TABLE OF CONTENTS

05 I. Africa as an Investment Destination

2. Penetration and Connectivity

3. Demographic Growth and Market Potential

15 II. Growth Potential, Promising Sectors, and Current Investment Opportunities in Africa

2. Healthtech

3. Digital Commerce

5. Media, Content, and Advertising

28 III. Challenges

2. Currency Devaluation

3. Cultural and Regional Barriers to Scale

36 IV. Success Stories in Africa

2. TradeDepot (Nigeria)

3. Fawry (Egypt)

4. Mdundo (Kenya)

6. Wave (Côte d’Ivoire)

7. Best Practices for Evaluating Africa

Based Seed Stage Companies

46 Conclusion

SUCCESS STORIES

IN AFRICA

-

Flutterwave (Nigeria)

Flutterwave (Nigeria)

-

TradeDepot (Nigeria)

TradeDepot (Nigeria)

-

Fawry (Egypt)

Fawry (Egypt)

-

Mdundo (Kenya)

Mdundo (Kenya)

-

Naked Insurance (South Africa)

Naked Insurance (South Africa)

-

Wave (Côte d’Ivoire)

Wave (Côte d’Ivoire)

INTRODUCTION

MaC Venture Capital (MaC VC) is a seed-stage venture capital firm prioritizing emerging sectors. Periodically, MaC Venture Capital compiles a list of cultural trends that we believe to be influencing global popular culture, termed Culture Shifts. These shifts represent areas that we, collectively, believe hold great opportunities for growth, innovation, and of course, investments in the coming year.

In our latest installment of the Culture Report, we explore why Africa is the next frontier for technology investment.

With its young, rapidly-growing and mobile-first population, the continent is ripe for investment opportunities. This report delves into the state of the technology and startup scene in Africa, the current and future investment landscape, its most promising markets and opportunities for growth, and the challenges that come with investing in an area that is largely untapped and underrepresented. MaC VC has deployed ~$20M of its investment capital into African startups, making it one of the largest and most active early-stage firms investing in the continent.

GDP BY AFRICAN REGION

2021 - 2025

Source: African Development Bank Group's

Macroeconomic Performance and Outlook, 2024

SECTION ONE

AFRICA AS AN INVESTMENT

DESTINATION

Africa has emerged as a beacon of potential for the technology sector among the world’s continents. Its journey from a resource-rich land sought after for its abundant natural wealth during colonial times, to a center of economic and technological growth, is a testament to its transformation. In the wake of decolonization over the last fifty years, Africa has rapidly evolved, entering a Golden Age powered by technological innovation and educational advancement.

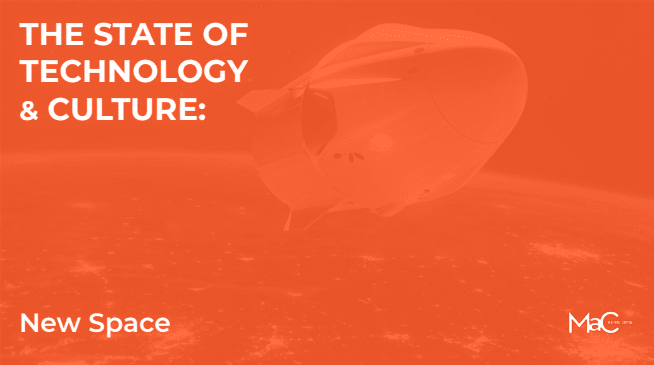

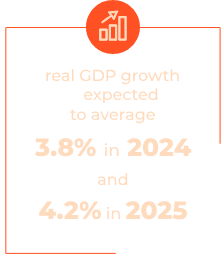

Today, Africa is poised to become home to 11 of the world’s 20 fastest-growing economies, with real GDP growth expected to average 3.8% in 2024 and 4.2% in

2025—surpassing the global growth projections of 2.9% and 3.2%, respectively.1 This economic vibrancy is partly fueled by the digital revolution sweeping across the continent. The surge in internet usage and mobile connectivity has catalyzed significant socioeconomic transformation, enabling businesses to thrive digitally, broadening economic activities, and enhancing market access. These digital advancements are empowering local entrepreneurs, accelerating the growth of fintech services, and driving progress in commerce, healthtech, and media further boosting Africa’s economic development.

MARKET SNAPSHOT

1MOBILE PENETRATION & CONNECTIVITY

2DEMOGRAPHIC GROWTH & MARKET POTENTIAL

3THE VENTURE LANDSCAPE

MOBILE PENETRATION

AND CONNECTIVITY

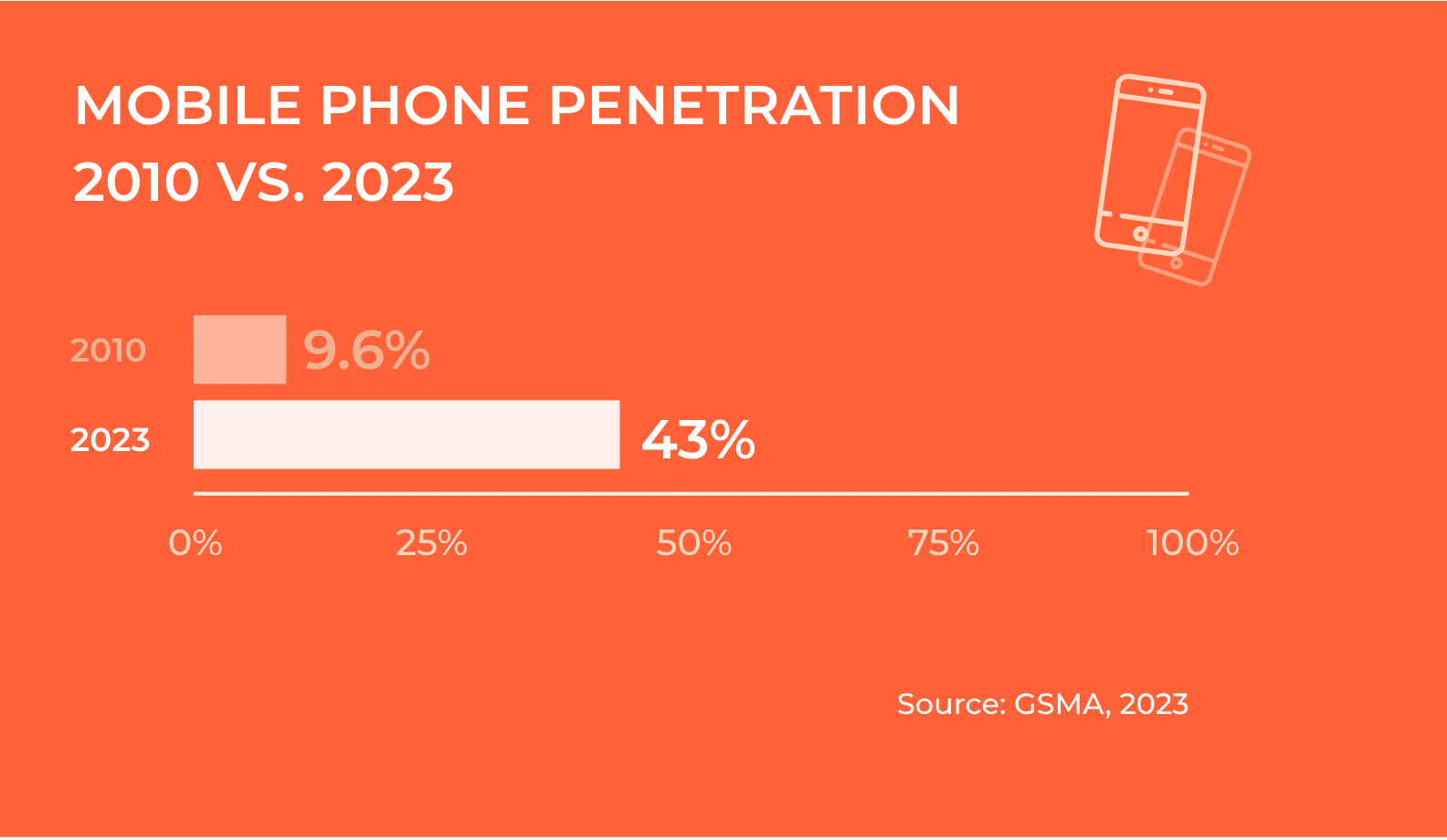

In certain parts of Africa, mobile phones are more accessible than essential sanitation facilities.2 In 2023, sub-Saharan Africa alone recorded approximately 489 million unique mobile phone subscribers, translating to a mobile penetration rate of 43%, a significant increase from just 9.6% in 2010.3 Predictions indicate that by 2030, the subscriber count could reach 700 million, with Nigeria and Ethiopia expected to account for a significant share of this growth.

Mobile penetration has been a pivotal driver in advancing technology across Africa. The adoption of 3G has accelerated this, with 55% of all mobile subscribers now utilizing 3G. Additionally, the expansion of 4G and 5G connections is gaining momentum, supported by the development of fiber optic infrastructure. Collaborative initiatives like 2Africa, involving major firms such as Orange, MTN,

and Vodafone, aim to connect Africa with Europe and the Middle East through a substantial international subsea communications cable project.4 While fiber optic cables don’t directly provide 5G connectivity to consumers, they are crucial for the supporting network architecture required for the effective operation of 5G networks. In the last quarter of 2023, the smartphone sector in Africa saw a notable rise in shipments, with a 12.5% increase compared to the previous year, totaling 19.8 million units.5 This is a testament to the continent’s growing demand for mobile technology, despite the ongoing challenge of high device costs. The market introduction of budget-friendly smartphones, some priced below $100, has begun to address affordability issues, although the cost remains a barrier for many, considering local economic conditions. Data from the

Alliance for Affordable Internet shows that the average cost of a smartphone as a proportion of monthly income in Sub-Saharan Africa declined from 41% in 2021 to 39% in 2022, a significant decline that meant Sub-Saharan Africa no longer had the highest relative cost of smartphones, with that honor going to South Asia instead.6

This momentum in mobile penetration is crucial for fostering a digitally inclusive Africa. The extension of fiber optic networks and the anticipated introduction of low-Earth orbit satellite services like Starlink, set to be available in 25 markets by the end of 2024, highlight a dedicated push to diminish the digital divide. These developments offer promising prospects for enhancing connectivity across Africa’s most remote and underserved areas, ushering in an era of unprecedented digital opportunity on the continent.7

The combination of increased mobile penetration and improved connectivity further amplifies the potential for a mobile-led boom in Africa’s digital economy. This mobile-first approach is proving invaluable for Africa’s technology sector, helping overcome economic, infrastructural, and social barriers that could otherwise impede market growth and startup success. For example, mobile technology in Africa acts as a natural support for efforts to enhance the digital identity systems that can unlock exponential growth in many sectors by removing the many structural barriers that arise in a low-trust environment. In fintech, stronger digital identity systems enable broader financial inclusion and financial intermediation; in healthtech, stronger digital identity systems ensure greater data accuracy, improving healthcare delivery and insurance outcomes; in commerce, stronger digital identity systems enhance transaction security and power customer loyalty programs; and so on. Some of these benefits are already being realized in the continent, as many of the success stories covered later illustrate how startups can intelligently leverage mobile technology to generate outsized returns in Africa.

DEMOGRAPHIC GROWTH

AND MARKET POTENTIAL

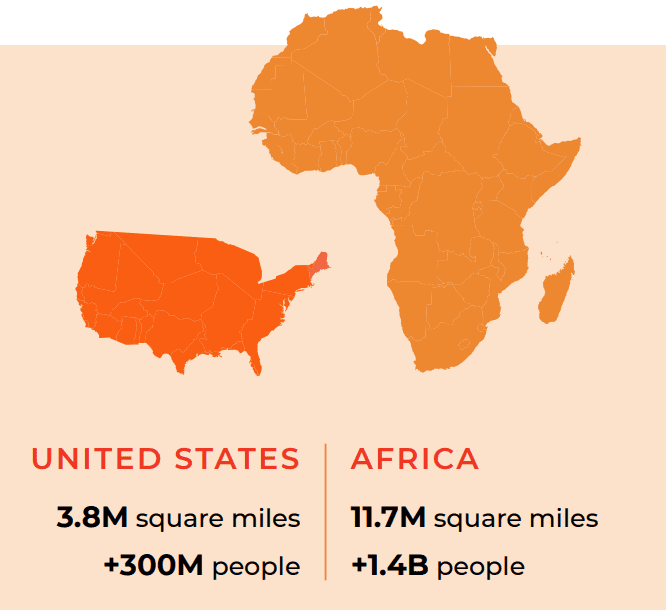

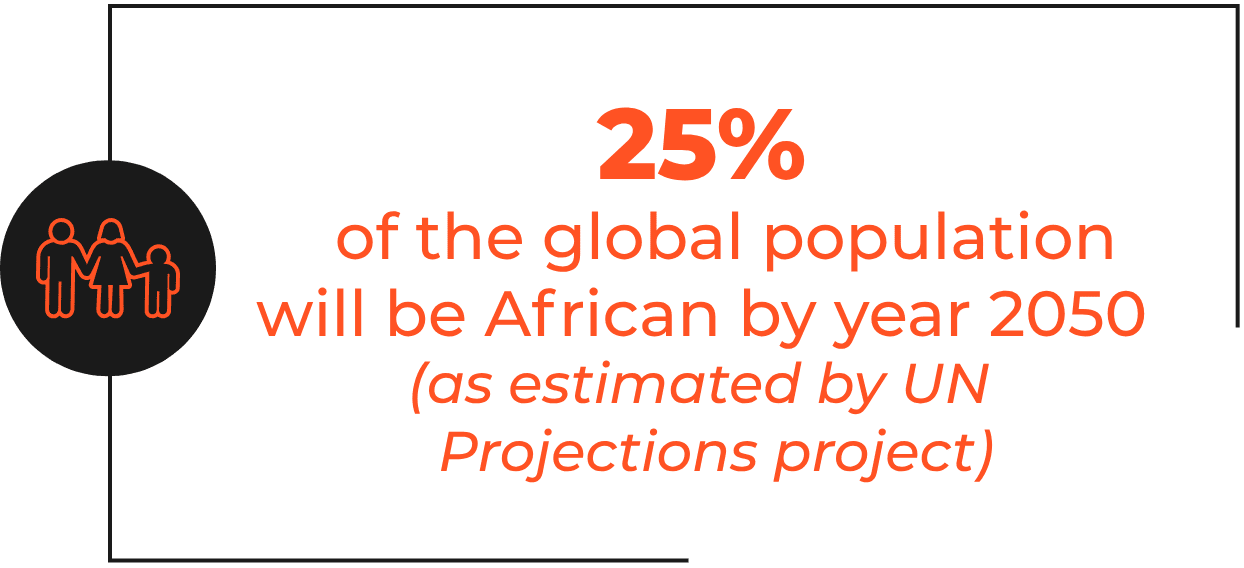

Population growth remains a core aspect of Africa’s global allure. Currently, over 60% of the continent’s populace is under the age of 25, making Africa the youngest continent on the planet. Projections by the United Nations suggest a monumental surge in Africa’s population to an estimated 2.5 billion by 2050, accounting for 25% of the global population.8,9 This demographic expansion is expected to be significantly fueled by five countries—Democratic Republic of the Congo, Tanzania, Ethiopia, Nigeria, and Egypt—positioning Africa at the forefront of global population growth according to the UN’s medium-fertility scenario.

The youthful and expanding population is crucial for key sectors such as fintech, healthtech, and digital commerce, industries experiencing innovation and leading the charge in tackling the continent’s most urgent challenges. The substantial market size offers a unique opportunity to leverage this demographic advantage by upskilling and nurturing a talented workforce. Most notably, Nigeria has emerged as the second-fastest-growing developer hub to GitHub data, highlighting the continent’s untapped software engineering talent.10 Promisingly, African policymakers are showing more appreciation for the role of technology in job creation and providing more support. Perhaps the most ambitious of these is Nigeria’s 3 Million Technical Talent (3MTT) program, rolled out in late 2023, intending to build Nigeria’s technical talent pipeline to position the country as a net exporter of technical talent.11 The critical role of early-stage startups in tapping into this large Total Addressable Market (TAM) cannot be overstated. Africa’s tech ecosystem, still in its infancy, is

witnessing rapid diversification across several sectors, establishing the continent as a vibrant incubator for new businesses. It must be noted that this growt is not simply about addressing immediate market needs; it’s about laying the groundwork for sustained innovation and development.

Source: PopulationPyramid.net

THE VENTURE

LANDSCAPE

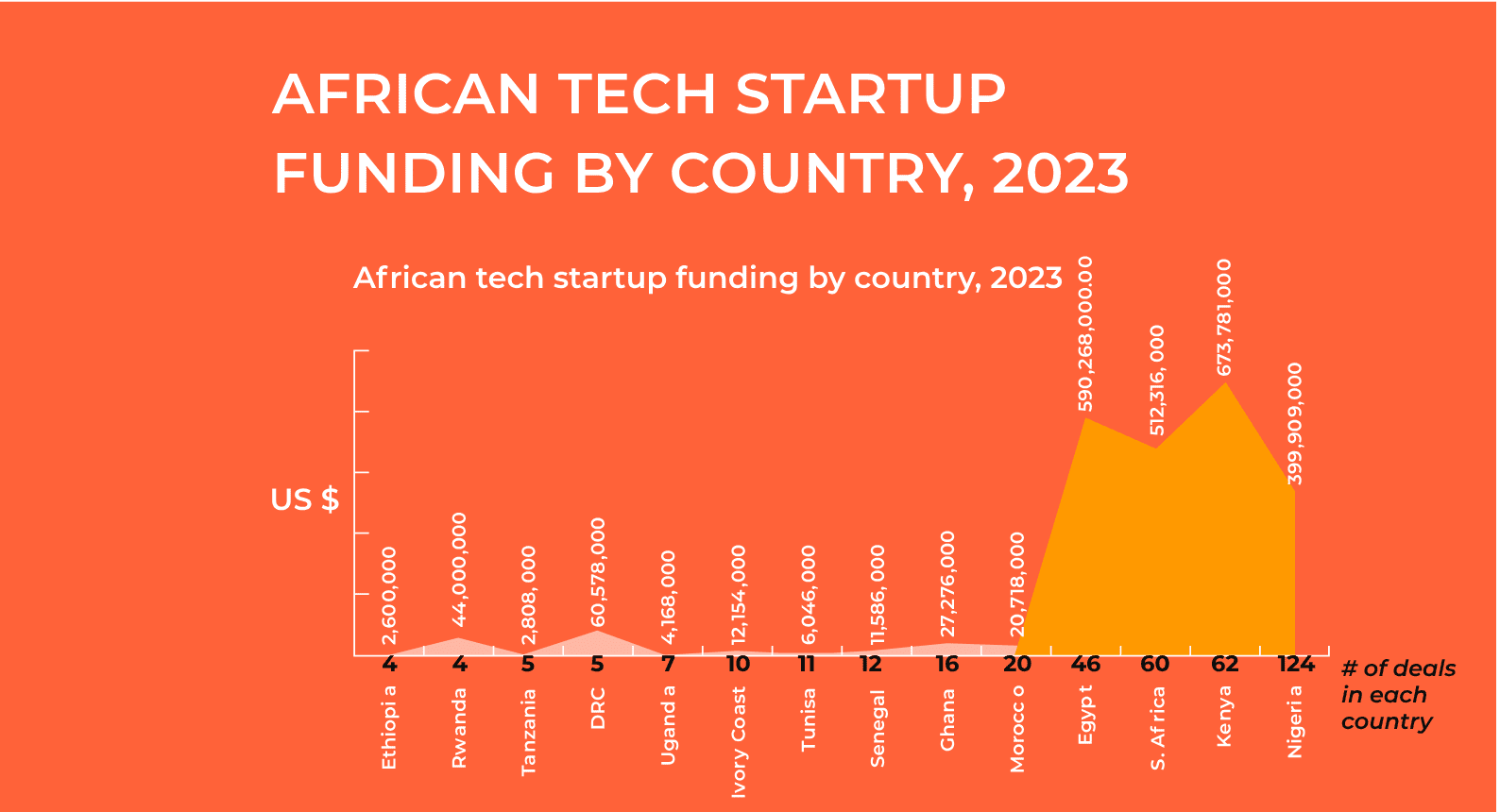

The landscape of startup funding in Africa has experienced both remarkable expansions and notable contractions over recent years, largely influenced by the global economic climate following the COVID-19 pandemic. After witnessing an extraordinary influx of capital, with African startups attracting an average of $4.8 billion in 2021 and $5.6 billion in 2022, the

continent saw a significant downturn in 2023—with funding dropping to approximately $3.5 billion—reflecting a 37.5% year-over-year decline.12,13 This shift mirrors a global trend, where venture capital funding for startups fell from $462 billion in 2022 to $285 billion in 2023, a 38% year-over-year decline.14 Africa and other emerging regions are expected to feel the worst of this

plight. Nevertheless, a focus on solid unit economics and maintaining positive cash flow has become a survival strategy for African startups navigating these financial headwinds. Investor engagement from outside Africa has notably decreased, with The Big Deal tracking a reduction in activity from North American investors, dropping from 35% involvement in previous years to 30% in 2023.15 Conversely, African-based investors have ramped up their involvement, becoming the most active investors on the continent representing 35% of all deal volume, an increase from 28% the year before. The participation rates from Asia, Europe, and the Middle East were recorded at 5.5%, 4.5%, and 25%, respectively. While some may see this as detrimental, the decrease in foreign investment provides less competition for highquality deals on the continent of Africa. Additionally,

investors can negotiate better terms, secure more favorable deals, and in some cases, have larger equity positions in companies. For startups, this change can be equally advantageous. With local investors taking a more active role, companies can benefit from investors who have a deeper understanding of the regional market, cultural context, and specific challenges. These investors are more likely to offer tailored support, relevant networks, and strategic advice that align closely with the local business environment. The increased presence of local investors fosters a sense of community and long-term commitment, which can be crucial for the sustained growth and development of Africa-based startups.

In regard to funding stages, African startups continued to secure early-stage capital. According to a report from the investment firm Partech, seed-stage investments accounted for 71.2% of all funding rounds (337 out of 473 deals), while Series A made up 18.2% (86 out of 473 deals).16 Seed-stage investments have decreased in recent years after a steady rise from 2018 to 2021. This decline, combined with slower progression to later funding stages, has led to expectations that African startups will conserve capital and minimize burn rates, driven in part by limited liquidity at later stages. In response, some startups have turned to alternative financing methods, including debt, which has seen a slight increase from 71 deals in 2022 to 74 in 2023, now accounting for 14% of all deals (up from 9% in 2022).17

Furthermore, Development Finance Institutions (DFIs) have also played a significant role, directly investing over $500 million in startups through equity or debt, targeting more established companies and contributing to the ecosystem’s growth.18 DFIs have even committed upwards of $4 billion in 2023 across various sectors, affirming Africa’s status as a prime investment destination.19 But what does this mean for the ecosystem and seed funds as well? For funds that have significant reserve capital, they may have the

ability to further double down on strong performing companies at the Series A stage. However, the capacity of Africa-based funds to participate meaningfully in Series A rounds remains limited. Most local funds are not sufficiently capitalized to support startups through multiple growth stages, which may explain why only 29% of active investors on the continent were Africa-based.20 Deal size trends further reflect this, with nearly 45% of venture deals valued at $5 million or less, and 40% of those under $1 million.21 The tendency toward smaller deal sizes is typical in Africa’s startup ecosystem, often requiring the involvement of larger international investors as companies scale. This presents an opportunity for larger foreign-based seed funds, like MaC Venture Capital, to increase their ownership in strong-performing portfolio companies at the Series A.

South Africa, Kenya, Nigeria, and Egypt have remained at the forefront of attracting startup investments, collectively representing 79% of the total equity deal volume in 2023, or $1.7 billion.22 The investor draw to these markets can be attributed to their relatively mature markets, dense populations, and strong economic indicators, including high GDP growth rates and increased consumer spending. However, this focus on the ‘big four’ does not detract from the potential in other African countries. Francophone nations, including Senegal, Morocco, and Tunisia, are rapidly gaining ground, with Senegal securing a spot among the top 10 countries for funding, signaling a broadening interest across the continent’s diverse markets. Another crucial aspect to consider is the state of exit opportunities on the continent. Over recent years, venture capital activity has led to overvalued expectations regarding startup exit velocity from a global perspective, affecting many funds now feeling the impact. In Africa, exit opportunities, particularly in the form of IPOs, remain relatively nascent compared

The first notable African startup exit occurred in 1999 when Verisign acquired Thawte Consulting, a South African digital certification company, for $575 million (equivalent to approximately $1 billion today).23 It took about a decade for another significant exit when Visa acquired Fundamo, a mobile financial services provider, for $110 million in 1-2 years.24 Eight years later, Jumia became the first African venture-backed startup to list on a major global exchange. Although Jumia’s stock surged to nearly $50 per share shortly after its NYSE IPO in 2019, it plummeted as low as $2.29 per share by 2023, negatively impacting the IPO environment for African companies.25 Given the stringent demands of capital markets, M&As are often more advantageous. On average, African startups take 4-7 years to be acquired, with the most successful exits taking around 10 years26,27 Most tech startup exits in Africa are driven by acquisitions aimed at market expansion, talent acquisition, and strategic investments from corporate entities. This strategy enhances companies’ product offerings, customer bases, and talent pools. In 2023, fintech dominated acquisitions, accounting for 31% of the 29 deals.28

While the volatility of the venture landscape today has affected markets globally, at MaC VC we remain optimistic about the potential in Africa. Though our investments are not limited to any specific region, we tend to focus on Nigeria and Kenya. This focus is due to our strong relationships in these countries, their favorable market conditions, and robust local networks, which align with our strategic emphasis on high-potential regions.

Section Two

GROWTH POTENTIAL, PROMISING SECTORS, AND CURRENT INVESTMENT OPPORTUNITIES IN AFRICA

Africa’s diverse economy presents a plethora of investment opportunities across various sectors yet to be fully embraced by consumers, small businesses, and enterprises. Key areas showing promising growth and innovation potential include Fintech, Healthtech, Digital Commerce, Information Services, and Media

and Advertising. The common thread weaving these sectors together is the fundamental need for access—be it to financial services, healthcare, or reliable information—which propels their growth and presents ripe opportunities for investment.

TOP FIVE INVESTMENT SECTORS

1FINTECH

2HEALTHTECH

3DIGITAL COMMERCE

4INFORMATION SERVICES

5MEDIA, CONTENT, & ADVERTISING

FINTECH

In just a few short years, the adage “every company will become a fintech” has proven remarkably accurate, particularly in Africa’s rapidly evolving market landscape.29 Sub-Saharan Africa is home to almost three-quarters of the world’s mobile money accounts.30 Telecom giants like Safaricom and MTN are at the forefront of this transformation, leveraging their extensive networks to process billions in transactions. In 2023 alone, MTN’s MoMo platform facilitated transactions totaling an astounding $221.3 billion, while Safaricom's M-Pesa exceeded this with a transaction value of $337.8 billion. This convergence of telecommunications and financial technology highlights a significant trend: transforming telecom operators into key players in the fintech space, advancing financial inclusion and making financial services more accessible to the unbanked and underserved populations.

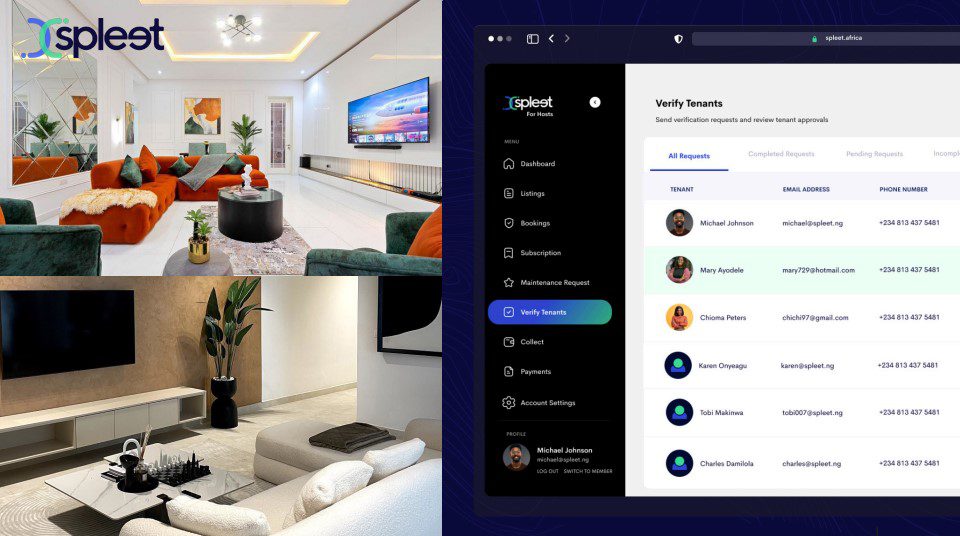

Spleet offers rental management solutions that address housing flexibility for a rapidly growing population.

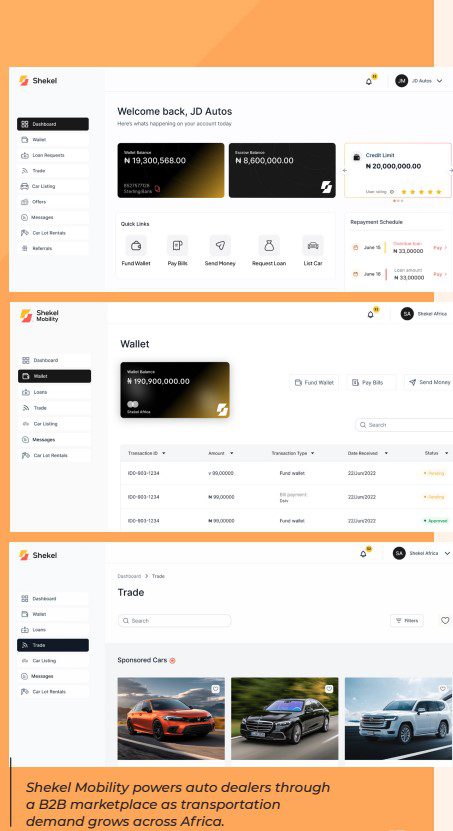

For small and medium-sized businesses (SMBs or SMEs), the integration of fintech not only facilitates immediate financial needs but also establishes a foundation for future adoption, thanks to the higher switching costs for startups integrating fintech services into their product offerings. At MaC, VC our enthusiasm is kindled not just by these immediate opportunities, but by the broader potential of companies that augment their core offerings with fintech capabilities. Our investments in Shekel Mobility and Spleet exemplify this. Shekel Mobility, a B2B marketplace for auto dealers in Africa, not only simplifies the buying, selling, and trading of vehicles in the continent’s $30 billion automotive sector but also enhances it with crucial financing options through partnerships with banks. This innovative approach has empowered auto dealers to expand their inventories significantly, tripling their sales. Spleet allows tenants to rent properties and pay monthly rent while also providing the option for landlords to receive the rent yearly through various financing options.

This approach of integrating fintech services into product offerings can be particularly potent given Africa’s current market conditions. There is significant

latent demand for credit on the continent. In Nigeria, EFInA data shows that only 1 in 10 borrowers obtain their loans from banking institutions, and conservative projections suggest that Nigeria’s consumer lending TAM is at least 30% greater than available market estimates for 2023.31,32 The pattern is similar in other major African countries, with credit access lagging global standards in Kenya (22%), Egypt (7%), and South Africa (18%), according to the World Bank Global Findex Survey.33 Furthermore, the recent rise in inflation has increased credit demand, while higher interest rates have simultaneously reduced access to it. Integrating fintech services into product offerings has dual benefits here: helping startups to mitigate the effect of higher inflation while also gradually building the credit data infrastructure necessary to unlock access to credit, which can, in turn, accelerate consumer spending growth in Africa.

MaC VC’s philosophy for investing in fintech focuses on backing companies led by founders with deep sector or domain expertise. We especially look to invest in companies that are able to facilitate a crucial financial service for enterprises, and have a competitive moat rooted in customer loyalty. Shekel and Spleet align with this approach, as both companies effectively address immediate financial needs while creating avenues for broader fintech adoption across various sectors.

HEALTHTECH

Enhancing healthcare access remains a critical challenge across Africa, particularly in remote rural areas far removed from medical facilities. Despite the ambitious pledge of the Abuja Declaration in 2001, where African leaders committed to allocating at least 15% of their national budgets to healthcare to address prevalent diseases, by 2018, only two nations had achieved this goal.34 In fact, Nigeria, the birthplace of this commitment, allocated less than 6% of its 2023 budget to the sector. The shortfall here is compounded by a significant “brain drain” issue, with a staggering 65% of Egyptian doctors and numerous Ghanaian nurses pursuing careers abroad, often in higher-income countries like the UK. Currently, Africa’s healthcare workforce density stands at approximately two workers per 1,000 inhabitants, highlighting a dire need for innovative solutions.35, 36, 37

Healthtech startups in Africa are poised to bridge this gap by leveraging technology to expand healthcare access. Initiatives such as virtual-first primary care and proprietary health data management can significantly mitigate the continent’s healthcare delivery challenges. MaC VC portfolio companies, including Afya Rekod and Antara Health, exemplify this approach by building solutions to improve health outcomes.

Afya Rekod has pioneered a patient-centric approach with its decentralized, patient-owned electronic health records system. The platform not only allows individuals to upload and manage their health data in real-time but also facilitates access to healthcare services by making personal health information

Afya Rekod enables better patient care through a digital data platform.

Antara Health offers holistic health & wellness solutions tailored to every life stage.

instantly actionable.

By ensuring that medical histories are complete and readily available, Afya Rekod empowers healthcare professionals to tailor treatment plans more effectively and enables public health officials to respond swiftly to acute health crises. Antara Health is integrating AI-assisted health navigation, simplifying complex healthcare processes for patients and providers alike. This model offers a holistic care package, especially for those managing chronic conditions, encompassing health and financial protection, concierge care coordination, and the reassurance of having a dedicated advocate throughout their

healthcare journey.

Notably, Antara has achieved significant outcomes, with 81% of chronic hypertension patients having their blood pressure controlled, compared to just over 2% of Kenyans nationally. Additionally, 87% of diabetic patients under Antara’s care have their blood sugar controlled. Insurers have seen 36-47% savings on claim costs in the first year, and employers have realized a 2.5x ROI in avoided medical leave, based on wage savings per staff member.

The healthtech companies we invest in leverage health data in novel and highly efficient ways, empowering providers by enabling more efficient and effective care strategies and ultimately driving better health outcomes for the overall patient population across the continent.

DIGITAL

COMMERCE

The combination of B2C and B2B e-commerce, fintech innovations, and the rise of social commerce is reshaping Africa’s digital commerce sector, positioning it for substantial growth in the near future. Projected to surpass half a billion users by 2025, the e-commerce sector in Africa is experiencing a remarkable 17% annual growth rate in its consumer base.38 The entry of online marketplaces like Jumia, Konga, Kilimall, Takealot.com, and Souq led to explosive growth initially as they became the de facto option for B2C e-commerce. Even so, infrastructural issues along with macroeconomic headwinds have resulted in many of these businesses struggling to reach profitability. On the B2B front, two of Africa’s largest B2B grocery marketplaces, MaxAb and Wasoko, decided to merge in 2023—a development that stirred mixed reactions.39 For some, this consolidation was an anticipated

strategy to address the sector’s challenges, including poor unit economics driven by high operational costs, complex supplier distribution networks, and slim gross margins.

Despite these obstacles, the demand for digital platforms that streamline supply chains remains robust. Suppliers still seek broader distribution and many mom-and-pop shops prefer online ordering especially with regard to imported goods. However, overcoming the hurdle of disintermediation, where users bypass platform fees to connect with each other directly, requires more than just connecting supply and demand. E-commerce marketplaces like Chari in Morocco are integrating services such as bookkeeping, digital payments, utility bill payments, digital cash transfers, and credit facilities for SMBs, thereby fostering a more integrated and indispensable value

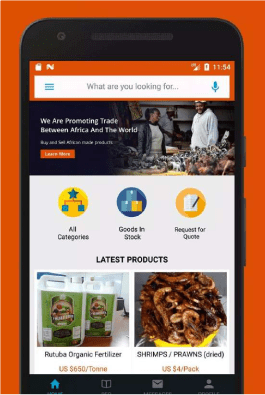

Commerce platform Traders of Africa supports the growing ecosystem of African entrepreneurs needing ecommerce solutions.

chain. TradersOfAfrica (TOFA) is another exemplary platform facilitating intra-African trade in various commodities and providing essential training to sellers, particularly farmers, to meet commercial demand. By facilitating transactions, e-commerce marketplaces have the ability to create a sticky product and further upsell customers on additional services.

Additionally, established and emerging online and offline retailers are increasingly adopting omnichannel strategies to grow their customer base. A company we’ve been fortunate to support is tackling this; Tappi is an end to end digital commerce solution for informal retailers. The platform helps SMBs create and manage their online profile, accept payments, and engage directly with customers through bulk SMS and reviews. Tappi has also partnered with telecom operators to enable SMBs to purchase ads using airtime minutes.

Other companies like Bumpa, Tendo, and Selar, heavily concentrate on e-commerce by allowing anyone to build and manage their online storefronts and sell products. Fintech incumbents, Flutterwave, and Paystack have also built similar storefront experiences as additional services on top of their core payment features. Each of these companies is contributing to

the rise of social commerce that continues to gain a strong foothold in the region. Social commerce refers to businesses leveraging online social media platforms such as Facebook, WhatsApp, Instagram to sell their products directly to consumers within those platforms. It’s become crucial to informal retailers. A recent study showed that in Africa, 60% of micro enterprises, 49% of small enterprises, and 33% of medium-sized enterprises depend solely on social media to facilitate sales.40 It’s no surprise that this has become the norm. Trust and relationships are a core component to African commerce, especially among informal retailers. By transacting via social media, consumers can build trust with merchants through direct communication without having to leave the platform.

MaC VC invests in companies that are building the infrastructure to support the proliferation of social commerce models. Facilitating transactions alone is no longer enough. By enabling social commerce to flourish, we believe these companies can contribute to the broader economic development and digital transformation of Africa’s commerce landscape.

Tappi helps business owners of all sizes find and convert new customers.

INFORMATION

SERVICES

Despite the statistics previously mentioned, the reliability of data remains questionable, particularly due to the challenging data collection processes in rural areas across African nations. This process remains predominantly manual, demanding substantial human resources. While companies may emphasize the importance of primary or secondary data, the perception among many African consumers regarding the value of data collection is lukewarm. Furthermore, regulatory hurdles across the continent further complicate access to government-mandated data. Data scientists have reported difficulties in navigating bureaucratic obstacles to close the data gap, including requirements to become authorized data processors and the need to lobby various stakeholders for data access.41 Even then, the accuracy of data collected by African government agencies is often suboptimal.

For instance, a recent report on data governance highlighted that only 10 African countries possess a birth registration system capturing at least 90% of births.42 The same report revealed that in at least 14 African countries, the most recent population census was conducted before 2010, leading to reliance on outdated estimates for recent planning. This deficiency in data transparency often results in numerous adverse effects, including ineffective governance, misallocation of scarce resources, and consumers’ inability to access resources due to lack of data.

African startups can face significant challenges due to outdated and inaccurate data sources or the daunting task of developing their own dataset. Nonetheless, startups have the potential to validate existing data through their products, effectively becoming an information service

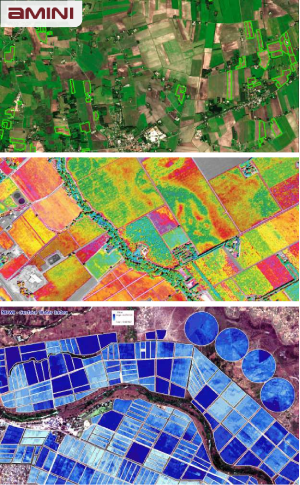

Climate-tech startup Amini AI unlocks environmental data to enable agriculture, clean energy, and climate action.

Advancements in AI empower these startups to efficiently collect and analyze customer information through services or surveys, leading the creation of valuable proprietary datasets. Still, the goal should not merely be data collection, but the creation of platforms that provide actionable insights, driving informed decisions and tangible actions. By productizing this data, companies can unlock their full potential, converting otherwise static information into a dynamic tool. A few companies doing this today include Amini and Rwazi. Amini is building environmental data infrastructure for Africa and the tropical belt using a combination of satellites, and machine learning. Rwazi provides brands with real-time insights into consumer behavior and market trends by leveraging a network of local consumers. At MaC VC, we have invested in two companies tackling the data accessibility challenge: Prembly and Stears. We’re excited about companies in this category that can capture proprietary data and productize it in a manner that amplifies and expedites decisions. Prembly specializes in identity verification, fraud detection/prevention, and background checks, enabling businesses to safely onboard customers and

conduct transactions across borders with trust, while adhering to regulatory compliance. This enhances business visibility into its customer base, effectively improving the quality of information being captured. It also eliminates the possibility of dealing with fake data enabling trust within the business environment. While Prembly works with some of the top brands on and off the continent, it also works with both national governments and regulators to create critical digital data infrastructures that are needed for growth across the continent. Recently, Prembly worked with the Namibian Government through Namfisa to create the first digital identity ID framework for the country.43 Prembly also secured a partnership with the Nigerian federal government to serve as the enrollment and verification partner for the 3 Million Technical Talent Program (3MTT) . The Nigerian federal government also chose Prembly to develop crucial data infrastructure for the Ministry of Arts and Culture, facilitating identification, verification, and other data-driven solutions.44 These initiatives highlight the importance of Prembly’s solutions as it aims to reduce identity theft and build the necessary digital data infrastructure across emerging markets.

Prembly offers data infrastructure for identity verification to enable secure and reliable digital business.

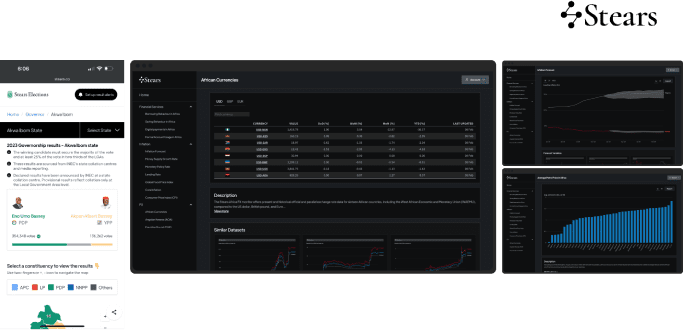

Stears offers economic and industry data and insights through a platform analogous to Bloomberg, aiding decision-making for organizations operating in Africa. By providing investors, policymakers and enterprises with actionable insights, Stears challenges the narrative of indecision and lack of direction in Africa, empowering decision-makers at various levels. Insights targeted at investors include foreign exchange forecasts to help investors and startups mitigate currency depreciation risks, robust market size estimates for identifying attractive markets, and periodic regulatory briefs outlining the impact of regulatory changes on companies in different sectors.

Stears’ election open data work further emphasizes our commitment to startups tackling the underlying data accessibility challenge in Africa. Having built a first-ofits-kind real-time elections results monitor in Nigeria in 2019, they went further in 2023 by providing results from polling booths as they were collated.45,46 Moreover, ahead of arguably Nigeria’s most pivotal elections in its recent democratic history, Stears combined a national pre-electoral poll with an innovative prediction model to successfully predict the outcome and turnout of Nigeria’s presidential elections, as well as the winning

candidate in five out of six polled states in Nigeria.47 In a country where politically motivated polls fail on account of transparency and bias while third-party polls struggle to account for the dysfunctions in the voting value chain, Stears combined machine learning modeling techniques with deep governance expertise

to generate accurate data-driven estimates of counted votes for each presidential candidate. The company continues to play a significant role in strengthening Africa’s governance data infrastructure through its Africa Democracy Open Data portal.48

Stears provides data to global organizations investing and operating in Africa.

MEDIA , CONTENT,

AND ADVERTISING

Media and entertainment is a sector that has garnered notable attention, largely due to the global rise of Afrobeats, and the continued growth in African OTT (Over the Top) video streaming markets. As we mentioned earlier, Africa continues to have a rising youth population leading to the emergence of influential media brands and an increased focus on effectively allocating advertising budgets to reach this demographic. This trend has also fueled the growth of the creator economy, a relatively nascent industry across the continent, with Nigeria, Kenya, and South Africa dominating the scene. According to PwC, total Entertainment & Media industry revenue across these three markets reached $17.5 billion in 2022 and is projected to grow, reaching $27 billion by 2027.49 This growth is primarily driven by two factors: the rapid increase in mobile and internet access, enabling a new

generation of highly monetizable communication, and Africa’s growing youth population, leading to a strong demand for fresher, more engaging, and culturally relevant content. The gaming and esports sectors are also expected to see strong future growth, with mobile gaming driving increased data consumption in Nigeria. Additionally, music streaming adoption is rising across South Africa, Nigeria, and Kenya, with subscription revenue set to surpass R1 billion in South Africa by 2027. That said, our team remains bullish on technologies that not only reduce the time and cost of content creation, but also provide robust methods for creator monetization and personalized content discovery. With the rapid growth of digital platforms and the emergence of new brands tailored to African audiences, there is a growing need for innovative

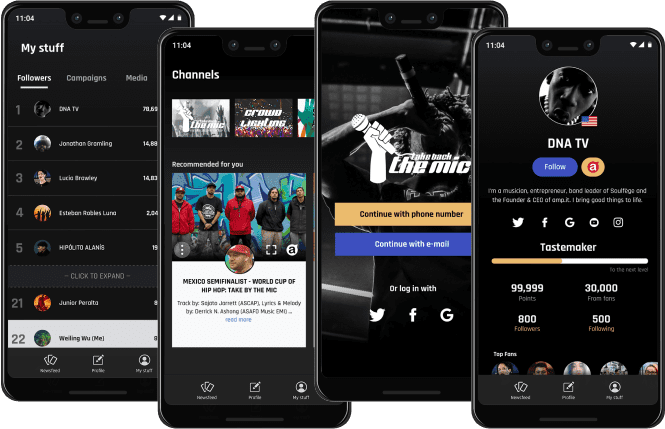

advertising solutions that can help brands connect with consumers in meaningful ways. One approach is through gamifying user engagement on mobile platforms, granting brands access to data they wouldn’t otherwise receive. MaC VC portfolio company

TakeBackTheMedia helps democratize entertainment

TakeBackTheMedia (TBTM) does exactly this by leveraging its AVOD (advertising-based video on demand) platform to drive financial gains and provide residual income for consumers who engage with content on TBTM’s mobile app or partner platforms. For example, if a user interacts enough within the platform, they’re able to win a variety of prizes through redeemable tokens called Kola. These prizes include mobile data packages, which are particularly valuable in Africa, where data costs are significantly higher than in other regions—the Alliance for Affordable Internet estimates that the median cost of 1GB of data as a share of monthly income is at least three times greater in Africa than in Asia.50 Through a partnership with one of the largest global credit card companies Kola tokens are also redeemable in the form of money/ credit. This model benefits both brands and consumers; brands gain a comprehensive understanding of the target community beyond simple demographic data, enabling targeted ad campaigns, while consumers earn rewards through their platform engagement.

In 2013, Jonathan Perelman of Buzzfeed famously stated, “Content is king, but distribution is queen and she wears the pants,” a sentiment particularly relevant

in Africa today.51 Increased advertising opportunities will directly be correlated with the rapid rise of local African media. In some countries, many Africans today are still dependent on international media such as Yahoo, BBC or international streaming services such as Netflix or Disney+ or ShowMaX (owned by Multichoice Group, influenced by European and American conglomerates). Additionally, younger audiences are increasingly finding value in social media pages for their primary sources of media. These platforms, while not inherently African, use algorithms and data collection to optimize content delivery. A key player changing that dynamic is MaC VC portfolio company Big Cabal Media, a pan-African multimedia platform producing highly engaging lifestyle and professional content for Gen Z and millennials. Big Cabal Media’s network includes its flagship brand, TechCabal—an online publication analogous to the U.S.’s TechCrunch—as well as Buzzfeed-esque Zikoko. As there continues to be a massive demand for advertising via African content, media businesses that understand the local context will present a huge value driver for brands looking to establish a presence in the region.

Additionally, as content and distribution become more

localized, the ability to produce content becomes ever so important. Companies such as StarNewsMobile in Côte d’Ivoire and CREAM in Nigeria provide platforms for individuals to create, distribute, and monetize their own content, ranging from music to video. These platforms offer Africans an opportunity to generate additional income streams, reducing their dependency on platforms like YouTube or TikTok, which can hinder monetization due to inconsistent CPM rates across the African continent and limited payment options.52 Additionally, these global platforms are not always optimized for mobile devices with low data capabilities, alienating a significant number of users

To support local creators and achieve an estimated $17B in market size by 2030, major telecom companies will need to continue improving digital infrastructure particularly related to connectivity and broadband access.53 Growth in local content creation offers the promise of a virtuous cycle: the industry offers job opportunities to Africa’s rapidly expanding youth population, who can then tap into export markets, earning valuable foreign exchange to stabilize domestic economies and boost consumer spending power.

Section Three

CHALLENGES

1REGULATORY

2CURRENCY DEVALUATION

3CULTURAL AND REGIONAL BARRIERS

REGULATORY

The narrative around Africa as an investment frontier is often clouded by a spectrum of challenges. These impediments, ranging from political instability and inconsistent regulatory frameworks to infrastructural gaps, currency volatility, and varied cultural landscapes, have tempered investor enthusiasm. Additionally, the complex and often inconsistent compliance requirements across different countries pose significant hurdles for businesses trying to operate seamlessly across the continent. Still, it’s crucial to discern that the essence of emerging markets lies in their inherent resilience and adaptability. Despite these obstacles, African startups have demonstrated remarkable ingenuity, showing that many of these perceived long-term issues are actually transitional challenges that can be overcome through time, learning, and innovation

One of the most common barriers to investment in Africa is the variation in regulatory environments across its nations, each shaped by unique economic and political contexts. Innovation often precedes regulation, leading to a gap that stems from insufficient collaboration or alignment between innovators and regulatory bodies. This phenomenon is not exclusive to Africa; in the U.S., for instance, the rapid evolution of cryptocurrency frequently outpaces regulatory frameworks. A case in point is the economic impact of internet shutdowns in Sub-Saharan Africa. In 2023, governments in the region orchestrated internet blackouts totaling 30,785 hours, affecting approximately 84.8 million users and resulting in nearly $2B in economic losses. These shutdowns, often instigated by governments during controversial elections

- Lagos’s Motorcycle Ban: In Lagos, Africa’s most populous city, a 2022 ban on motorcycles dealt a heavy blow to the informal sector. This regulation has forced a considerable number of startups to either cease operations or drastically pivot their business models, disrupting the ecosystem and livelihoods dependent on this mode of transportation.

- Kenya’s Minimum Tax Regulation: In 2021 Kenya introduced a tax policy requiring all businesses to pay a minimum tax of 1% of their gross turnover, regardless of their profitability. This broad tax policy has disproportionately affected startups, particularly those in their early stages or struggling with growth challenges.

- Exchange Control and IP Regulations in South Africa: Stringent exchange controls and intellectual property (IP) regulations in South Africa complicate foreign investment processes and IP management for startups. These startups find themselves navigating a complex web of regulations, where actions related to IP and foreign investment necessitate conditional approvals from the South African Reserve Bank, hampering startups’ agility and growth potential.

to enforce censorship and maintain order, reveal the fragile balance between political stability and economic vitality. Senegal’s decision to disable mobile internet for six days is a poignant example. The shutdown cost the economy an estimated $8M per day—a significant toll considering the country’s 10.2 million internet users, who constitute 58% of the population.54 Many local businesses, which depend on platforms like WhatsApp for transactions, faced significant disruptions. This situation has raised concerns about the reliability and openness of Senegal’s startup environment. Despite these obstacles, there’s been growing recognition and receptiveness to change and innovation among African governments. A milestone was achieved in 2018 when Tunisia enacted Africa’s first Startup Act—a groundbreaking piece of legislation designed to foster an environment conducive to innovation and entrepreneurship.55 Offering benefits such as eight-year tax breaks, first-year salaries for founders, a one-year leave policy for new company employees, and capital gains tax exemptions for investors, Tunisia’s initiative has inspired more than 20 African countries to either adopt or consider similar legislative frameworks. These measures are

empowering startups to contribute significantly to their economies, enhancing GDP growth across the continent.

Building on these developments, Rwanda, under President Paul Kagame’s leadership, has emerged as a leader in fostering technological innovation and supporting startups across East Africa. The country

has deployed a nationwide fiber optic network and established incubators like Norrsken Kigali House and 250 Startups. These initiatives, coupled with a new investment code, have made Rwanda attractive to foreign investors and facilitated collaborations with global corporations and academic institutions to craft innovation-friendly policies. Remarkably, the process

of starting a company in Rwanda has been streamlined to be cost-free and accomplishable within 24 hours. This wave of progress is not limited to Rwanda. Namibia, Sierra Leone, and Nigeria are witnessing the rise of a new class of progressive leaders dedicated to propelling their countries into the forefront of technological advancement.56,57,58 Through such leadership and policy reforms, Africa is gradually transforming its challenges into stepping stones for creating a robust, innovative, and sustainable startup ecosystem.

In parallel with these governmental efforts, startups are actively addressing regulatory and compliance challenges across various African markets. For example, Nigerian-based Startbutton is helping businesses manage compliance in multiple countries by acting as a “merchant of record.” Co-founded by Mallick Bolakale and Kelechi Obi in 2022, Startbutton enables companies to accept payments in local currencies and meet regulatory requirements without the need for establishing local offices. This is critical for companies seeking to expand across Africa, as it streamlines operations and mitigates risks related to currency fluctuations and compliance.

CURRENCY

DEVALUATION

Rising inflation and currency volatility present substantial challenges across numerous countries, largely stemming from political instability, the prolonged impact of the COVID-19 pandemic, and dwindling foreign investment. In the four major African nations where startup activity is most vibrant (Nigeria, Kenya, Egypt, and South Africa), the economic strain has been palpable. According to data provided

by Stears, on average, these countries lost 25% of their currency value when compared against the dollar, with the Nigerian naira depreciating by 50%. Both consumers and businesses are grappling with escalating living costs and diminishing purchasing power, compelling them to cut expenditures on goods or technologies essential for enhancing their quality of life. Consequently, startups, often expected by investors to scale rapidly, have encountered difficulties in expanding their revenue bases—a key factor for securing later-stage investment.

Amid the economic challenges, recent policy actions to begin long-awaited economic reforms are a silver lining. After significant pushback against the 2024 Finance Act, the Kenyan government is working with the International Monetary Fund and other multilateral agencies to review its fiscal plans, with the aim of

providing the government with the necessary fiscal muscle to prop up the economy.59 Meanwhile, Nigeria’s year-old government has enacted a wave of reforms on foreign exchange, petrol subsidies, and the banking sector, hoping to create a more enabling business environment and attract long-term investment. In South Africa, after a period of uncertainty following the presidential elections, cautious optimism trails the formation of a coalition government.60 A common pattern emerges across the continent: unsteady steps toward reforms that ought to stabilize African currencies, improve living standards, and support business growth in the medium to long-term.

Despite the overall withdrawal of international investors, African startups that have secured foreign capital in USD are in a stronger position. They benefit from extended financial runways, allowing them to continue product development and prepare for market opportunities when economic stability returns. The access to capital also allows them to explore new international markets, opening up additional revenue streams. Ultimately this period has seen a shift back to core business fundamentals, with a heightened emphasis on achieving cash flow positivity. From an investment perspective, the devaluation of currencies has unveiled more cost-effective opportunities, drawing investor interest. This dynamic has played a significant role in the surge to $1.2 billion in debt financing for startups in 2023, as equity financing becomes increasingly challenging to secure—a trend highlighted by Partech.

CULTURAL AND REGIONAL

BARRIERS TO SCALE

With its 54 countries, over 3,000 ethnic groups, and more than 2,000 languages and dialects, Africa’s cultural diversity is unparalleled. While this can be a source of strength and innovation, it introduces complex challenges for startups looking to scale across the continent. The journey from a local entity to a regional powerhouse is fraught with hurdles: a Ghanaian enterprise branching into Francophone Africa, or an Egyptian firm eyeing expansion in SubSaharan markets, must navigate through a labyrinth of linguistic, cultural, and regulatory barriers. The commonly held VC maxim that a product’s inherent excellence can drive growth—a cornerstone of the product-led growth philosophy—faces significant

challenges in this context.61 Language discrepancies can render a product irrelevant, while user experience preferences, such as design aesthetics and color schemes, may stall adoption. On top of that, startups must contend with varying regulations from country to country and work to build trust within new communities.

Despite this, African startups continue to exemplify resilience, and strategic ingenuity. Jumia, dubbed the “Amazon of Africa,” overcame initial infrastructural constraints to dominate the e-commerce space across ten countries. By establishing a proprietary logistics network and customizing its service offerings—such

as localized payment solutions and culturally resonant marketing campaigns like Mobile Week—Jumia has managed to bridge the divide between diverse African markets, offering tailored product categories that mirror local consumer behaviors and preferences.62

Some expansions demand a more calculated and strategic method, as demonstrated by Paystack, the leading Nigerian fintech acquired by Stripe in 2020. Paystack was much slower in scaling beyond Nigeria and it faced initial challenges such as understanding diverse regulatory landscapes, navigating cultural nuances, and overcoming barriers to entry in new markets. For instance, during its expansion into South

Africa, Paystack encountered cumbersome online payment processes and extensive local paperwork. The team quickly realized they needed to localize their product to meet local needs and build trust with South African merchants.63 For example, Paystack integrated with popular local payment options like SnapScan, in addition to already supporting payments from cards, electronic funds transfer (EFT), and Masterpass. This provided merchants’ customers with a more familiar and convenient payment method. Another localization effort was adjusting its pricing model to align with the South African norm of VAT-exclusive pricing. Value Added Tax (VAT) is a type of consumption tax placed on a product whenever value is added at each stage of the supply chain. In South Africa, the VAT rate is 15%, and it is commonly expected that prices are shown as VATexclusive in business transactions. Initially, Paystack’s pricing included VAT within the listed prices, which caused confusion among South African merchants. Paystack updated its handling of VAT to exclude VAT, matching local expectations, which helped build trust with South African merchants.

By 2023, post-acquisition, Paystack’s efforts have paid off, allowing the company to secure operational

“Paystack’s remarkable success in online payments, particularly card payments in Nigeria, has prompted us to replicate that success in other markets. Our expansion strategy is based on thorough research, considering factors such as GDP, card penetration, population size, and the strength of the startup and developer ecosystem. We focus on penetrating markets that serve as regional hubs and are strategically positioned to facilitate sub-regional growth.”64

—PAYSTACK COO, AMANDINE LOBELLE

licenses and initiate private betas in markets such as Egypt, Rwanda, and Côte d’Ivoire. This phased, feedback-driven expansion ensures that by the time Paystack fully launches in each market, their product is perfectly attuned to local needs and conditions.

Another more recently common method for African startups to overcome regional barriers is through

mergers and acquisitions (M&A). By acquiring other African startups in different regions, companies can swiftly break into new markets and leverage the local knowledge, existing customer base, and regulatory understanding of the acquired entities. Some examples of this include: Nigerian fintech company Interswitch acquired Kenya’s Paynet Group to expand its footprint in East Africa.65 Kenyan-based BuuPass acquired its Nigeria and South Africa-based competitor QuickBus to access major banking and telecom distribution channels in Nigeria and South Africa.66 More recently, MaC VC company Prembly merged with Peleza, another Kenyan startup that has some key customers in the East African market.67

Successful scaling in Africa demands more than just a great product; it requires a nuanced strategy that includes leveraging local partnerships, employing targeted growth hacks, and fostering trust within communities. By adapting to each country’s unique needs, these companies are paving the way for others, demonstrating that cultural and regional challenges can be transformed into opportunities for pan-African success.

AFRICAN SUCCESS STORIES

BEST PRACTICES FOR

EVALUATING AFRICA BASED

SEED STAGE COMPANIES

Venture capital investors are creatures of habit, so for many investing in an emerging foreign market, let alone one that is on the other side of the globe, is a daunting proposition. When speaking about the early stage investment opportunity in Africa with several of our colleagues at other U.S. based venture capital firms we often hear versions of the following questions/ statements.

- “How do you conduct due diligence on an early-stage startup in Africa?”

- “It must be extremely challenging, right?”

- “I wouldn’t even know where to begin!”

- “I’m not sure I can be helpful to founders in that market.”

Given that many of these investors have not visited the continent of Africa, do not have ecosystem relationships there, nor understand the business landscape, it’s reasonable that there would be trepidation when it comes to investing on the continent. At MaC VC, we believe that the fundamental process of evaluating a Seed stage investment opportunity shouldn’t change due to geography. For U.S. and Africa based companies alike, it’s important to gain an understanding of and conviction in the following.

- The founding team’s unique qualification to build this company

- The validity of the problem being solved

- The novelty and defensibility of the solution

- The size of the market opportunity

- The competitive landscape

- The viability of business model

- The regulatory or cultural obstacles the company will need to hurdle

As we are based in the U.S., we are constantly learning to navigate the emerging tech market in Africa, allowing our newness in the market to be bolstered by

our relationships with successful founders, co-investors, limited partners, and ecosystem players (banks, accelerators, government agencies, corporate executives, etc.) in the region to help us complete our due diligence process. Our strategy is broken up into a three pronged approach. With number one, leveraging this network to verify and quantify the problem being addressed and to understand how people and businesses navigate the challenges today. Then, we lean on our founder network to gain an understanding of a founder’s reputation and profile in the region. Finally, we conduct due diligence by relying on our allies in local government to understand the regulatory landscape and the viability of this company’s solution within that context.

Though it may be uncomfortable in the beginning, if U.S.-based investors take the time to build relationships within and gain an understanding of select African markets, while adhering to universal investing principles, they can find success in Africa.

CONCLUSION

Africa is experiencing an unprecedented period of growth, and we’re living through a truly remarkable period of transformation on the continent. Its large and growing population, coupled with rapid advancements in technology, has created a foundation for a future of progress that will continue to elevate the continent. As barriers to technology continue to be reduced, industries such as fintech and healthtech have emerged as key drivers of change, solving critical challenges that have persisted for years. The widespread adoption of mobile technology has accelerated this transformation as people can now handle their banking, access critical health information, and tap into a world of economic opportunities at their fingertips. Technology has not only improved access to essential services, but has also fostered a new generation of entrepreneurs who are reshaping the landscape.

But beyond the tech itself, what’s truly inspiring is the human element – the entrepreneurs who are driving this change. From trailblazers such as Olugbenga

Agboola at Flutterwave and innovators we’ve had the pleasure of working with such as Kebba Jobarteh and Kuang Chen at Antara Health, to the countless others, these founders have paved the way for aspiring entrepreneurs. They’re proving that with the right tools, mindset, and support, there are no limits to what Africa based startups can achieve on the global stage.

At MaC VC, we recognize the immense opportunities that lie ahead in Africa. By supporting innovative startups and visionary founders, we believe we can play a small role in unlocking the continent’s vast potential and creating a more inclusive, prosperous future. Today’s Africa is vastly different from yesterday’s; it is a continent full of untapped potential and an unrelenting entrepreneurial spirit.

We remain committed to backing founders who are writing the next chapter of Africa’s story.

Report researched and written by Dela Adedze and Marlon Nichols.