Finessing a Data-Driven, Environmentally-Friendly Model for Fashion

A History of Fast Fashion

Fast Fashion is as much a concept centered around supply chain and manufacturing models as it is around actual fashion trends. The purpose of fast fashion is to bring trends driven by resurfacing vintage and high-end haute couture showcased on catwalks around the world to the mass market as quickly as possible. Prior to the industrial revolution, all clothing — haute culture or not — was made individually and by hand. Innovations such as the sewing machine (patented in 1846), textile machines, factory-style assembly-line processes, and the use of outsourced, low-priced labor all laid the groundwork for mass-produced apparel.

With the foundation laid by the industrial revolution, the Europeans were the first to build companies around the concept of fast fashion. The first Hennes store (now known as H&M) opened in the Swedish city Västerås back in 1947; Zara started in 1963 as Confecciones GOA, a modest workshop making dresses and quilt dressing gowns for distribution, and then opened its first retail store in 1975 in A Coruña, Spain. American companies like Wet Seal, Express and American Eagle opened in the late 1980s and early 1990s, but ultimately were unable to churn out new collections as fast as their European counterparts. Even Forever 21, which opened as a small shop called Fashion 21 in Los Angeles back in 1984 and became a retail giant peaking at about $4.4 billion in sales, could not stay competitive and went bankrupt in September 2019. Zara opened its first US store in New York in 1989 and H&M ten years later in 2000. By that point fast fashion had taken over the industry and consumers — including everyone from Kate Middleton to Michelle Obama — were spending tens of billions of dollars on the low-priced versions of high-fashion.

Powering the explosion of the fast fashion industry were a conflux of factors:

- A quick response (QR) manufacturing process that took catwalk designs to retail floors in five weeks by eliminating a significant amount of time between design and production

- The development and sale of hundreds of new styles and thousands of different products each month through the QR process

- The use of low-cost synthetic microfibers derived from fossil fuels

- Outsourced, ultra-low-wage factory workers used to quickly mass produce millions of apparel items

- A general public whose style choices were heavily influenced by fashion icons, celebrities and the glossy fashion magazines like Vogue that showcased them all

Retailers were stocking thousands of new styles of cheap items mimicking what consumers saw in fashion magazines every two weeks driving tons of foot traffic and repeat purchases which resulted in billions of dollars in revenue and hundreds of billions of dollars of value for these fast fashion companies. But as time passed, and new retail trends emerged, fast fashion companies found themselves with billions of dollars worth of unsold inventory — inventory that could not be destroyed in an environmentally-friendly manner.

Supreme and the Drop and Collab Models

Launched in New York in 1994 as a small underground skate shop, Supreme would grow into its own industry and ultimately change fashion forever. Whereas Zara and H&M initially took their fashion cues from the Paris fashion houses, Supreme was influenced by street and skate subculture; a bottom-up contrast to fast fashion’s top-down approach. Out of necessity, Supreme was forced to do small production runs. The store had a small, niche customer base and not enough capital to finance large inventory buys. But the t-shirts, hoodies and caps they did produce in small batches almost always sold out, leaving their customers desiring more. Small runs also allowed Supreme to experiment with several different styles without putting a lot of money at risk. Eventually, Supreme started releasing the unique items from these small runs at the same time each Thursday in what became known as “drops.” Fans caught on and realized that if they wanted the fresh goods that week from Supreme they better show up early on Thursday or chance missing out on the limited-quantity inventory.

Today, Supreme’s Thursday drops have become major, frenzied fashion events. Supreme will release complete collections twice per year (fall-winter and spring-summer) in the tradition of many of the Paris fashion houses. New collections are debuted in their entirety in advance, then divided into the weekly drops that occur every Thursday over the course of a few months. Unless there are leaks, you don’t know what’s going to drop in any given week. Drive by a Supreme retail location in New York, Los Angeles, San Francisco, London, Tokyo or one of the other four cities where the brand has a brick-and-mortar presence on a Thursday morning (or more likely Wednesday night) and you will undoubtedly see lines down the block. Because Supreme never saw themselves as a mass brand, and more likely shunned popular culture, their intention even in success was to never mass produce items for everyone. So while both Supreme and the fast fashion companies shared a strategy of releasing new items on a weekly basis, fast fashion took the low-cost/low-quality volume approach, while Supreme took the opposite strategy.

In addition to drops, Supreme’s collaborations have fueled the astounding growth of the brand. Supreme did not invent the collaboration, but starting in 2002 with the first Nike x Supreme sneaker release, it proved that a big-brand partnership could be explosive in the best possible way. Since that first Nike collab, Supreme has partnered with high and low fashion brands that include Comme des Garçons, Louis Vuitton, Jean Paul Gaultier, Vans, Keith Haring, Oakley, The North Face and many, many more. These collaborations succeed in two ways: they fulfill Supreme’s mission of giving kids a chance to get their hands on rare and expensive fashion for a cheaper price, and they let established fashion designers experience Supreme’s unique ability to sell clothes.This “brand x brand” collaboration strategy has been copied by dozens of retails including Target, Birkenstock, and even H&M.

New Entrants and The Price of Fast Fashion

As noted above, because of the rise of fashion influenced by street subculture, and limited-quantity drop strategies pioneered by Supreme, the haute-couture-inspired, volume-based business of fast fashion is quickly fading. Indeed, many of the fast fashion incumbents such as Arcadia Group, H&M, Nasty Gal, Forever 21, Missguided, and ASOS have all faltered. However, newer fast fashion brands have risen up on the backs of Facebook, Instagram and TikTok and the army of influencers on those platforms. Companies like Revolve, Something Navy, Dolls Kill and Fashion Nova have taken a new digital-media approach to fast fashion, but the rest of the playbook remains the same.

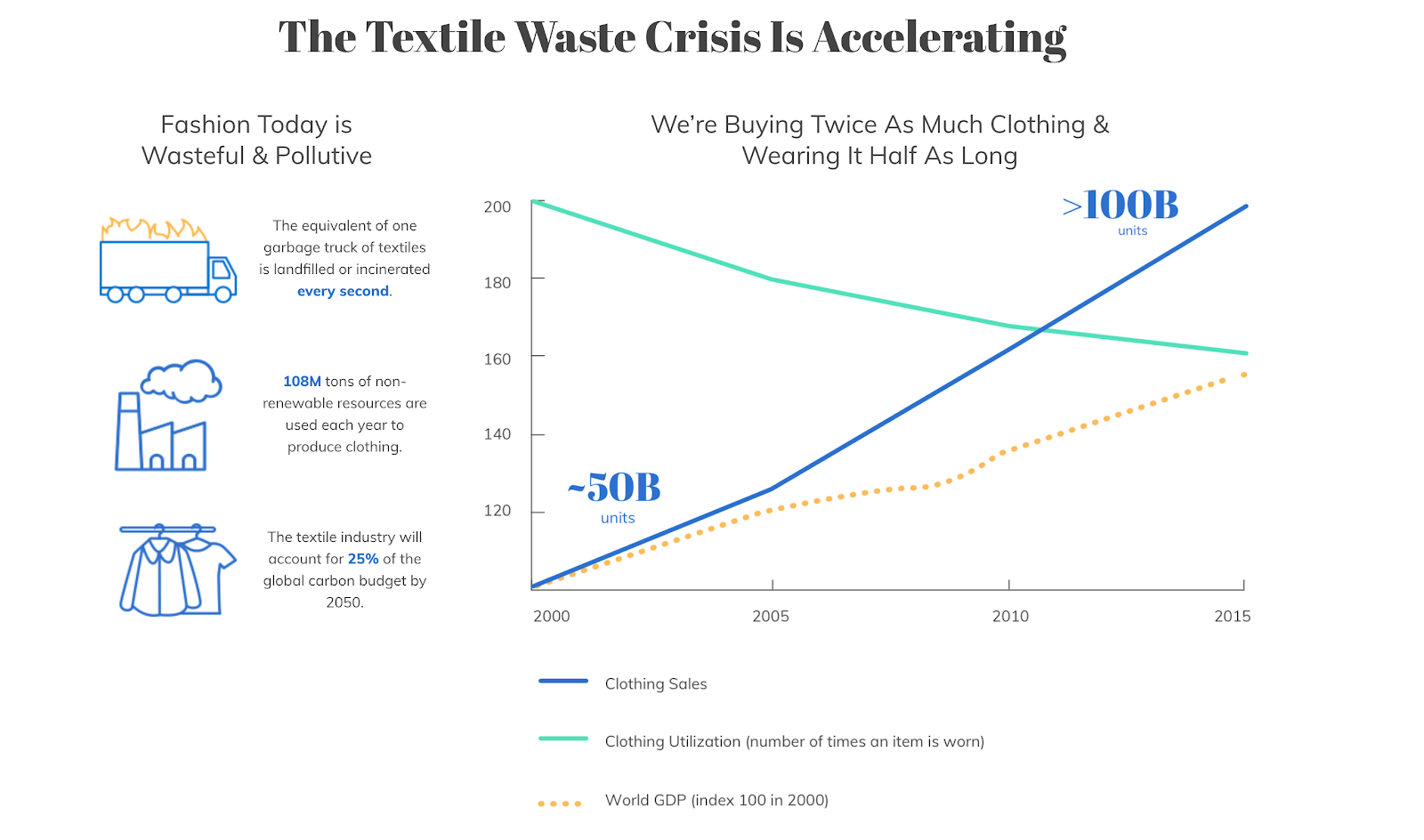

Fast Fashion’s disastrous effect on the environment is both cause and effect in nature: the waste that has been generated from unsold inventory has destroyed the planet as noted in more detail below, and because of this environmental impact, eco-conscious and sustainability-minded consumers have turned their back on these companies en masse, leading to even more unsold inventory in a vicious cycle.

Enormous amounts of energy, water, chemicals and other resources are needed to make clothes. And more than half of fast-fashion items are tossed within 12 months of purchase. Global clothing production doubled between 2000 and 2014 as garment firms’ operations became more efficient, their production cycles sped up and shoppers got better bargains. According to the World Resources Institute:

- One garbage truck of clothes is burned or sent to landfills every second.

- Consumers waste enough clothing to fill up 1.5 Empire State Buildings every day.

- It takes the amount of water that could sustain one person for two and a half years to make a single shirt.

- Making a pair of jeans produces as much greenhouse gases as driving a car more than 80 miles.

- Discarded clothing made of non-biodegradable, fossil-fuel-based fabrics can sit in landfills for up to 200 years.

- And in addition to the environmental impact, there is also a massive human one: from the collapse of Rana Plaza in Bangladesh killing over a thousand fast fashion factory workers and injuring thousands more to underpaid factory workers in Los Angeles being treated like indentured servants, fast fashion has degraded (or worse) the lives of hundreds of thousands of people across the planet.

And as noted in ThreadUp’s 2019 Resale Report, the textile waste crisis is accelerating. Clothing sales have been going up while the average number of times an item is worn is going down.

So while young consumers have moved away from legacy fast fashion brands, they have replaced them with fresh ones in different wrappers and new marketing plans. The environmental and human impacts will remain the same if a new model is not put into place.

Big Data to the Rescue

Historically, the fashion industry has favored merchant-and designer-driven “gut feel” over insight-driven decision making, but this stance has been changing as retailers like Amazon have shown the value of using data science to inform product and marketing decisions. Most apparel companies now are pursuing data strategies to varying degrees of success. One of the fundamental challenges has been the conflict between designers and data scientists inside of fashion companies. The consultancy McKinsey put it this way:

Apparel players have long had to balance tensions between creative-minded design teams, consumer-focused merchant organizations, and efficiency-oriented operations teams. Apparel is a fundamentally art-based business that will always require creative direction to ensure that products remain innovative, relevant, and beautiful for the consumer. Investing in analytics and technical skill sets — for example, data scientists and architects, as well as coders and developers — will certainly be an important aspect of an advanced analytics transformation.

However, the data teams at most fashion companies (if they exist at all) are siloed at best and ostracized at worst. The fashion industry has yet to see a company that puts data and analytics (and the teams that facilitate such strategies) at the center of their organization.

Making Fashion (and Demand) Predictable

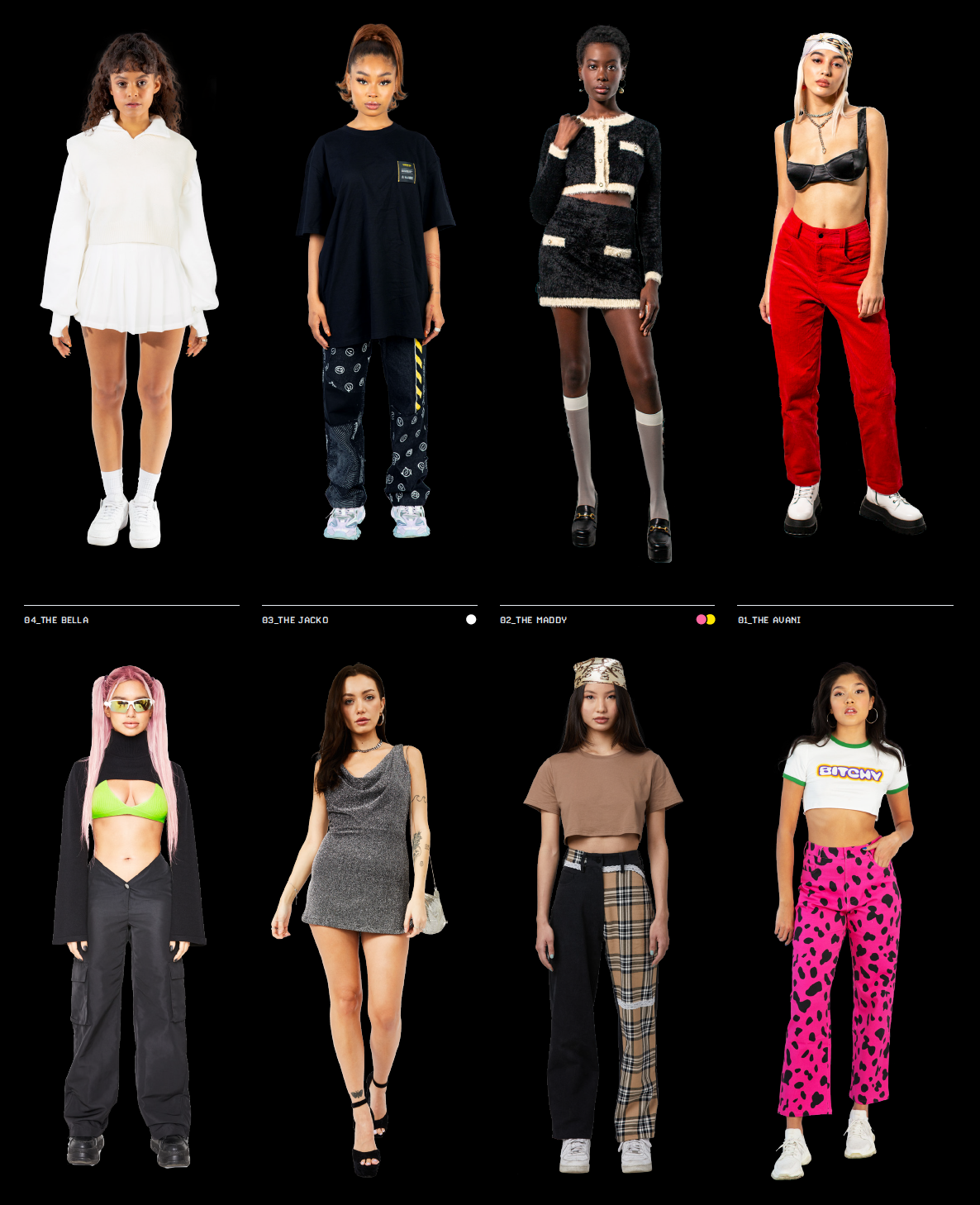

Today we are announcing our investment into the seed round of FINESSE, a company taking a data-centric, eco-friendly approach to fashion. FINESSE’s strategy is to gain asymmetric advantages in fashion by identifying trending items, styles, colorways, fits, fabrics, patterns, grommets, hems, seams, trims and everything in between at inception and then creating apparel collections around those trends at affordable price points in a timeframe that is meaningfully faster than the competition. The company will also use data science to not just more accurately predict demand so that they are not overproducing inventory, but to also better identify digital and social platforms and individual micro-influencers to target as optimal sales channels and marketing partners.

MaC Venture Capital invested alongside a noteworthy group of investors that includes Mango Capital, Hoxton Ventures, SGH Capital, TinyVC and Lawrence Chu. Marlon Nichols led this deal for MaC VC and has joined the board of directors.

The team behind FINESSE is 100% unique to the world of fashion and perfectly suited to execute on such a vision:

Ramin Ahmari is Co-Founder and CEO of FINESSE and his story is pretty extraordinary. He self describes as a queer non-binary brown kid that grew up in Germany using fashion as a means to navigate the intersections of his identities and deal with the associated labels. He went to boarding school in England and ended up at Stanford where he pursued a joint BS/MS in Computer Science (with a minor in Art History) with a concentration in artificial intelligence. During and after Stanford he went to work in financial technology working for several notable firms including BlackRock and Two Sigma. He started FINESSE in May 2019 and is taking an analytical trader-like approach to fashion with FINESSE employing similar strategies to trend prediction as quantitative hedge funds would take to stock prediction.

The rest of the team is made up of a wonderfully diverse combination of killer product people, operators and machine learning / data scientists from across the tech and fashion worlds with former backgrounds ranging from REVOLVE & DollsKill to NASA.

FINESSE will be taking the most successful strategies from both fast fashion companies (quick response manufacturing processes) and Supreme (collections released as limited-quantity, timed drops and key focused and strategic collaborations with influencers and brands alike) and applying those to a data-driven / data-central approach to sourcing, pattern making, design, demand-prediction, manufacturing, and sales/marketing.

To date, FINESSE has created several lines that have sold out within hours of dropping and was able to move a substantial amount of merchandise in five hours using very targeted influencer marketing. They also understand how to market to the hype-driven gen Z demo. Just compare their social advertising to Zara’s (also compare the view counts).

How FINESSE Works

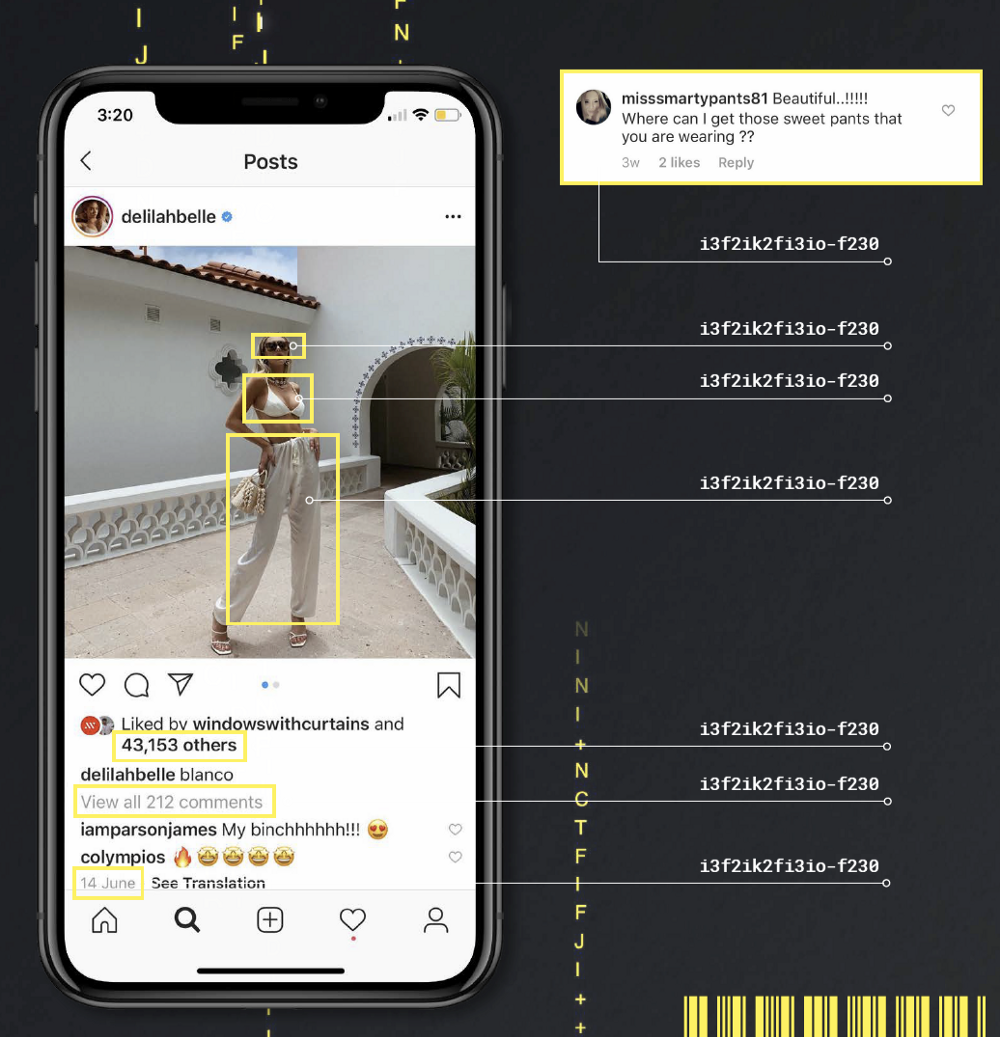

Inspired by Ramin’s previous work in the financial industry, FINESSE looks at fashion in the same way an economist or hedge fund trader would look at stock performance. What are the signals that predict this stock — or fashion item — will be going up to record highs, and what are the chances it will underperform? With the advent of social media, fashion has arguably some of the most expressive data of any industry with customers using their platforms to be vocal about exactly what they want. FINESSE uses a variety of machine learning techniques — across natural language processing, computer vision, time-series analysis, deep learning — as well as mathematical and statistical analysis to build what they consider their equivalent of financial portfolio strategies. Not surprisingly, their first hire on the engineering team was an engineer who used to work in a leading hedge fund on strategies pioneered by Nobel-Prize winning economic theorist Myron Scholes.

At the ground level, FINESSE analyzes the millions of comments underneath hundreds of thousands of posts on social media where users leave comments such as “love this fit!!” or “where can I get this from?”. Go to nearly any post on supermodel Bella Hadid’s Instagram account and scroll through the comments and you will see all kinds of comments relating to the item she is wearing in the post. FINESSE is ingesting all the signals from all of these posts (and posts of hundreds of influencers like Bella) to pinpoint specific product trends. This is compared and correlated across a multitude of sources and posts to distill the essence of a trend and catch it as it is catching fire.

Their voting feature — which allows customers to additionally vote on 3D rendered, pre-selected items — acts as a further level of data that is generated by FINESSE itself, telling them exactly what their audience prefers and how much demand certain products will drive.

Akin to Google’s underlying data representation, all of FINESSE’s data is transformed and embedded into a central knowledge graph which enhances the expressivity of the data even further to allow the deduction of graph-specific features that are natural to social networks.

The Big Opportunity

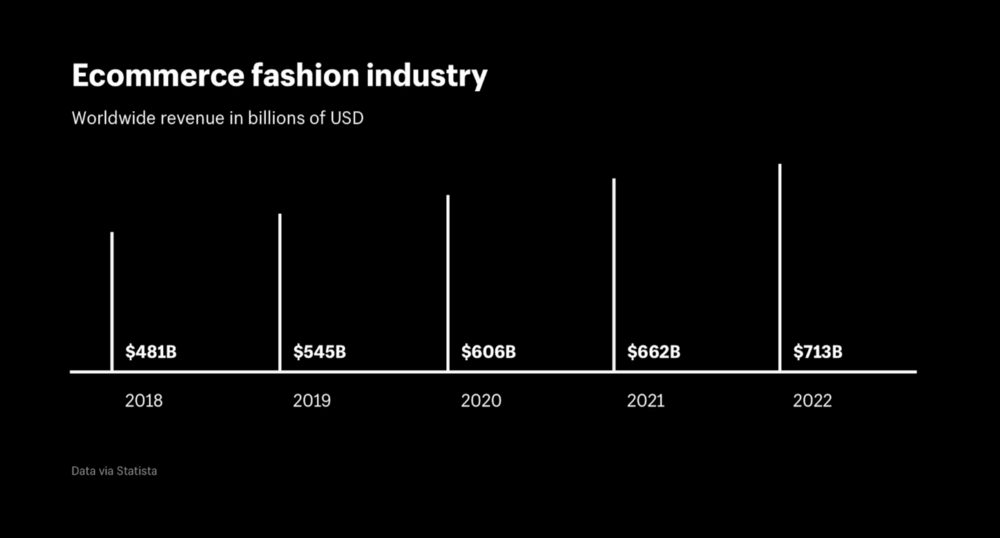

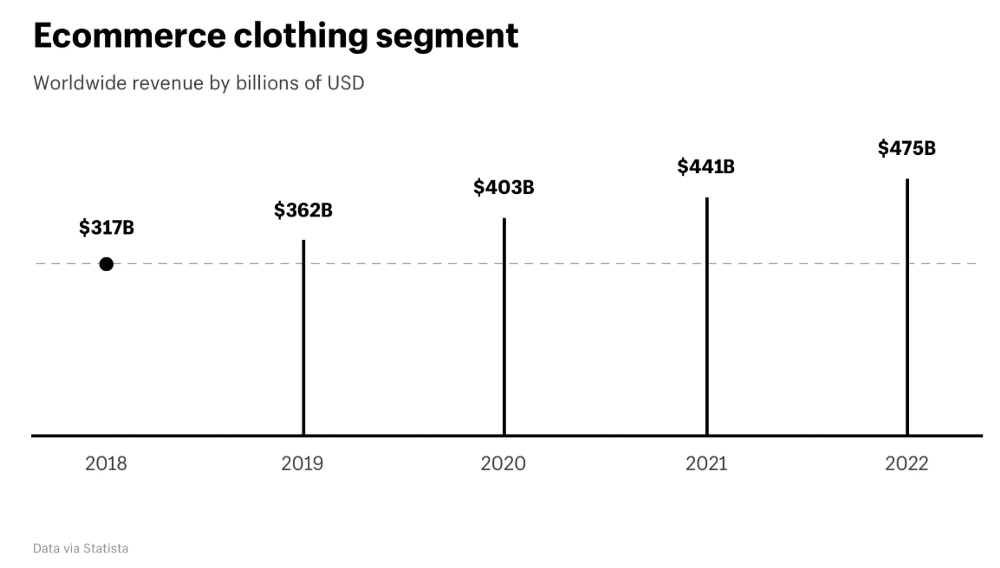

In addition to saving the environment and providing better working conditions for fashion factory workers, there is an enormous economic opportunity on which FINESSE will capitalize. The global apparel, footwear, accessories and beauty market is $2.7 Trillion. This encompasses all clothing and beauty purchases globally. FINESSE will be focusing on the $1.8 Trillion global apparel market which takes into account both brick and mortar and online sales. According to a study done by Shopify and Statista, the 2019 online-only ecommerce fashion industry stood at $545 Billion and is expected to grow to $713 Billion by 2022. And narrowing the scope even more, that same report estimates that online clothing sales in 2019 were $362 Billion growing to $475 Billion by 2022.

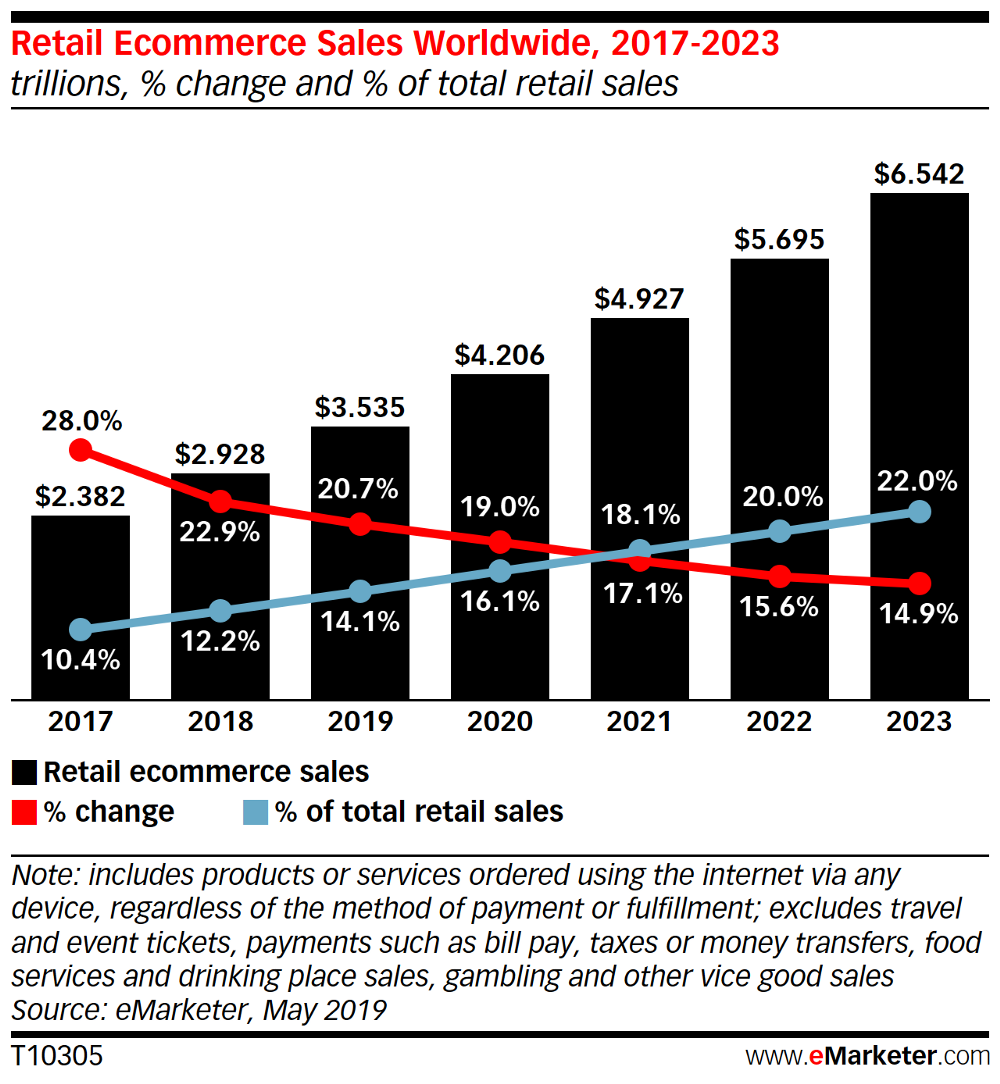

ASOS, Zara and H&M alone made combined top-line revenue of $47 Billion USD in 2018 from physical and online sales. Another data point is around the pioneering high-end streetwear brand Supreme, which was estimated to have done $100M in topline revenue in 2017 and took a $500M investment from The Carlyle Group that same year valuing Supreme at $1 Billion. And as the chart to the left shows, US (and global) ecommerce penetration of overall retail sales is still under 20%. There remains a lot of room for growth of ecommerce retail in all industries, fashion and apparel included.

FINESSE represents an opportunity to take fashion into the 21st century, and use sophisticated technology to drive cost, efficiency and environmental gains. The company will build on the success of H&M, Zara and Supreme while learning from their shortcomings. Every twenty years or so a new model in fashion emerges, and we strongly believe FINESSE is the company to usher in this new data-driven, environmentally-friendly model.

About MaC Venture Capital

Formed in 2019 after the merger of seed funds Cross Culture Ventures and M Ventures, MaC Venture Capital (MaC VC) backs technology companies that create infectious products that benefit from shifts in culture trends and behaviors. MaC Venture Capital identifies emerging behavioral trends and unaddressed multi-billion-dollar challenges, where technology will increase efficiencies, create new markets, and/ or expedite the move from a growing trend to a cultural and behavioral norm. MaC VC invests in talented and uniquely qualified entrepreneurs creating the next generation of technology and consumer products at the seed stage.