Goodfair: Sustainable Apparel for All

Where Does Donated Clothing End Up Really?

The annual ritual of spring cleaning is a favorite among many. The chance to purge the old to make way for the new. The end of winter marks the moment when so many among us go through our closets and get rid of all our excess clothes to make space for the new year’s fashions. And in today’s world of fast fashion, this practice is indeed happening year round. Where does all of that purged clothing end up? In garbage bags that ultimately make their way to Goodwill or Salvation Army. Goodwill and The Salvation Army made a combined $9B in revenue in 2018, much of which came from the resale of donated clothing. The amazing part is that on average, those two companies only have the capacity to process and sell about 15% to 25% of what is donated to them by the public. The other 75% to 85% is sold to clothing recyclers for literal pennies on the pound. These recyclers are private, usually family-run businesses that employ workers and machinery that sort and separate collected textiles by color, size and quality, often into thousands of different categories. They process this sorted clothing into hundred and thousand pound bundles that look like the ones in the image above. They then turn around and sell those bundles to mostly overseas buyers — apparel entrepreneurs — who run large businesses selling cheap clothes in places like Nigeria, Vietnam, India and Russia.

Fast Fashion is Killing The Environment

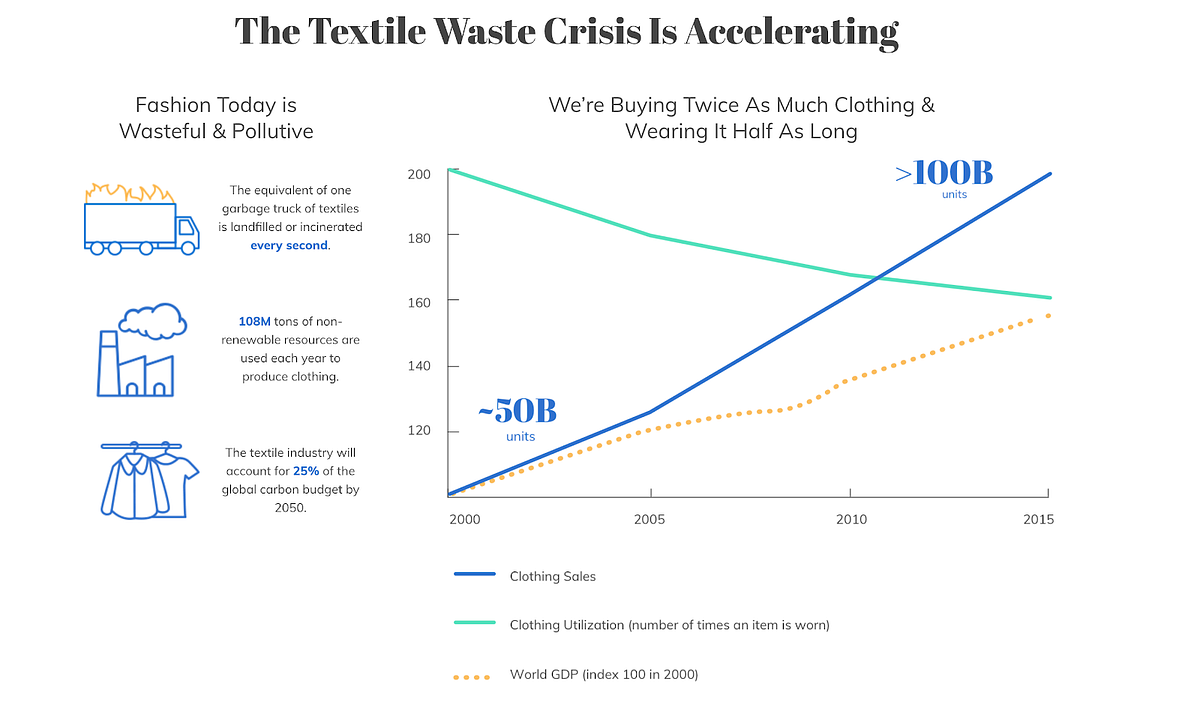

Fast Fashion is having a disastrous effect on the environment. Enormous amounts of energy, water, chemicals and other resources are needed to make clothes. And more than half of fast-fashion items are tossed within 12 months of purchase. Global clothing production doubled between 2000 and 2014 as garment firms’ operations became more efficient, their production cycles sped up and shoppers got better bargains. According to the World Resources Institute:

- One garbage truck of clothes is burned or sent to landfills every second.

- Consumers waste enough clothing to fill up 1.5 Empire State Buildings every day.

- It takes the amount of water that could sustain one person for two and a half years to make a single shirt.

- Making a pair of jeans produces as much greenhouse gases as driving a car more than 80 miles.

- Discarded clothing made of non-biodegradable fabrics can sit in landfills for up to 200 years.

Worse yet, as noted in ThreadUp’s 2019 Resale Report, the textile waste crisis is accelerating. Clothing sales have been going up while the average number of times an item is worn is going down.

A Better Way

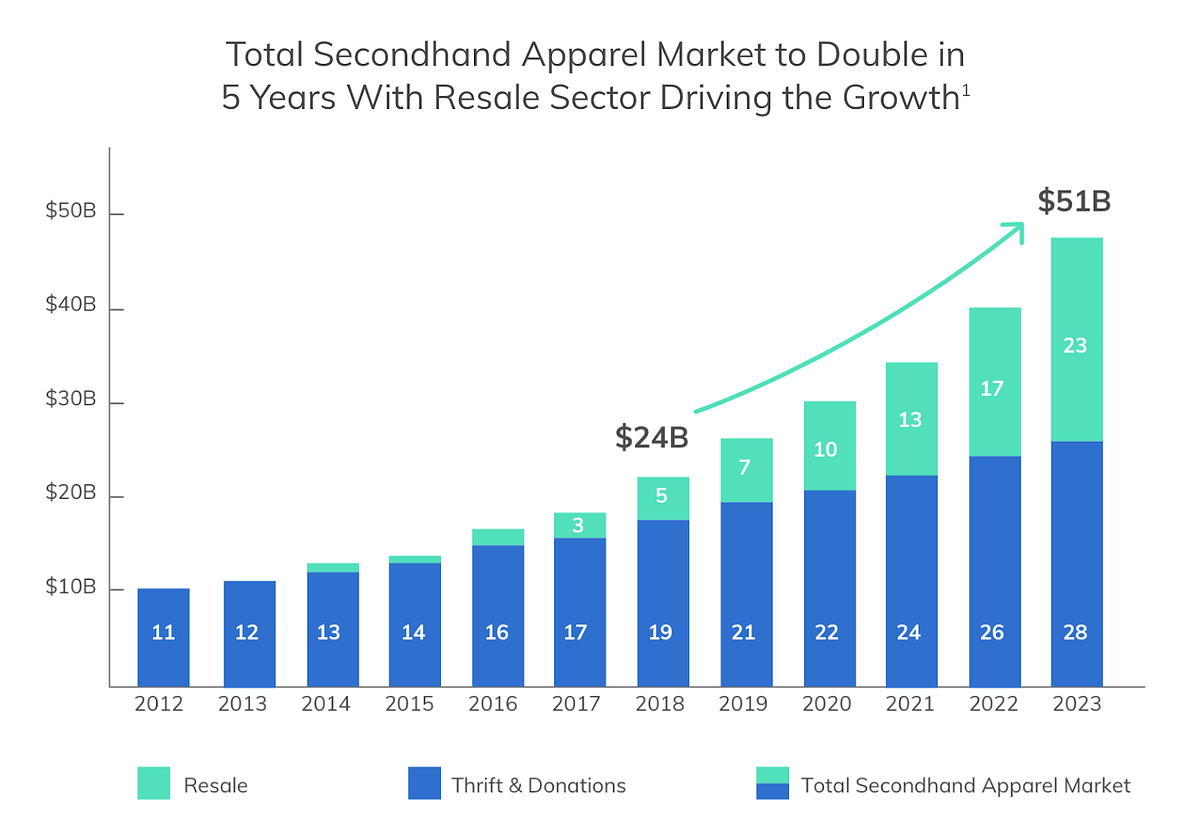

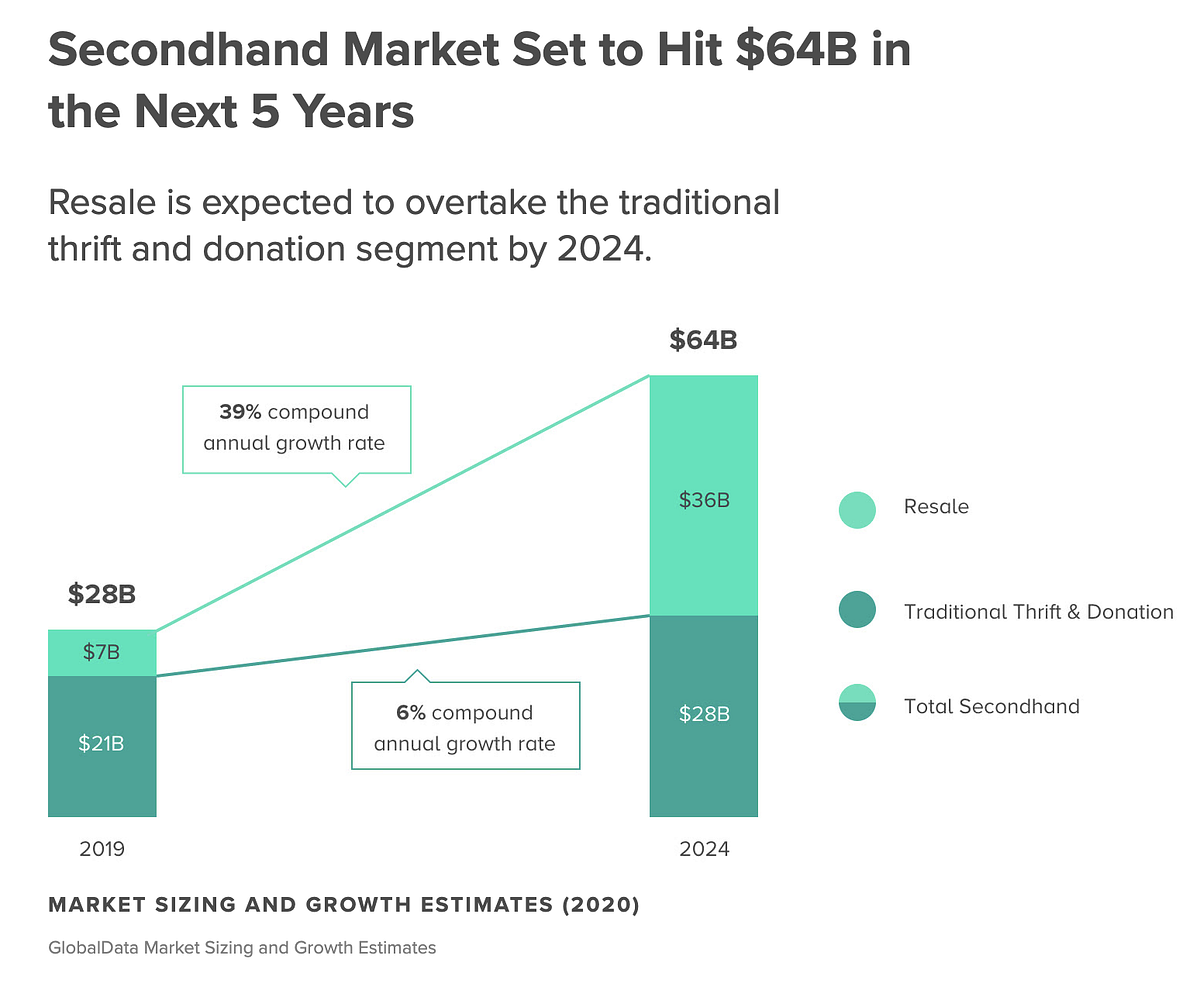

Large and small clothing manufacturers alike have finally taken notice of the environmental impacts of their actions, and consumers have started to express their conscious consumerism via their wallets by supporting those brands that take sustainability seriously. The secondhand retail market is a $28B industry in 2019 ($21B thrift + $7B resale) growing at a rate of 6% YoY — double that of the overall fashion industry. Analysts project that the total secondhand apparel market will double over the next five years. By 2024 it is estimated that the market will grow to $64B, with apparel resale making up more than 50% of that market.

Like in other areas of retail, the vast majority (~75%) of this market is still offline. More retail coming online coupled with the fast growth of the secondhand market presents a compelling opportunity in secondhand retail.

The market has shown there is massive demand for secondhand and lower price-point items:

- Goodwill Industries International did $5.9B in 2018 revenue.

- The Salvation Army made $4.3B in revenue in 2018, $587M coming from retail sales.

- Wish.com did over $3.8B in 2019 revenue.

- 99 Cents Only Stores grossed $2.2B in 2017 revenue.

- The Real Real, Tradsey, threadUP, Poshmark, Rent the Runway and MaterialWorld (all sellers/ renters of secondhand items) did a collective $903M in 2018 revenue.

We feel that the big winners in this secondhand retail explosion will be several sustainability-minded incumbent brands as well as a few select challenger brands with new and innovative business models, which is why we are excited about our investment into one such brand: Goodfair, an online, second-hand, sustainability-focused clothing retailer based in Houston, TX. We have invested alongside a fantastic group of investors that includes the ecommerce powerhouse Imag/nary, the LA-based incubator/accelerator Amplify, Willow Growth Partners, Global Founders Capital, Daniel Broukhim, and Manuela Zoninsein.

The Goodfair “surprise and delight” experience is unique: to save on operating costs, Goodfair does not spend a lot of time or resources taking elaborate photographs of their inventory and cataloging and tagging them into minute details. The cost to photograph, measure, describe, upload and color correct every photo prohibits profitability at scale. Rather, Goodfair sells by category: if you want a medium blue flannel shirt, they send you a medium flannel shirt — the customer does not choose a specific style or color of shirt, but rather a size and category of shirt and is sent a shirt of random style and color. Savings are passed along to the customer.

Goodfair also has a unique inventory supply chain. Goodfair — like many of the overseas clothing entrepreneurs mentioned at the beginning of this post — sources their inventory from the clothing recyclers who take in donated clothing from Goodwill and The Salvation Army. Buying by the hundred and thousand pound bundles, Goodfair offers some of the lowest prices anywhere because of their low cost of goods sold and lean operating costs.

Goodfair was started by five-time secondhand retail entrepreneur Topper Luciani whose prior startups were Sir Drake, Ronnie’s Ties, Nifty Thrifty and TagPop. Topper has seen more than his fair share of successes and failures. Recognizing that Houston had the highest concentration of clothing recyclers in the country, Topper relocated there from Brooklyn to be at the epicenter of the clothing recycling industry. Topper has spent his entire career building retail models that are sustainable and accessible by a large portion of the general population.

Serving an Underserved Market

One of the things that stands out about Goodfair is their demographic focus. Yes, the company is capitalizing on the surging interest in vintage retail from the eco-conscious Gen Z and Millennial consumers, but Topper has a passion for super-serving those who he feels Silicon Valley has consistently overlooked: that price-conscious consumer who views clothing as a more functional need rather than a means to express oneself. Other companies focused on secondhand retail such as Poshmark, TheRealReal, Rent the Runway, and even ThreadUp target their efforts to an up-market consumer. Luxury and higher-end brands are the focus of their offerings. They are selling affordable-priced fashion to a mostly urban consumer. Goodfair is happy to appeal to that demographic, but they are more focused on middle-to-low income shoppers whose priorities have a different order: function then price then personal expression.

The vast majority of people who buy from Goodwill shop at one of their 3,200 brick and mortar retail outlets. Because Goodwill donation centers and retail stores are organized as individual regional operations, there is little cooperation amongst all the stores to sell this donated clothing online, and as noted above, Goodwill is only able to manage a small percentage of what is donated to them each year given the need to sort and separate donations by a number of categories. The focus of Goodwill’s e-commerce efforts are ShopGoodwill.com, which sells items that are considered collectible or more valuable. Goodfair presents an online alternative to the in-store Goodwill experience.

Putting It All Together

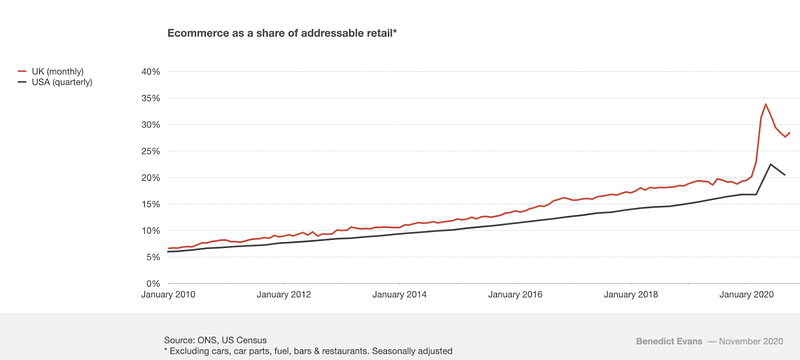

As seen in the chart below, e-commerce’s percentage of total retail sales has surged during this pandemic. We have seen all kinds of categories of products from grocery, glasses, razors, contact lenses, birth control, and mattresses shift drastically from offline to online in the past five years, and significantly in 2020. It feels like this trend will continue, even post pandemic, and that new categories — like thrift and secondary retail — will follow suit.

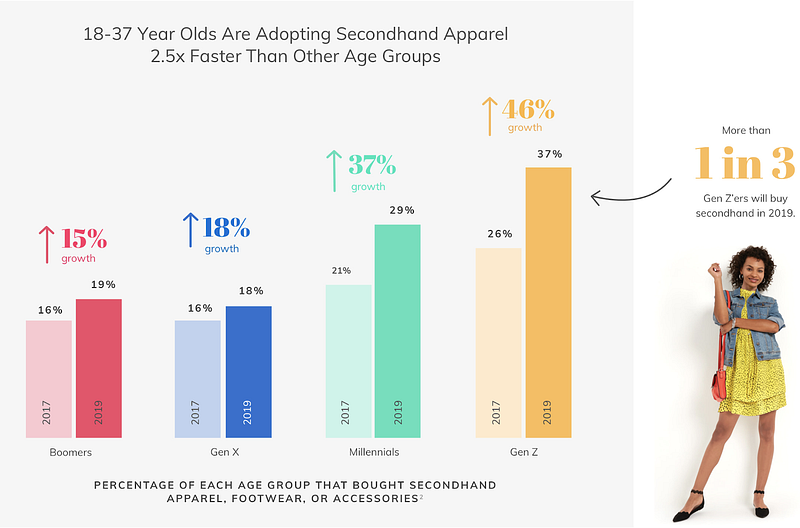

Additionally, consumers — especially younger consumers — are becoming more and more eco-conscious, driving a desire for secondhand apparel. The resale retail market is growing at twice the rate of traditional retail, and is projected to hit $64B in 2024.

It’s not just good business to focus on sustainable retail, but also essential. The toll on the environment puts future generations on the hook to pay for this generation’s fast fashion addiction.

Goodfair is poised to be a leader in this extremely important area of retail, and by focusing on the large majority of consumers who have been traditionally overlooked, they not only stand to make a large economic impact on the apparel sector, but an environmental one as well.

About MaC Venture Capital

MaC Venture Capital is a Seed stage venture capital firm focused on finding ideas, technology, and products that can become infectious. We invest in technology companies that benefit from shifts in cultural trends and behaviors in an increasingly diverse global marketplace.