Could these 50 hot tech startups be tomorrow’s unicorns?

From the MaC Portfolio: PlayVS and Citizen featured in this year’s CB Insights x Fast Company’s 50 Future Unicorns.

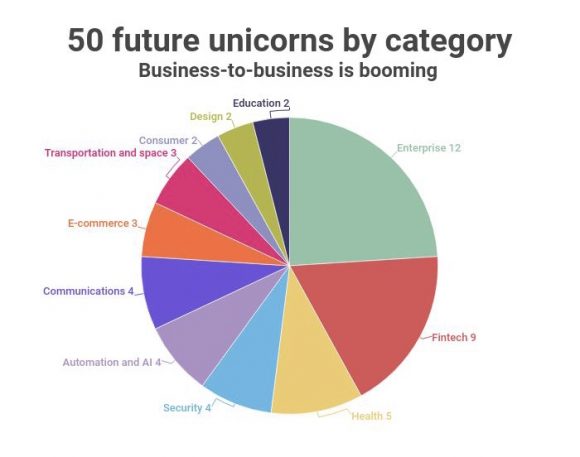

The next crop of billion-dollar phenoms may be dominated by companies that quietly help other companies get business done, not splashy consumer brands.

Startup companies can be black boxes—opaque operations with few public disclosure requirements. That makes it hard to see tomorrow’s standouts today. So the research firm CB Insights, with the support of the National Science Foundation, set out to build an algorithm to discern the health of startups through their publicly available data, and even identify ones that could grow to a billion-dollar valuation—making them, in one of the tech industry’s favorite buzzwords, unicorns.

CB Insights calls this algorithm Mosaic, and in the past, it has indeed pinpointed promising startups that went on to achieve unicorn status. For the company’s 2015 Future Unicorns list, for instance, it identified restaurant delivery Postmates as a contender. The on-demand delivery service is valued at $2.5 billion today. Also on that list was Dollar Shave Club, which Unilever acquired for a cool billion the following year. The Berlin-based meal kit delivery company HelloFresh, another 2015 future unicorn, went on to a $1.7 billion after its late 2017 IPO, and its stock price has tripled since then.

Mosaic’s past success is one of the reasons the strikingly different makeup of this year’s Future Unicorns list—which you can read in its entirety at CB Insights’ site—is so intriguing. Postmates, Dollar Shave Club, and HelloFresh caught the last of the wave of consumer-focused e-commerce mania, but that wave is long gone in 2020. Most of the companies on CB Insights’ 2020 list cater to the needs of corporations, not consumers. In fact, 37 out of the 50 companies on the list have no consumer-facing products at all.

“There’s a lot of big companies that are looking for technology solutions and there’s a lot of startup companies that are building for them,” CB Insights cofounder and CEO Anand Sanwal told me. “From a revenue perspective, these are companies that have a repeatable, understandable subscription model. So you’re seeing less of these consumer-driven, hit-based businesses.”

SPOTTING UNICORNS

The Mosaic algorithm sifts through data on 280,000 tech startups tracked in CB Insights’ database, looking for traits shared by movers and shakers. These factors include how much investment money the startup has attracted—and how quickly it seems to be burning through it—as well as at the pedigree of the company’s investors and board members. It also looks for signs of momentum in customer growth, media coverage, and social media sentiment.

Mosaic’s unicorn-spotting skills certainly aren’t perfect, as CB Insights is quick to acknowledge. Along the way, some of the companies it’s identified as high flyers have turned out to be duds or even downright disasters. It picked the peer-to-peer used-car marketplace Beepi in 2015 and the startup crashed and burned the next year, for example.

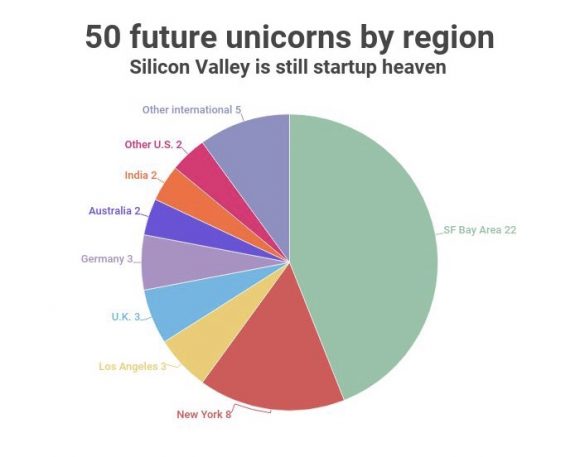

Still, along with serving as an early-detection system for unicorns, the list is a snapshot of the demographics of the startup economy, for better or worse. Though it’s global, 35 of the 50 companies on this year’s edition are U.S.-based, and 30 of those are from either the Bay Area or New York City. Dominated by companies started by white and Asian men, it also reflects the tech industry’s dismal record on diversity. No women are among the founders, and black entrepreneurs are almost as poorly represented.

“We have a serious lack of racial and gender diversity in tech, and this just emphasizes how far we have to go,” says Aileen Lee, the Cowboy Ventures partner who famously coined the unicorn term back in 2013. “At a time when there’s increased awareness about systemic, deep-rooted injustice, I hope this is a call to action for founders and investors. When you’re thinking about starting a company, be purposeful in the composition of your founding team,” Lee says. “And when you’re investing, play a role in the composition of the team.”

QUIET COMPANIES

This year, the Future Unicorns list comes out right in the middle of the worst public health crisis and accompanying financial downturn in a century. That means this year’s would-be unicorns are survivors, insulated from the current economic trauma by their business models, by the deep-pocketed faith of their investors, or by the industries they play in.

Cockroach Labs, for instance, sells an IT product that works behind data center walls where banks of computers serve up the distance-learning, remote-working, binge-watching, and teleconferencing services we’re now depending on. Cockroach’s product, a database architecture that can “survive data center-scale outages,” is used by big companies such as Comcast, Baidu, and Bose. The New York company is backed by some high-profile VCs including Google Ventures and Benchmark.

Enterprise-focused startups such as Cockroach Labs make up the biggest chunk of the Future Unicorns list. This is driven in part by the increasing power of developers within large companies, and by shifting philosophies on how they should spend their time.

“Many Fortune 1000 companies are transitioning to cloud-based technologies, and we’re seeing a greater willingness to purchase best-of-breed developer platforms and tools to solve problems rather than build homegrown solutions, freeing developers from noncore tasks,” says Ethan Kurzweil, partner at Bessemer Venture Partners. Kurzweil adds that developers can devote the hours they regain to work on projects that more directly improve the company’s core product or service offerings.

For instance, developers can devote full attention to perfecting an app they provide to customers, but rely on a third-party platform to report and analyze crashes. One of the companies on the list, San Francisco-based Sentry, provides just such a platform, which its customers can either self-host or run from the cloud. The startup, which has raised $65 million in venture capital and is valued at $100 million, says a million developers at 50,000 companies–including Microsoft, Disney, and Symantec–use its product.

Search is another app or website feature that might be better provided by a dedicated third party like Algolia. The San Francisco-based company puts a Google-caliber search engine in its customers’ websites or apps that let users call up the customer’s product or other information easily and quickly. It also offers voice-based and location-based search. That kind of functionality would be expensive and time-consuming to build internally. That may be why Algolia has 8,500 customers, and has already amassed $184 million in funding.

“A generation of new platforms and tools like Sentry, Cockroach Labs, and Algolia [are] solving highly acute pain points for developers and allowing their customers to be more innovative, agile, and quick to adapt,” Kurzweil points out.

THE BANK IS OPEN

Some industries–such as the retail and travel–have entered the digital age with relative ease. Venerable tech companies such as Amazon and Expedia have played major roles in those transitions. Now more startups and investors are focusing their efforts on harder-to-digitize industries such as healthcare and financial services—areas that are more attached to old workflows and systems, and more tightly regulated.

Financial technology (fintech) companies are the second-best represented group among CB Insights’ future unicorns. Most of them are riding the “open banking” wave, which has banks melding their internal systems and data with third-party services via application programming interfaces (APIs), allowing them to create new offerings for tech-savvy customers.

“These institutions figured out that you can outsource your R&D and get something purpose-built for your needs by a startup that might have access to capital and access to talent that they don’t,” says Sanwal. One example from the CB Insights list is Stockholm-based Tink, which partners with European banks to build apps that offer users financial planning features and the ability to see all their accounts in one place.

Other fintech startups build for the needs of businesses. Lehi, Utah-based Divvy built an expense management platform that allows companies to more easily issue and manage corporate credit cards. Expense reports go away because all purchases are done with the card and tracked through the platform.

DAYLIGHT FOR DIGITAL HEALTH?

Digital health startups haven’t had an easy time finding their footing within the greater healthcare industry during the past 10 years.

“The delivery of healthcare in the U.S. is a very large ecosystem with enormous inefficiencies, cross incentives, and entrenched interests,” says Bryan Roberts, a partner at Venrock, a top-shelf investor in digital health companies.

ALONG WITH OPENING UP NEW POSSIBILITIES, THE PANDEMIC HAS INTRODUCED UNCERTAINTY THAT THE ALGORITHM HAS NEVER SEEN BEFORE.

Despite these challenges, health is an increasingly tantalizing space for tech entrepreneurs. “A huge, inefficient, and important sector of the economy is often fertile ground for disruption by innovative startups,” Roberts says. Healthcare not only offers startups a shot at building the next unicorn, but also a chance a playing a role in fixing one of society’s biggest problems. The COVID-19 pandemic has amplified existing problems in the healthcare system, and highlighted the need for tech approaches to long-standing issues.

One area of reinvention immediately opened up by the virus is telemedicine, as millions of people stuck at home have accessed health services remotely for the first time. One potential unicorn, Doctor on Demand, which provides virtual visits with its network of primary care doctors, has seen rapid growth in demand since March. Two other startups on the list, Omada Health, which specializes in managing chronic health conditions, and Lyra, which offers mental health services, each moved quickly to video visits during the pandemic. Yet another company, New York City-based Capsule, saw its prescription delivery service flourish as people found a new need to avoid brick-and-mortar pharmacies.

Along with opening up new possibilities for startups, the pandemic has introduced a level of uncertainty that CB Insights’ Mosaic algorithm has never seen before. For all the lessons it can draw from past startup successes, it has no way of predicting all the direct and indirect effects on startups during the uncertain recovery ahead. This batch of potential unicorns must follow through on their promise even as the world has turned upside down around them—and that means that an even greater number of surprises than usual surely lies ahead.

Read the full 50 Future Unicorns list here.

Original Post: Fast Company, Mark Sullivan, 6/10/20

[Source images: arthobbit/iStock; rbiedermann/iStock; talhakhalil007/Pixabay; Chris Briggs/Unsplash]