No matter the extent to which an individual understands the quirks of neo-banking, perhaps the majority can agree that the current deal offered by traditional banks is not sufficiently beneficial to the average person. Whether a revolution is necessary, maybe they have yet to be convinced, but a few more generous interest rates on their savings might be well received.

As evidenced by the GameStop short squeeze earlier in 2021 and the cryptocurrency phenomenon, many Americans are beginning to elect to allocate their money elsewhere. The problem is investments such as those just mentioned come with a notable degree of risk, a risk that individuals living between paydays just aren’t prepared to take. But the new app StoreCash, and its founder Daricus Releford, come to the market armed with a perfect marriage of security and benefit and a much more favorable risk-reward ratio for the middle classes.

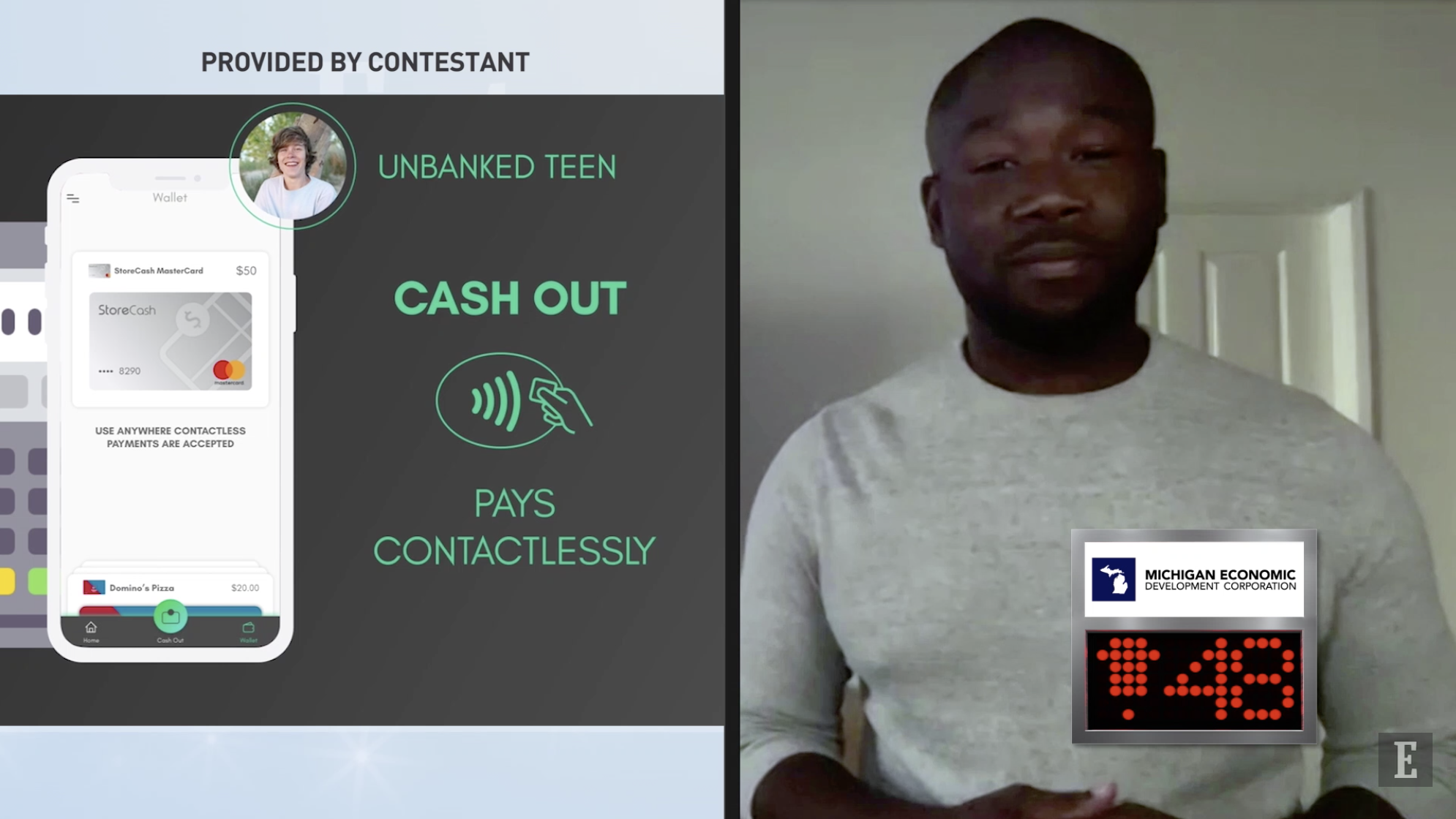

In essence, StoreCash is a technological solution to the growing identity crisis faced by brick and mortar banks. The asset to its users is the opportunity to earn up to 15% cash back at some of America’s most popular retailers. Outlets such as Five Guys, FootLocker, and Sephora are all supported by StoreCash’s remuneration campaign, as it seeks to resurrect the interest of all generations in financial management.

Putting money in people’s pockets is indeed a huge part of StoreCash’s agenda, but it equally serves as a mechanism to engage young people and underrepresented communities in financial literacy and fiscal responsibility. “We provide a way for those living paycheck to paycheck to saving money in places that they already spend, that they can then use to invest,” Releford explains.

Young people at the beginning of their career journey and those stuck in stagnant wage growth both serve to benefit from the app, as Daricus Releford aims to alleviate the neglect he can see across the nation’s middle classes. While currently only available to some 50,000 on its waitlist, StoreCash will soon be open to all Americans over the age of 13 in a move designed to tackle stunted social mobility on a generational scale. Releford believes his app can step in where traditional banks won’t, to teach the lessons necessary to attain financial literacy.

The banking platform, and the responsibility that comes with using it, are, of course, the primary tools through which Releford hopes users will become more responsible with their money. But the learning process, he believes, is ongoing, as the team has ambitious goals for the level of insight and guidance they can provide to those saving with StoreCash. “It’s our aim to provide the analytics and suggestions needed for our users to make smart, financially literate decisions,” outlines the founder. An informed consumer is a wiser one, and Releford believes in two to three years, he can be saving each user at least $50 a month. A target of two million users brings the potential annual savings pot to a staggering $1.2bn.

Though such a figure may draw cynicism to those still sitting on a savings account in a traditional bank, Daricus Releford believes the numbers are more self-evident than ever. StoreCash is aimed towards young and lower-income people, it’s true, but as its users begin to prosper, the real terms benefit to each account’s bottom line only continues to grow. The attraction of these exponential gains sits comfortably alongside other perks, such as free use of ATMs and a better user experience designed by experts in the tech industry.

There is a higher resulting purpose from the growth of StoreCash, however. Greater financial literacy deriving from a platform accessible to all is a surefire step towards increasing the saving and investment potential of underrepresented communities. Daricus Releford is black and keeps the interests of the African-American population close to the heart of his latest business venture.

African-Americans make up the highest proportion of America’s underbanked, and Releford believes this is down to two factors: capital and representation. The former has been addressed, but Releford thinks the two are interlinked, as a lack of representation means black earners are less likely to place their trust and funds in an institution that doesn’t reflect them. If Releford can set a precedent for a black person succeeding in the tech and finance spheres, he hopes to reinvigorate trust and draw interest to the banks of the future.

Whether a technological concept is a perfect answer to tomorrow’s questions is always difficult to guess. However, StoreCash boasts a multidimensional appeal to some undoubtedly complex economic issues. By the very humblest estimation, its launch has the potential to save the nation’s teen and adult population cash on a day-to-day basis – the ideal starting point for a transformative venture.