Black Entrepreneur Daricus Releford’s Fintech Startup StoreCash Is Taking the Teen and Young Adult Banking Industry by Storm

For decades, the banking industry has focused the majority of its attention on building offerings catered to adults, whether it’s debit cards, credit cards, or even cash-based services. Yet, the way in which people interact with money has changed significantly over the last few years, with a corresponding rise in companies providing solutions for key sectors that physical banks tend to overlook – both trends certain to continue at an exponentially faster rate.

Spending money as a teen involves more than a weekly cash allowance these days, and without both encouraging sound financial literacy and enabling exposure to the tools that power modern transactions at such a pivotal point in life, it can set many up for a major disadvantage. StoreCash was founded around a vision to create a bank that not only encourages the development of financial literacy through easy-to-use technology but also saves its users money by offering the maximum cashback available at the popular retailers they shop at themselves.

The StoreCash Story

The story of StoreCash starts in 2019 when, after building and selling his previous company, founder Daricus Releford was driving across the country to begin a new life in the thriving tech scene of San Francisco. One day, he received a call from his nephew Will, asking for money for a new laptop. Wanting to encourage his interest in technology, Daricus prepared to send the money via a mobile application, only to find out it was impossible unless his nephew was both over 18 and had his own bank account to receive the funds. Reflecting on the similar problems he himself faced when he founded his first business as a teen, Daricus started thinking of a solution to allow teenagers and young adults to participate in the digital banking world. Using a portion of the $50k he had generated from just a few thousand dollars as an eager budding investor to fund his initial efforts, Daricus built a team with his friends Phani and Sheetal, and soon after, StoreCash was born.

Seamless Transactions For Teens

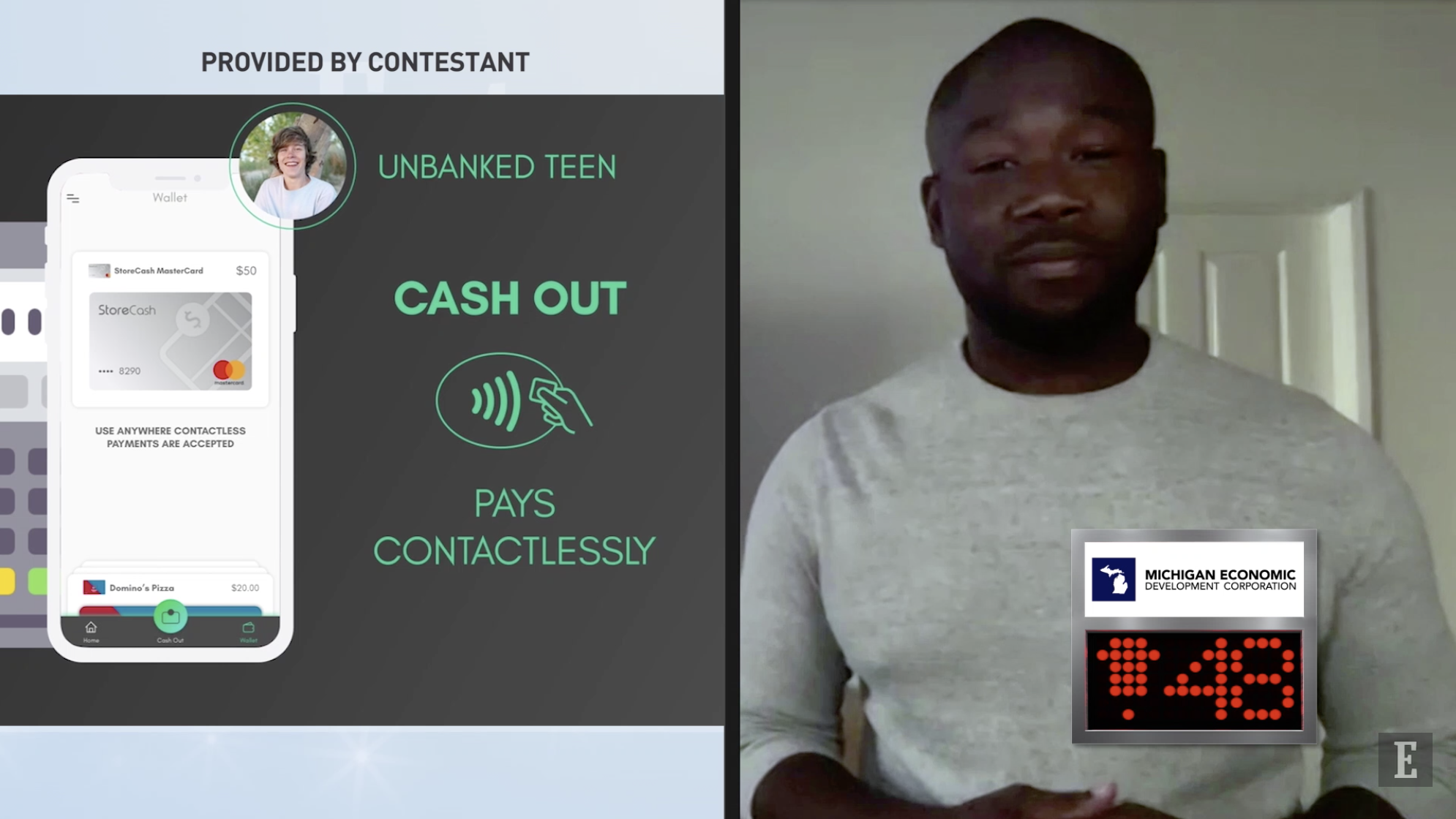

StoreCash takes the form of a free-to-use app that teens can activate through linking their account with that of an adult sponsor, ordinarily their parent or guardian. After this, they gain immediate access to a virtual card that can be used with Apple or Google Pay while their free MasterCard debit card gets shipped out within a week. The app offers a huge amount of flexibility, allowing for instantaneous money transfers and account top ups via direct deposit, paycheck, or a weekly allowance – all with zero fees.

Each user’s cashback balance can be used towards gift cards at popular retailers across the country, including Sephora, Domino’s Pizza, Old Navy, Nike, Taco Bell, and GameStop. As StoreCash deals with teens’ money, the app is built with security in mind, featuring encryption, privacy protection, fraud monitoring, and FDIC insurance up to $250,000.

What’s Next For StoreCash?

StoreCash was originally founded to help the millions of currently unbanked American teens and young adults receive and use funds immediately, which they’ve struggled to do until now, even though over 95% have smartphones.

Their broader mission, however, is to make a major impact for low-income teens and young adults, a demographic which StoreCash plans to empower to invest, build generational wealth, and break the cycle.

By the end of the year, StoreCash is aiming to hit 10,000 active users and break a $100,000 target for total user savings through their cashback program. This year, StoreCash is also planning to raise their Series A funding round to drive further growth and product development, and will be releasing details on this soon.

Keep In Touch With StoreCash

Company website: https://www.storecashapp.com

Founder LinkedIn: https://www.linkedin.com/in/daricusreleford

Founder Twitter: https://twitter.com/daricusreleford

Press: zaki@theprgenius.com

Source: Business Insider

More On StoreCash: Yahoo!Finance