Rares, the platform democratizing investments

Consumer adoption of digital financial services has increased, especially during the pandemic. To provide context on the momentum, in January 2020, retail investors made up 17% of the stock market. By July, this number increased to 25%. Fast forward to 2021, retail investors purchased nearly $28 billion in stocks. This is the highest amount deployed in a month since 2014. As the arcane world of investing has become more mainstream with increased consumer financial literacy and disposable income, this has also grown with the rise of startups such as Robinhood democratizing access. Retail investors, especially Millennial and Gen Z, are optimistic about investing and are planning to continue investing.

In this market, all boats rise. NFT marketplaces and alternative assets have obtained a significant amount of traction as retail investors have looked for ways to diversify their holdings outside of the public markets. With the ability to trade unique assets that have appreciable value, investors have valued the opportunity to trade on digital marketplaces that allow for real-time price fluctuations and a high amount of liquidity. In the past year alone, new types of market exchanges — such as Masterworks (Fine Art), Arrived Homes (Real Estate), and Mythic Markets (Pop Culture Collectibles) — have gained much consumer traction as the everyday consumers want to put their money to use outside the traditional stock market.

Sneakers as an asset class and market

Looking back in the past decade, investment returns on premium sneakers have outperformed Gold, The S&P 500, and Apple. There has always been a large and growing community of sneakerheads. In recent years, these communities have congregated on new digital platforms like StockX, GOAT, Reddit, fueling interest and demand for sneakers. According to Cowen, Sneakers are an attractive investment because they earn illiquidity premiums, provide diversification — non-correlated with traditional asset classes, and earn favorable risk-reward characteristics. In North America, the sneaker resale market is a $2B+ market. Globally, this market is expected to grow to $30B+ by 2030.

However, not everyone has had access to participate in the appreciation of this asset class. Premium, collectible sneakers are difficult to procure and expensive to own. That’s where the opportunity for Rares comes in.

Introducing Rares: a platform that allows consumers to invest in the sneaker culture

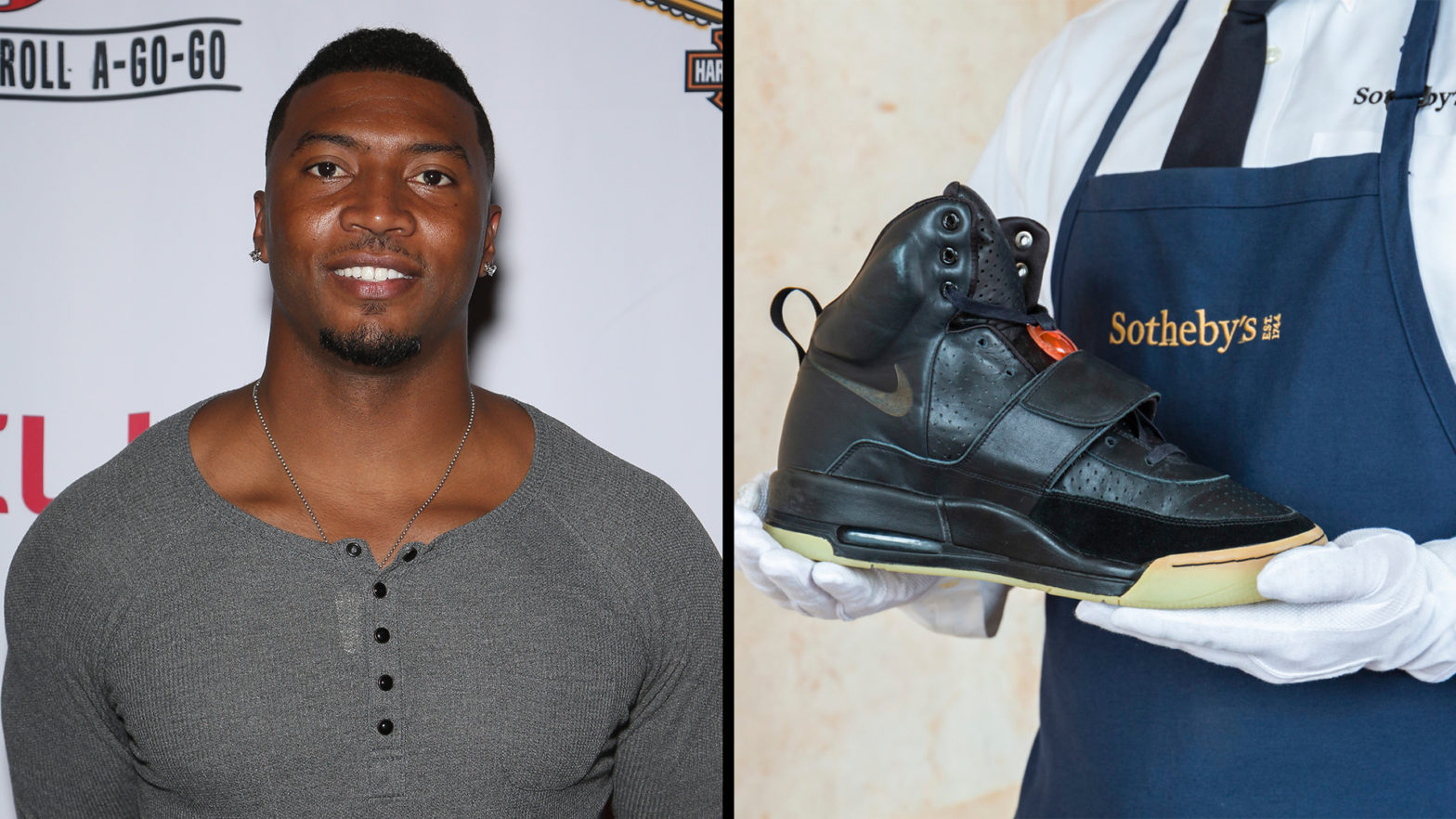

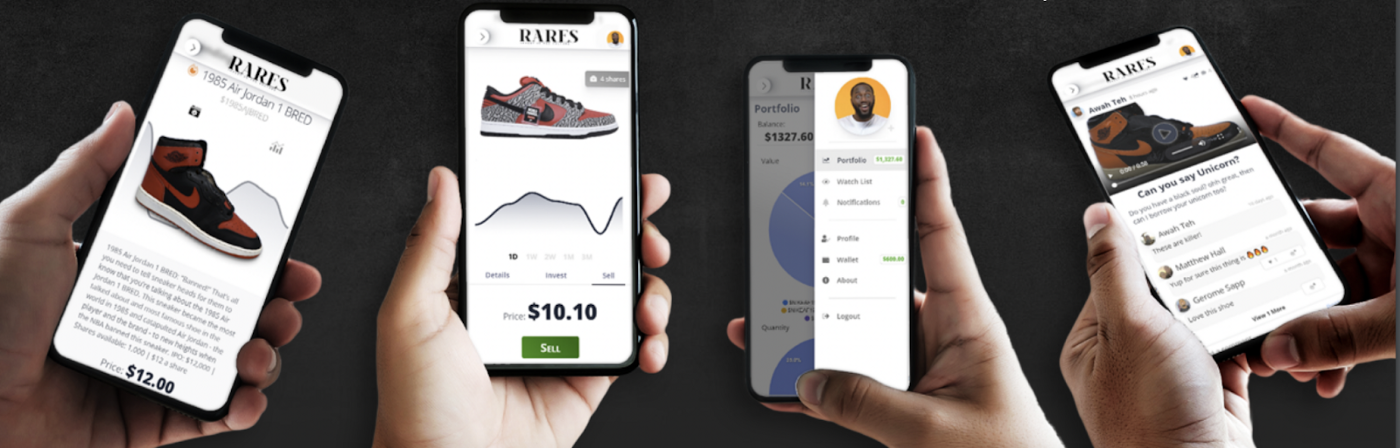

Rares offers access to fractional ownership of exclusive collectibles, starting with collectible sneakers. Co-founders Gerome Sapp, a former NFL athlete and repeat entrepreneur, and Matthew Hall, a former Peloton Technology Executive, are building a platform for buying and trading fractional shares of collectible assets, as well as a social community to engage with. In other words, Rares will be acquiring the rights to assets, such as collectible sneakers, and providing fractional shares of ownership to the mass market. Users can purchase shares during an Initial Public Offering window or participate in the liquid secondary market. The Company launched their MVP with the IPO of the Nike Air Force 1 HOV. Today assets are live on the platform, accessible via the Apple Store and Android Store.

Rares is well-capitalized and poised for growth

MaC VC is excited to announce that we are leading Rares’ $4M Series Seed financing round. Cake Ventures, W Fund, Gaingels, Rising America Portfolia Fund 1 & 2 will also be participating in this round. MaC’s General Partner, Marlon Nichols will be taking a board seat and MaC Partner, Zhenni Liu will be observing the board. We’re extremely excited to partner with Gerome and Matthew in this next chapter of the business and can’t wait for Rares to democratize access to alternative investing.

What’s Next For Rares?

Matthew and Gerome have been hard at work for the past couple of months, launching the platform, and driving customer education in financial literacy. With Gerome’s background in sports, Rares was able to land a partnership with NBPA for PlayerCon. Additionally, on November 6th and 7th, Rares will open investing in the Nike Air Yeezy 1 Prototype at ComplexCon in Long Beach, CA. This will mark the first of several opportunities to view this iconic asset and learn more about Rares and alternative asset investing. To complement their existing lineup, Rares has a pipeline of additional collectible sneakers to IPO. Investors can download and sign up on the Rares platform to start buying and trading today.

About MaC

MaC Venture Capital is a seed-stage venture capital firm that invests in technology startups leveraging shifts in cultural trends and behaviors. Our diverse backgrounds in technology, business, government, entertainment, and finance allow us to accelerate entrepreneurs on the verge of their breakthrough moment. We provide hands-on support crucial for building and scaling category-leading companies, including operations strategy, brand building, recruiting, and mission-critical introductions.

About Rares

Rares is the premier alternative asset investment platform focused on sneakers and sneaker culture. Head to the Rares mobile application (iOS, Google Play), or the responsive website (www.rares.io) to purchase and trade shares in the most iconic and valuable sneakers, from 1-of-a-kind vintage museum pieces to the latest hype drop collaborations. Rares is qualified by the Securities and Exchange Commission, and acts as a medium to democratize the investing process through access, education, and financial literacy. Visit Rares to “Invest in the Culture.”

Source: Medium