WHY SPACE?

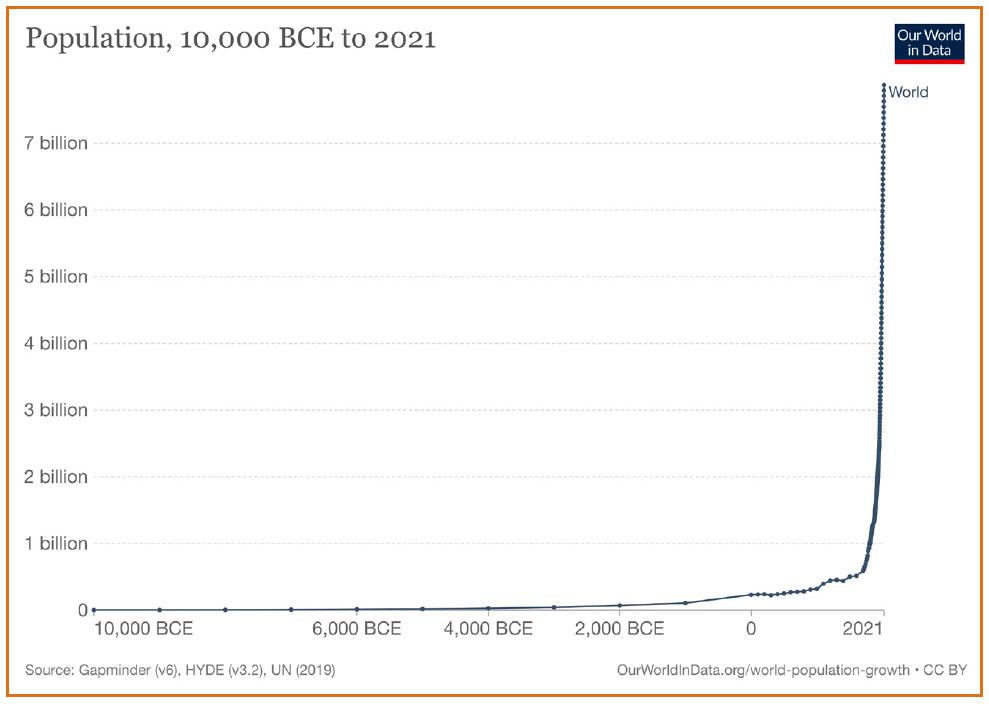

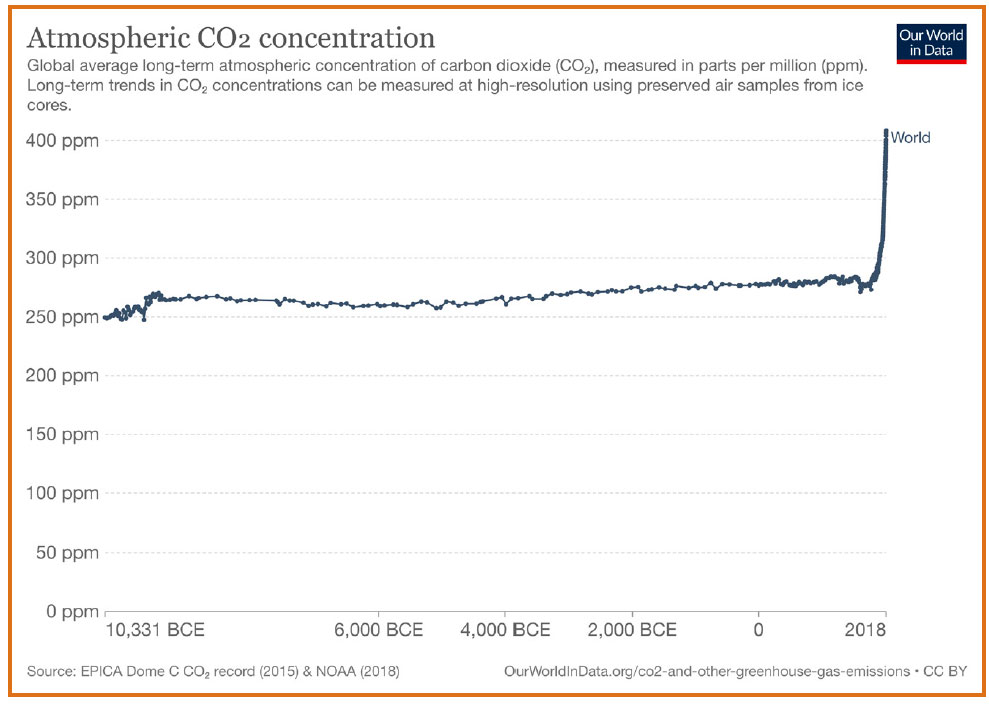

The two Time Magazine covers to the right are separated by 54 years, a span that seems tiny when comparing the space industry of the 1950s to the one emerging today. Once the realm of only a homogeneous select few, space has been opened to companies and people of all kinds. But before we jump into the enormous shifts the space industry has undergone, we first want to take a step back and ask why space? The reason humans have endeavored to leave Earth and conquer the cosmos might be more of an existential question, but there are practical and economic drivers behind these efforts. At a macro level, the exponential growth of the human race and the correlated rise in carbon dioxide emissions is the result of more people, doing more things, requiring more energy and causing more waste. While the implications of this population growth are difficult to fully comprehend, it has become clear that going to space can help us better understand the challenges we face on Earth, and move us forward in building solutions.

Earth-Bound Activities

Trillions of dollars of economic activity here on earth are reliant on space infrastructure. GPS alone in the US powers not just navigation, but timing services relied upon by numerous industries like finance and energy. Communication satellites provide internet service to millions of people and have the potential to connect the entire planet. Broadcast TV, radio, text messages and cell phone calls could not reach us were it not for satellites in space. Even Pokemon Go would not be possible without space infrastructure. Continuous improvements and innovation are needed to maximize the value of space for these types of Earth-bound activities

Earth Observation

A picture is worth a thousand words, and looking at the Earth from space gives us a much richer understanding of our planet, ourselves, climate change, effects of population growth, environmental changes, weather and much more. To ensure the longevity of planet Earth we must continue to deepen our understanding of the planet and develop solutions to the planetary challenges we face.

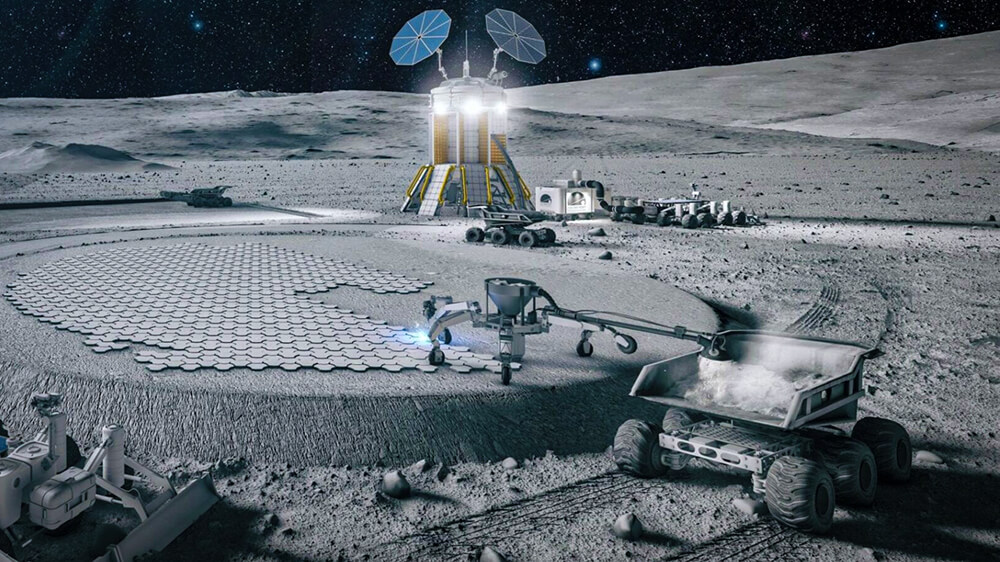

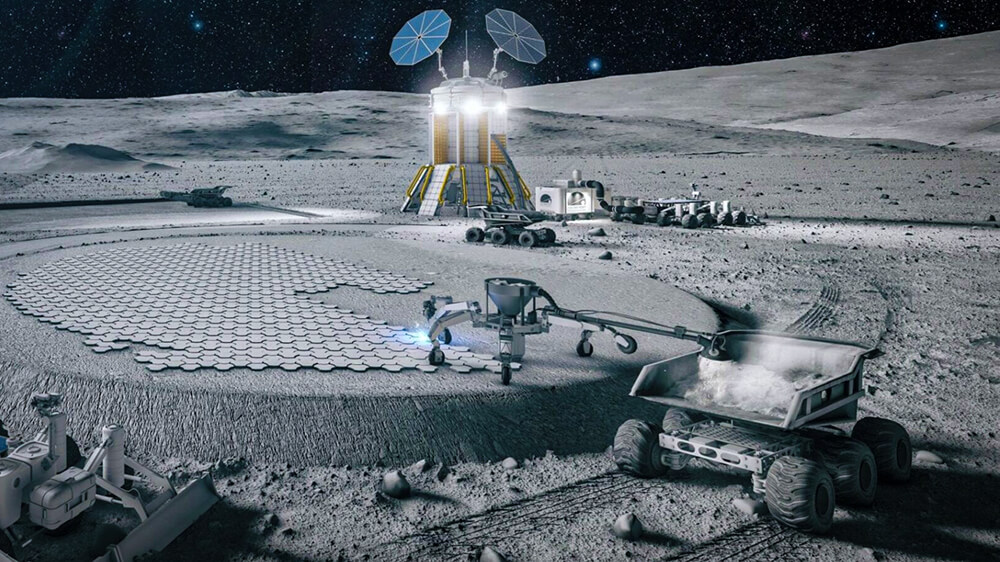

Manufacturing, Energy, Resource Harvesting

Memory foam, LEDs, artificial limbs, baby food and car tires all owe something to NASA. Manufacturing items for and in space have practical advantages over strictly earthbound manufacturing. Some items are more efficiently developed and produced in a zero-gravity environment. Harvesting energy and resources in space can help us not just here on Earth, but could also propel us further into the universe.

Research and Development

Performing science experiments in space and learning more about the effects of zero gravity and extended exposure to radiation makes us better equipped to live here on Earth. We can learn much about our bodies by studying ourselves in space. Companies can better understand carbon capture and how to fight global warming by doing research in space. Many of Earth’s questions and challenges can be answered through R+D in

Security

The origins of the space industry are rooted in national defense, and as military technology evolves, space will play an ever-present role in nations defending themselves. It’s now widely recognized that space is a warfighting domain and continued investment in the space sector is key to keeping peace between nations.

Each of these objectives represent tremendous challenges but also large economic outcomes to those companies that become category leaders. Some are more immediate and practical than others. But to ignore any one of them puts all of us here on Earth at a disadvantage. As we will explore in the next section, we are at an inflection point in the space industry and the work done and capital invested over the next decade will have a profound impact on humanity.

NEW SPACE

NEW SPACE

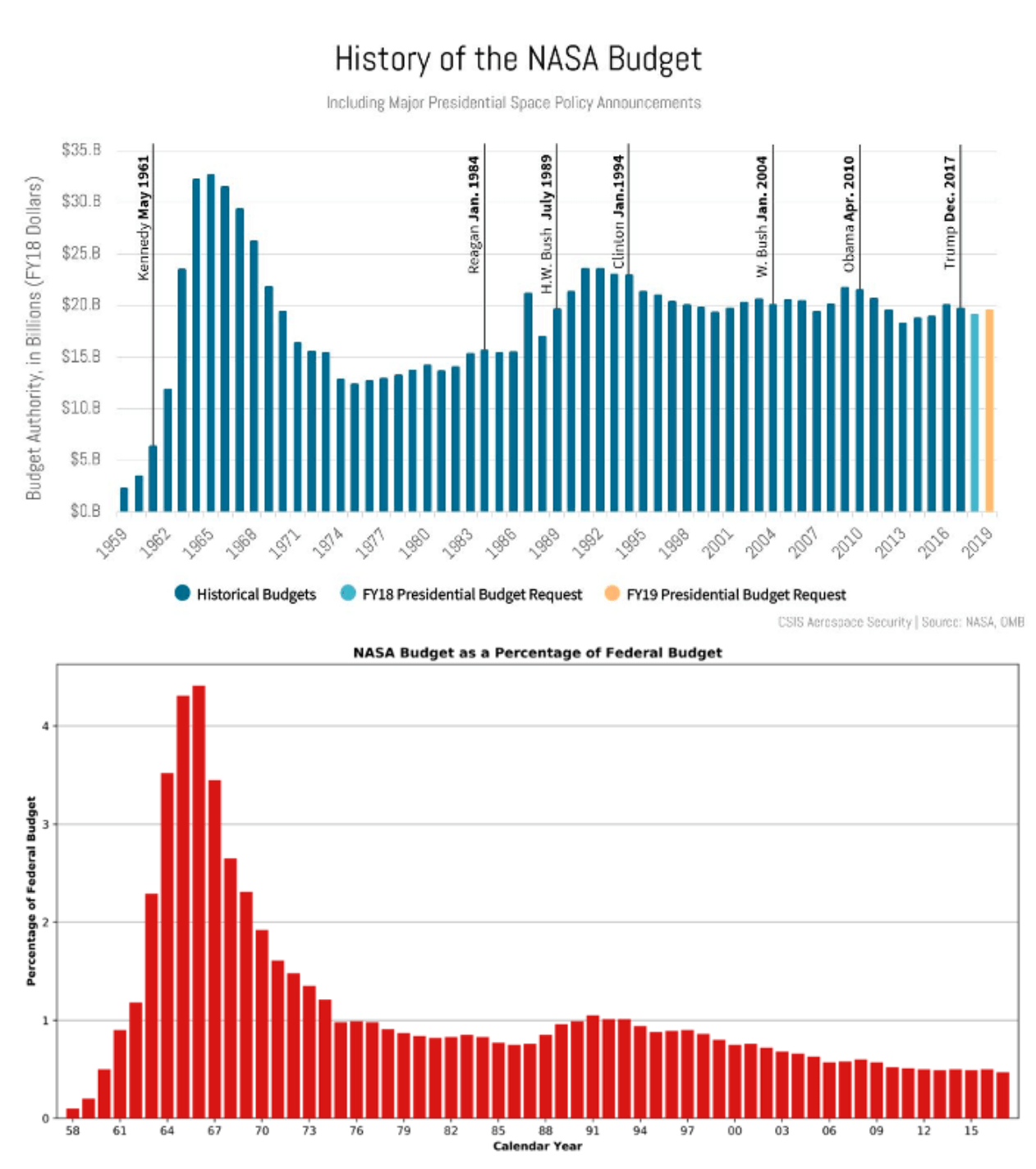

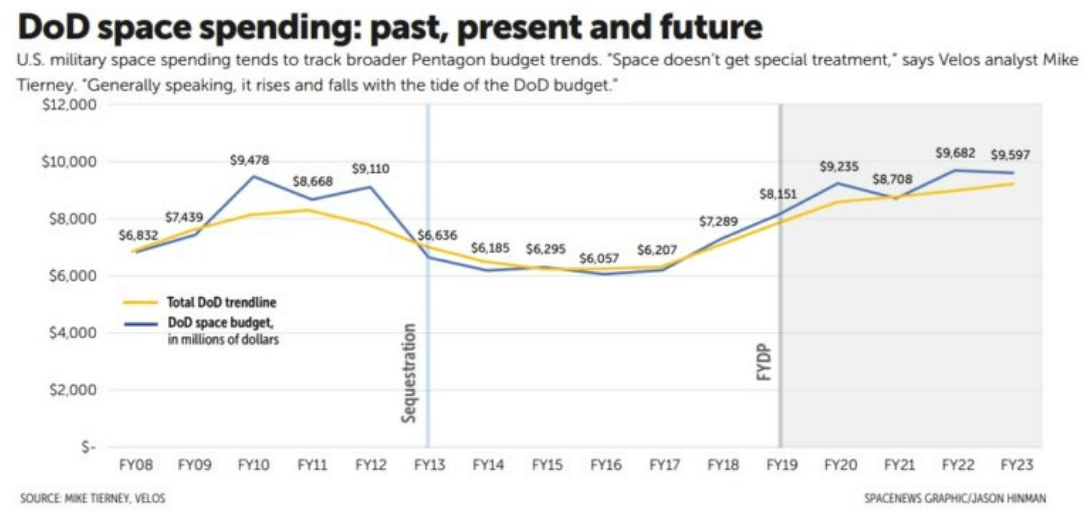

DoD space spending has been on an upward trajectory going from $6.8B in 2008 to a proposed $15.3B in 2022. So while NASA’s budget as a percentage of the overall federal budget has been falling steadily since the 1960s, the DoD’s space spending has been increasing. This US government space resource reallocation from the civilian to defense sector is indicative of a few recent developments. The first is the development of space as a warfighting domain and the role space plays in national defense. A 2016 academic paper titled Fast Space: Leveraging Ultra Low-Cost Space Access for 21st Century Challenges made the argument for a US Space Force. One of the paper’s co-authors, Lt. General of the US Air Force Steven Kwast again made the case in this speech from 2019, and the US Space Force was formally established on December 20th 2019. In August 2021, the US Space Force launched “Guardians Wanted”, a new recruiting effort looking for young, diverse talent. Given how much of what humans do on earth is dependent on space infrastructure, protecting space assets, and ensuring mutual cooperation between nations in space is of paramount importance to our future security and prosperity.

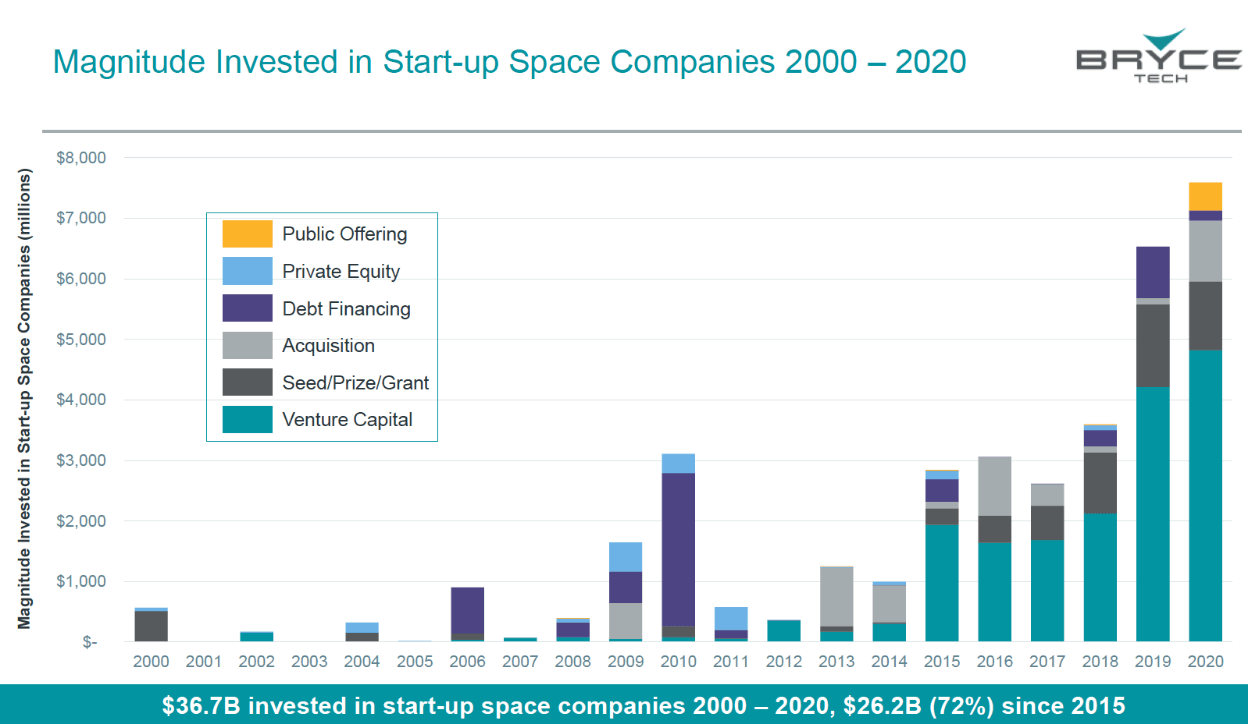

The second development is “New Space”, a term referring to the commercialization and privatization of the space industry. While governments will remain one of the biggest space spenders, there has been a shift in their spending over the past 20 years from a government owned-and-operated model to a strategy much more reliant on private companies. As seen in the next chart, investment into private space companies has been on the rise for the past 20 years. Collectively $36.7B has been invested in the sector since 2000.

FASTER, CHEAPER, SMALLER

Work on the US Interstate Highway System began in 1956 and over the ensuing two decades over $114B was spent building nearly 50K miles of roadway. This system paved the way for suburban america to flourish along with national gas stations and restaurant chains like McDonalds. Amazon Web Services launched in 2006 forever changing the startup ecosystem. Founders could now outsource their storage, server and networking needs, paying a relatively small monthly fee rather than millions of dollars in up-front costs. By lowering the cost to launch a company, AWS birthed a new era of startup growth. In June 2007 the first iPhone was released providing a new mobile computing platform that would birth millions of apps including Uber, Instagram, Candy Crush and a multitude of mobile messaging products.

Throughout history and across industries, infrastructure buildout often leads to new, cheaper, faster and smaller products. This is as true in the space industry as anywhere else.

The two primary infrastructure-drivers in the space industry are launch (getting to space) and satellites (doing things in space). Both have seen incredible improvements over the past twenty years.

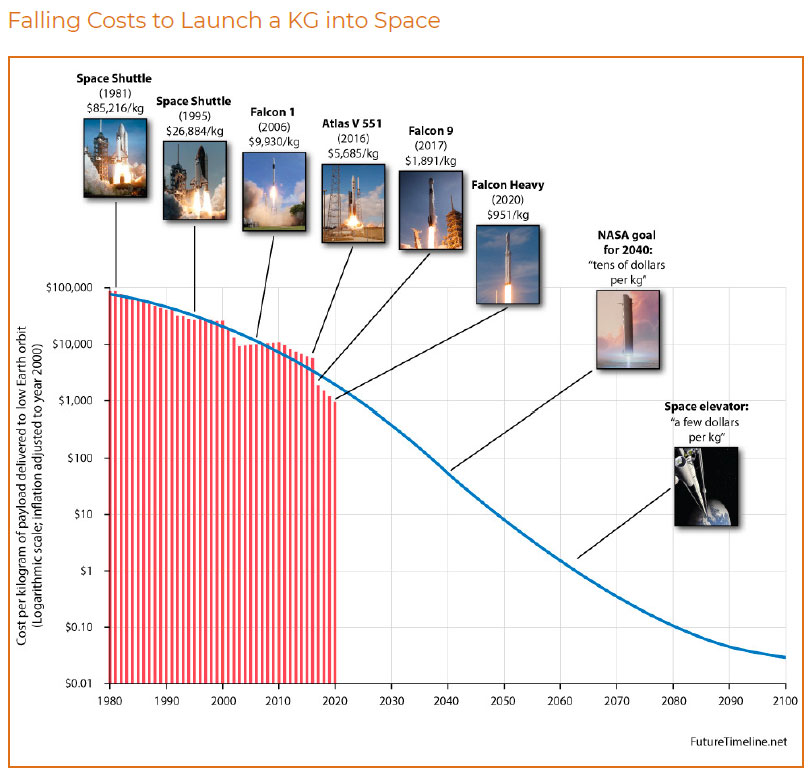

The cost to launch a rocket into space is typically measured by the cost to get a kilogram of a payload into low earth orbit (LEO). The US Space Shuttle program paid $85K to get a kg of payload to LEO in 1981. Forty years later that same payload can be brought to space on a SpaceX Falcon 9 rocket for a cost of $2,700. Other startup launch companies are working on launch technology that can lower launch costs by another 10x to $300 per kg. Efforts to make rockets more like commercial airliners where they are fully reusable and can be flown daily have been some of the primary drivers of these falling launch costs. Second-order effects of falling launch costs can be compared to those from the creation of AWS: a whole new ecosystem of companies can now exist because the prohibitively-high costs are no longer. A new space economy is emerging now that access to space is becoming democratized.

Source: Future Timeline

Source: Future TimelineFASTER, CHEAPER, SMALLER

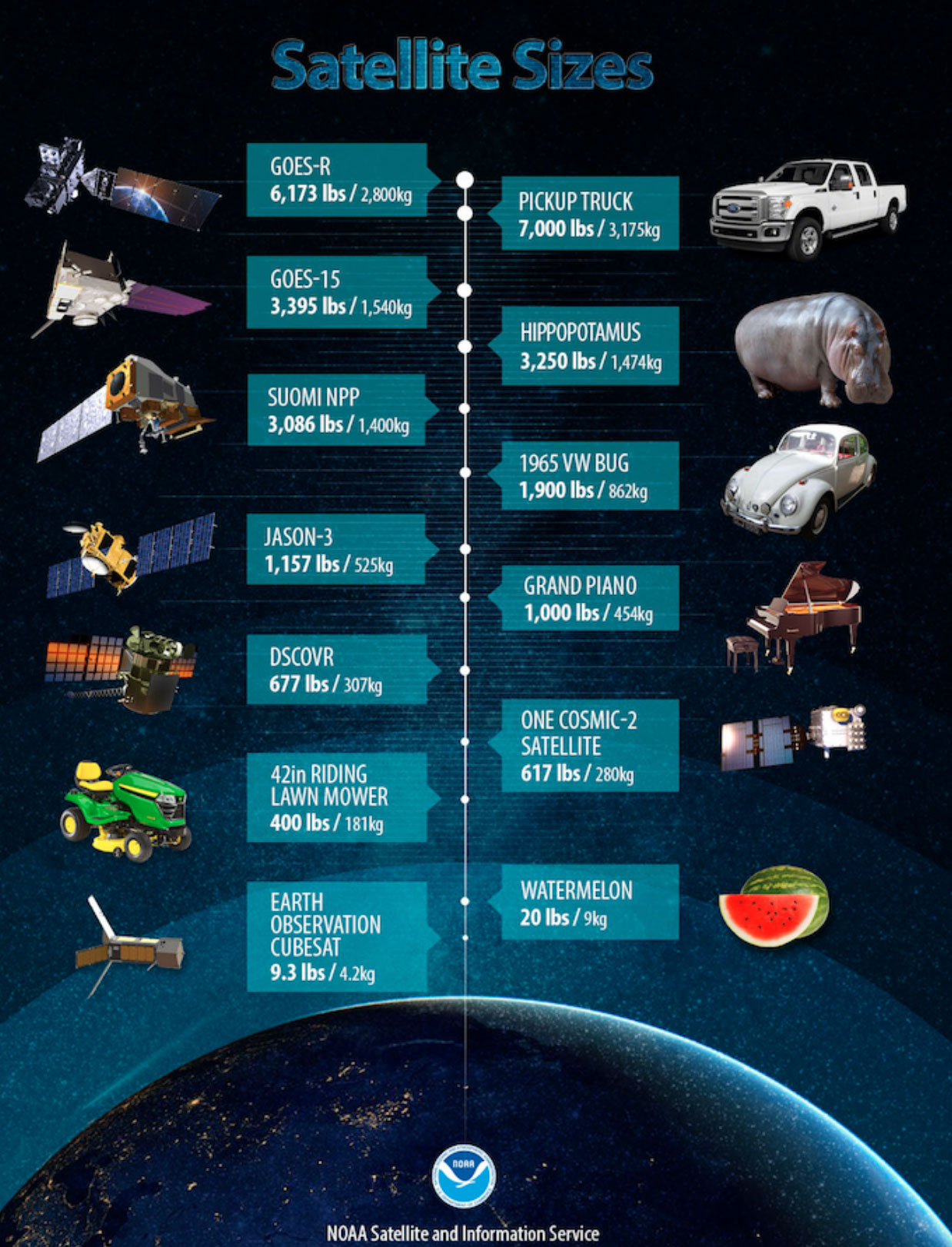

Source: NOAA

Source: NOAAFASTER, CHEAPER, SMALLER

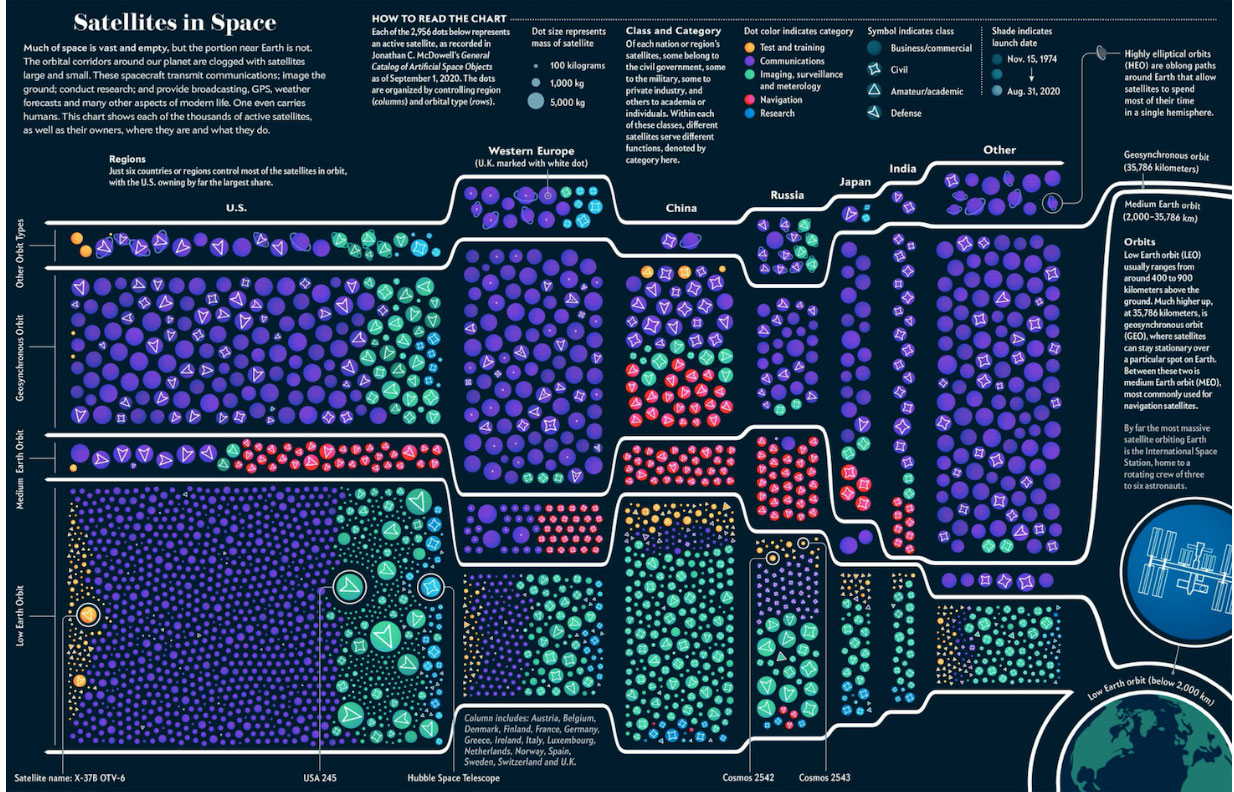

By 2020, 114 launches carried around 1,300 satellites to space, surpassing the 1,000 new satellites per year mark for the first time. But no year in the past compares to 2021. As of September 2021, roughly 1,400 new satellites have already begun circling the Earth, bringing the total number of in-orbit satellites to nearly 3,000 – a number expected to grow to 40,000 by the early 2030s. These satellites, as shown in the image to the right, underpin some of the most essential activities of daily life. And more than half of these satellites — as seen by the size of each circle — are 1,000 kg (over 2,200 pounds) or more in size.

In contrast, the majority of satellites that have been sent into space over the last few years have been much smaller in size. SpaceX has put up over 1,700 260-kg Starlink internet satellites since 2019. Earth observation company Planet Labs has put up over 366 100-kg cubesats since 2013 and has 150 orbiting Earth today. These small satellites can be manufactured for a fraction of the price as their larger and older brethren. The space exploration satellite Galileo had a price tag of $1.6B and the GOES-16 weather satellite from the graphic on the previous slide cost $11.4B. A current Planet Labs satellite, the size of a shoebox, costs a few thousand dollars. Yet it produces better images than satellites the size of a compact car.

WHERE OPPORTUNITY EXISTS

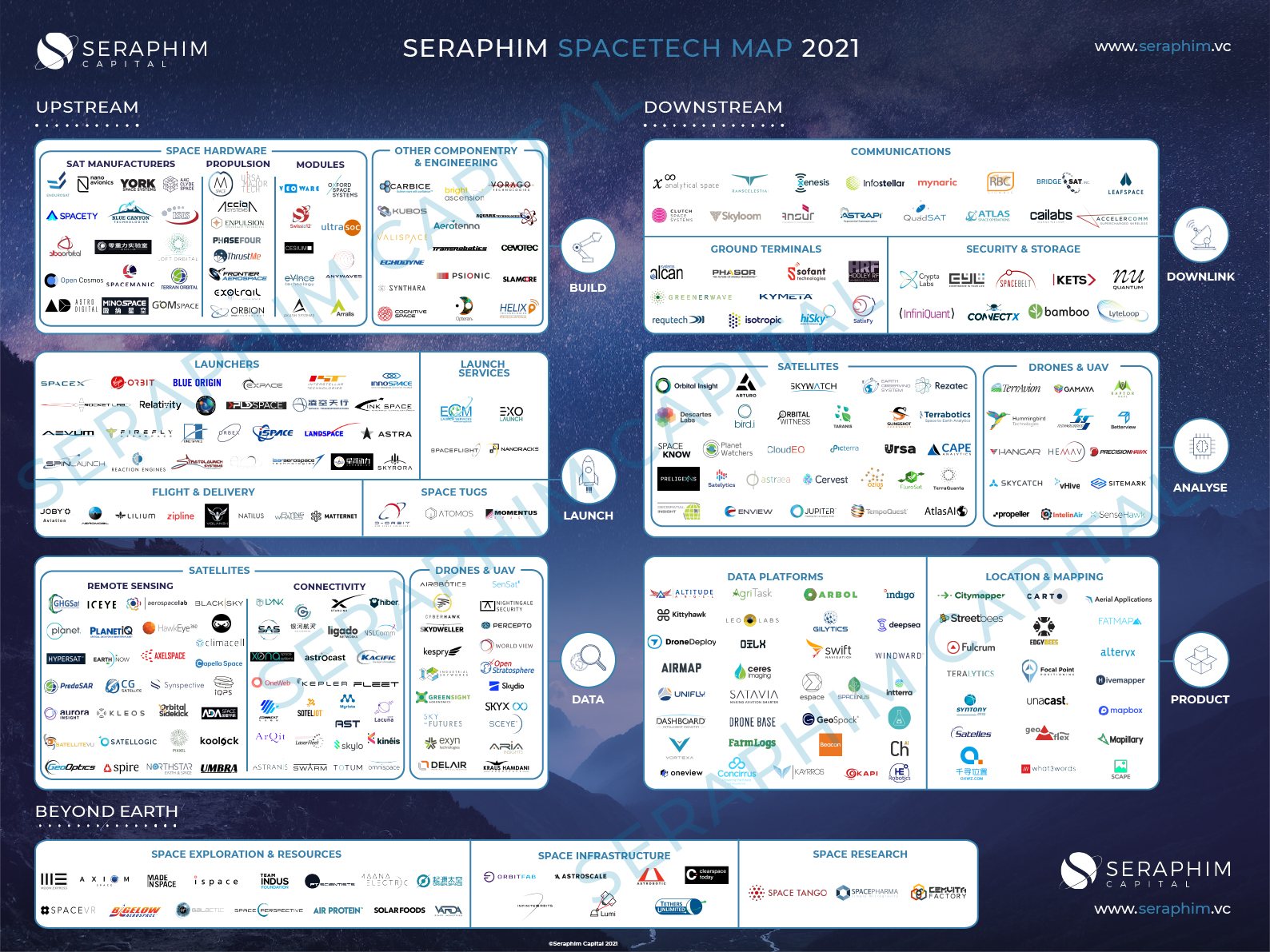

As the Seraphim space tech map shows, the space industry is home to hundreds of companies across a number of sectors. The general space value chain lays out as follows:

Infrastructure or Upstream Companies build products and services that provide access to space or other hardware that is used to conduct activities in space.

Distribution or Downstream Companies build products and services for a consumer or enterprise end-user that leverages space infrastructure.

Application-Layer Companies take advantage of the products and services from both the infrastructure and distribution companies to create all kinds of products, some of which feel pretty removed from space. As we mentioned earlier, Pokemon Go is an app that is reliant upon launch companies to take GPS satellites into space (upstream) to provide mapping and navigation services back down on earth (downstream). The number of companies and applications that are enabled because of upstream and downstream space businesses are almost too many to count.

At MaC VC we see numerous opportunities across upstream, downstream and the application-layer. Thus, we have been building our portfolio accordingly. The areas that follow are where we see the most near-term opportunities for startup value creation.

1. Launch and Transportation

2. Power, Propulsion and Materials

3. Satellite Ground Segment Tools + Infrastructure

4. Satellite Space Segment Tools + Infrastructure

5. Space Junk Detection and Removal

6. Manufacturing Tools + 8. Earth Imaging Infrastructure

7. Global Navigation Satellite Systems (GNSS) and Positioning, Navigation, and Timing

8. Earth Imaging

9. Data, Analytics and Application Layer

LAUNCH AND TRANSPORTATION

The entire space industry is rooted in our ability to get things and people in and out of space safely, reliably and as inexpensively as possible. While many feel launch is saturated and over-invested, we feel there is much innovation to be made in this sector. The first Ford Model T was released 113 years ago in 1908 and we’re just now getting to mass market electric vehicles and are still in the early innings of autonomy. The first rocket was sent into space just 80 years ago so it makes sense to us that we will see new and innovative companies like Stoke Space* which is working to build fully-reusable rockets designed to fly daily, arrive doing something important and differentiated around launch. The road to space will continue to be paved by companies lowering launch costs and offering daily access to specific orbits for people and large and small satellites alike. Stoke is creating the workhorse 737 to space that will lower launch costs by another 50- 100x and open up space to even more types of companies. Additionally, over time we will need reliable transports in space to move items and people from one orbit to another. Companies like Starfish* and Momentous are working on this today. Epsilon3* is building software to enable complex operations in order to get things to and from space. As more companies do increasingly complex things in space, the need for a robust and user-friendly mission control operating system will be essential and Epsilon3 is delivering that for its customers.

*MaC VC portfolio company

POWER, PROPULSION AND MATERIALS

Historically all efforts to get to and navigate around space have been centered

around chemical propellants. Developments in nuclear fusion and electric propulsion will allow humans to go farther faster and more efficiently than chemical based propellants. And as humans go farther into space, protecting them (and their equipment) against space debris and radiation will be of paramount importance. Cosmic Shielding Company is developing composites that will protect against secondary radiation. New carbon-based “nanoarchitected” materials — materials designed from precisely patterned nanoscale structures — can protect against objects moving at over 17,000 miles per hour in space.

SATELLITE GROUND SEGMENT TOOLS + INFRASTRUCTURE

The satellite industry is made up of three interoperating segments: ground, space, and user. The ground segment manages the satellites in space and retrieves the data from them to transmit to the end users on Earth. This segment is made up of the stations with earth-bound antennas, communication networks, control systems and user terminals. The explosion of the satellite industry has put stress on the ground segment, and new tools and infrastructure are needed to keep pace. UTVATE* is building phased-array antennas that can be placed anywhere on land, sea or air, and Kubos and Kratos are offering mission control and ground segment as a service to satellite operators.

*MaC VC portfolio company

*MaC VC portfolio company

SATELLITE SPACE SEGMENT TOOLS + INFRASTRUCTURE

As LEO, MEO and GEO become more and more crowded as the number of satellites in orbit increases exponentially, managing the space segment will also increase in importance. Starfish* will help extend the orbital life of satellites as well as deorbit older satellites so that they don’t crash into other orbiting objects. Laser-based inter-satellite communications can help coordinate satellites in orbit and also reduce the burden on the ground segment.

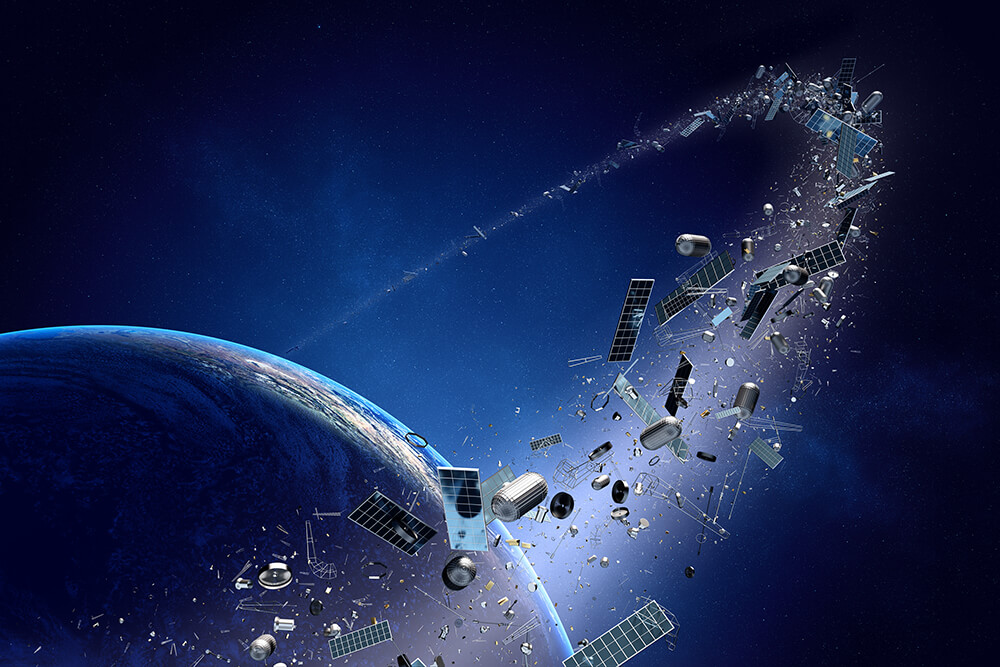

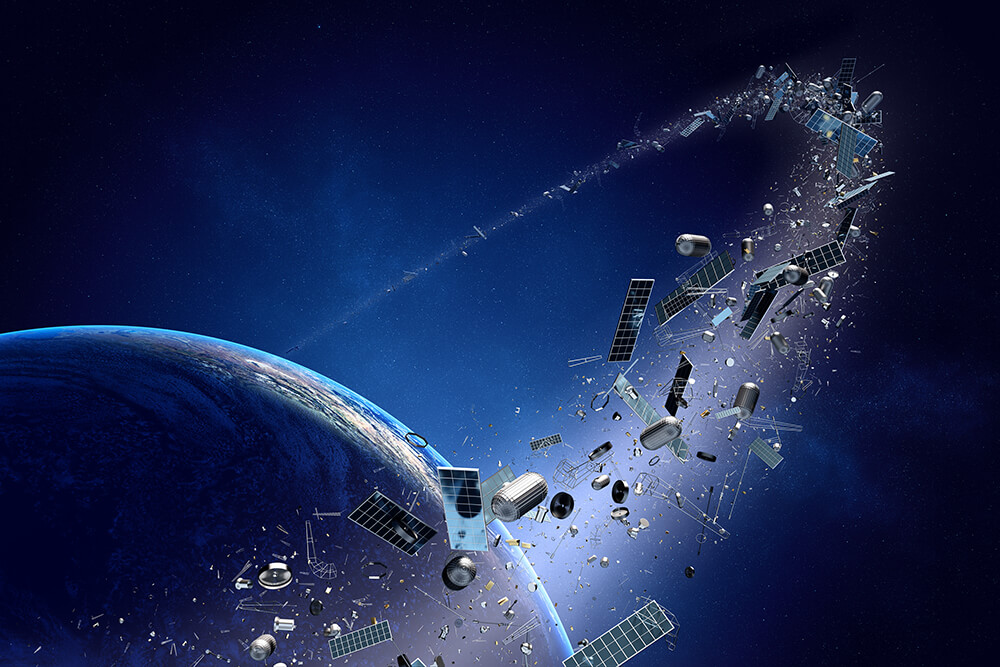

SPACE JUNK DETECTION AND REMOVAL

Related to the previous segment, the massive space junk problem needs immediate attention. There are over 20,000 known and tracked pieces of space debris orbiting Earth, each one traveling at about 15,000 mph and

several hundred thousand fragments (and possibly millions more) of smaller, un-tracked debris that could still cause catastrophic damage. As more things and people end up in space for longer and longer periods of time, products and services like those from Aurora Propulsion and Astroscale need to be built to keep everything up there safe.

*MaC VC portfolio company

MANUFACTURING TOOLS + INFRASTRUCTURE

Almost anything that goes to space, even a cube-sat, is going to be complex in nature. Advanced parts procurement and manufacturing systems are needed to drive efficiency, reliability and cost reductions in this process. Gridraster* provides a unified and shared software infrastructure to empower aerospace and defense companies to build and run scalable, high-quality XR, AR, VR and MR applications in public, private, and hybrid clouds. Through the Gridraster cloud remote teams around the world can collaborate on the development of sophisticated space hardware via graphically dense and interactive visual models. SynchFab is building an end-to-end supply chain management system, Hadrian is building the factories of the future for rocket ships and advanced manufacturing, and First Resonance is building a factory operating system for complex manufacturing. Companies like these will pave the way for future space startups to get payloads to space in a much more efficient way than ever before.

GLOBAL NAVIGATION SATELLITE SYSTEMS (GNSS) AND POSITIONING, NAVIGATION, AND TIMING (PNT)

While GPS (Global Positioning System) is often used as an umbrella term to describe an industry at-large, GPS is actually one of several global navigation satellite systems (GNSS) in existence. And GNSS is a subset of positioning, navigation and timing (PNT) systems that are the backbone of not just location and navigation applications, but also timing applications that are crucial to a variety of economic activities around the world. The challenge with GNSS and PNT systems today is that they were designed and built 30-40 years ago with a very different purpose than many of the modern-day use cases, especially autonomy. Centimeter or millimeter accuracy was not relevant when the use case was mainly navigating planes in the wide-open sky. Several factors have led to a drastic need for an updated and enhanced GNSS, and companies like Xona Space* are working to build a more accurate, secure, and resilient GNSS.

*MaC VC portfolio company

*MaC VC portfolio company

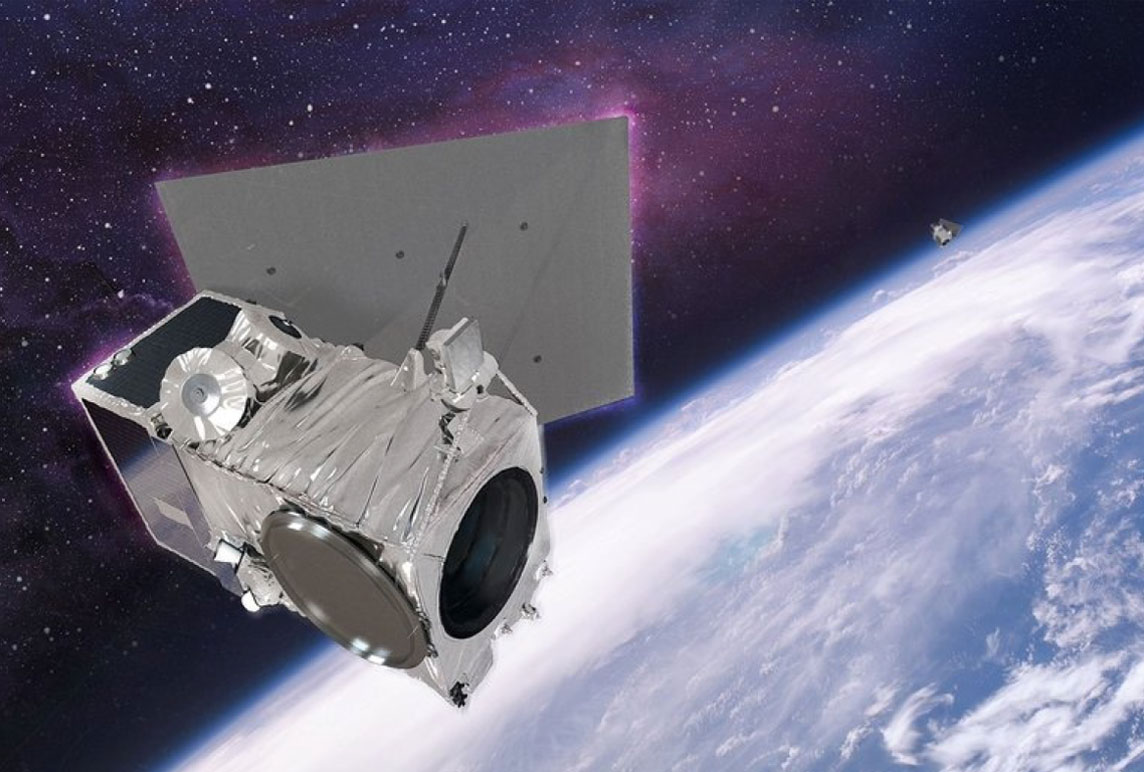

EARTH IMAGING

A deeper and better understanding of our planet is one of the main reasons for humans to pursue a space agenda. Key to better understanding our planet is looking at it (and its inhabitants) in a million different ways from space. Companies like Planet Labs are looking at Earth geospatial data, Capella Space is using synthetic-aperture radar, and Wyvern* and DigitalGlobe which operates the WorldView-3 satellite are focused on hyperspectral imagery, which has a broad range of applications. One example being the ability to regularly image agricultural fields, enabling insight into the health of crops and land. Wyvern will allow humans to observe Earth in ways never before possible at a price that is affordable to a wide array of companies. By democratizing detailed hyperspectral Earth imaging, Wyvern and others will open up new applications for this type of data, allowing companies to not just better understand our planet but to provide solutions to planetary problems.

DATA, ANALYTICS AND APPLICATION LAYER

Blanketing the world with information in the form of super-fast broadband access is a way to level-up all of humanity, and companies like UTVATE*, Starlink, and Astranis are working on this ambitious goal. The products that can be built once the entire world is fully connected are almost endless. And with an almost constant stream of data coming from space we will need companies to help us understand this data and uncover novel ways to apply these insights. Satelytics helps oil and gas companies better detect methane and Co2 leaks, or predict when power plants may overload causing wildfires. Skywatch connects developers with one of the largest networks of satellite imagery providers. Other companies like Spartan Radar*, which is taking advanced radar techniques from aerospace and applying them to the field of autonomous automotive, will take space-based learnings and apply them to new businesses down here on Earth.

*MaC VC portfolio company

ABOUT MaC VENTURE CAPITAL

MaC Venture Capital is a seed-stage venture capital firm that invests in technology startups leveraging shifts in cultural trends and behaviors. Our diverse backgrounds in technology, business, government, entertainment, and finance allow us to accelerate entrepreneurs on the verge of their breakthrough moment. We provide hands-on support crucial for building and scaling category-leading companies, including operations strategy, brand building, recruiting, and mission-critical introductions.