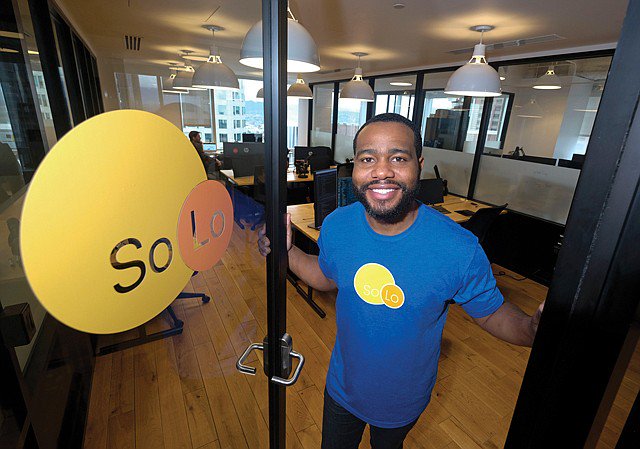

SoLo Funds is a capital marketplace reimaging how traditional lending platforms should operate in communities.

Founders Rodney Williams and Travis Holoway created a solution to financially empower underserved communities. The fintech company was launched after witnessing the economic hardships of close peers and family members that arose during an unplanned emergency. In fact, most Americans can not afford a $1,000 surprise expense, according to a new survey. For cash-strapped Americans who do not have aid from family members or access to financial solutions, the founders pondered, “Where can they go for assistance?”

This question served as the premise for SoLo Funds’ inception in 2015. The company prides itself in offering equitable solutions to build minority communities. Now through the company’s mobile app, individuals looking to acquire emergency capital can acquire a loan in less than 30 minutes.

“For us, this is huge. I think about what the community bank is supposed to do and they’re supposed to allow lending and borrowing in the community. It’s supposed to empower the individual and build the community. So, that is what we are doing in a different way,” Williams revealed to AfroTech.

SoLo Funds Empowers Underserved Communities

The diverse marketplace allows users to request loans as needed directly from their phone, and users can also fulfill loan requests from other community members.

According to Williams, 30 percent of lenders on the platform have borrowed money in the marketplace. In the event funds cannot be paid back to the lender, the company has created a protection plan to deploy credit to their lenders.

“Our current marketplace offers a solution for members who have the cash flow to either pay back or fund emergency loans. Yet we know that there are members who need additional support,” said Holoway in a press release revealed exclusively to AfroTech. “We’ve figured out how to provide value at a critical moment when someone needs a helping hand. Now we’re building an ecosystem around those members to fulfill our mission of financial autonomy.”

SoLo Funds Makes History

According to a press release:

“SoLo Funds is the only Black-owned financial services Certified B Corp in US & Canada. With only 4,111 companies certified by B Lab, and only 13 Black-owned companies in the US & Canada, SoLo Funds joins a small group of businesses committed to ushering in innovations for a better world.”

The certification is granted to companies that balance purpose and profit. In an evaluation period of six months, the company scored 10/10 for their mission-locked impact business model and 4.1/5 for customer stewardship. The company believes its mission centering on social impact has surpassed the expectations even required from the certification.

“By SoLo Funds certifying as a B Corporation, it has met the highest form of verification for its commitment to people and the planet,” said Andy Fyfe, Director of Equitable Growth, B Lab US & Canada said in a press release. “B Lab holds a vision for a more inclusive, equitable, and regenerative economic system for all people. Though income levels among most demographic groups in US & Canada have climbed in recent years, the racial wealth gap remains wide. We cannot credibly work towards this vision and address this issue without leaders like SoLo Funds demonstrating the way forward.”