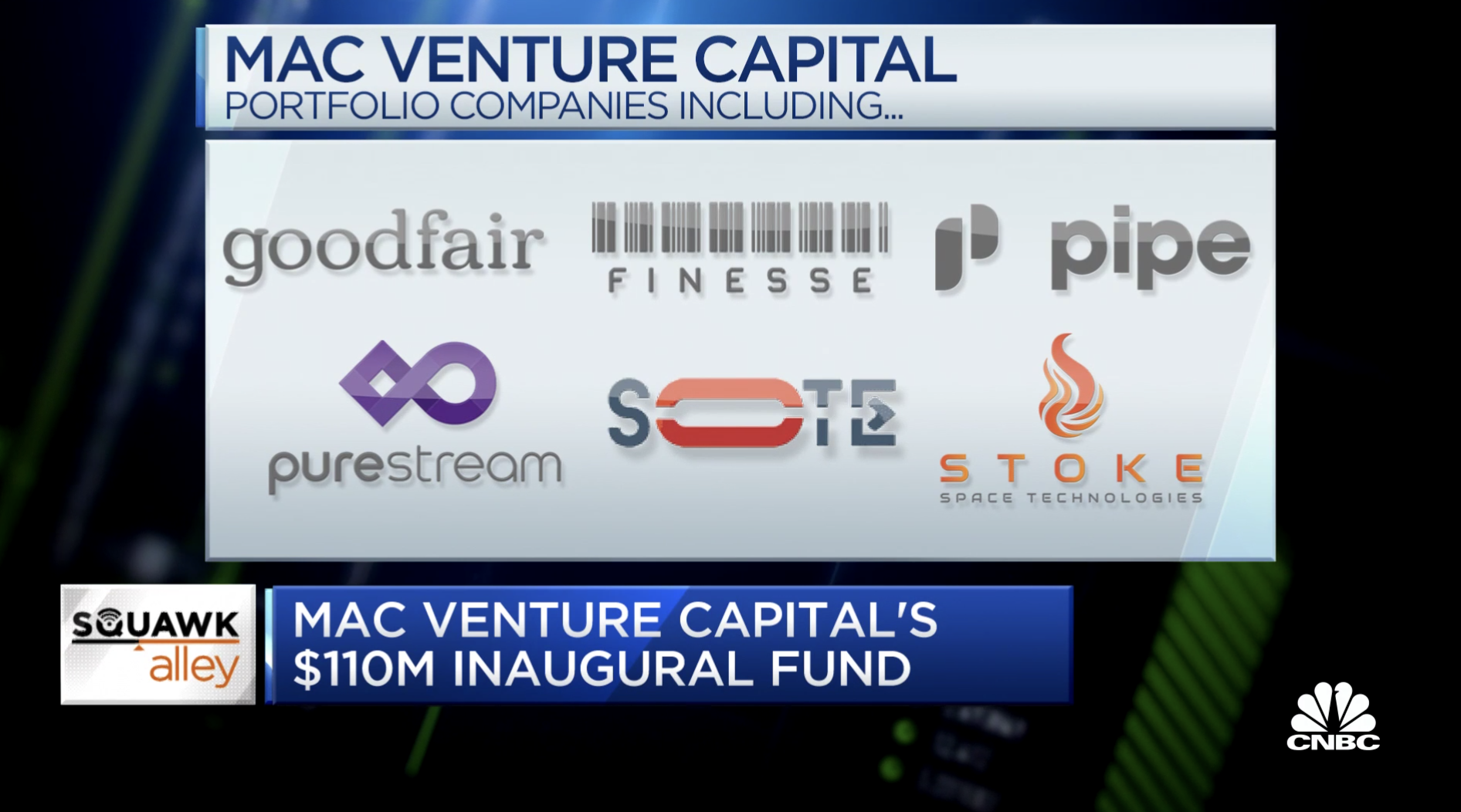

Majority Black venture capital firm announces $110 million fund to invest in entrepreneurs of color

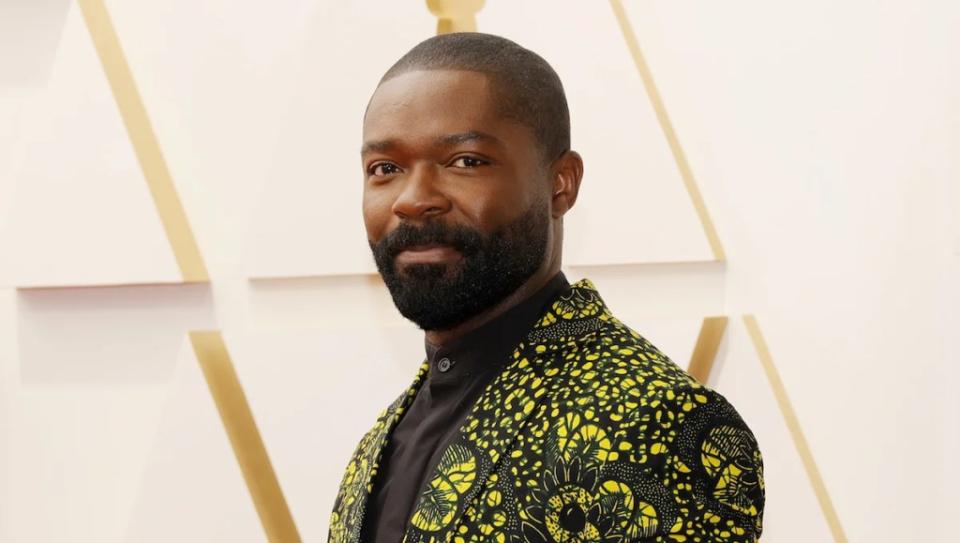

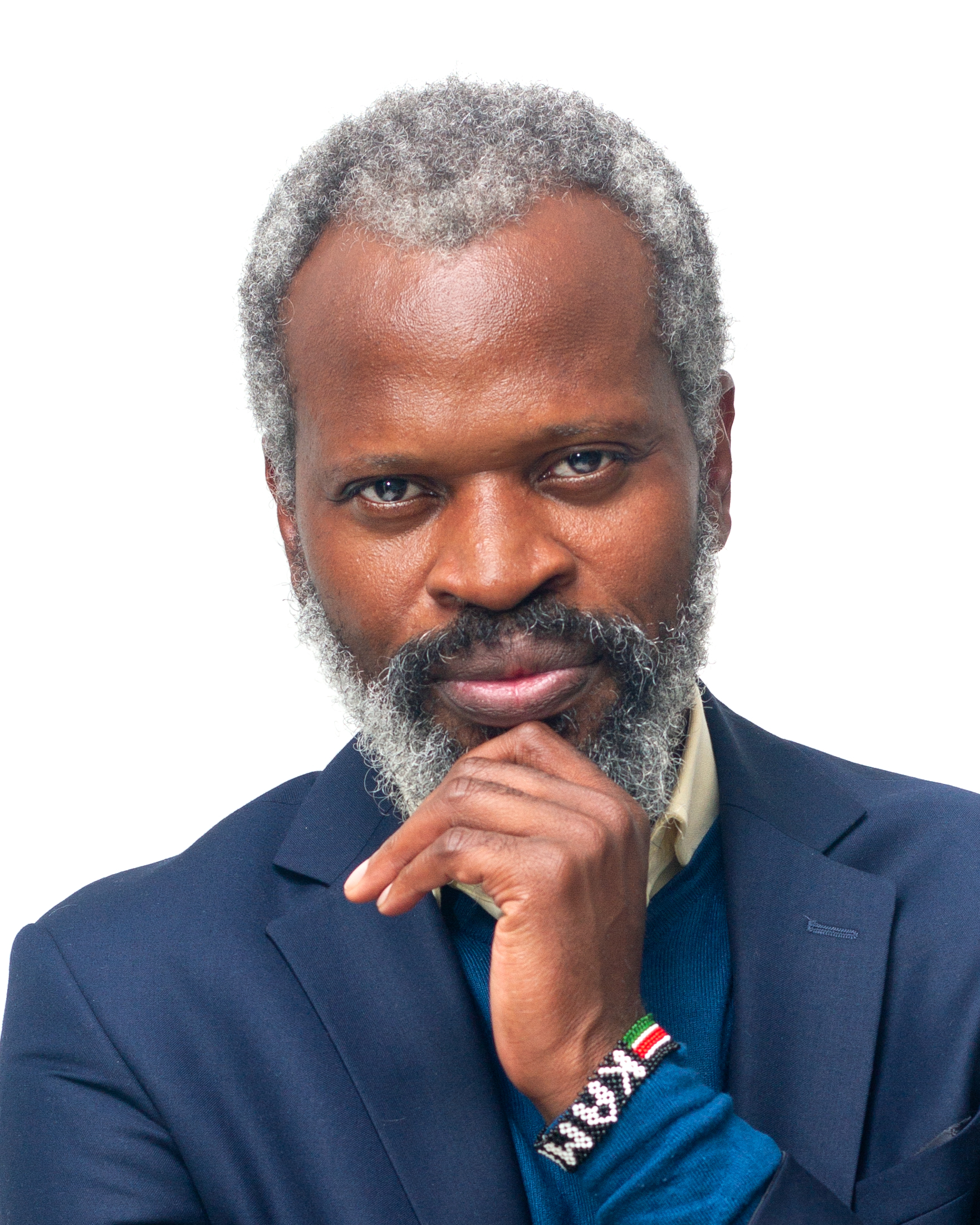

A majority Black venture capital firm, helmed by a technology veteran, a Hollywood producer, and a former mayor of Washington, D.C., is leading a new $103 million fund to seed young companies started by people of color.

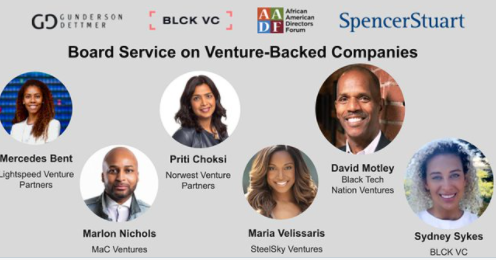

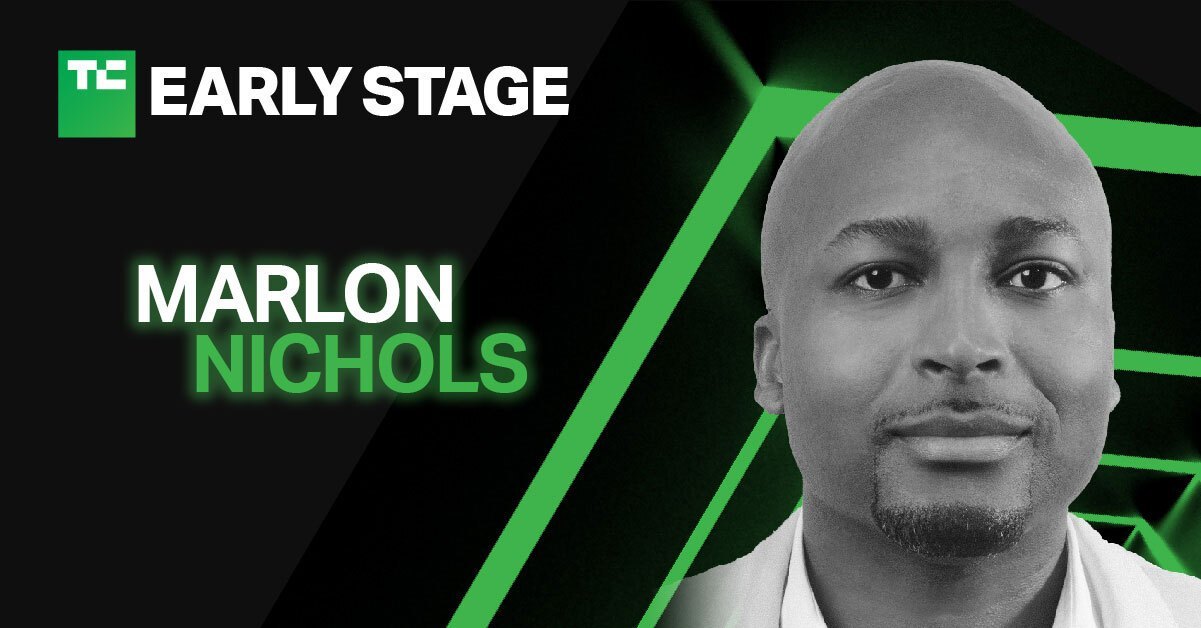

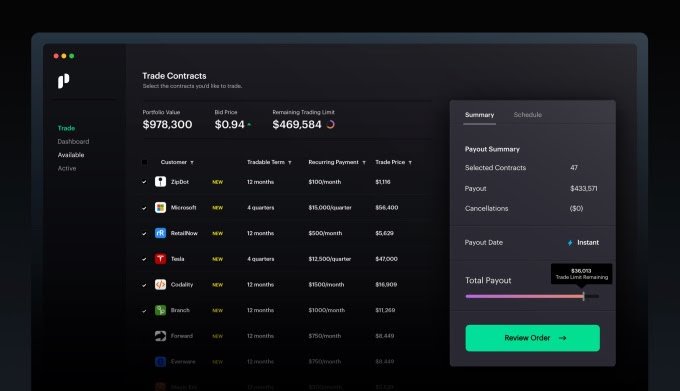

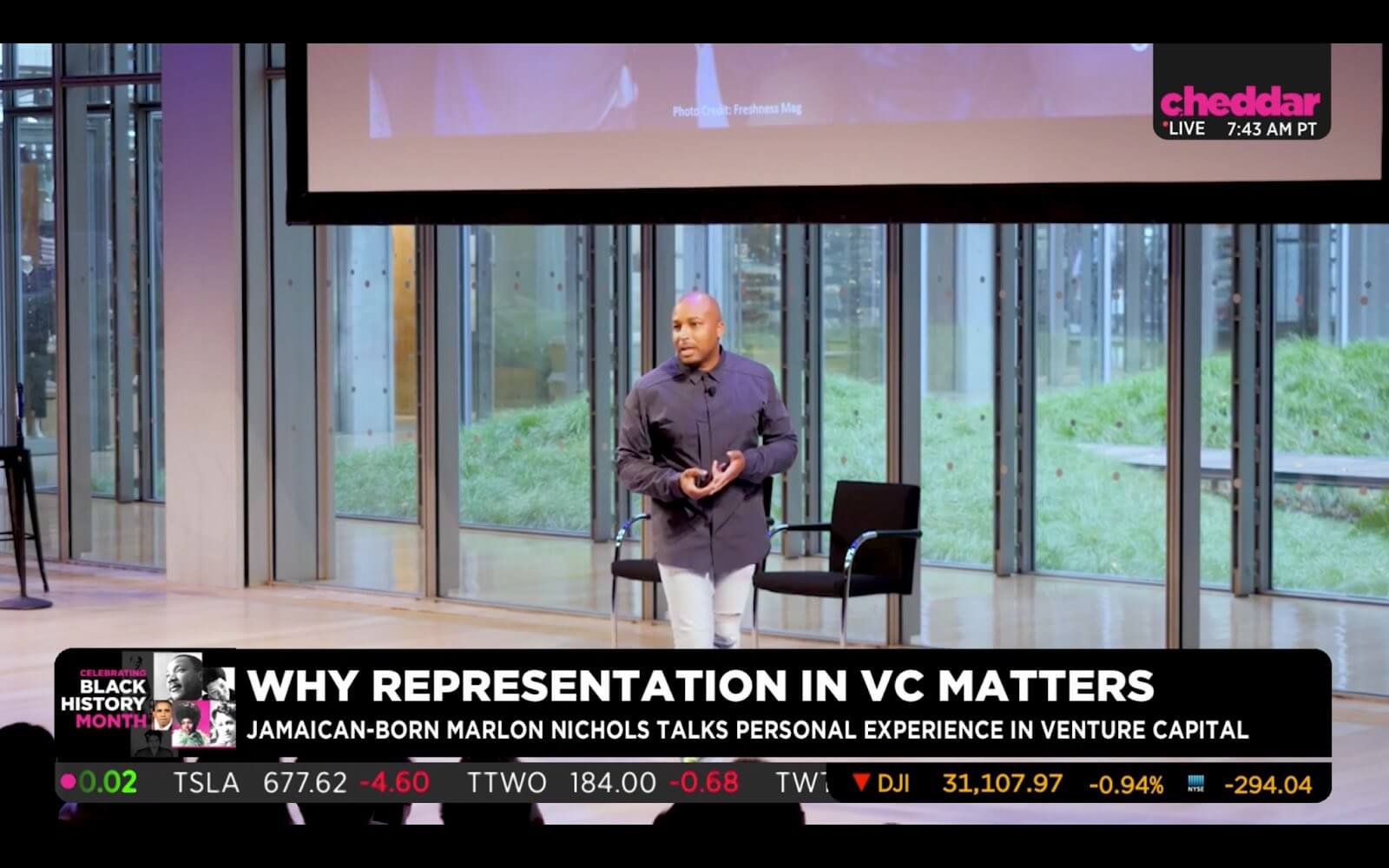

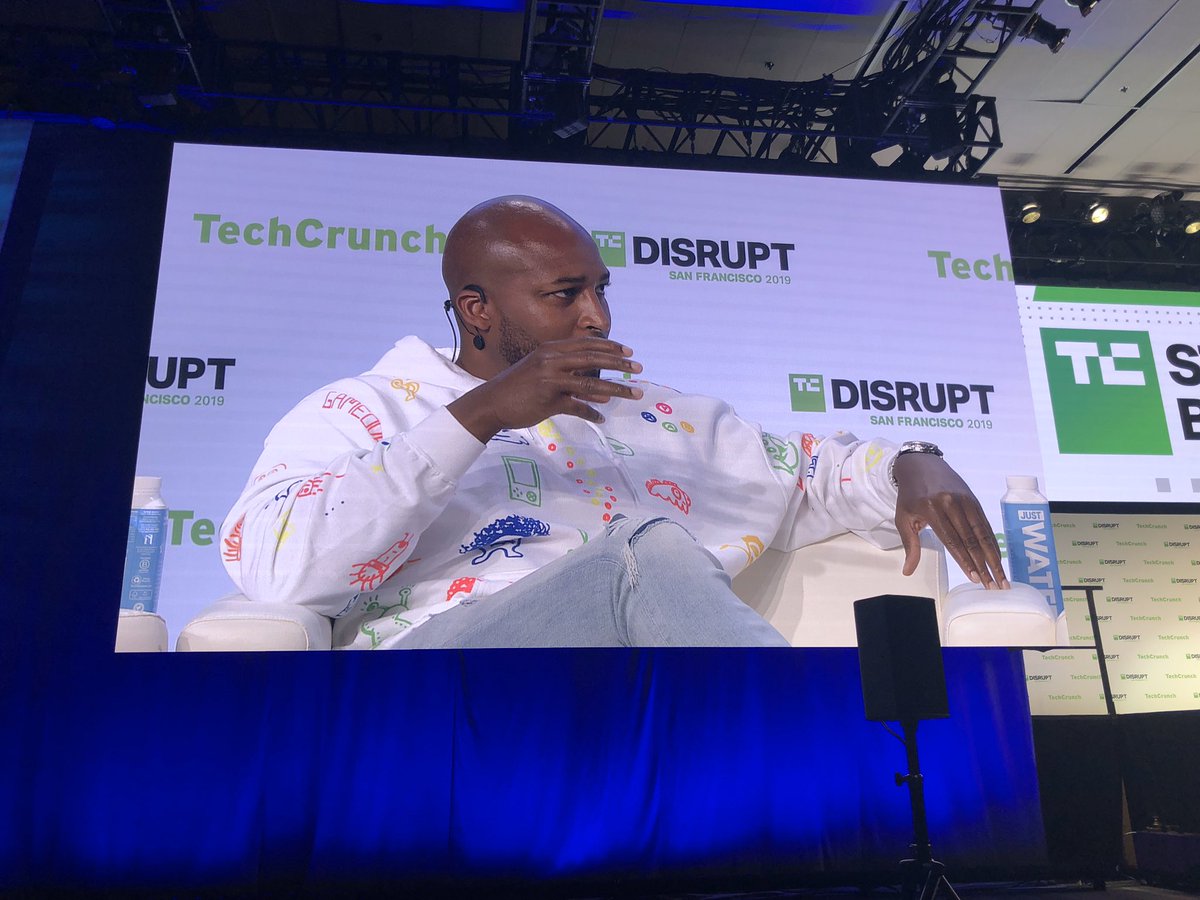

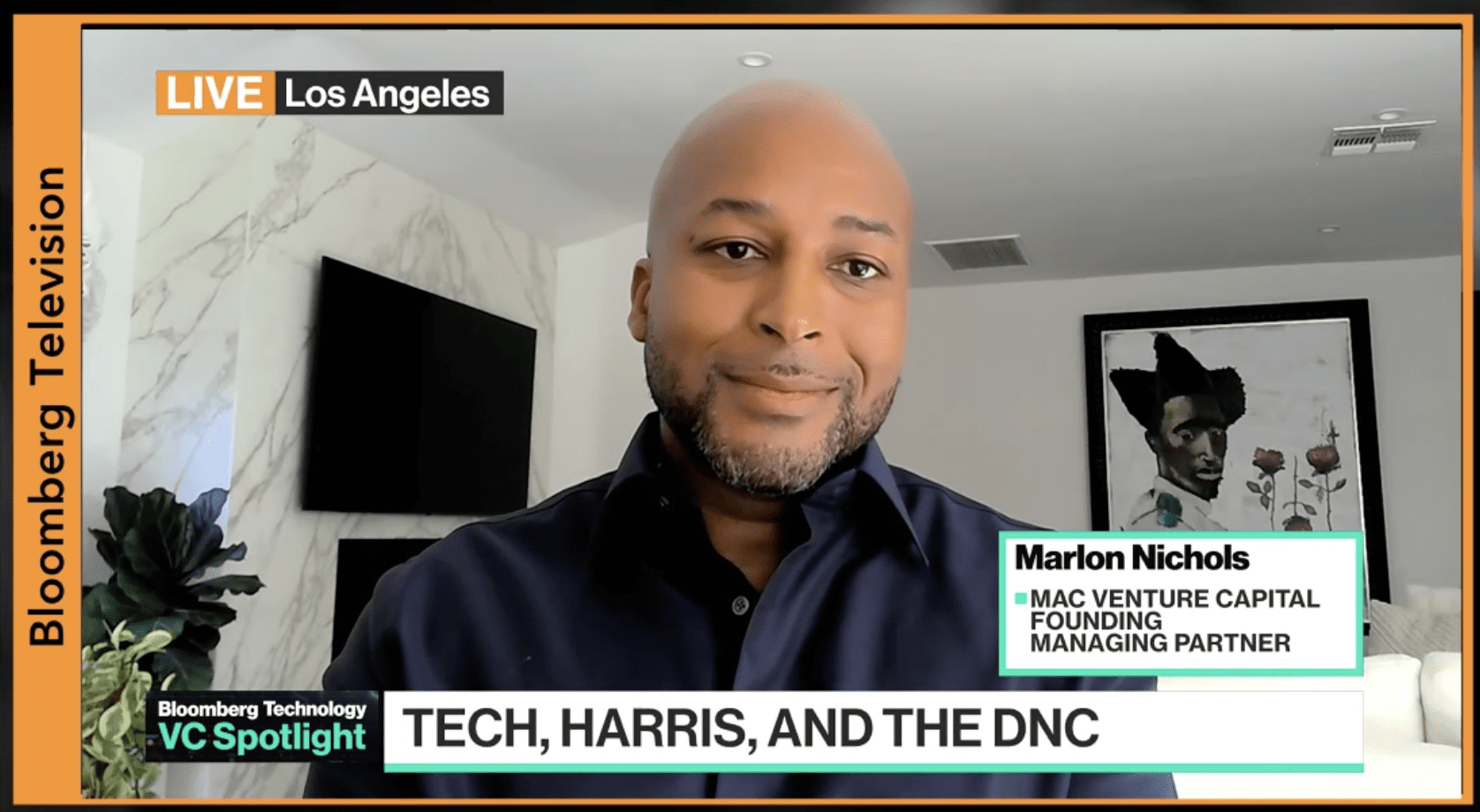

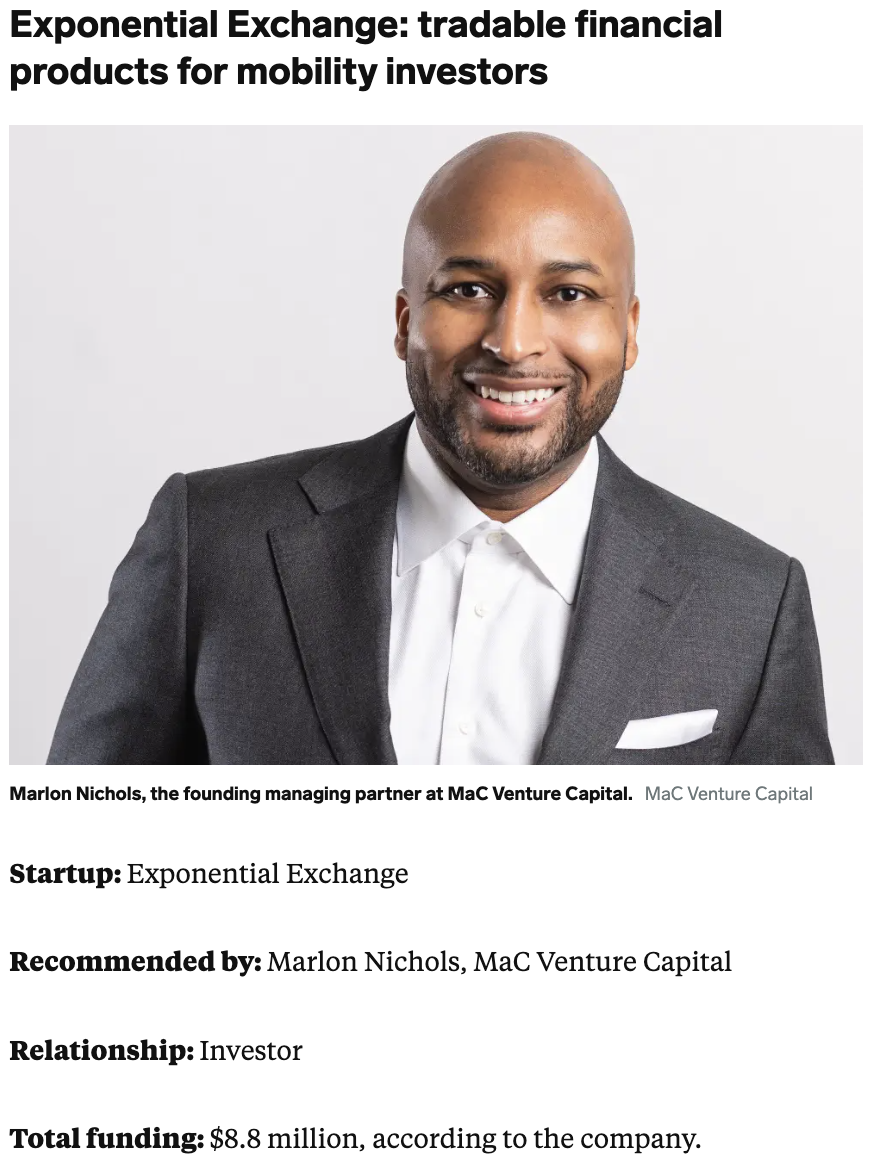

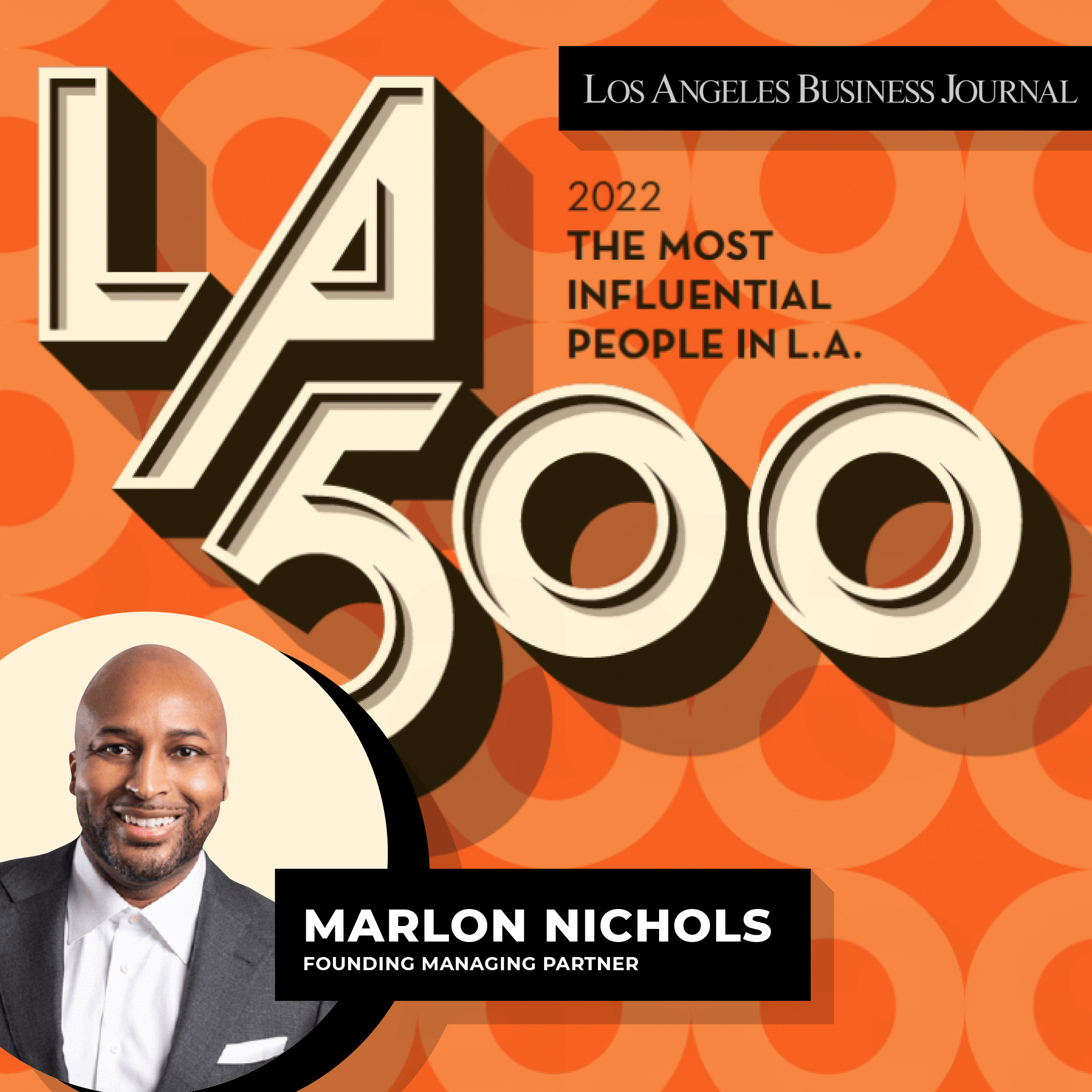

MaC Venture Capital, based in Los Angeles and Silicon Valley, is the result of a 2019 merger between Cross Culture Ventures, founded by Marlon Nichols, and M Ventures, co-founded by Adrian Fenty, Michael Palank and Charles D. King, who was the first Black partner at a major Hollywood talent agency. It has already invested in 25 companies.

The firm’s philosophy: Women and people of color should be represented in the business and cultural life of the nation, particularly in the tech industry that drives so much innovation and so much of the economy.

“We want to get as close to a crystal ball as possible,” Nichols told USA TODAY in an interview. “If human behavior is driving everything, then we should look at which of these emerging trends will be the new social norm.”

MaC Venture Capital belongs to a new wave of venture capital firms and a new generation of venture capitalists shaking up the status quo.

These investors don’t invest exclusively in entrepreneurs of color but make sure entrepreneurs from diverse backgrounds who’ve been largely overlooked by venture capitalists get an equal shot at Silicon Valley success.

Among those championing a more diverse set of entrepreneurs are Plexo Capital’s Lo Toney, Backstage Capital’s Arlan Hamilton, Equal Ventures’ Richard Kerby and Precursor Ventures’ Charles Hudson.

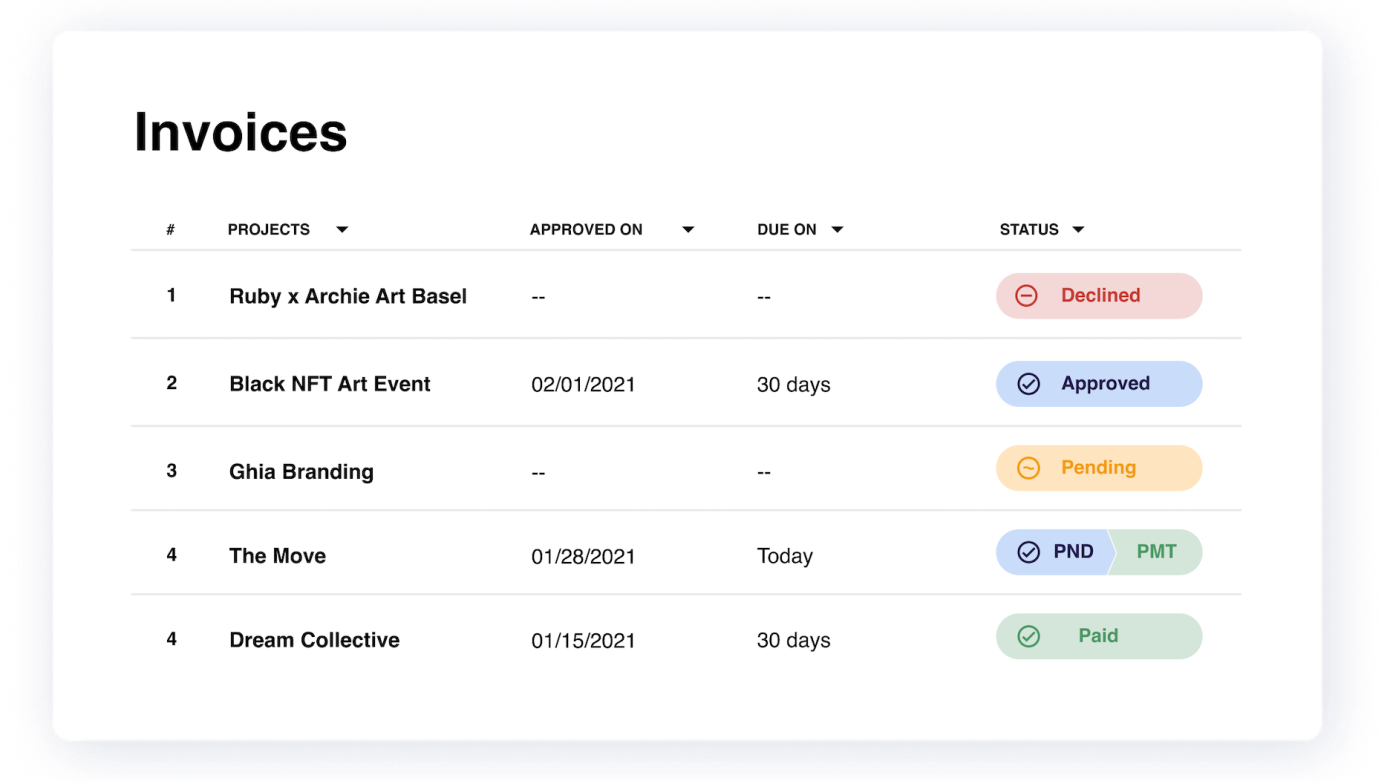

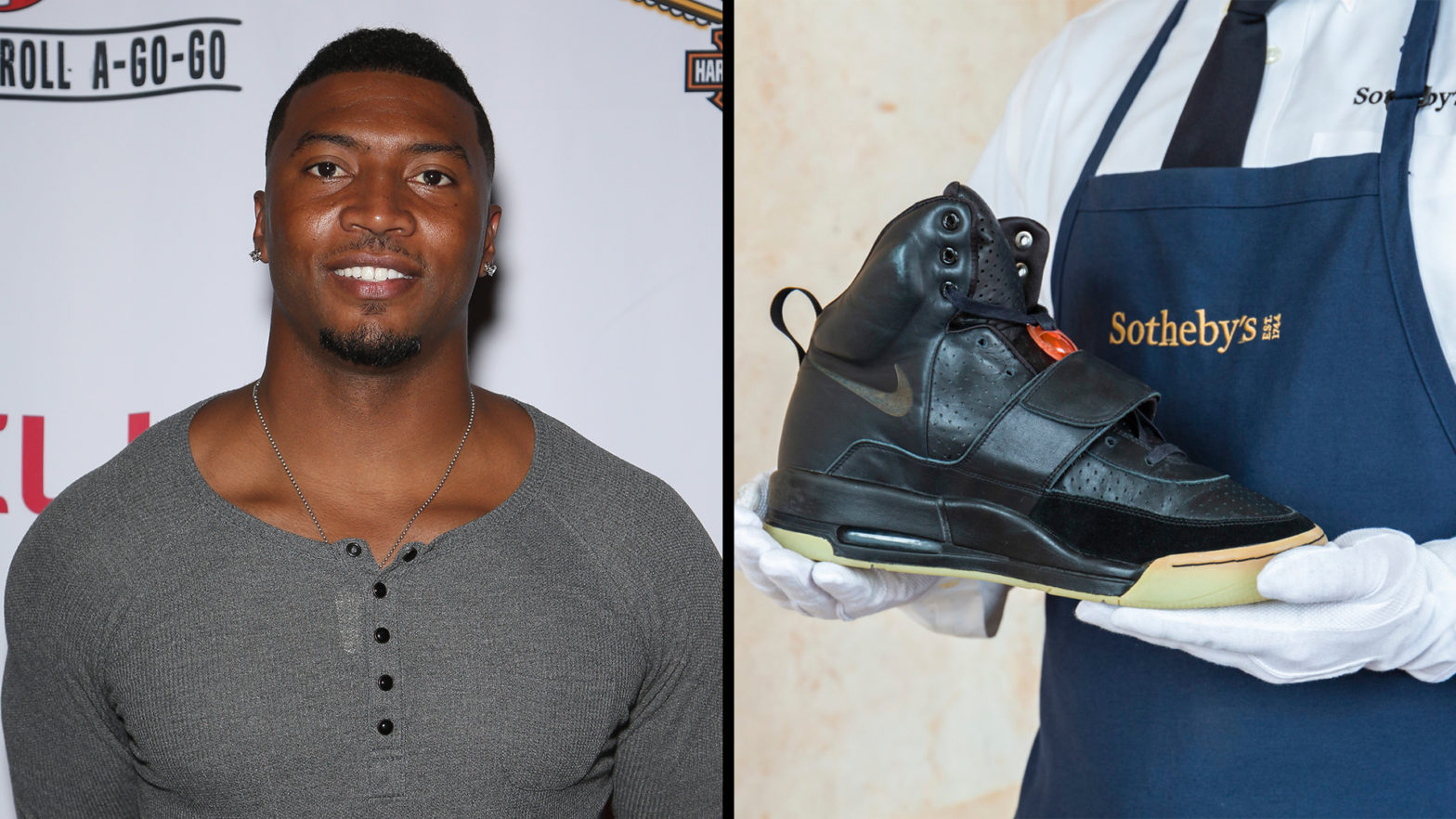

With the new fund, MaC Venture Capital says it will make 40 investments, with an average investment of $1 million. Limited partners include Foot Locker, Goldman Sachs, Bank of America, and Howard University.

“It’s important to approach the investing game without bias,” Nichols said.

The vast majority of entrepreneurs who land venture capital funding are white men, much like the financiers who hand it out. Venture capitalists tend to place their bets on people who’ve already succeeded or who remind them of the people who have.

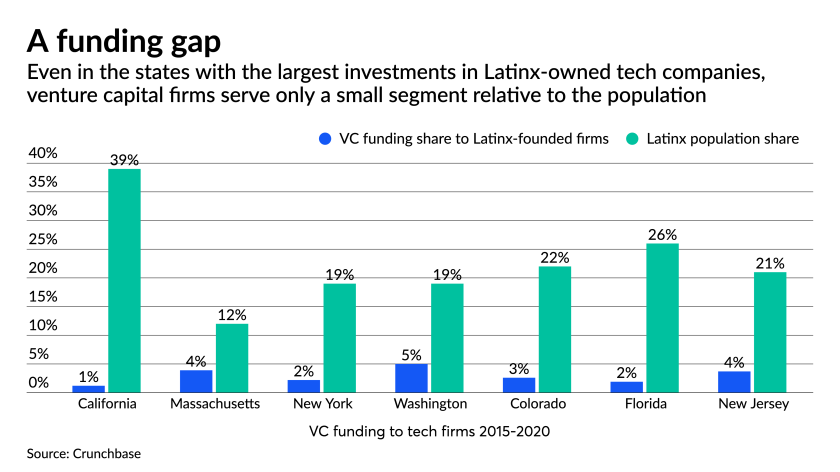

Black and Hispanic entrepreneurs face significant hurdles – insular networks, negative stereotypes, and racial discrimination. A tiny fraction of start-ups led by people of color attract venture dollars.

For example, despite gains, Black women and Latinas combined make up less than 1% of all venture capital investment, a recent study by Digitalundivided, a nonprofit that supports female entrepreneurs of color, found.

. . .

Keep reading the full post from USA Today.

.png)

![The Future of [X] is Decentralized](https://macventurecapital.com/wp-content/uploads/2021/10/1_wxZCJOTF67hb8W79oe_Zww.jpeg)