How One Company Combats Predatory Loans And The Never Ending Cycle Of Debt For Black Women

While the economy is slowly but surely beginning to recoup, with the employment rising to over 550K in May, we must not skip over how the pandemic significantly impacted the Black community, specifically women. According to US News, over 58.4% of black women were/ are unemployed, leaving Black families at a disadvantage to care for day-t0-day needs such as groceries, rent, gas and transportation and more.

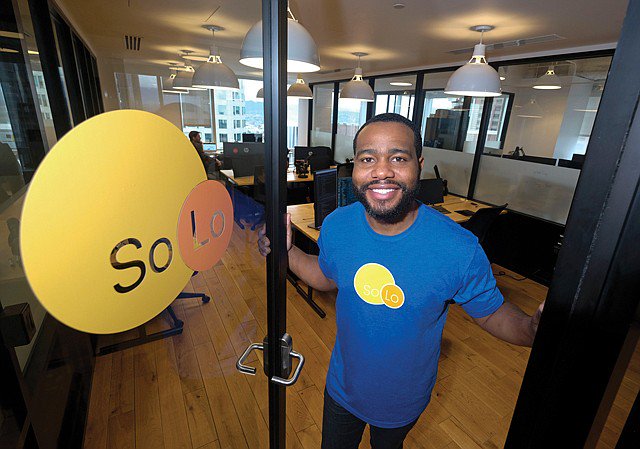

Thankfully, SoLo Funds, an online community co-founded by two BIPOC financial services leaders, exists where members can request and fund short-term needs in a non-predatory and accessible way. SoLo aims to create a community that enables financial autonomy and level the playing field for those in need of assistance. Over the course of the past year alone, SoLo Funds has funded 28,084 borrowers to date with 7,030 being women of color.

According to SoLo Funds co-founder and CEO Travis Holoway, the company was conceived from a lived experience that both he and co-founder Rodney Williams shared. As two of the more successful people in their families, they began to have the burden of financially supporting those in their families who weren’t as fiscally fortunate or stable.

“Ultimately, we wanted to send them somewhere else to be able to get access to the funds, but we just couldn’t find any viable and equitable solutions. We realized that the number one way to get a loan under a thousand dollars was to borrow from friends and family,” he explained to ESSENCE. “When you don’t have access to resources like that, not getting that gas to put in your car and not getting to work can be a downward spiral that it takes months or even years to get out of sometimes.”

Below, check out our conversation with Holoway about how the community has supported women of color long before the pandemic, the benefits of peer-to-peer lending, and how the company is erasing the stereotype associated with short-term loans. Check it out!

ESSENCE: Where do you see the projection of SoLo Funds going in the coming years?

Travis Holoway: SoLo creates an opportunity for a path to upward financial mobility. The whole goal here was to create an opportunity for equitable loans, and we fulfill that by empowering borrowers to create all of the loan terms. SoLo is the only place that you can “walk into” (because it’s mobile) and tell the institution how much money you need to borrow, what you need it for, what day you’re going to pay it back, and if you’re willing to pay anything in addition to the principal for it.

ESSENCE: How has the SoLo Funds community-supported Black women and women of color prior to the economic crisis of the pandemic?

Holoway: Our number one user is a minority, particularly Black women. It’s an interesting dynamic when you think about who’s actually funding these transactions. They actually tend to be majority white men and SoLo is proving that the world is more empathetic than the media allows us to believe. The support occurring every day on the platform and has been occurring since inception, is that there are women who are able to buy groceries, pay rent, pay their utility bills, and get the medicine that they need. It’s all completely on their terms where they’re deciding what they pay when they pay, and it allows for more control of autonomy and dignity.

When you think about no longer having to be vulnerable, ask a friend and they now know that you’re in a bad financial position, you’re able to post your own terms for a marketplace. It’s like magic. You post the loans for marketplace and on an average of 36 minutes, a stranger somewhere in this country is sending you the money that you need. This is an opportunity where it creates that ability for that borrower to get the access to capital that they need. It also creates this new opportunity where Black women are also lending and investing on this platform. Of course, you can lend money and not really be focusing on returns, but for many individuals who are deploying capital, they’re earning significant returns.

ESSENCE: What exactly is peer-to-peer lending, and what are its benefits?

Holoway: I like to say SoLo is peer-to-peer lending in the purest form. There have been peer-to-peer lenders in the past that are much more institutional. Typically, they would take money from someone like yourself and then the company would hold your money. In peer-to-peer loans, you would give your money to lending club, they would take applications from someone like myself, and they would make a decision on if I’m approved or declined. If they decide to approve me, they would take a little bit of your money and a little bit of some other people’s money, and deploy it out to me. Then, I would pay lending club back the money.

They would give you all the returns based on those loan transactions. Peer-to-peer lending, as it pertains to Solo, is literally, “Travis lending directly to Natasha.” As a borrower, Natasha has her loan terms posted to a marketplace. I come in as a lender and I determine whether or not I’m comfortable lending Natasha the money. I’m looking at what does she need it for, when is she going to pay it back, maybe what the return is actually going to be, and the SoLo score. Our SoLo score is a per transaction-based credit score determining her ability to repay me that loan on the 15th of the month and it’s largely looking at cash flow.

If I’m comfortable with her score and I pushed the button to lend, there is a debit from my checking account and credit immediately to her checking account. This happens in real-time. Within seconds, she has ready-to-use funds and on the agreed-upon repayment date, there’s an automatic debit from her checking account and credit back to mine. Peer-to-peer lending is individuals funding the loans of other individuals directly, and provide a marketplace to connect these two individuals together.

ESSENCE: How is SoLo Funds erasing the stereotype that is associated with short-term loans?

Holoway: We put all the power into the hands of the users. We don’t tell lenders what loans to fund. We give them information to empower them to make informed decisions, but they have complete control over where their money goes. When you think about the borrower perspective, they have autonomy over all of the loan terms. We’re not telling them what they should pay. We’re not telling them that they have to pay anything in addition to the principle amount. We don’t select their repayment date. We give them all of that control.

The most important thing is we’re not a traditional lending company, where the lending company is reaping the benefits of deploying the capital. This money is being circulated right back into the community. When you think about financial collaboration and empowerment for a community, we’re like the community bank redefined. You used to be able to go into a bank and your last name, based on your lineage, and a particular city would allow you to get access to capital. We’re bringing some of those aspects back, but what’s really important is that the community benefits. Everyone in the community benefits from this. Solo benefits, the lender benefits, the borrower benefits, but that financial collaboration is incredibly empowering.

This article was written by D/yshonda Brown for Essence.