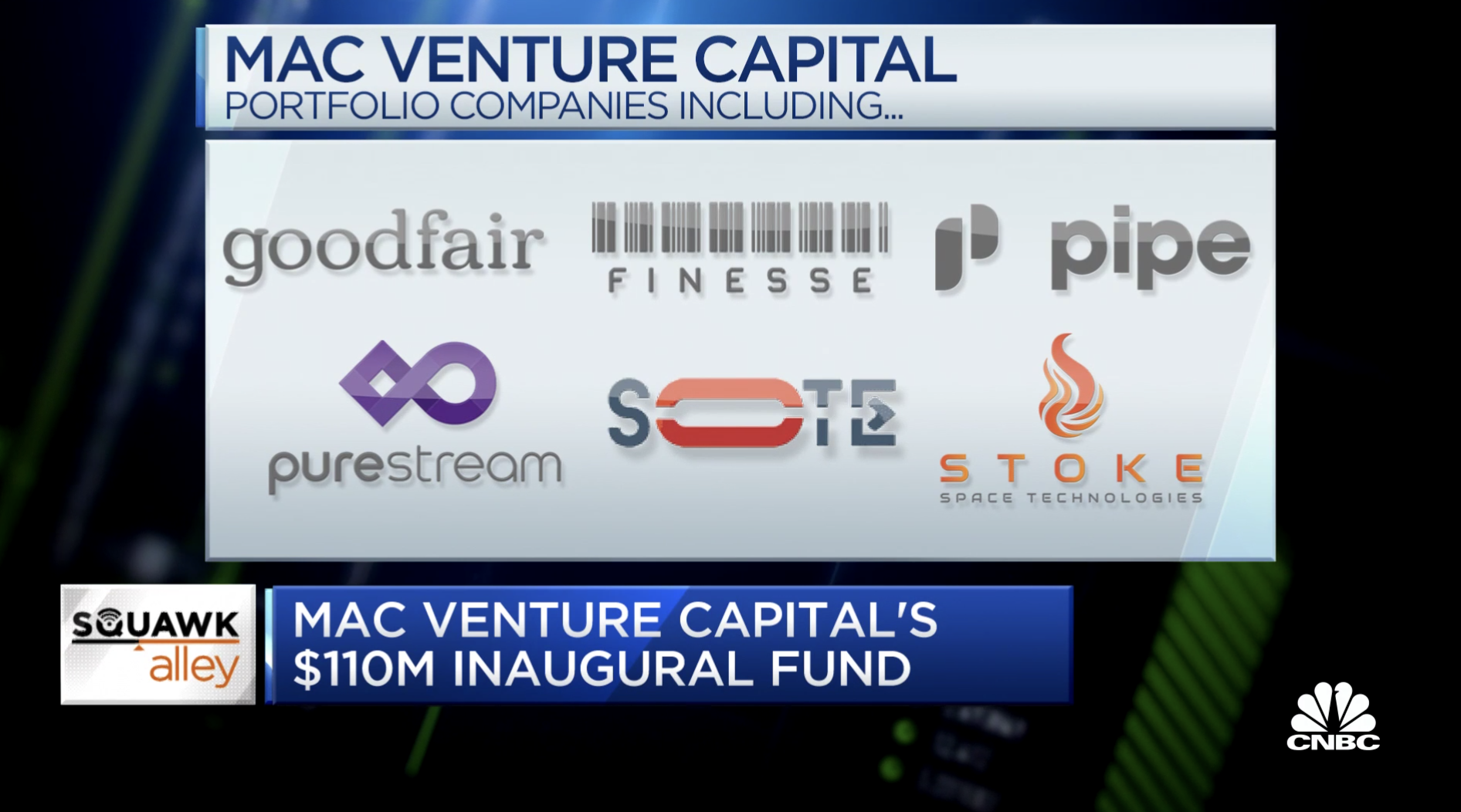

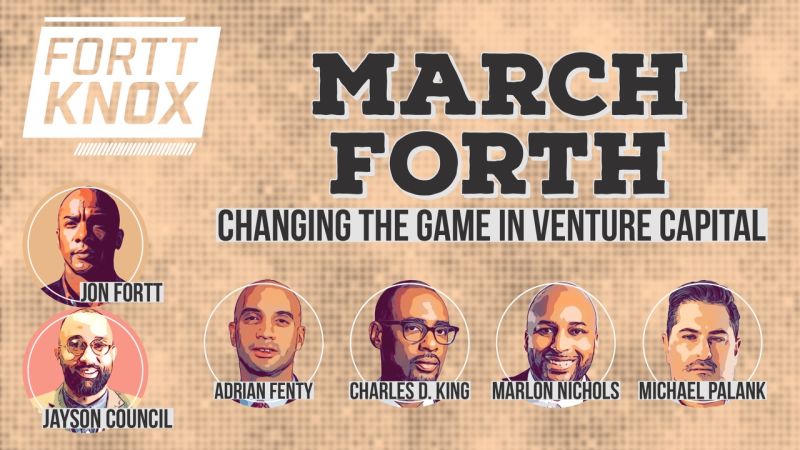

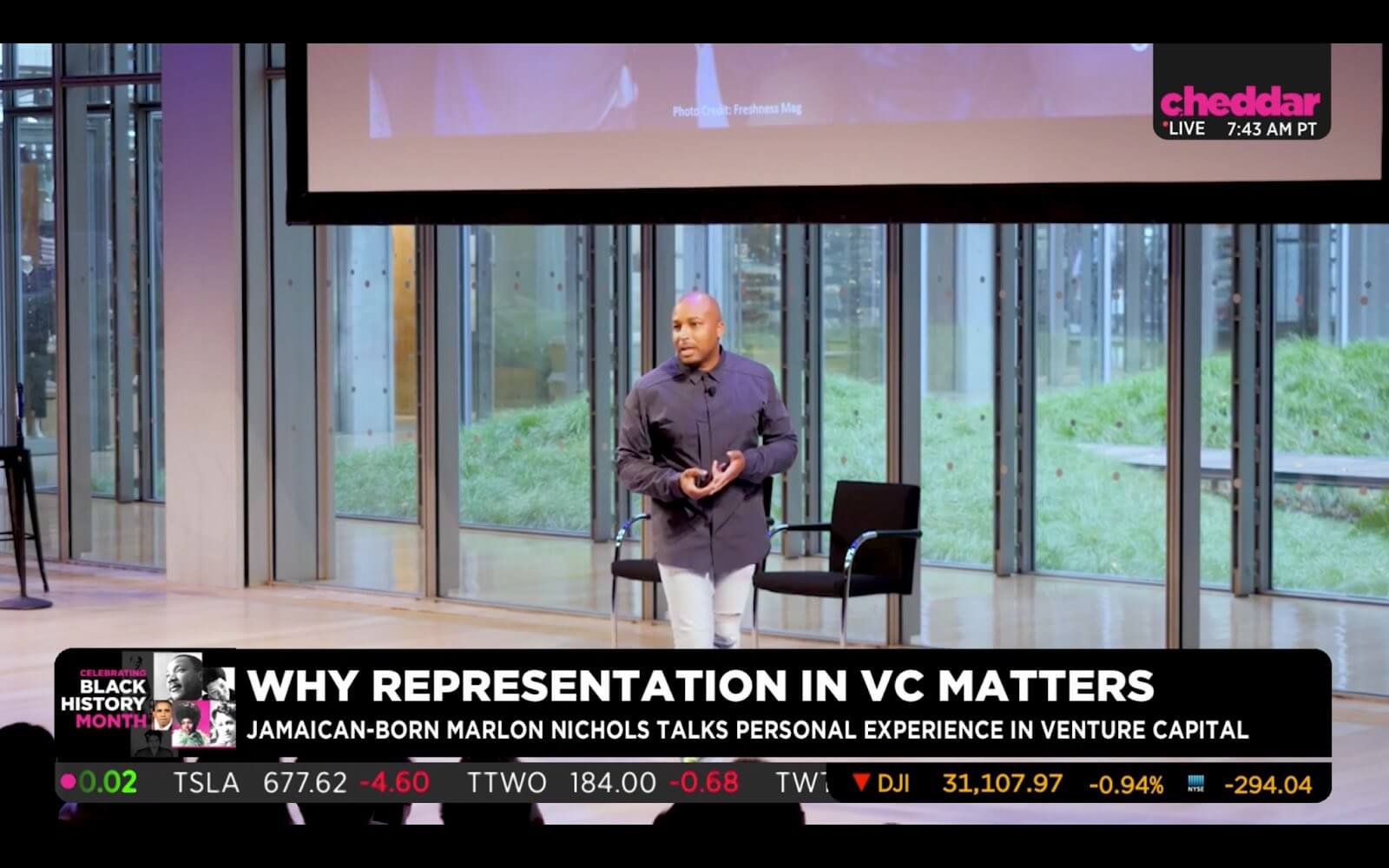

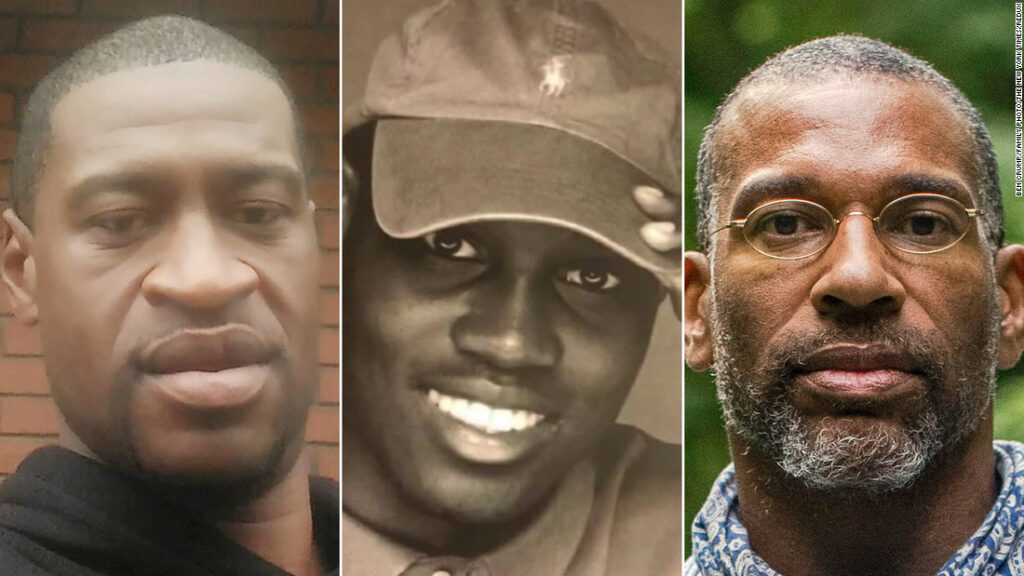

MaC Venture Capital founder Marlon Nichols’ strategy for spotting early stage opportunities.

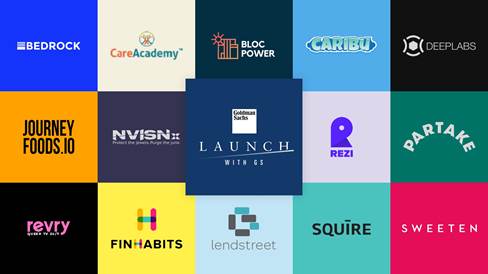

Being a successful early-stage investor is about a lot more than simply identifying trends. A successful VC needs to think several steps ahead. For MaC Venture Capital founder Marlon Nichols, it’s an ability that’s helped him spot big names like Gimlet Media, MongoDB, Thrive Market, PlayVS, Fair, LISNR, Mayvenn, Blavity and Wonderschool early on.

Nichols joined us on TechCrunch Early Stage to discuss his strategies for early-stage investing, and how those lessons can translate into a successful launch for budding entrepreneurs. Success involves not only a solid team and great ideas, it also requires the willingness and ability to change and adapt to an ever-changing world.

Getting ahead of the trends

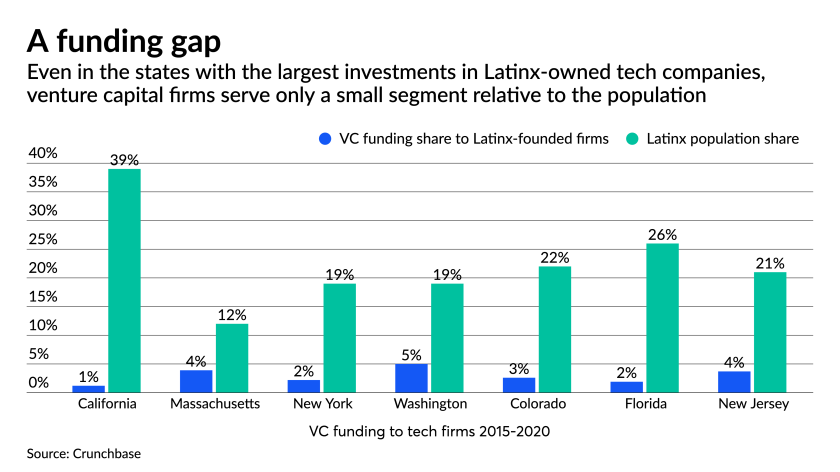

Anyone can identify trends once they’ve broken, but a successful investor needs to see several steps ahead of the pack. This ability helps VCs know where to focus their attention and, eventually, how to weed out the snake oil from the true value pitches.

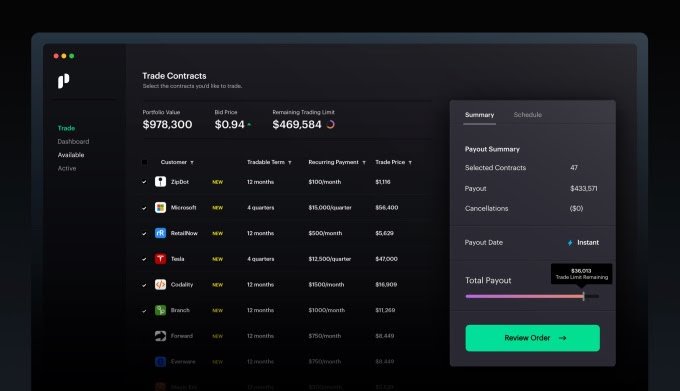

For us, that means taking a look at emerging behavioral trends and shifts in culture. What we’re looking to understand is where people and companies are going to spend their time and money – not only today, but in the future. So we do research to see if there are supporting factors for this thing sticking around and being successful. If that answer is yes, then we can dig a bit deeper.

. . .

Image Credits: MaC Venture Capital