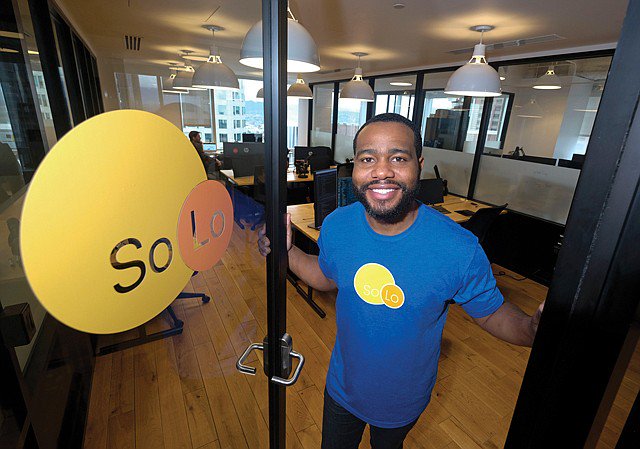

Microlender Solo Funds, a Cross Culture Ventures portfolio company, relocates to Los Angeles and hires Tala’s former co-founder and Chief Product Officer. They are on a path to disrupt payday lending.

Read more in the LA Business Journal

Microlender Solo Funds, a Cross Culture Ventures portfolio company, relocates to Los Angeles and hires Tala’s former co-founder and Chief Product Officer. They are on a path to disrupt payday lending.

Read more in the LA Business Journal