Financial institutions that leverage underserved communities should provide value to those communities

In today’s financial space, the importance of community is an afterthought. While financial institutions leverage revenue from underserved communities, typically, this revenue does not flow back to the communities it came from. This shouldn’t be the case.

American families have leaned on big banks as a bedrock for wealth building. But those families don’t get a say on where revenue generated on their investments goes, and often this means their communities don’t reap the benefits. Even with the Community Reinvestment Act in place, most banks answer to their corporate bylaws and financial goals, not the needs of the communities they serve. This has an especially detrimental effect on low-income communities.

Big institutions tend to have requirements and rates based on national averages, not neighborhood realities. Access to money is a huge problem for many Americans. According to Bankrate’s January 2021 Financial Security Index survey, fewer than 4 in 10 Americans could pay for a $1,000 emergency by tapping into savings. Considering this harsh reality, it’s ludicrous to institute a $500 monthly checking account minimum. Further, any money made from banking services in these communities tends to get reinvested in places the bank might deem “less risky.”

Meet the cycle behind the cycle of poverty.

If traditional financial institutions want to retain their prominent position, they must address this imbalance. Yet large scale financial institutions have their focus elsewhere. Just look at where they are building their footprint; between 2014 and 2018, major banks closed 1,915 more branches in low income areas than they opened according to S&P Global data. This is not purely a charitable call to action, it’s a practical one. While it’s important for banks to allocate capital efficiently to generate returns for depositors, current savings yields call into question whether they are truly doing so.

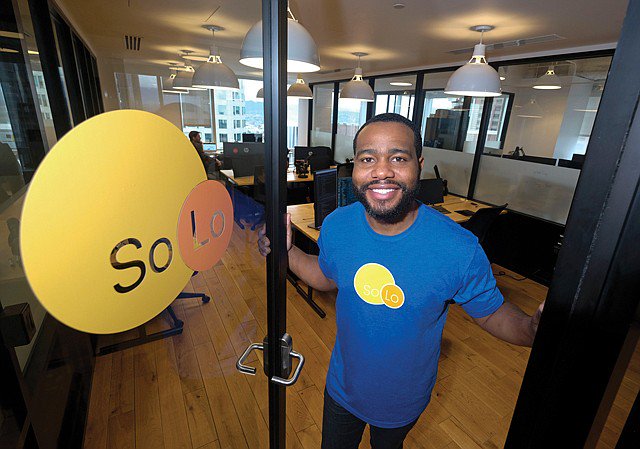

It is possible to put the power back in the hands of the people. As a co-founder of SoLo Funds, I’m proud that 82 percent of all members transacting on the SoLo lending marketplace are from underserved areas, enabling loans and profits to flow back to these communities. In fact, banking started as a community institution, turning local deposits into local loans.

Everyday Americans are hungry for financial service solutions that meet them where they are. It’s on financial institutions to do so while building dignity and value for all of their members, not just the wealthiest. That means giving customers the ability to choose what their funds support, and ensuring there are clear pathways/opportunities for funds to make their way back to the communities where they live.

This should be a wake up call for financial institutions–and especially big banks—to get back to community banking, to see all customers as people and worth as potential.

Rodney Williams is the Co-founder of SoLo Funds, an innovative capital marketplace where members request and fund capital based on voluntary terms, where he assists SoLo’s leadership in growth, finance, and innovation. Prior to founding SoLo, Rodney founded LISNR (Visa Backed Fintech) and led the company to over $40M in funding, numerous awards and partnerships across retail and financial services. He currently serves as the company’s Chairman. Rodney was recognized by Ad Age’s 40 Under 40 in 2012; Cannes Gold Lion award in 2015; and CNBC Disruptor 50 List in 2015, 2016, 2018 and 2019. Rodney is a graduate of West Virginia University and Howard University. He is a member of the 2019 Class of Henry Crown Fellows within the Aspen Global Leadership Network at the Aspen Institute.

Source: Changing America