It’s Not Debt, It’s Better: an Interview with Harry Hurst of Pipe

Harry Hurst of Pipe x Alex Danco’s Two Truths and a Take Newsletter.

July 28, 2020

This week, I’m delighted to share an interview with Harry Hurst, founder and co-CEO of Pipe.

Six months ago I wrote a post in the newsletter called Debt is Coming, about the all-equity model of funding startups finally coming to the end. It ran away to become the most widely-read thing I’ve ever written, ever. (Read it first, if you haven’t yet.) Since then, I’ve had a blast getting to meet all sorts of interesting founders, operators and investors who are thinking about the future of financing recurring revenue software businesses.

Harry is one of those people. A short two weeks after Debt is Coming got published, Pipe launched with an investment from David Sacks’ firm Craft Ventures, and since then they’ve gone on to scale up their business with help from our good friends at Tribe Capital.

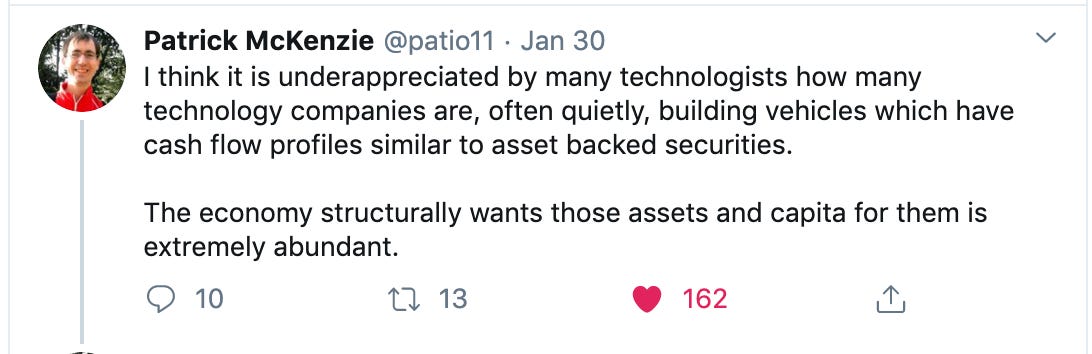

It’s been awesome to see this story come together. Last year when I interviewed Jonathan Hsu from Tribe for this newsletter he shared a great preview of what’s since begun to materialize:

“When you acquire some customers and they start yielding revenue that behaviour sounds an awful lot like buying a fixed income instrument and there is a lot of sophistication around how to value those cash flows. In some sense, what we’ve seen over the last decade is that software enables a whole new business model – recurring revenue – which is both good for customers and is good for investors. It’s good for investors because it becomes more “predictable” in the sense that it starts to look more like a fixed income yielding asset and thus more amenable to traditional financial techniques and thus potentially “in scope” for a wider set of investors.”

Pipe is this thesis, made real.

Up until now, founders have only two things to sell as they raise capital to fund their business: they can sell equity, and take expensive dilution, or they can sell debt, and take on covenants and other handcuffs. Pipe creates a new asset class to sell: the software subscription. Founders can now sell the recurring revenue from a cohort of software customers, as an easily tradable asset, and fund their growth without taking dilution. There’s enormous demand for those kinds of cash flows, but up until today, founders haven’t been able to hook up to that demand. Now they can, and the early results sound like they’ve been spectacular.

So I’m really excited to share this interview with Harry. Enjoy.

Read the full interview with Harry Hurst and Alex Danco.