TrueBill in the 3 Smart Apps That Lower Your Bills, Cancel Unwanted Subscriptions and Automate Saving

If you want to cut back on your spending but don’t have the time to figure out how, these apps can help.

Whether money is tight or you’re financially comfortable, it’s always important to be smart with the cash you earn. Spending less in one area frees you up financially to use your earnings on the things that matter most to you. (Hello savings accounts, debt elimination or even a fun family vacation!)

But let’s be honest. The actual process of cutting expenses can be time-consuming. Perhaps you have the best intentions about trimming the fat from your budget. Even so, finding the time to negotiate better rates with creditors and service providers or to cancel unwanted subscriptions can be challenging to fit into an already busy schedule.

The good news is that the best money-saving apps make it easier to stretch your hard-earned dollars. Check out these three smart services below that can help you lower bills, cancel unwanted subscriptions and even automate your savings.

Truebill

Try Free Version | Try Premium Version

Truebill is another online financial service that may lower your expenses in a number of ways. Customers can use Truebill to manage their subscriptions, reduce bills and optimize their spending. The service is reported to save customers an average of 20% on telecom bills and up to 30% on utility bills.

Truebill may also be able to save you money on your utility bills in some unique ways. For example, if electric services are deregulated where you live, Truebill can shop around to help you find the best rate.

Like similar apps, Truebill comes in a free version and a premium version that features more bells and whistles.

Truebill Free Version

You can download a free version of the Truebill app for both Apple and Android. But if you want to use the service to negotiate your bills, you must first agree to give Truebill 40% of any savings it secures for you.

Truebill Premium Version

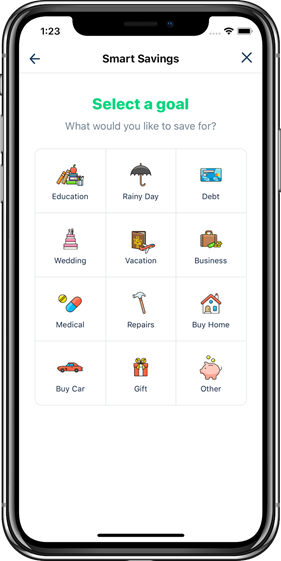

Depending on the features you want, Truebill Premium costs between $3 and $12 per month. Your premium membership may include dedicated chat support, balance syncing, subscription cancelation, unlimited budgets, Smart Savings plans and more. A premium Truebill membership will also include monitoring your accounts for late or overdraft fees and asking for refunds on your behalf.

Other Truebill Services

- The Bill Negotiation Service through Truebill comes with additional fees, even as a premium member. You’ll pay 40% on the first year’s savings when Truebill successfully lowers your bill. So, if the service saves you $20 per month for 12 months ($240 in total savings), your fee would be $96. However, you don’t owe additional fees if the service doesn’t negotiate a lower bill.

- The Outage Refund Service is a unique way that Truebill may be able to save you money where other apps can’t. Truebill watches for cable and internet outages in your area and can ask for bill credits on your behalf if they occur. When successful, Truebill will charge you 40% of the credit it secures for you.

Read the full post on SlickDeals.