The Top 25 Women Leaders in Financial Technology of 2021

The Financial Technology Report is pleased to announce The Top 25 Women Leaders in Financial Technology of 2021. As the financial technology sector continues to evolve, thousands of women in leadership roles help propel their companies and its products to more competitive positions in the market. The women nominated and selected for this year’s awards have demonstrated exceptional skill in their respective positions. They were evaluated based on substantive reviews from peers and colleagues both within their organization and from across the industry. Their positions range from founder and C-level executives to product and operations heads to human resources and marketing officers, among others.

The companies represented by this year’s awardees showcase the breadth and increasing sophistication of the fintech sector, from financial planning tools for individuals to software for financial institutions to global payments platforms. These companies succeed in large part because of their ability to recruit and retain the best talent such as the women leaders on this year’s list whose innovative thinking, ability to inspire others and disciplined approach to operations have had a significant impact on their organizations. Please join us in recognizing The Top 25 Women Leaders in Financial Technology of 2021.

1. Katherine Salisbury

1. Katherine Salisbury

Company: Qapital

Title: Co-Founder & Co-Chief Executive Officer

Katherine Salisbury is the Co-Founder & Co-Chief Executive Officer of Qapital, a financial planning technology company. Since 2015, Qapital has been changing the way people interact with their personal finances with its financial planning app, built for individuals and couples with dual accounts to better plan and track their fiduciary future. The signature app is designed to gamify personal finances and financial planning by tracking spending behavior, applying custom rules for spending, and building the user’s savings accounts. Salisbury founded the company with her husband, co-CEO George Friedman, as a next-generation personal and joint banking tool that works to make financial tracking and planning easier, more transparent, and more productive.

Qapital is not the couple’s first foray into business together; since 2009, the couple has owned and operated Friedman & Salisbury Sports Management, a management agency focused on professional soccer. Salisbury boasts nearly 20 years of experience in corporate finance, banking, and law, including two years as vice president and counsel at Jeffries Finance, LLC. She received her BA from the University of Chicago and her JD from Cornell University.

2. Anna Fridman

2. Anna Fridman

Company: Spring Labs

Title: Co-Founder and General Counsel

Anna Fridman is co-founder of Spring Labs, a fintech startup founded in 2017. Spring Labs creates and oversees anonymous, decentralized data networks that vastly increase the amount, quality, and security of information available to market participants. Spring Labs leverages sophisticated cryptographic tools and blockchain technology to provide data and metadata integrity guarantees, tamper-evident workflows, and privacy-preserving tokenization that allow for the corroboration of information without the exchange of underlying data.

Prior to her time at Spring Labs, Fridman was the founding general counsel of Avant, an online consumer lending platform that began operations in 2012 and has been recognized as one of the fastest-growing startups in the U.S. at that time. Prior to joining Avant, she worked as in-house counsel at another financial technology startup in Chicago, and prior to that, she worked in private practice focusing on transactional law.

Fridman graduated from UCLA School of Law and holds a BA degree from UCLA in business economics with a minor in Russian literature. She is a frequent speaker on the topic of innovation and diversity in the fintech space. Additionally, she teaches a class at USC Gould School of Law, where she parlays her professional experiences to the next generation of professionals.

3. Ksenia Yudina

3. Ksenia Yudina

Company: UNest

Title: Founder and Chief Executive Officer

Ksenia Yudina, CFA, is the Founder & CEO of UNest — the money app for children’s future. UNest’s services make financial planning easier for parents in order to give their children a financial head start. Anyone with a smartphone can sign up in just a few minutes, with no paperwork. The platform has quickly emerged over the last year as the leading provider of financial planning, saving, and investment tools for parents and kids. UNest has achieved this by being the first to develop a native app that eliminates the complexity and limitations of legacy 529 and custodial (UTMA) products.

Yudina spent over a decade working in financial services. While she was at Capital Group/American Funds, the largest provider of 529 college savings plans in the country, she realized that most families were struggling to meet the cost of education and did not have access to a convenient way to avoid the kind of debt she had experienced. She knew that it would be difficult for a large institution to move quickly enough to solve this problem, so she decided to build it herself.

As founder and CEO of UNest, she has spearheaded the development of her company’s breakthrough fintech solution and raised funding from leading venture capital funds. Among her accolades, Yudina was a 2019 Finalist in Quesnay’s “Female Founders in Fintech” competition. She was also recognized as a “40 Under 40” by Investment News in 2020. Ksenia Yudina received an MBA at the UCLA Anderson School of Management and holds a CFA charter.

4. Sumita Pandit

4. Sumita Pandit

Company: dLocal

Title: Chief Operating Officer

Sumita Pandit is the Chief Operating Officer at dLocal, a global payments platform enabling merchants to reach billions of emerging market consumers across 29 countries in Africa, Asia, LATAM, and the Middle East. More than 325 companies rely on dLocal to accept over 600 local payment methods in emerging markets and issue millions of payments to their customers, agents, and sellers worldwide. At dLocal, Pandit oversees client management, marketing, investor relations, and corporate development. Since joining dLocal in April 2021, Sumita has led the company’s immensely successful listing on Nasdaq.

She has worked with multiple high-growth fintechs over the years and leveraged her past experience in creating a compelling and differentiated positioning for dLocal. Pandit has 18-plus years of experience in investment banking, advising companies across verticals in fintech, including payments, financial software, neo-banks, and insurtech. Prior to joining dLocal, she was a Managing Director, Global Head of Fintech Investment Banking for J.P. Morgan. Before J.P. Morgan, she worked at Goldman Sachs. She received her MBA from The Wharton School at the University of Pennsylvania, where she was a Palmer Scholar and earned her undergraduate degree in electrical engineering from India.

5. Trisha Price (tie)

5. Trisha Price (tie)

Company: nCino

Title: Chief Product Officer

Trisha Price is the Chief Product Officer of nCino, the leading global provider of cloud-based software for financial institutions. nCino works with more than 1,200 financial institutions globally, whose assets range in size from $30 million to more than $2 trillion. The nCino Bank Operating System digitizes, automates, and streamlines inefficient and complex processes and workflow, and utilizes data analytics, artificial intelligence, and machine learning to enable financial institutions to more effectively onboard new clients, make loans and manage the entire loan life cycle, open deposit, and other accounts and manage regulatory compliance. With more than 20 years of financial services and technology experience, Price leads the nCino team responsible for the design, development, and roadmap of the nCino Bank Operating System.

Prior to joining nCino in 2016, Price held various positions at Primatics Financial, including Head of Global Sales and multiple accounting roles at Fannie Mae. She was also appointed to the board of directors for Docebo Inc.’s Audit Committee in 2021. She holds a Bachelor of Science in mathematics and mathematics education from North Carolina State University and a Master of Liberal Arts in extension studies, software engineering from Harvard University.

5. Kristina Wallender (tie)

5. Kristina Wallender (tie)

Company: Human Interest

Title: Chief Product Officer

Kristina Wallender is a metrics-focused, customer-obsessed brand builder and Chief Product Officer at Human Interest. She is responsible for building a top-rated 401(k) experience for America’s 32 million small businesses and their 61 million employees and advancing Human Interest’s mission to ensure that people in all lines of work have access to retirement benefits. In her role, Wallender is transforming retirement industry practices through leading industry-changing initiatives such as eliminating transaction fees and enhancing monitoring technology to further protect plan administrators from unexpected costs and penalties. Her organization spans the full lifecycle of the customer experience, including product management, design, customer success, operations, and marketing.

Prior to Human Interest, Wallender held product and marketing leadership roles at Amazon, Ticketfly, and RealtyShares. She is known for building customer-centric products and closing gaps to create a more integrated and differentiated customer experience. Outside of work, Wallender volunteers with community-based organizations that emphasize empowerment. She is currently focused on helping older adults live independently, and families build emergency preparedness plans. She has an MBA from the Stanford Graduate School of Business and a BA from Cornell University.

6. Allison Amadia

6. Allison Amadia

Company: Personal Capital

Title: General Counsel, Chief Compliance Officer, and Head of Human Resources

Allison Amadia is Personal Capital’s General Counsel, Chief Compliance Officer, and Head of Human Resources, directing the company’s legal, compliance, and HR functions. She also serves as executive co-chair for Personal Capital’s Diversity, Equity, and Inclusion Committee. Personal Capital is an online financial advisor and personal wealth management company that provides a number of digital solutions for enhanced personal financial planning.

Previously, Amadia served as General Counsel and Chief Compliance Officer at Extreme Networks, where she managed the legal and compliance functions, including driving the successful acquisition and integration of a peer-size company. Prior to that, she served as General Counsel and Chief Compliance Officer at Handle Financial Inc., a privately held payment processor, and mobile bill pay provider. She also successfully founded and managed a consulting firm for over a decade, providing strategic advice and counsel to public and private technology companies. Amadia also serves as Vice-Chair of the Dean’s Advisory Council for the College of Letters and Science at the University of California, Davis. She holds a BA in political science and government from the same university, as well as a JD from the University of Pennsylvania Law School.

7. Allison Netzer (tie)

7. Allison Netzer (tie)

Company: Nymbus

Title: Chief Marketing and Strategy Officer

Allison Netzer is the Chief Marketing and Strategy Officer for Nymbus, a leading provider of banking technology solutions for financial institutions. Nymbus enables banks and credit unions of any size to grow and attract new market segments by delivering a full suite of banking technology, including Loan Origination, CRM, and Digital, along with the operational resources to launch and run a new digital bank. As Chief Marketing and Strategy Officer at Nymbus, Netzer is among the senior leaders orchestrating a well-timed disruption in banking by helping financial institutions break through the limitations of legacy technology.

She began her 20-year career in sales leadership at Dell, transitioning to high-profile marketing responsibilities and ultimately becoming an essential voice in corporate strategy development. As SVP for strategy and marketing at Kony, she helped grow the digital banking platform provider 500 percent in two and a half years and played an instrumental role in strategy development on the run-up to a 2019 blockbuster $580 million acquisition by Temenos, Europe’s third-largest software company.

Netzer writes regularly for the Forbes Communication Council about issues influencing the future of banking. She has further been a champion for women in the workplace for the entirety of her career and has focused especially on elevating women’s voices at the strategic decision-making table over the last several years. She holds a Bachelor of Business Administration degree from North Carolina State University.

7. Minyang Jiang (tie)

7. Minyang Jiang (tie)

Company: Credibly

Title: Chief Strategy Officer, Sales and Marketing

Minyang Jiang is the Chief Strategy Officer overseeing the Sales and Marketing teams at Credibly. As one of the nation’s leading small business lenders, Credibly has seen no shortage of volatility during the past year. Jiang was brought on in January 2020 to take a hard look at the business and put a plan in place to grow revenue 5x in the next five years. In the year and a half she’s been with the executive team, Jiang has had an outsized impact on the people, processes, and platforms at Credibly. Her focus on high performance and accountability for herself, direct reports, and peers has resulted in the successful steering of Credibly’s marketing and sales team through the biggest operational undertaking to date, record-breaking months in Credibly’s history, and the implementation of a women’s leadership program.

In another life, Jiang spent eight years leading in marketing and strategy at Ford Motor Company, eventually becoming the CEO and founder of her own mobility company. She was also named one of Automotive News’ “40 under 40” in 2014. Prior to Ford, Minyang worked in non-profits and startups in roles requiring dexterity and the ability to build from the ground up. She graduated Summa Cum Laude from Harvard University and later received her Master’s in marketing and operations management from Wharton School of Management.

8. Elizabeth Jenkin (tie)

8. Elizabeth Jenkin (tie)

Company: Nimbla

Title: Chief Executive Officer

Elizabeth Jenkin is the Chief Executive Officer of Nimbla, a digital invoice insurance company. Founded in 2017 by Flemming Bengtsen, Nimbla provides SMEs with a unique platform that uses algorithmic analysis to deliver real-time insurance protection of B2B customer credit. Despite being a young company, Nimbla was recently recognized as one of the Top 100 companies to work for by ‘Escape the City.’

The fintech world is a natural step for Elizabeth. She cut her teeth in underwriting and then transitioned to broking at Aon where she remained for nearly two decades, latterly as the chief broking officer for EMEA. There she championed the use of technology to make better, faster business decisions to provide superior client outcomes. Her knowledge of insurance, trade credit and structured finance is broad and deep which enables her to bring a richness of experience to the role which complements Nimbla’s cutting edge tech.

Elizabeth is passionate about her family, people, and sport. Reflecting these passions, she currently sits on the board of the Women’s FA and co-founded a not-for-profit network and mentoring community ‘Lift as you Climb.’

8. Anna Hawter (tie)

8. Anna Hawter (tie)

Company: Lumi

Title: Chief Operating Officer

Anna Hawter is the Chief Operating Officer and co-founding member of leading and rapidly growing Australian small business lender, Lumi. Hawter has built and leads Lumi’s team in the day-to-day operations and shapes the strategic direction and culture of the business. Since Lumi’s inception in 2018, she has overseen its explosive growth through a challenging period, originating more than $100 million in loans, growing employee headcount by over 300 percent in three years and raising more than $100 million in debt facilities and $35 million in equity.

Hawter is relentless in her pursuit to position fintech as a more viable alternative to traditional lenders. As COO, she is also committed to diversity including empowering females in fintech with over 30 percent of Lumi’s permanent staff being female, many of whom are in leadership positions.

Prior to Lumi, Anna worked in corporate restructuring, turnaround and optimization at Deloitte and Australian boutique McGrathNicol. Through working on large-scale turnaround projects she acquired a passion for well-managed, lean organizations, and it is this experience that enabled her to steer Lumi through the COVID-era and to emerge operationally stronger. She is a Chartered Accountant and has earned an MBA from IE Business School in Madrid. She also volunteers as a mentor to junior females in the fintech startup space, providing them with the guidance and network they need to navigate their complex career paths.

9. Amabel Polglase

9. Amabel Polglase

Company: Zilch

Title: Chief Marketing Officer

Amabel Polglase is the Chief Marketing Officer of Zilch, one of the fastest-growing Buy Now, Pay Later providers in the world. Polglase has a strong track record of aggressively scaling startups, bolstering growth at Zilch with a customer-centric brand view. Founded in 2018, Zilch recently surpassed 700,000 users with quarterly growth in excess of 80 percent. Polglase thrives in the fast-paced world of fintech and has worked with her team and several agencies to articulate Zilch’s unique brand proposition and approach to responsible lending, which has seen the business grow more than 40 percent since she joined.

As a leading CMO, Polglase has diverse experience in business, marketing and entrepreneurship, including founding her own successful startup. She served in several senior leadership roles prior to joining Zilch, including at Gather App and Curve Card where she led brand, marketing and communications. Before joining the fintech revolution, Polglase was managing global client partner at Facebook and managing partner at McCann-Erickson, the world’s largest ad network. She volunteers at Girls Out Loud, a charity created to empower and inspire teenage girls, and is also a mentor at The Girls’ Network. She received her MA in history and international relations from the University of St Andrews.

10. Katherine Degnen

10. Katherine Degnen

Company: Fidel API

Title: Vice President of Product

Katherine Degnen is Vice President of Product at Fidel. Fidel offers the only suite of financial infrastructure APIs that allows developers to build programmable experiences around the moment when a user’s payment card is swiped, dipped, tapped, or typed. Degnen oversees the development, commercialization and management of Fidel’s product offerings, influencing the direction of the company. Degnen leads a global team of 20 talented engineers and managers from across functions. She is passionate about enabling developers to build powerful and engaging user experiences using real-time payments.

Prior to joining Fidel, Degnen worked at Zola where she focused on building new business verticals within the wed-tech startup. Her career in product began while working on creating new ways of helping customers save money on everyday purchases at RetailMeNot. In her spare time, she acts as the head of volunteer corps for Off Their Plate, a non-profit focused on solving gender and racial inequities through food justice. She holds an MBA from Harvard Business School and a BSBA in economics from the University of Richmond.

11. Alena Valovaya (tie)

11. Alena Valovaya (tie)

Company: FINOM

Title: Chief Marketing Officer

Alena Valovaya is the Chief Marketing Officer and co-founder of FINOM, one of the fastest-growing European B2B financial services platforms. Alena joined the company in late 2019 and since then she has been in charge of creating the brand and leading in clients acquisition, targeting three key markets: France, Germany, and Italy. FINOM’s mission is to make the life and business of entrepreneurs and professionals a lot easier. A value proposition that is working well as FINOM is on a path for becoming a unicorn company, currently growing its customer base at an average of five percent per week.

Before FINOM, Valovaya was already working in fintech as the brand director of Modulbank, one of the most successful online B2B banks in Russia. She also worked across different industries, including telecommunications (YOTA and Euroset), publishing (AST), and video gaming (Nival Network). She loves to change and challenge herself; she holds an MSC in Psychology from Voronezh State University and started her career in HR, climbing the ladder until she reached the position of HR director. She is also a movie director, having studied at The Gerasimov Institute of Cinematography in Moscow.

11. Angie Goertz (tie)

11. Angie Goertz (tie)

Company: Issuer Direct Corporation

Title: Vice President of Marketing

Angie Goertz is the Vice President of Marketing at Issuer Direct Corporation. Issuer Direct is an industry-leading business communications and compliance company focusing on the needs of corporate issuers. Issuer Direct’s principal platform, Platform id., empowers users by thoughtfully integrating the most relevant tools, technologies, and services, thus eliminating the complexity associated with producing and distributing financial and business communications. Headquartered in Raleigh N.C., Issuer Direct serves thousands of companies around the globe in 18 countries. As the VP of Marketing, Goertz is responsible for developing the long-term, global marketing plan for the organization that outlines marketing strategies to tactical execution in order to achieve defined goals and objectives.

Before being promoted to her current role, Goertz was Issuer Direct’s director of marketing, responsible for creating, implementing, and managing marketing plans that support the organization’s growth strategy within the financial services industry. She was responsible for leading a team to manage the day-to-day digital marketing activities for Issuer Direct and identifying opportunities to launch new products or to enter new markets. Prior to joining Issuer Direct five years ago, Goertz held a number of senior-level marketing roles across a wide variety of industries, including online education, telecommunications software, and enterprise systems management. She began her career at Dell Technologies after graduating from the University of Texas at Austin with a Bachelor of Science degree in advertising.

12. Annaliza Liddelow (tie)

12. Annaliza Liddelow (tie)

Company: Verrency

Title: Global Head of Client Services

Annaliza Liddelow is the Global Head of Client Services for Verrency, a global SaaS payment innovation platform. Since 2019, Liddelow has been leading Verrency’s global Customer Success function. As a senior fintech leader, her focus is on achieving successful customer outcomes by creating productive partnerships and delivering transformational outcomes. She leads the global delivery for some of the world’s largest banking and financial institution clients. Her tenacity and dedication to solving client problems and achieving success, together with her excellent relationship management skills, have been instrumental in the company’s recent recognition as a finalist for Australia’s Fintech Organisation of the Year 2021 and Australia’s fastest-growing company in the Deloitte Technology Fast 500 Asia Pacific.

Liddelow has over 22 years of technology program management experience in the financial services industry. As a strong woman of minority heritage, she ensured she gets recognized on her merits as an outstanding performer in an industry still run predominantly by Caucasian men. Annaliza is a strong advocate of diversity, gender equality, and the advancement of women in the financial technology workspace. She contributes by spending time mentoring and encouraging young professionals in the industry. She received her Bachelor of Applied Sciences degree from Victoria University.

12. Alexandra Boyle (tie)

12. Alexandra Boyle (tie)

Company: OpenFin

Title: Head of Strategic Client Group Europe

Alexandra Boyle leads OpenFin’s Strategic Client Group in Europe, driving technology transformation with the largest global banks, asset managers, and vendors. OpenFin is the financial industry’s Operating System, enabling rapid and secure application deployment, native experience, and desktop interoperability. Today OpenFin is used to deploy 3,500 applications across 300,000 desktops at more than 2,400 buy-side and sell-side firms. Boyle joined OpenFin in 2014 as one of the first ten employees. She has always championed female representation and the importance of diversity in financial services. She regularly participates in women in technology events, panels, and podcasts. In September 2020, Boyle and her colleague Jessica Meiselman founded the OpenFin Women’s Group, an employee resource group dedicated to building community in the remote working world. She enjoys mentoring young female professionals and advising early-stage startups.

Prior to OpenFin, Boyle held both product and business development positions at NYSE Technologies. She has been consistently recognized in the industry, most recently winning the 2020 Banking Tech Awards Rising FinTech Star Award, being nominated for the 2020 European Women in Finance Awards, and being included in the Tech Women 100 Shortlist 2020. She received her Bachelor of Science in Finance from Lehigh University.

13. Michelle Cramer (tie)

13. Michelle Cramer (tie)

Company: Andesa Services

Title: Director of Client Experience/Chief Actuary

A multifaceted executive and seasoned actuary, Michelle Cramer is the Director of Client Experience and Chief Actuary of Andesa Services, Inc., a leading third-party administrator of Software as a Service (SaaS). Cramer has more than 25 years of experience in the life insurance industry, serving both the traditional and corporate-owned markets. Since joining Andesa in 2014, she has championed the personal and professional development of her team, helping them to achieve their fullest potential while driving client service excellence and quality performance. Andesa, a fully employee-owned organization of nearly 200 team members, provides technology and services to eight of the top 13 insurance carriers in the nation.

Working in a fast-paced, complex, and evolving environment, Cramer has a proven ability to assess business operational effectiveness and administrative accuracy. Her time at Andesa is not just focused on the financial health of the company but also the corporate culture. She is an active contributor in an employee-lead diversity, equity and inclusion focus group, engagement team, and leadership development program, all of which have built the framework around the Andesa Forever Vision. Previously, she was a life actuary with Nationwide Insurance, as well as an assistant director and senior actuarial consultant with Hartford Life. She holds a BA in math from The College of New Jersey.

13. Kristy Lagle (tie)

13. Kristy Lagle (tie)

Company: Step

Title: Head of Customer Experience & Community

Kristy Lagle is the Head of Customer Experience & Community at Step, a next-generation banking platform tackling the financial literacy gap by offering modern financial tools and education for Gen Z. Since its public launch in late 2020, Step has skyrocketed to over two million customers. In her role overseeing Customer Experience, Trust & Safety and Community, Lagle leveraged her operational and industry expertise to scale the team, ensuring customers continued to receive the high-touch experience they’ve come to love. As a result, Step was the 4th most downloaded digital banking app in 2021, with an App Store rating of 4.7.

Over the past 20 years, Lagle has started, grown, and managed operations and analytics teams across several early-stage startups. Prior to joining Step, she spent six years developing and scaling one of the largest same-day delivery driver operations at Deliv. Lagle also spent a number of years at LiveOps, where she grew and optimized a 20,000+ team of independently contracted agents. Her career ventures at Deliv, LiveOps, and Luminate have led to many successful acquisitions as well as a patent. Lagle holds a bachelor’s degree in psychology from Mills College and a master’s degree in Clinical Psychology from the California School of Professional Psychology.

14. Galvea Kelly (tie)

14. Galvea Kelly (tie)

Company: Collective

Title: Chief Marketing Officer

Galvea Kelly is Chief Marketing Officer of Collective, an online administrative services provider for single-member S-corporations. With its suite of tools, Collective offers a completely online back-office platform for “businesses-of-one” to manage everything from business incorporation to accounting, bookkeeping, and tax services — plus access to a thriving community of small businesses. The company is backed by General Catalyst, QED, Sound Ventures (Ashton Kutcher and Guy Oseary), Google’s Gradient Ventures, Expa, and other prominent investors who have financed and built iconic companies like YouTube, Uber, Stripe, Snap, Udemy, Lyft, Instacart and more. As CMO, Kelly is a global award-winning marketing leader who has led marketing departments across multi-billion dollar, global organizations — and had her own digital marketing agency to boot.

Before joining Collective, Kelly served as global VP of digital marketing for LVMH (Moët Hennessy Louis Vuitton), where she led digital strategy for Benefit Cosmetics, a $1.5 billion prestige beauty brand. She has also held marketing leadership roles with Chobani, L’Oréal, and more. She holds a Bachelor’s degree in law and business from University College Dublin and an MBS in international business from the UCD Michael Smurfit Graduate Business School.

14. Kate Farmer Rojas (tie)

14. Kate Farmer Rojas (tie)

Company: Notion

Title: Vice President of Marketing

Kate Farmer Rojas is the Vice President of Marketing at Notion, a Comcast Company. Notion works with leading insurance providers and partners to deliver DIY monitoring solutions that empower home and property owners with a simple, smart, and effective way to proactively monitor their properties from anywhere. As head of marketing, Rojas leads all marketing efforts, driving the company’s B2B2C marketing strategy from partner marketing to throughout the customer journey. In over two years with Notion, she has led the brand through an acquisition by a Fortune 50 company, implemented and operationalized an end-to-end marketing tech stack, helped triple the amount of insurance and financial service partners, and designed programming geared to drive business growth.

As a leader with more than 14 years of experience in both B2C and B2B, Rojas has an extensive marketing background spanning a variety of industries, including consumer goods, SaaS, cannabis tech, mobile apps, insurance, and financial technology. Prior to joining Notion, Rojas was the VP of marketing for Baker Technologies, where she grew the brand to be the number one CRM in the industry and helped take the company through a four-way merger to form TILT Holdings, a publicly-traded company. Early in her career, Kate spent over four years at Nielsen BASES, where she drove new product innovation and predictive forecasting for top Fortune 500 companies. She holds a bachelor’s degree from the University of Cincinnati and resides in Denver, Colorado.

15. Arlene Dzurnak (tie)

15. Arlene Dzurnak (tie)

Company: Bond

Title: Chief Compliance Officer

Arlene Dzurnak, CPA, is Chief Compliance Officer for Bond, an enterprise financial technology provider. Bond is on a mission to accelerate financial innovation and access to capital, providing

an enterprise-grade financial technology platform that streamlines the integration between brands and banks, dramatically reducing friction and creating a more repeatable model. Through its AI-powered infrastructure, Bond enables digital brands to better engage their customers by offering personalized and compliant banking products. As Bond’s CCO, Dzurnak has confidently built the company’s compliance program from the ground up, keeping customer protection the top priority.

Dzurnak is an accomplished, performance-driven Risk & Controls leader with proven versatility in the areas of compliance, risk management, audit, internal controls, accounting, and corporate governance. Prior to joining Bond, she served as a risk and compliance leader at Affirm, Celtic Bank, Alliance Data Card Services, and GE Capital Bank. She began her 25-year career with 12 successful years at Washington Mutual Bank, where she grew from a teller to HR operations manager, ultimately serving as assistant vice president of internal controls. She is also a founding member of Chief San Francisco, a private network built to drive more women into positions of power in the corporate world. She earned her BS in accounting and MBA from the City University of Seattle.

15. Amanda Bafaro (tie)

15. Amanda Bafaro (tie)

Company: BridgePoint Financial Group

Title: Chief Risk Officer and General Counsel

Amanda Bafaro is the Chief Risk Officer and General Counsel at BridgePoint Financial Group, a Canadian provider of litigation funding solutions. BridgePoint is committed to providing the most responsible and affordable litigation financing and risk management solutions in Canada. It offers a range of innovative and affordable financing solutions to meet the specialized needs of personal injury plaintiffs, their lawyers, and the experts called upon to develop their legal claims and protect their rights to full and fair access to justice. In her role as Chief Risk Officer, Bafaro plays a lead role at BridgePoint by providing insight and knowledge of personal injury practice as well as litigation outcomes and risk. She brings a wealth of experience at a time of exceptional growth in BridgePoint’s business amidst transformation and legislative change in the personal injury arena.

Bafaro is an experienced litigation lawyer who brings extensive knowledge and practical expertise in all facets of personal injury law and litigation. Prior to joining BridgePoint, she practiced exclusively with Paul Lee & Associates, a boutique firm that specialized in both defense and plaintiff personal injury law. She holds a BA from The University of Western Ontario and an LLB from the York University Osgoode Hall Law School.

16. Nora Droste

16. Nora Droste

Company: SmartAsset

Title: Vice President of Human Resources

Nora Droste is the Vice President of Human Resources for SmartAsset, an award-winning financial technology company. Founded in July 2012 by Michael Carvin and Phillip Camilleri and headquartered in New York City, SmartAsset helps more than 100 million people each month make smart financial decisions. The company offers free tools, calculators, and advice that are all objective and based on data, using its proprietary Automated Financial Modeling (AFM) technology to help people make confident decisions that impact their finances and financial goals. In her role as head of HR, Droste oversees the HR, recruitment, and office management teams to control every aspect of the employee life cycle, ensure seamless internal operational efficiencies, and attract top employee talent.

Droste boasts nearly 25 years of experience in corporate sales and leadership, including as a human relations consultant. Prior to joining SmartAsset, she served as director of HR for Objective/SinTec Media. She holds a Bachelor of Science degree in accounting and an MBA in finance from Saint Thomas Aquinas College and is a member of the Society of Human Resources.

17. Tracy Linbo

17. Tracy Linbo

Company: Growers Edge

Title: Executive Vice President and Chief Commercial Officer

Tracy Linbo is Executive Vice President and Chief Commercial Officer for Growers Edge, a provider of financial technology solutions for agriculture businesses. The Growers Edge intelligence platform uses sophisticated data science, as well as public and private data sets and deep learning algorithms to design warranty-backed crop management plans sold through U.S. agricultural retailers. These plans reduce a farmer’s risk and help them more efficiently and effectively plant, nurture and harvest crops. Bringing extensive experience growing agricultural businesses and developing strong partnerships to Growers Edge, Linbo drives the company’s commercial strategy and the continued development of its sales organization.

Prior to joining Growers Edge, Linbo served as SVP of agronomy, communications & marketing with Agtegra Cooperative. She also spent a decade with DuPont Pioneer, from 2007-2017, last serving as director of strategic planning. In her spare time, Linbo owns and operates her own business as well, Double T Acres and Tillit Solutions, an immersive farm experience in Minnesota, and serves as an advisor for AgVend. She holds an AgEcon degree from the University of Minnesota.

18. Yasmin Moaven (tie)

18. Yasmin Moaven (tie)

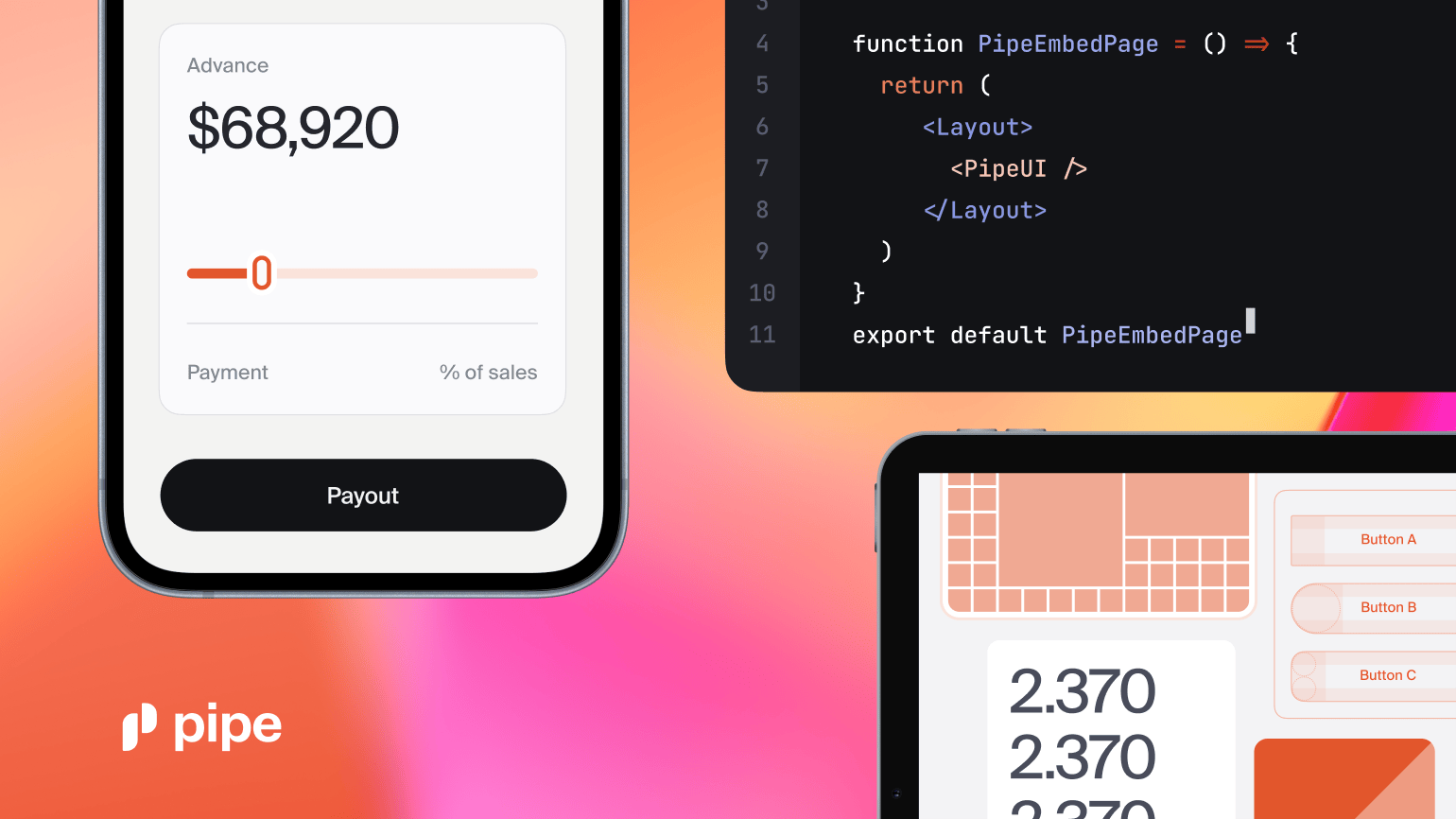

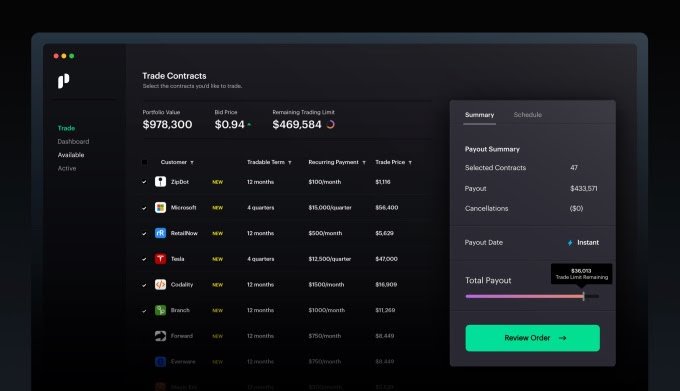

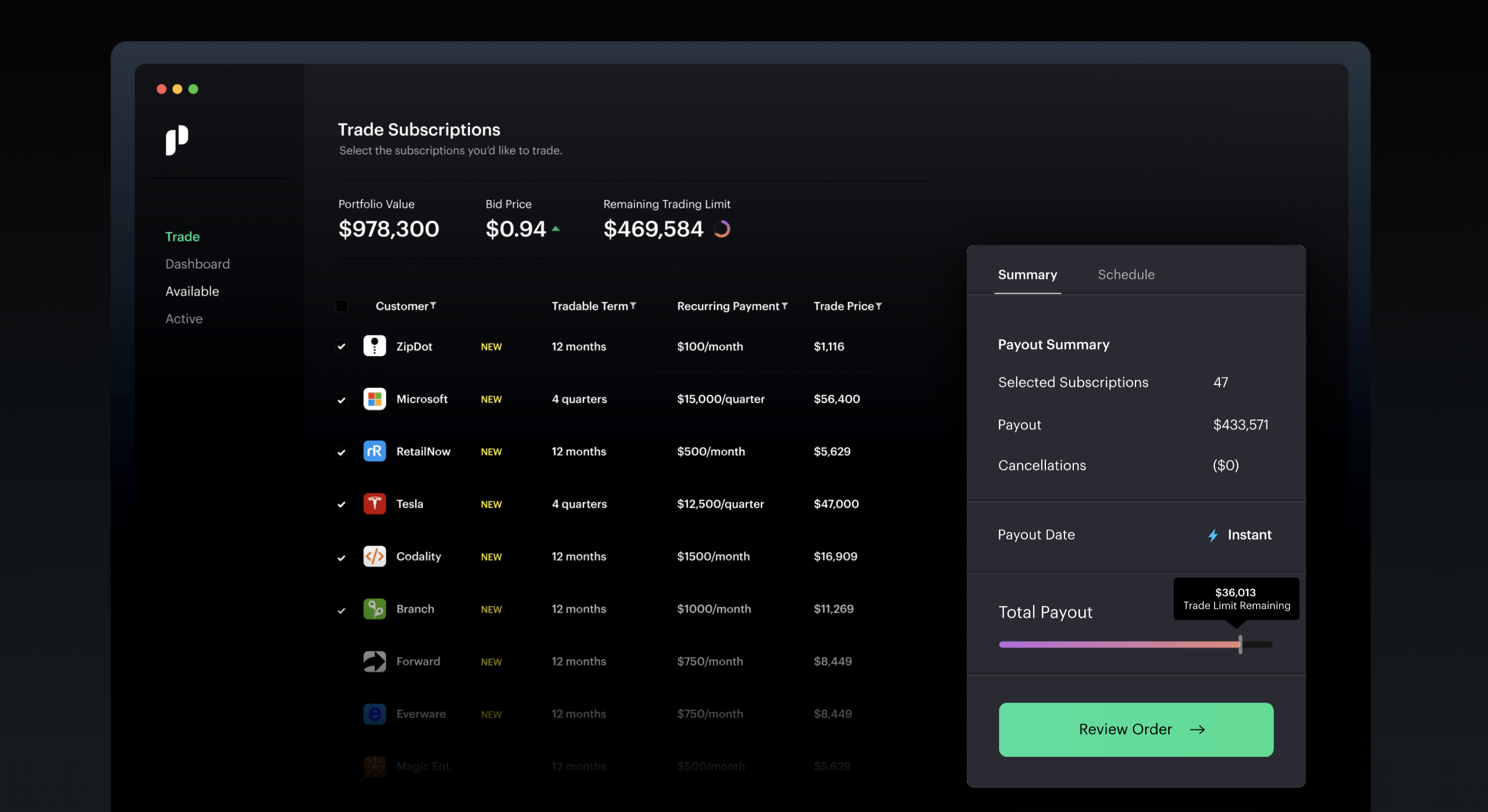

Company: Pipe

Title: Vice President of Marketing and Communications

Yasmin Moaven is the Vice President of Marketing and Communications for Pipe, creators of the world’s first trading platform for recurring revenues. The Pipe platform provides direct access to the capital markets for companies of all sizes, ranging from early-stage all the way to publicly listed companies, turning their recurring revenue streams into annual recurring revenue upfront, without debt or dilution. For institutional investors, Pipe has unlocked the largest untapped asset class, revenue — which acts similar to fixed-income products.

Moaven has a decade of experience managing and running marketing and communications for public and emerging technology companies. Prior to joining Pipe, she was one of the early employees at Fair.com, the car subscription app, spearheading investor relations, communications, and marketing – raising over $1.3 billion in debt and $500 million in equity. Before Fair, she worked in marketing and communications for Sotheby’s, TrueCar, and the L.A. Tourism Board, where she spearheaded all brand, growth marketing, communications efforts as well as capital raising. She has a passion for fintech and financial literacy and holds a BA from the University of Southern California.

18. Olya Laktyushina (tie)

18. Olya Laktyushina (tie)

Company: Sumsub

Title: Chief Marketing Officer

Olya Laktyushina is the Chief Marketing Officer of Sumsub, a company that tackles KYC/AML, anti-fraud, and compliance challenges for regulated businesses. In her three years managing marketing at the company, Sumsub has grown from a four-person operation into a 150 strong international team overseeing more than 1,000 clients — including DiDi, BlaBlaCar, ESL, Hyundai, MetaQuotes, Binance, Flippa, and TransferGo. During that time, Sumsub has been featured by leading publications like Forbes and Business Insider and has received over a dozen awards, such as The UK Startups 100, Golden Bridge Business Award, Global InfoSec Award, Benzinga Global Fintech Award, and more.

Olya has been in marketing for a decade. Before Sumsub, she worked in pop-science journalism, systems integration, tech, and fintech. This includes major companies like ABBYY and fintech startups like FBS Broker. She studied management and innovation at the Business School of the Technical University of Munich and applied communications at Saint Petersburg State University.

19. Aimee Young

19. Aimee Young

Company: Noah Financial Services

Title: Advisory Chief Marketing Officer

Aimee Young has helped build some of the most well-known consumer brands in financial technology. Today she serves as advisory Chief Marketing Officer to Noah, a pioneering housing finance company. Noah’s equity sharing products allow homeowners to tap and build wealth in their homes without the burden of additional debt. Noah is proud to be one of the most diverse and inclusive companies in fintech. As the CMO of SoFi, she led the brand strategy to evolve from student loan refinancing to a modern consumer finance company with products across the financial services lifecycle. Her team scaled the business from $200 million to over $5 billion in origination — launching home loans, mortgage refinancing, personal loans, and parent loans.

After SoFi, she joined personal finance company Quicken, Inc. as CMO to revitalize the brand. During her tenure, the company achieved double-digit revenue growth, rebuilt its marketing function, and developed the Simplifi app to attract a new audience to the aging brand. Prior to her work in fintech, she held brand, digital marketing, and e-commerce leadership roles at companies ranging from Virgin Atlantic to food app HarvestMark. Her team’s work has been awarded “Millennial Brand to Watch” by Forbes and several CreativeMedia Awards. Aimee received her MBA from the Harvard Business School and her BA from Wellesley College.

20. Brittney Newell

20. Brittney Newell

Company: Expansion Capital Group

Title: Chief Financial Officer

Brittney Newell is the Chief Financial Officer at Expansion Capital Group (ECG), a leading technology-enabled small business lender based in Sioux Falls, South Dakota. She is responsible for overseeing the company’s Accounting, Treasury, Human Resources, and Underwriting departments. Since joining ECG in 2015, Newell has led the organization to increase its impact on America’s small businesses from $23 million to $500 million and be named one of the “Best Places to Work in Fintech” by American Banker in 2019 and 2020 as well as one of “America’s Fastest-Growing Companies” by Inc. 5000 in 2018 and 2019.

A former business owner herself, Newell founded Nico Consulting in 2009, focused on providing accounting and internal audit professional services. Brittney has also held leadership positions with McGladrey & Pullen, LLP, MetaBank, and several community banks. Throughout her financial services career, she has worked to help thousands of Americans define and achieve their financial success goals. She has led leadership teams, influenced industry stakeholders and thought-leaders, and built long-lasting relationships to ensure that men and women of all backgrounds are better served in building and managing their finances. She received her bachelor’s degree in business from the University of South Dakota.

21. Natalie Keogh

21. Natalie Keogh

Company: NorthOne

Title: Head of Compliance

Natalie Keogh is Head of Compliance at NorthOne, a banking app built for Main Street small businesses across America. Founded in 2016, NorthOne is a fintech company enabling easier digital banking for small businesses and freelancers across America. In her role, Keogh has built NorthOne’s compliance and risk teams from the ground up, as well as architecting the fintech’s core compliance and AML policies. The work that she has done has been instrumental in enabling NorthOne’s growth, which has seen more than 190,000 small businesses sign up since the app launched in August 2019.

Prior to NorthOne, Natalie has spent more than 15 years in financial services and has led teams at Square, Citi Bank, and Google. Throughout her career, she’s been critical in the creation, implementation, and maintenance of anti-money laundering programs. Now living in San Francisco with her family, Natalie is a graduate of the University of York, where she studied Politics and Sociology. In her free time, Natalie cares deeply about animal welfare and volunteers at San Francisco Animal Care & Control.

22. Nicole Valério

22. Nicole Valério

Company: Apiax

Title: Head of People, Places and Finance

Nicole Valério is the Head of People, Places, and Finance at Apiax, a business enablement solution for global financial institutions. Through digital regulations, the company removes the regulatory barriers for companies to grow their businesses. With Apiax, financial institutions can accelerate growth, reduce compliance costs and minimize risks. Valério joined the 2017-founded company in 2019 to organize the People, Places, and Finance department. Since her entrance, Apiax has grown from 25 to 75-plus people and has established three new offices, totaling five globally (Zurich, Lisbon, London, Singapore, and Frankfurt). In the finance department, Valério was responsible for the digitalization of all aspects and processes of the department through the adoption of several tools and software in combination with in-house developed RPA tools making the department fully and globally digital.

Before Apiax, she supported different startups in their finance departments, such as Vida and Hambro Perks’ portfolio companies in the UK. The role of Finance Senior executive at PwC is also part of her professional background. She received her degree in business management from Universidade Autonoma de Lisboa and has worked in different countries such as the United Kingdom, Angola, and Portugal.

23. Billi Jo Wright

23. Billi Jo Wright

Company: Payrix

Title: Chief Risk & Compliance Officer

Billi Jo Wright, Chief Risk and Compliance Officer for Payrix, has 20-plus years of payments industry experience, with a background in issuing and acquiring. She joined Payrix— a first-of-its-kind payment facilitation solution provider — two years ago to lead risk management and compliance. Payrix provides vertical software companies with an all-in-one platform — and a white-glove approach — to capitalize on the opportunities within embedded payments for growth, innovation, and transformation. At Payrix, Wright is responsible for providing a holistic view of business line risks to develop or stabilize merchant portfolios. Wright leads a team that oversees the company’s payment facilitator program and is working to expand the platform’s security and compliance capabilities.

Wright is known for deep expertise in risk, compliance, fraud, business development, and partner management. She has empowered companies to scale while building top-rated risk and compliance programs, again and again. Wright previously held leadership roles at Elavon, MerchantE, 2Checkout, and Worldpay. Along with a diverse industry perspective, Wright has the keen ability to influence the strategic vision and transform plans into workable solutions. Outside of work, she is an Atlanta local, mother of four, wife, and lover of tennis, running, and traveling.

24. Carrie Griffin

24. Carrie Griffin

Company: Treasury Prime

Title: Founding Engineer

Carrie Griffin is Founding Engineer with Treasury Prime, a banking technology firm. Treasury Prime builds application programming interfaces (APIs) that let both banks and their corporate customers automate their banking operations, connecting visionary fintechs with innovative financial institutions. The company is modernizing the API banking and technology systems to deliver new value to everyone in the pipeline, providing invaluable financial services solutions. As founding engineer, Griffin writes integrations to banking and financial service software to make banking services available, simple to connect, and easy to use.

Previously, she was senior QA engineer for Health Markets, Inc., where she led quality assurance for small employer and individual insurance marketplace web applications — a role that, similar to banking technology, involved navigating thorny compliance issues. Prior to Health Markets, she was a senior software engineer for NWEA, and senior QA engineer for Fios, Inc. — marking a decade in engineering leadership. She also held engineering roles with Motorola, Extensis, and other businesses in the Pacific Northwest. She holds degrees from the California Institute of Technology and Brigham Young University.

25. Parisa Gonzalez

25. Parisa Gonzalez

Company: Invoice2go

Title: Lead Product Manager

Parisa Gonzalez is a Lead Product Manager at Invoice2go, an all-in-one tool that helps small businesses manage customer relationships, send invoices, accept payments, improve cash flow, create an online presence, and much more. Parisa specializes in and manages the cash flow product and brings extensive ‘ hands-on’ experience with a committed approach to strong relationships across customers, business partners, and colleagues. On July 23rd, Bill.com announced its intent to acquire Invoice2go for $625 million.

Prior to Invoice2go, Gonzalez was a Senior Product Manager at the Domain Group, a leading digital real estate platform in Australia, where she was both a champion for customers and a leader in product/ technical decision making. She also rose through the ranks from a Software Developer to a Senior Product Manager during her 13-year tenure with Whitech Software Solutions (acquired by FujiFilm Australia). Her team developed cloud-based omnichannel solutions for major global retail chains and photo independents. Their Imagine Online, Kiosk and Mobility products earned Whitech Winner of the 2005 Telstra Small Business Awards in both the National and State categories. Parisa received her Bachelor of Science in Computer Science, Diploma in IT Professional Practice from the University of Technology Sydney.