Fintech Startup Bolt Sees Valuation Surge to $6 Billion

A startup that’s trying to bring Amazon’s speedy one-click checkout to the rest of the internet saw its valuation jump to $6 billion.

Bolt Financial Inc., founded in 2014, raised $393 million in its latest round to bring total funding to $600 million, the company said. In December, the company was valued at $850 million, according to researcher PitchBook. Earlier this year, Bloomberg reported the company was eyeing a $4 billion valuation.

The company pitches its offering as a universal login credential that will allow e-commerce sites to compete with Amazon’s speed. Bolt said that once shoppers sign up, including providing shipping and payment information, they can quickly log into any site using its software and complete a one-click purchase.

“Bolt has the opportunity to be one of the most impactful e-commerce solutions in the world,” said Neeraj Chandra, chief executive officer of Untitled Investments, which participated in the series D. “It’s leveling the playing field.”

The company, based in San Francisco, has 10 million shoppers signed up. And that number has the potential to hit 100 million once all the deals Bolt has signed are fully activated, according 27-year-old founder Ryan Breslow.

“Our next 10x of growth is in the bag,” Breslow said.

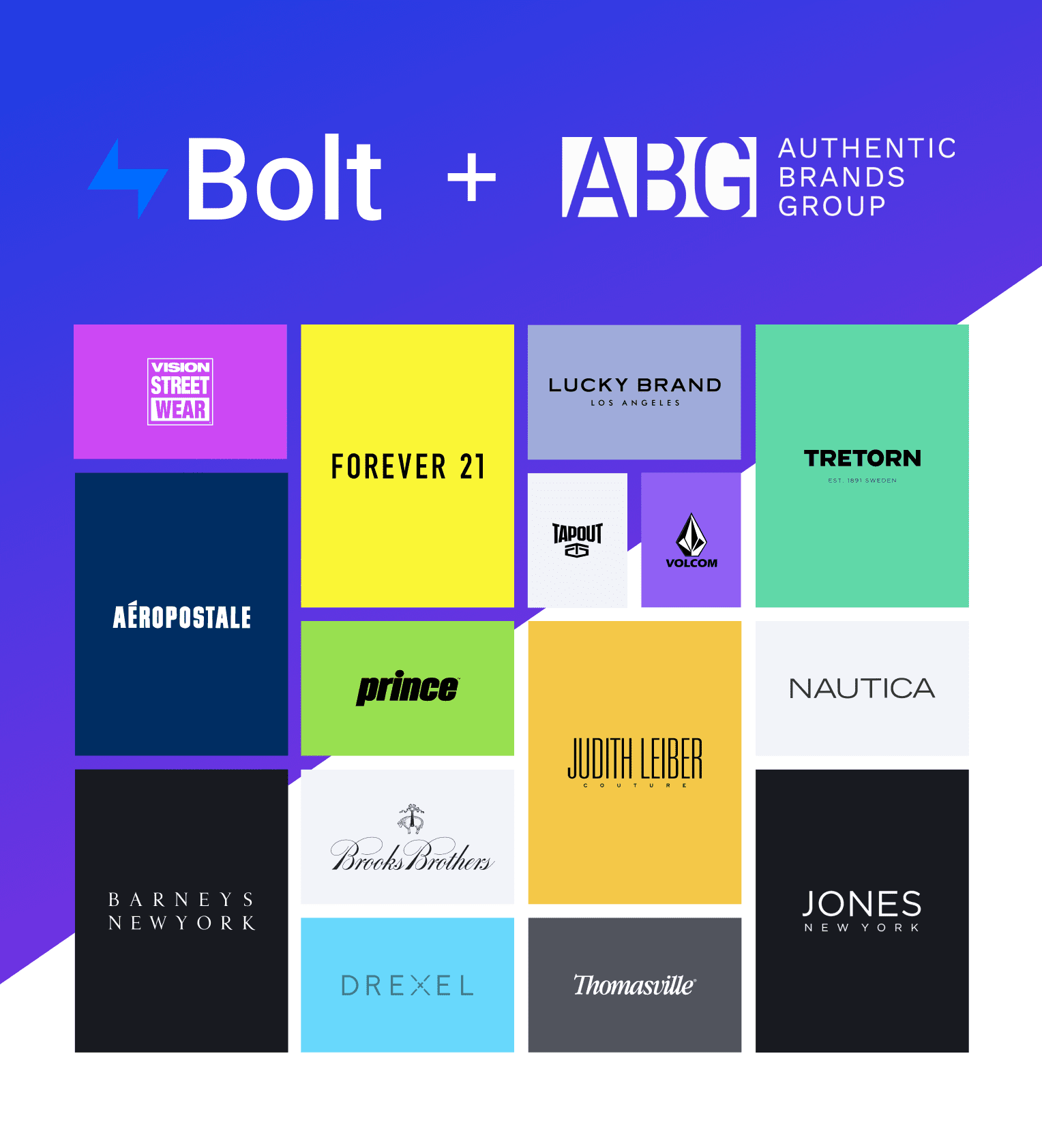

Bolt, which makes money by getting a 2% cut of purchases made through its one-click checkout, will use the funding to expand overseas, add more features and boost brand advertising. Some of the biggest retailers in Europe will be debuting Bolt in the first half of next year, Breslow said without providing the brands. Current customers include Forever 21 and Brooks Brothers.

For Moon Audio, a retailer of high-end audio gear, Bolt’s software increased conversion rates and repeat purchases, according to co-owner Nichole Baird, who also serves as chief financial officer. Since becoming a customer in 2018, the company saw fewer shoppers abandoning carts.

“They are about truly making the user experience easier and simpler,” Baird said. “Anytime you can remove a barrier, you will increase retention.”

Chandra has been investing in e-commerce and fintech for 15 years and said Bolt stands out by focusing on checkout, whereas a lot of companies lump it into a big suite of offerings. That allowed the company to spend several years building software to tackle the challenges of checkout, including being integrated into multiple systems and databases, he said.

Larger providers “built the whole banana and checkout is just one piece,” Chandra said. “But by trying to do everything, everything was a seven out of 10, not 10 out of 10.”