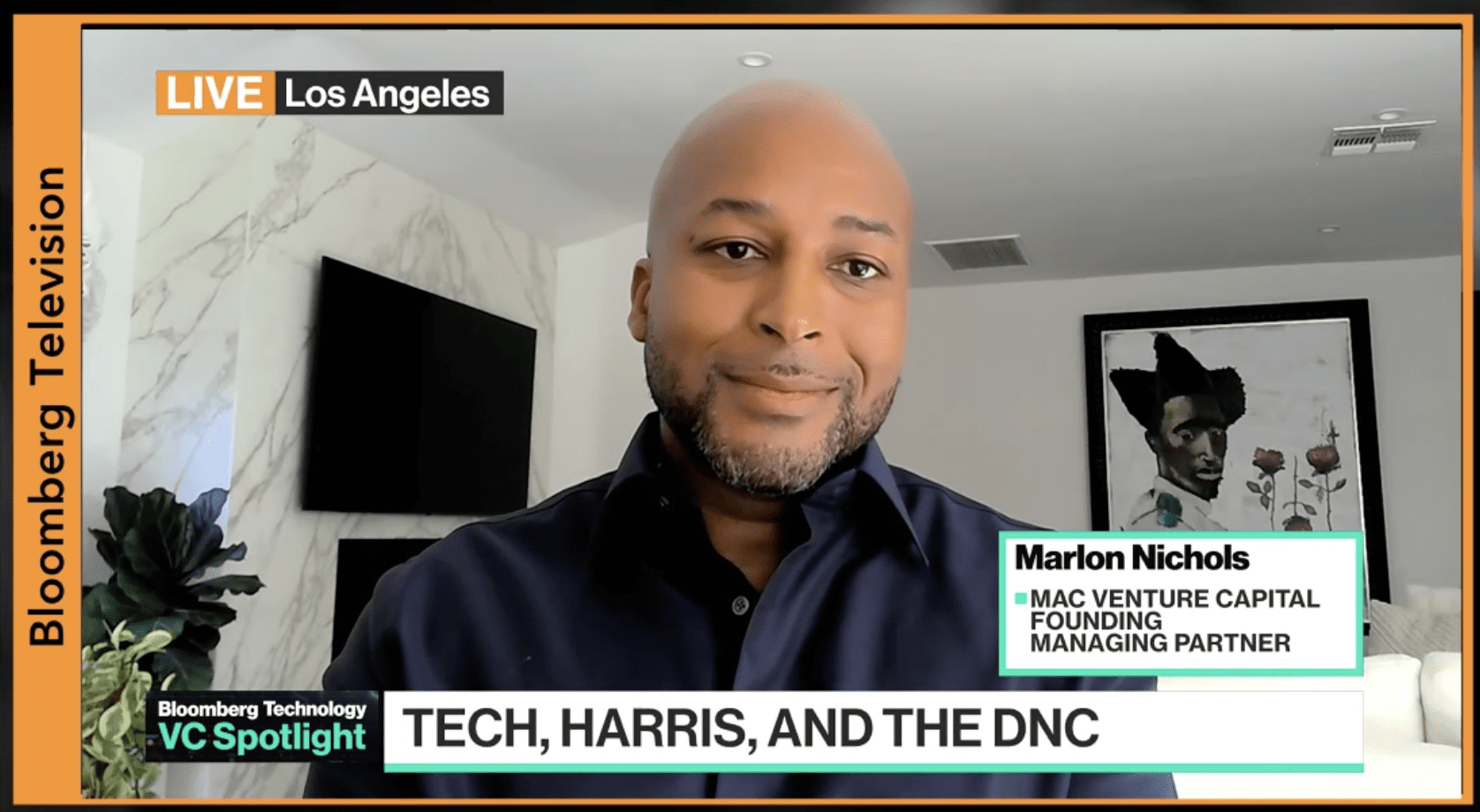

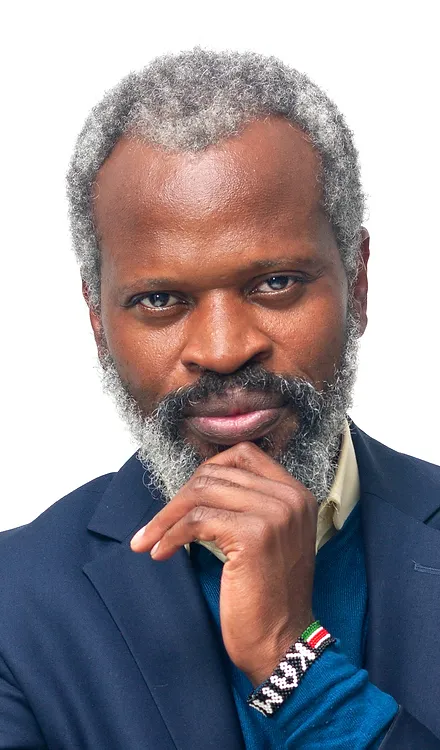

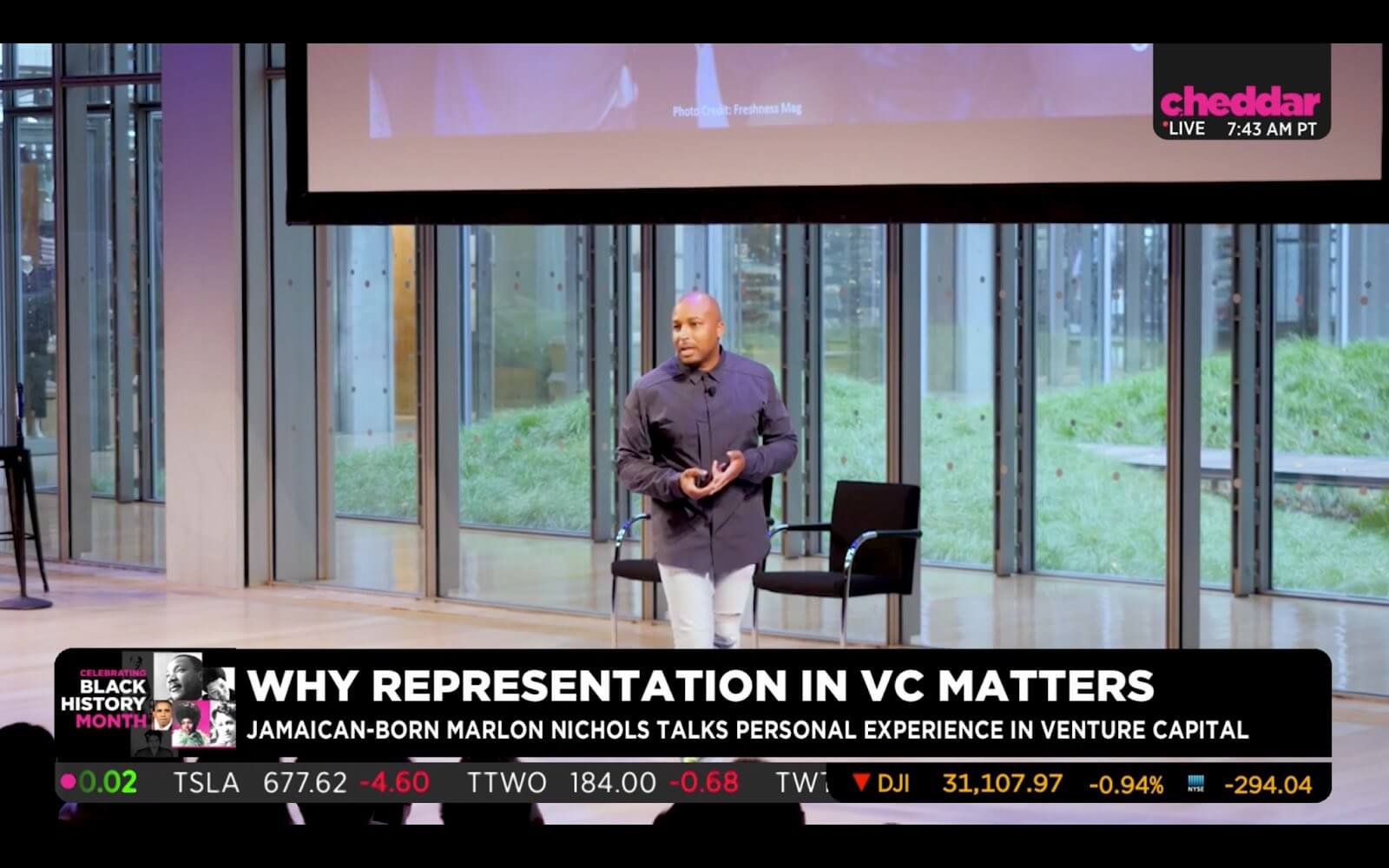

Forbes: Marlon Nichols Is Changing The Face of Venture Capital

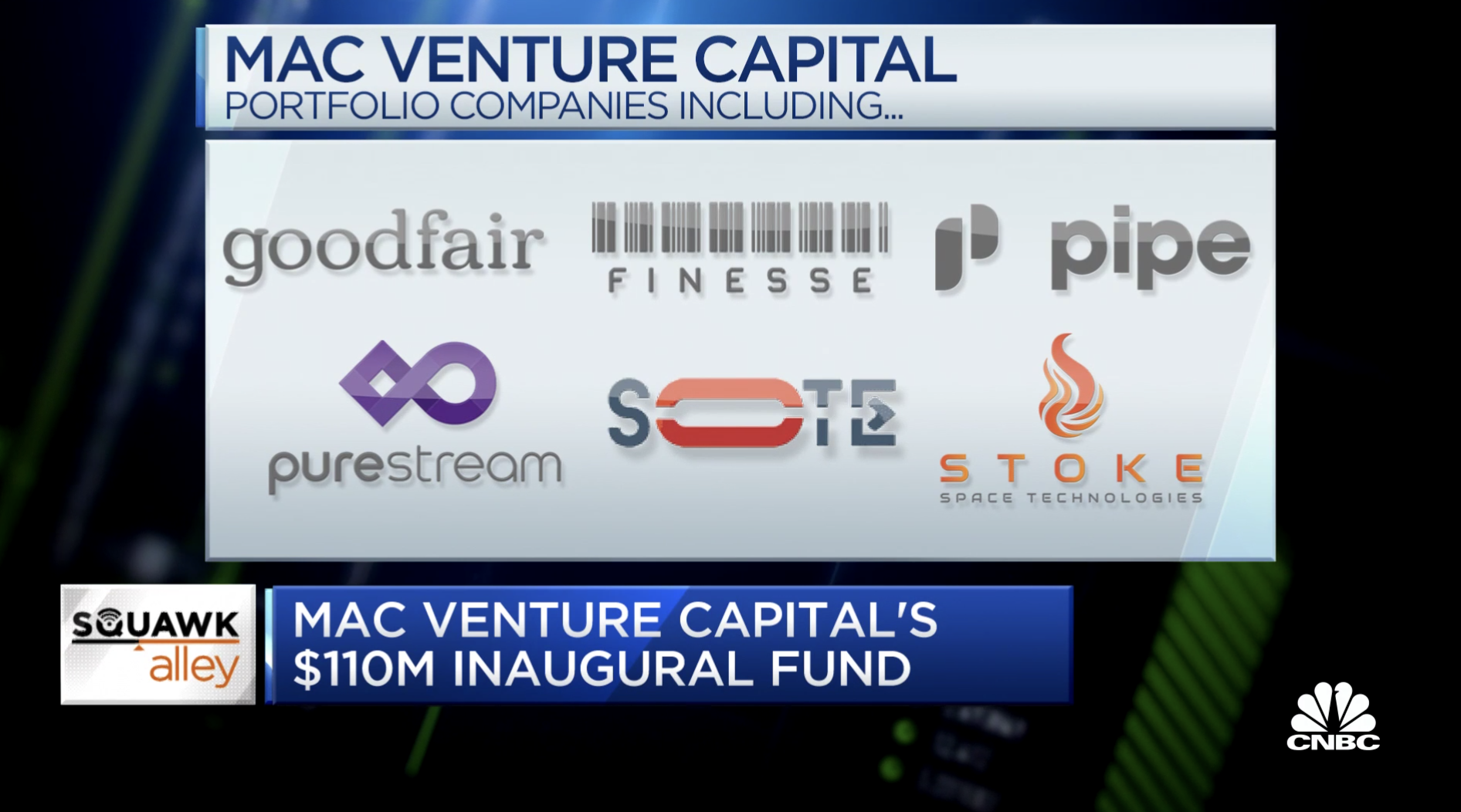

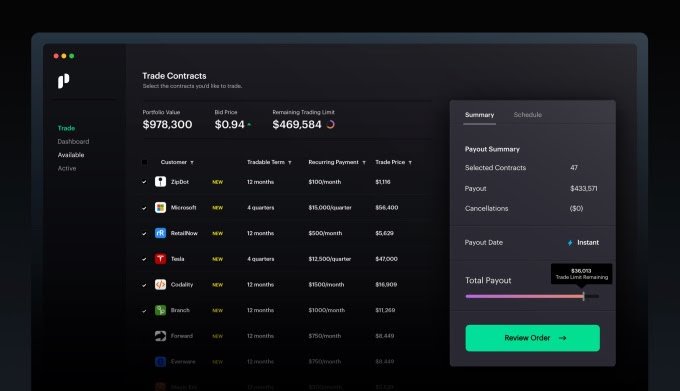

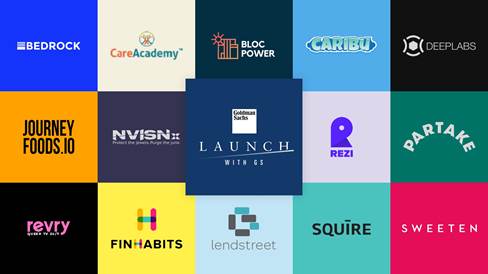

…CCVs investment strategy is also an important study in how cultural diversity can positively impact the bottom line. By employing a “cultural investing” thesis that Nichols defines as “the impact of the convergence of global popular culture and consumer behavior on technology / innovation,” CCV develops a deeper understanding of the cultural trends and consumer patterns that can capture high-potential investments. Additionally, by maintaining a varied portfolio that includes Health Tech, Education, Media, and Financial Services, and features companies with diverse leadership (66% of CCVs companies are led by black, Latinx, or women founders), Nichols has positioned CCV as a capable player with strategic assets in multiple markets. Diversity works both ways. White-owned companies also benefit from building investment relationships with black-backed firms…In fact, CCV has already seen two exits and a number of their portfolio companies have gone on to raise next round of funding at higher valuations from some of the top tier Silicon Valley Venture capital firms. A couple recent examples are Blavity (founded by a black female) and Wonderschool who raised series A funding from GV and a16z respectively.