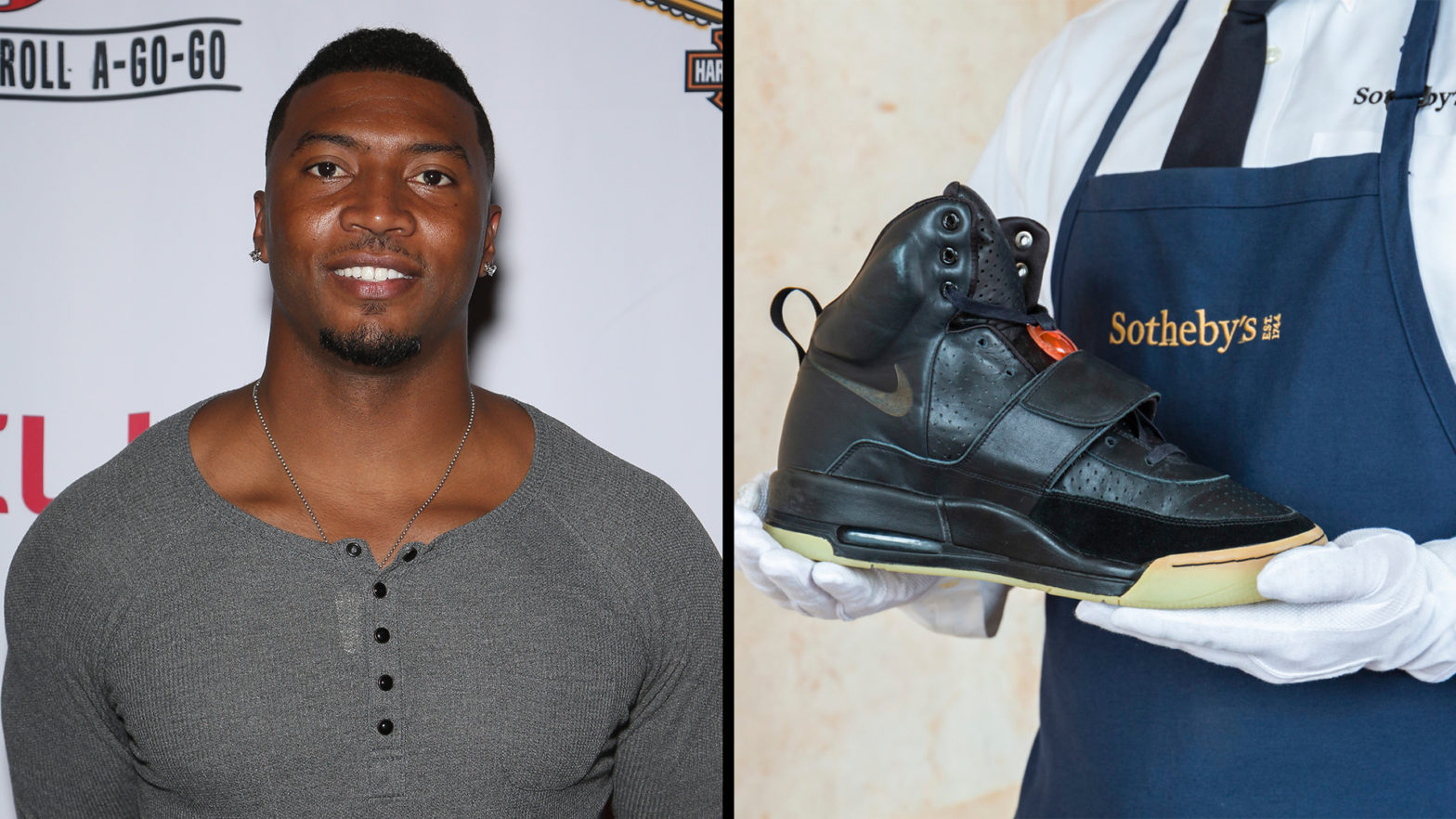

Athlete-Turned-Techpreneur Gerome Sapp’s $1.8M Yeezy Prototype Sneaker Purchase Is Giving Back To The Culture

For former NFL player Gerome Sapp, transitioning from the world of professional sports to the world of business came with ease once he found the right concept. After retiring from the league in 2008, he was inspired to start a new career as a tech founder, and his latest conquest in the industry is proving to be quite a force in the investment space.

With his driven mindset and finance background, the athlete-turned entrepreneur came up with an innovative concept to educate his community on what it means to make smart investments in assets that especially resonate with them — sneakers.

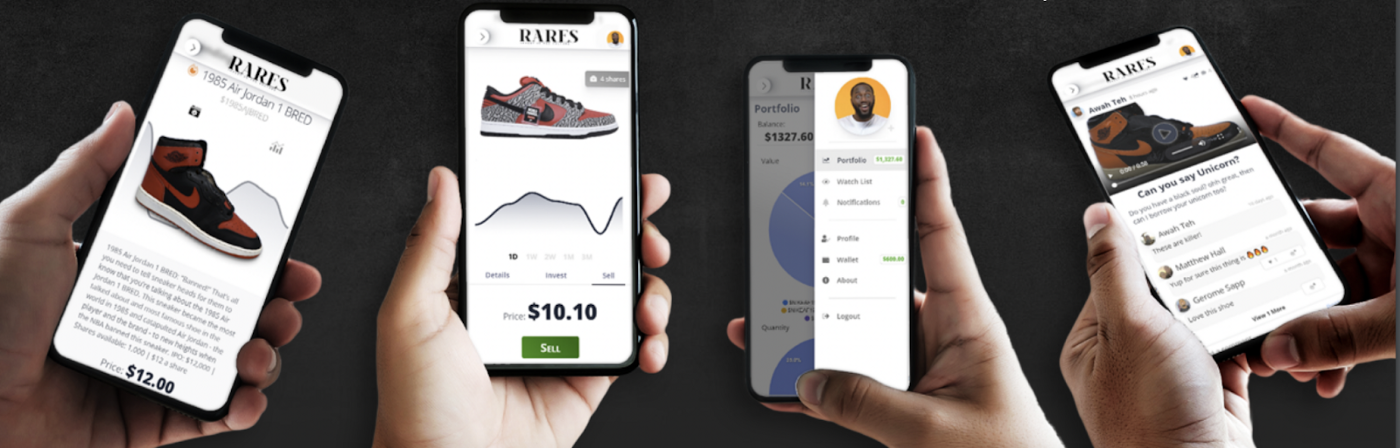

This simple yet revolutionary idea is what paved the way for his new fintech startup Rares — a product of the Techstars Los Angeles Accelerator program — to launch as a platform to help people to invest in shares of particularly notable sneakers. The business, which launched earlier this year, was born amid the pandemic and gave Sapp the opportunity to combine his two passions — the Stock Market and sneakers — in a company that offers millions of people fractional ownership through rare, high-priced sneakers.

Beyond being a one-of-a-kind platform for smart investors, Rares is also the history-making company that acquired the holy grail of kicks — Kanye West’s 2008 Grammy-worn Air Yeezy 1 Prototype sneakers that sold for $1.8 million. The acquisition broke a record for the biggest individual sale of a pair of sneakers in auction history, and made it Rares’ most expensive purchase to date. Now equipped with one of the sneaker world’s most-prized possessions, Sapp’s company is positioning itself to use this opportunity to give back to the community that created today’s rich sneaker culture.

AfroTech spoke with the serial tech entrepreneur about how he got his tech start and what plans lie ahead for Rares in the multi-billion dollar sneaker market.

AfroTech: How did you make the transition from sports to the business world?

Gerome Sapp: The transition actually came pretty easy. All athletes go through this kind of “now what” phase when they retire from sports, but competing in the entrepreneurial space was my new competition in life. So, that void that football left when I retired, the business world and being an entrepreneur really filled it.

AT: How did you discover that sneakers are the new asset class in the market?

GS: Sneakers have always been something that we [in the Black community] have looked up to. We always knew that Jordans were expensive, and I [myself] always knew that they would appreciate in value [one day]. I was an 80s baby, so we were the first generation that really made sneakers what they are in terms of value and popularity. So once I started to study finance at the University of Notre Dame and then Harvard [University], we started learning about alternative assets and things of that nature. For me, the first thing that came to mind was sneakers.

No one was looking at sneakers as this new asset class that you could make money off of. While people were thinking about crude oil and gold and stuff like that, in terms of commodities, I was thinking about sneakers. My company is now at the right place at the right time because sneakers are being recognized as a thriving new asset class that is actually making people money.

AT: At the intersection of tech and entrepreneurship, how can you help someone like me get involved in the sneaker market?

GS: Well, you already have a familiarity with sneakers, even if you don’t know anything about how they appreciate, why they appreciate [and so forth]. People are gravitating more towards investing in things that they know and see as tangible. Now, all I have to do is explain to you why sneakers are important, why they’re valuable and why they’re something that you should invest in, and that’s where Rares comes in. You can invest in a lot of different things in this world, but why not invest in something in a culture that you had a hand in helping create at some point in your life? For me, it starts with just allowing you to understand that this is the intersection of Wall Street and the hood basically coming together around an asset class that you already have a certain familiarity with.

AT: What inspired you to create Rares and teach others how to invest?

GS: I grew up in a community where I knew firsthand what a lack of opportunity and access felt like. So I always told myself if I had the opportunity, I would create a company that helps solve the access and opportunity issue in a particular industry. When I was at Harvard, I remember walking to class and some kid stepped on my Jordan 11’s. So, I’m like in class wiping my sneakers off and I’m thinking like there has to be another way where I can derive value out of these shoes without having to physically own them. I said what if you could turn these sneakers into a stock, just like any other company, and take it public to allow people to invest in it.

Part of Rares’ mission is giving back and teaching financial literacy because for many people, this is their first investment. We want to educate you on how to make the best investments, and why you [as a consumer] should invest in a particular sneaker. [Our hope] is to teach you to become a better investor so you can move on to other more traditional assets.

AT: What are your thoughts on the wealth gap that exists amongst minority investors and how can you begin closing that gap through your startup?

GS: The wealth gap is troubling for a lot of reasons, but mainly because there’s a lack of information afforded to certain people. If you really want to find out certain things [about investing], you could, but a lot of people don’t have time to go through the hurdles of finding out how to decrease that gap. So, it’s up to me and companies like Rares to help to decrease that gap, starting with education.

AT: Talk to me about how the acquisition for the Yeezy Prototype came about.

GS: I remember watching that performance of Kanye actually performing in that sneaker. At that time, I was a big sneaker head, so I knew everything that went into that sneaker and, it being the prototype, what was to come from the sneaker industry. Before then, Nike had never collaborated with a musician so that was the first time they ever broke the mold. It was the catalyst that literally made Kanye a billionaire, and it set the tone for how Nike and other shoe brands were to operate afterwards. That sneaker was basically a one-of-one prototype so we had to purchase that shoe, as rare as it was, given our company name. It literally catapulted [Rares] to the front of the line in the alternative asset investment space, as it relates to sneakers. No one else is only doing sneakers. We do them the best because we come from a cultural standpoint and have paid homage to all the people that came before us that are still doing it, and we’ve been co-signed because of that.

AT: What will happen once Rares launches the IPO for that sneaker?

GS: We split it into 72,000 shares and so we’ll offer [Rares users] each share at $25. Meaning people will be able to own a piece of the most expensive sneaker in history for $25 a share. We wanted to have the ability to regentrifiy the culture and allow the people that were left out back in to potentially participate financially in owning a piece of that [shoe’s history].

This article was featured on Afrotech.